ADYEN a great company with short term headwinds.

Last week I wrote an article about PayPal, you can find it here. I wrote about how I believe it has serious competitive pressure and a history of destroying shareholder value, but it could have some serious upside if the new management can realize their turnaround plan and use free cash flow to buyback substantial amounts of stock.

This week Im writing about Adyen, a European payment company that’s become a major player in the payments space. Adyen is taking market share from competitors, including PayPal, and growing as a brisk pace. The stock however, has been punished by the market, just like many other fin-tech and payment companies, and a lot of investors are wondering if this is a buying opportunity.

Overview

The payment process is complex and somewhat different depending on which companies you choose to use. Many companies overlap and provide multiple products or services in the payments value chain. But to give you a basic understanding, below you’ll find a few key players involved in most online transactions, which is what Adyen primarily facilitates.

A merchant who sells something and a customer who buys.

A payment/card network like Visa or Mastercard

A gateway who captures the card information and transmits it to a merchant acquirer.

A merchant acquirer who settles and processes fund between the issuing bank and the merchant.

An issuing bank such as Bank of America or Chase that provides the funds and business accounts.

This is a very basic description of the process, it’s even more complex than this. The reality is, everyone is trying to take a cut off each transaction.

Adyen is primarily a gateway and a payment processor/acquirer and they have created a platform that essentially does everything except the job of the bank and the card network which affords them high payment acceptance and quick settlements. They also offer an in house risk management system that detects and minimizes fraud and maximizes auth rates. Another cool thing they offer is data tracking and analytics sharing that helps merchant make decision based on geographic and device data.

They have a hot of other enhancement and financial products but the bulk of their revenue currently comes from payments.

Adyen’s payment platform facilitates payments both online and in person, but they focus on e-commerce payments online. They’ve grown at a rapid pace, especially over the last few years and they continue to take marketshare, or as they call it “wallet share”.

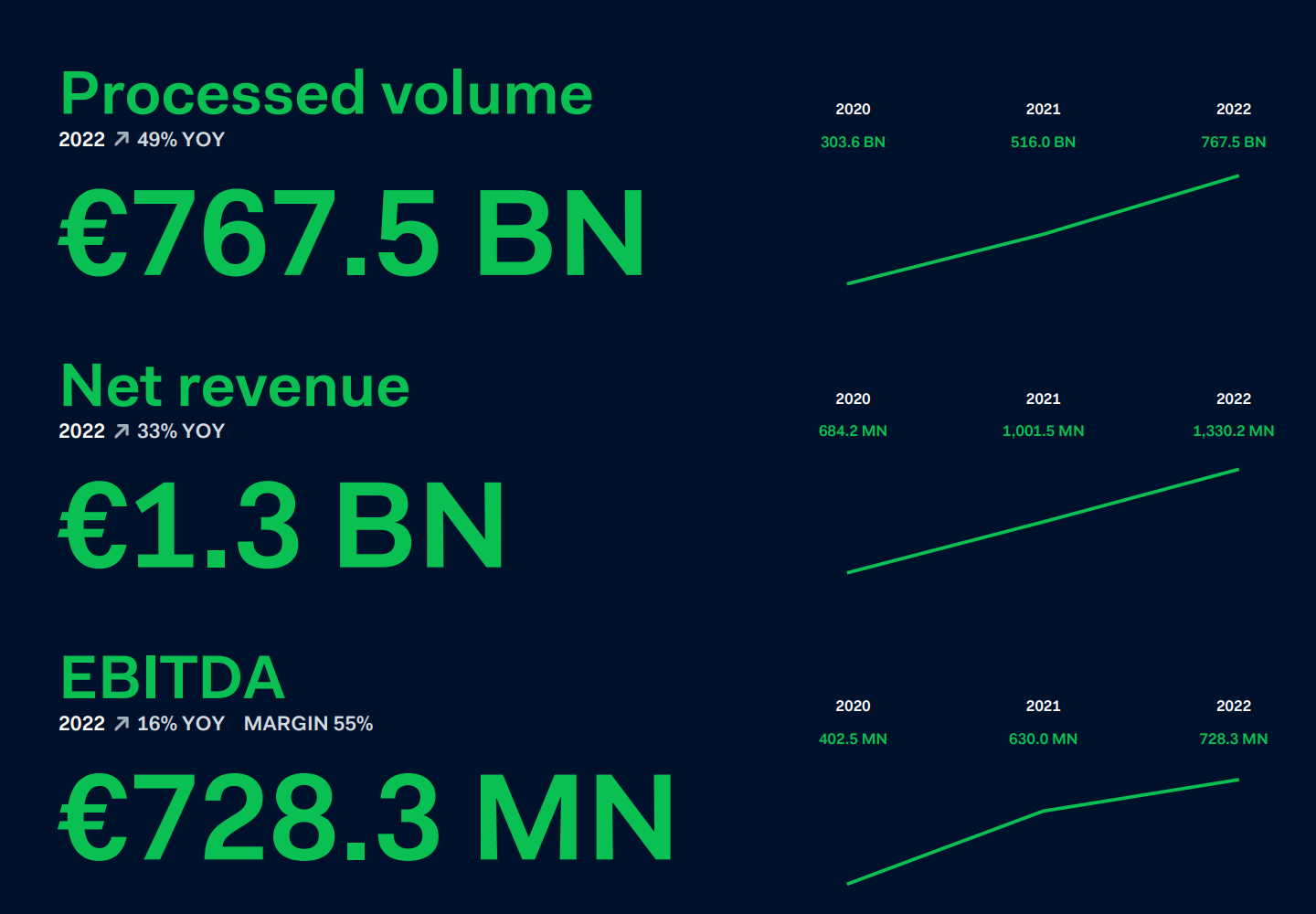

Below you can see that between 2020 and 2022 their payment volume grew by 152% which is about 59% per year. Even more impressive, they’ve also grown their revenue at a compound annual growth rate of 63% since 2014, Wowzers.

80% of Adyens volume growth in 2022 came from businesses that were already on their platform when the period began, which is a trend they have seen since their IPO. This implies that they’re getting customers to use their products more, and they’re able to sell additional products and services to their existing customer base.

A few more key pieces of data over the last decade

They’re median ROIC: 24%

Median ROE: 26%

Median FCF margin: 27%

Revenue segments

Adyen breaks their revenue down into four different segments

Settlement fees - Settlement fees make up the bulk of Adyens revenue, making up 90% of total sales. These are fees paid by the merchant to Adyen for acquiring services, usually as a percentage of the transaction value. Settlement fees are comprised of a few different fees include the following

Interchange fees - Every time a transaction is made with a card, Adyen must pay a fee to the issuing bank (Chase, Bank Of America, Wells Fargo) which is then passed on to the merchant in the form of an interchange fee and Adyen add’s a small mark up on this fee. Revenue for interchange fees are recognized when a transaction is settled for the merchant.

Card network fees - These fees are made to card networks like Visa and Mastercard and then passed onto the merchant in the form of car scheme fees.

Processing fees - This is a fixed fee that merchants pay for using Adyens platform. This revenue is recognized when a transaction is initiated.

Sale of goods - This is revenue generated from the sales of POS terminals and other related accessories.

Other services - This is revenue from fees associated with foreign exchange, third party commissions and issuing services.

Below is the break down of their revenue for 2021 and 2022.

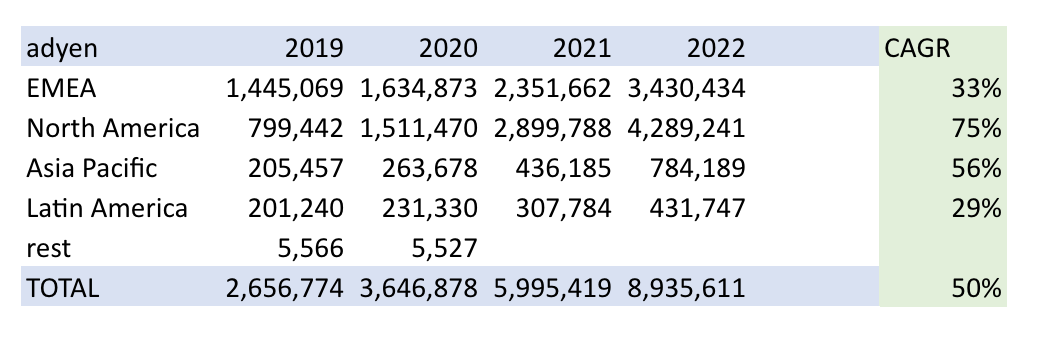

Geographically, their 2022 revenue is broken down as follows

North America 48%

Europe, Middle east, Africa (EMEA) 38%

Asia Pacific 8.7%

Latin America 4.3%

Below is a breakdown of the compound annual growth rate in each geographical area. Obviously North America has grown at a staggering rate and become the biggest revenue source, while EMEA is still a close second largest. Asia Pacific could also be doing a few billion in revenue in just a few short years if they continue growing this fast.

Management

Adyen was founded by Pieter van der Does and Arnout Schuijff in 2006. Before founding Adyen, Pieter and Arnout played key roles in the founding of Bibit Global Payments Services, a payment processing company that was sold to the royal Bank of Scotland for $100 million. The company has been acquired several time by different companies and is currently as subsidiary of FIS 0.00%↑ Fidelity National Information Services.

Arnnout is no longer part of the company but Pieter remains CEO and major shareholder, holding around 3% of the company.

Pieter also has an extremely low salary around $600-700k which is always good to see. Often times CEO’s who are paid a lot and don’t have ownership in the company have no incentive to create value for shareholders. But in this case, Pieter is a founder and major shareholder so we know his incentives are aligned with ours.

Capital allocation

Acquisitions

Adyen has chosen a strategy of organic growth rather than acquisition, and in fact, Adyen has never made an acquisition.

In and interview by Techleap Pieter said:

“With Adyen we have a great preference for simplicity. Because if it’s simple, it’s easier for us to control it. So therefore we never made an acquisition. We only run one system. We only have engineers that are educated in the languages we use within the company. So we wanted to have a very simple relationship with our investors too”

This is surprising strategy when you consider most of their competitors including Stripe, PayPal, Fidelity National Information Services, Fiserv and Square have all grown through numerous acquisitions, especially legacy platforms like Fidelity and Fiserv. Consolidation has been a huge trend in the industry and its all been done in the name of quick market share gains, at the cost of complexity, higher administrative costs and less customer satisfaction.

In general, great acquisitions are rare, and require intelligent and skilled management with a mind for capital allocation. Often times, acquisitions just end up destroying shareholder value. PayPal for example, made six major acquisitions, of which five were over valued and did hardly anything for shareholders. However, PayPal got lucky because one of them, the Braintree/Venmo acquisition, is arguably the best thing that ever happened to PayPal, and probably PayPal’s primary source of growth going forward.

I say all this so say that I largely agree with Pieter about this strategy and think its wise. It’s simple, and doesn’t require complex integration between different payments platforms and allows them to carefully control customer data and user experience which is a big part of their value proposition.

Buybacks

Often times companies in a growth stage like Adyen issue a bunch of stock to fund their operations. Adyen seems to have bucked the trend and really limited their net issuance of stock. Since going public in 2018, Adyen’s basic shares outstanding have only increased by 4% and their diluted shares have increased by only 1.7%. This is a great sign and exactly what I want to see from management.

Capex

Adyens cash flows are invested back into the business but surprisingly their capex is small relative to their operating cash flow, averaging roughly 3% of operating cash flow since going public.

I imagine, when the time comes to return cash to shareholders, buybacks will be the preferred method.

Risks

Concentration risk

Their top 10 customers make up 18% of revenue.

Contrary to many other payment platforms, Adyens strategy has been to work with big global brands like Uber, Ebay, Etsy, McDonalds, Microsoft, and many more.

Obviously this creates some customer concentration, which is risk a that we should take into consideration. Even though Adyen’s client base is becoming more diverse and the concentrations is getting smaller over time, it’s still a big risk if 10 customers make up 18% of revenue.

It’s unlikely that all 10 customers would ever switch at the same time, but even if just a few of them decided to go with some other payment service it would affect Adyen’s revenue in a substantial way. So this is something to keep in mind for sure.

Competition risk

Adyen is in a very competitive industry and faces multiple formidable competitors. Below is an example of how crowded this space is.

It makes sense why this industry is so crowded, it’s stable, predictable, and necessary for modern commerce and the internet has created incredible opportunity for growth in the payments space.

Some of Adyen’s major competitors are PayPal PYPL 0.00%↑, Fiserv FI 0.00%↑ , Fidelity National Information Services FIS 0.00%↑, Chase Paymentech JPM 0.00%↑, Stripe and Square SQ 0.00%↑ .

Execution and valuation risk

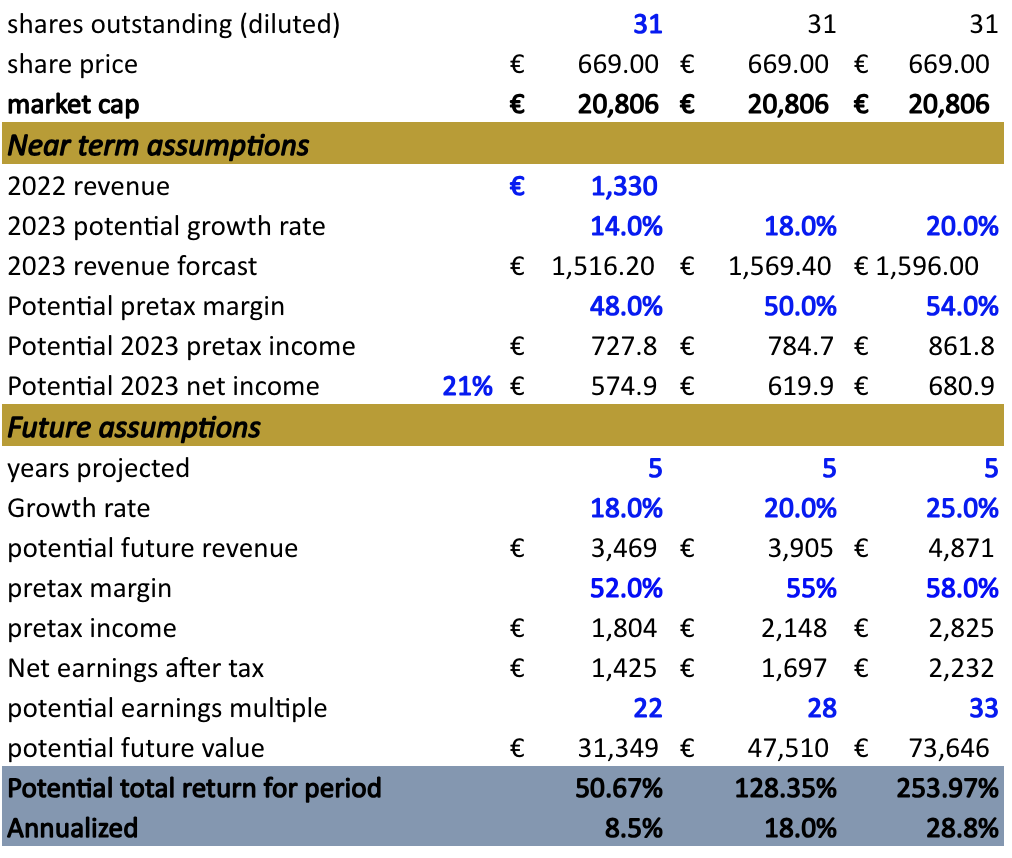

At over 34x earnings, Adyen is currently priced for growth. If they don’t live up to their growth guidance and hype, look out below, they could easily be repriced down to 20-25x earnings.

Financials and valuation

Adyen has a strong balance sheet, if you take their cash and equivalents plus receivables, which is about EUR 6.9 billion together, it covers their total liabilities of EUR 5.2 billion. Another thing that’s impressive, Adyen currently has no debt, aside from a lease liability of EUR 169 million, which isn’t financial debt.

They also have very little stock based compensation which is unusual for a company this early in their growth phase, but they seem to be pulling it off. This is partially because they’re able to pay cash as they have a cost advantage when it comes to labor, because most of their workforce is in Europe where labor is cheaper.

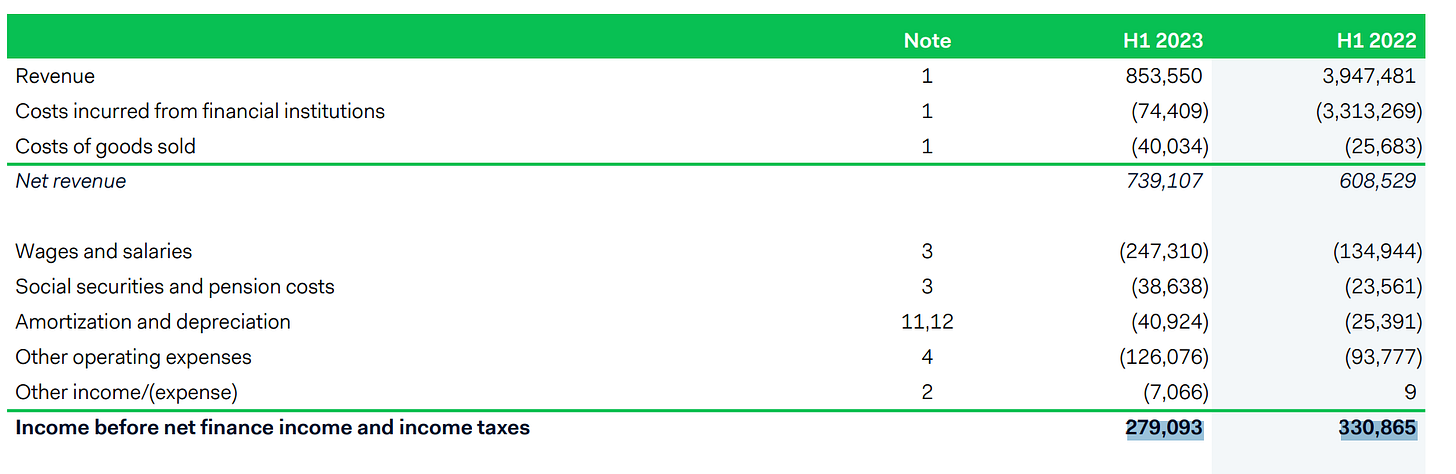

Recently Adyen’s operating margins have been squeezed because they’ve continued to spend money on expanding their global workforce while revenue has slowed a bit.

Their revenue was up 21% and total processed volumes were up 23%, and while these numbers are great, they’ve slowed compared to the last half report, and their “wages and salaries” expense is up 45% , which is why their operating income is down 15%.

So basically, this is a great company with short term headwinds and margin pressure, although the margin pressure is intentional on their part as they continue hiring and growing the business. Look at it this way, they’re profitable enough to grow their workforce while competitors are cutting theirs.

Valuation

Adyen’s pretax margins have been squeezed from their normal level around 55%, down to around 50% in the latest report. They said margins will be back to normal levels maybe even higher over time. I’m assuming lower margins this year, between 48-54%, and higher margins a few years out. They’ve guided to mid 20’s to low 30’s revenue growth in the medium term, but I’m going to assume a more conservative growth rate around 18-25% with an end multiple of 22-33x.

Final thoughts

I like this set up and I personally own a very small position and I’m thinking about making it a bigger position. When a company interests me and its trading at a reasonable price, I usually take a small position and then I continue to increase it as I learn more about the company. This is one of those companies.

Thats it for this week. Thanks for reading!

Let me know if you have some different thoughts in the comments.