Intro

Since I pitched APG 0.00%↑ last November, the stock is up about 43%, and almost 55% from my cost basis around $32.75 per share. Needless to say, I am very happy so far. The company continues to improve incrementally while also raising their financial targets and returning cash to shareholders.

This isn’t meant to be an in-depth article on API Group, I already wrote about it last November. You can find the article here. Instead this article is just a brief overview for the first timer, along with an update on and some thoughts on valuation. I also want to lay out a case for a path to $75 per share, based on some new financial goals API has adopted.

NOTE: This was written prior to the upcoming 3-for-2 stock split. This means the $75 price target will instead be closer to $50 after adjusting for the increased share count.

API overview

For those who are already familiar with API, you can skip to the “Promises delivered and updated” section below.

For those who aren’t familiar, API Group is a business services company that is focused on acquiring and growing compliance-driven testing, inspection, and service businesses. The largest portion of sales comes from their fire safety business, which tests, inspects, and maintains commercial fire suppression systems in commercial buildings globally. This makes up 87% of North American revenue. They have also acquired their way into new service lines such as elevators, escalators, and security system services, which require similar annual tests, inspections, and maintenance. The common theme is that they are compliance driven businesses.

API was originally more similar to cyclical specialty industrial construction company, but a strategic shift in revenue mix, and a large sales team, has transformed API into a recurring inspection and testing company. These tests and inspection services are higher margin and they are also recurring because they are baked into the annual operating expenses of their customers. The tests and inspections are required by local jurisdictions and they allow their customers to maintain operational permits. Inspections also lead to future project work when deficiencies are found. Since API already has an established relationships with the customer, the customer typically has API bring the building back into compliance by fixing or installing new systems.

The inspection-led model is focused on servicing the existing commercial market, which is differentiated from competitors who typically seek out large new construction projects and then pitching the ongoing inspection offering near the conclusion of the project. API has expanded this aspect of the business and intents to continue going forward. In 2011 Inspection Service and Monitoring made up just 20% of API’s revenue and today it makes up 55%.

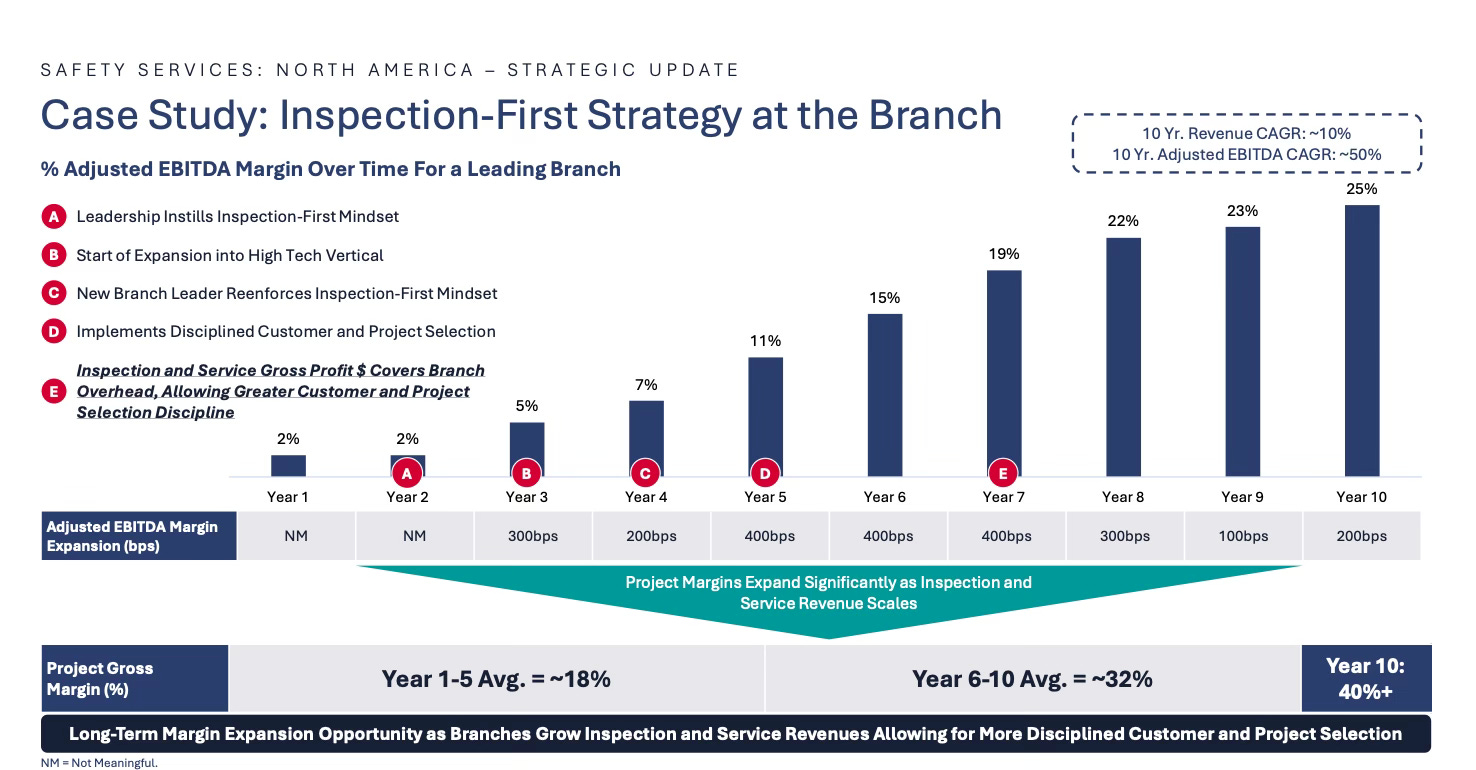

API’s has impressive branch level improvements in the years following the implementation of their inspection-first model. Below you can see a case study for a leading branch where EBITDA margin improvements are fairly dramatic.

In 2021, the average branch margin was 13%, and today sits sat 17%, with management aiming for 20% in North America and 18% internationally.

Management

The business was taken public by Martin Franklin, who is board chairman and owns 11% of the company. I’ve written about Franklin multiple times so I don’t think I will go into much detail here except to say that he is an intelligent entrepreneur and a good capital allocator who has made investors a lot of money. He has done a great job in guiding API’s management to incrementally improve the company.

Russel Becker is the CEO. My impression of him is that he’s a good ol’ boy who drinks Macallan 12 single malt and he’s been with the company since 1995. He is a good and loyal operator who aims to please shareholders and the team. The combination of Franklins strategic intellect and Russel’s operational commitment seem to be a good duo.

Promises delivered and updated

In my last article, I talked about API’s 13/60/80 targets, which was to achieve a 13% EBITDA margin by 2025, 60% of long term revenue derived from Inspection Service and Monitoring, and 80% long term free cash flow conversion.

Today the company has delivered on their EBITDA margin target, and the company derives 55% of revenue from Inspection, Service and monitoring, and boosts 75% FCF conversion.

However, management has already put forth new targets, a trend I expect to continue going forward as they near achievement of targets.

The newest initiative is 10/16/60+ which includes the following

$10 billion in revenue by 2028

16% EBITDA margin by 2028

60+ % of revenue from Inspection Service and Monitoring

10.4 billion in revenue

The target is $10 billion or more, but $10.4 billion was specified as a target. Given that API has $7 billion in revenue today, $10.4 billion in revenue implies 3.4 billion in incremental revenue which is 49% growth, or 10.4% annualized from 2024.

Below is how they plan to tackle the $3.4 billion over the next few years;

$1.4 billion in total organic growth ($350 million per year)

$1 billion from smaller acquisitions ($250 million per year)

$1 billion from one or two large platform acquisitions (similar to Chubb acquisition)

This is ambitious in my view, but it’s not unreasonable. API’s revenue has doubled since going public in 2020, compounding at 15% annually and growing largely through acquisition. Obviously, the law of large numbers comes into play as the company has scaled to a much bigger size; regardless, 10% growth for a few years is not unrealistic.

16% EBITDA margin

API has updated its EBITDA target to 16% over the next few years. So far, API has been able to expand adjusted EBITDA margin from 10% in 2021 to 13% through a mixture of the following;

Improved revenue mix, focus on ISM, divesting low margin aspects of API.

Pricing initiatives.

Branch and field optimization.

Customer and project selection.

60% + of revenue from Inspection Service and Monitoring

This target isn’t much of a change from the previous one, except the added a plus at the end, implying that management intends to continue orienting their revenue mix towards the Inspection Service and Monitoring—going beyond 60% of total revenues. I personally think API will continue to push this target higher, potentially towards 70% or more over time. This is the part of the business that investors like because it’s recurring, stable, and it’s a cash-flowing business that leads to more service revenue when inspections reveal deficiencies that need to be updated.

Free cash flow

API also believe they can produce 3 billion in cumulative adjusted free cash flow through to 2028. If revenue and adj EBITDA targets are achieved, 1.6 billion in adj. EBITDA is possible in 2028. If they retain their 75% FCF conversion, the company could produce over $3 billion in adj. free cash over the next few years. My estimation is closer to $4 billion.

Valuation: A path to $75- $80 per share by 2028

The valuation below assumes

10 billion in revenue per target

16% adj. EBITDA margin per target

Slight multiple contraction to 15x EV/EBITDA

Buyback of $1 billion at average price of $58

Net leverage of 2.7x (within stated range of 2.5x - 3x)

Final thoughts

57% upside may not seem exciting for many, and I understand that. But API Group is a very well-run company, in fact, my only regret is not making this a 10% position right from the gate. A this point, I would consider adding to my position if I can’t find anything else better, and definitely if the stock were to dip down to the $40 - $45 range.

That’s it for this week, thank you for reading.