Asseco Poland

The poor mans Constellation Software?

Intro

Asseco Poland is the largest IT group in Poland and the Central and Eastern European region. They develop proprietary software for public institutions, banks, insurance carriers, energy producers and many more. The software is designed to meet custom tailored needs of an organization.

Asseco grows through both organic growth and acquisition.

The company recently received an investment from TSS, a Topicus subsidiary, which is key to the thesis.

Context of the TSS investment in Asseco

Let’s briefly go through a few important companies that are key pieces of context.

Constellation

I have no intention of writing a deep dive on Constellation Software (or its subsidiaries) because most people reading this are likely already familiar with the company already. There are plenty of podcasts and articles about the company by people who know more about the company than I do. I’ve casually followed the company for a few years, reading annual letters and admiring from afar.

Nevertheless, for those who aren’t familiar, I owe a brief introduction to Constellation and a few other relevant companies. After all, it would be difficult to grasp this investment idea without it.

Constellation is a vertical market software (VMS) serial acquirer that has beat the market by a wide margin since going public in 2006—compounding at 33% annually for 19 years, a total of almost 25,000%.

Constellation’s business model is simple: they buy small, cash-flowing, vertical market software (VMS) companies with high customer retention and then use the cash flows from those businesses to make more VMS acquisitions.

Constellation was founded by Mark Leonard, who is an extremely reclusive CEO, but also happens to be a legendary capital allocator. The only time he communicates with the public is through his shareholder letter that he only publishes every few years now. The letters are well worth reading.1

Constellation consists of 6 operating groups, each focusing on a specific set of industries. Leonard has gone to great lengths to maximize autonomy within the organization by encouraging subsidiaries to retain their company brand and culture after being acquired. He also trains managers at the operating groups to be capital allocators so that they can source, analyze, and underwrite their own acquisitions. This liberates Leonard from having to underwrite 100+ acquisitions per year himself.

The other key feature is ownership. He requires senior employees to invest a portion of their bonuses in the company stock, which aligns them with their shareholder base, fostering a corporate culture and attitude that is positively oriented towards shareholders.

These things, among others, have produced incredible results for Constellation. They have also attracted a sort of investor cult following.

Topicus

Topicus, previously called TSS, is one of the 6 operating companies of Constellation Software. It can be thought of as the Constellation European division.

TSS merged with Topicus in 20202 and then the combined companies were spun-off in 2021 as a separate company under the name Topicus.3 Constellation acquired 30% of Topicus as part of the transaction agreement.

Topicus employs the same basic playbook as Constellation. Not surprisingly, they have attracted a similar investor following. Lumine Group $LMN.TO also spun off from Constellation in 2023 and has followed a similar trajectory.

Many investors love these “mini Constellations” because they employ the methods of Constellation which orient them towards the good of shareholders. Most investors see them as second chance to “get in early on another Constellation.” I‘m not entirely convinced this is the best way to think about these companies but it’s useful nonetheless.

I own very small positions in both Topicus and Lumine because I do find them interesting but I have never scaled them up because they are too richly valued for my taste. Low valuation is typically not the reason people buy these companies. Instead investors choose to put their faith in the abilities of management.

Personally, I keep positions in companies like this in case they ever become more reasonably priced.

Sygnity

Sygnity is a Polish software development company. In 2022, TSS made a large (73%) strategic investment in Sygnity.4 This investment subsequently brought changes to the company as the board and management team is now fitted with a handful of TSS members.

The intention was to implement Constellations playbook at the company. Sygnity leveraged the experience of TSS to optimize their operations and use expertise in the acquisition process. In the first year with new management, Sygnity went from 17% EBITDA margins to 21% and has continued to grow since.

Investors initially jumped at this as an opportunity to get in early on another “mini Constellation”. $SGN.WA has since increase 550% and has been re-rated higher on further expectations of operational improvements.

This investment would have been compelling had I found the idea earlier. But as investors discovered the idea its become more richly valued.

This leads me to Asseco Poland S.A.

TSS’ investment in Asseco Poland S.A.

TSS also recently announced an investment in Asseco Poland, in what appears to be a similar play to the investment in Sygnity.

TSS CEO, Ramon Zanders, is apparently a big fan of Asseco's CEO Adam Góral and Vice president Rafał Kozłowski.

“We believe that together with Adam Góral, Rafał Kozłowski, and the rest of the management team, we have a unique opportunity to support each other and continue to create long-term value for shareholders and other stakeholders. Together, we will build a partnership of two strong European IT Groups based on perpetual ownership, decentralized governance, and client centricity.” – Ramon Zanders, TSS Group CEO.

It’s likely that the Constellation playbook will be implemented by virtue of TSS board members joining the Asseco board. One key pillar to the thesis is that TSS managers know how to implement the capital allocation principles they’ve inherited from Constellation, and those principles and disciplines will translate into shareholder returns for $ACP.WA shareholders.

What I like about this set up

Low starting valuation: 21x earnings (19x when I first aquired) and 5x EBITDA. This both reduces the risk of losing money and makes multiple expansion more likely in the event that the company begins to see improvements in margins and capital allocation.

Well run business with room for improvement: Asseco is well run and is a decent business, however, there is room for margin optimization and efficiency gains within the company.

Very high inside ownership: Adam Góral owns 10% through his family foundation, and the additional 25% ownership from TSS will provide insider alignment with retail shareholders. Not to mention TSS plans to influence Asseco and maximize its own interest.

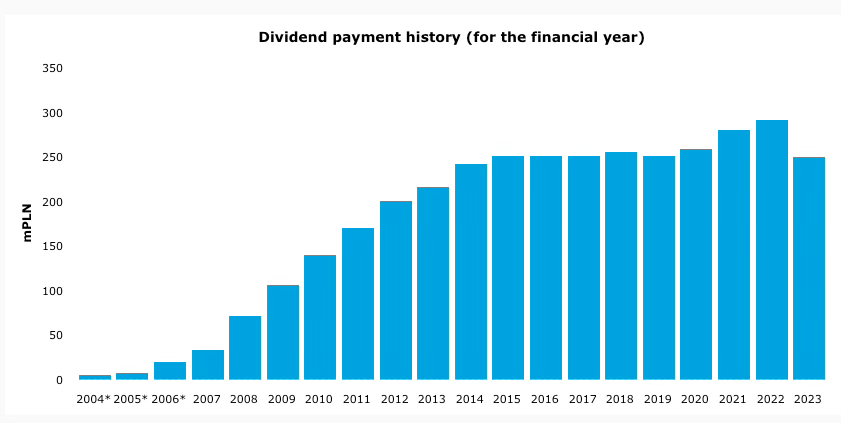

Pays a dividend of 2.6%: They have historically paid out a consistently high dividend with a payout ratio above 50%. However, I imagine this ratio will not remain due to new business and financial goals that will require capital elsewhere. They will, however, remain a dividend-paying company.

Details of the transaction

On January 31, 2025 TSS acquired 9.99% of Asseco Poland at PLN 85 per share.

On February 4, 2025, Asseco Poland signed an agreement to sell 12,318,863 treasury shares (14.84% of the total capital) to TSS at PLN 85 per share.

The total investment between both transactions will equate to 20,618,892 shares of Asseco Poland, which is 24.84% of the company.

According the shareholder agreement, which I will explain in a minute, they won’t be able to acquire more than a total of 27.96% of Asseco’s total capital.

Shareholder agreement

The shareholder agreement between Asseco shareholders, specifically the Goral Family Foundation and TSS. The agreement lays out a path to further develop Asseco Poland in order to enhance shareholder value.5

The agreement is contingent upon the conclusion of the second transaction mentioned, the acquisition of the 12,318,863 treasury shares.

Asseco then intends to use their remaining treasury shares (3% of total capital) to incentivize the president and key managers at the company.

Key agreement details

TSS board members: The supervisory board will have nine-members, consisting of including three persons nominated by Yukon (TSS)"

A new framework for mergers and acquisitions, although no details yet, I assume this part of their capital allocation strategy will be shaped by TSS and by extension Topicus and Constellation.

New CEO: Current CEO Adam Góral will be replaced with Vice President Rafał Kozłowski. Adam Góral will be assigned to the board. Management at TSS seems to be fond of Rafał Kozłowski, and I can speculate why. He was previously the CFO for Asseco and oversaw M&A activity for years. As they adopt a new framework for acquisitions, it appears they believe Rafał Kozłowski is more suited to lead, considering his skillset. Companies in the Constellation sphere emphasize capital allocation abilities rather than business leadership skills.

TSS will have the ability to influence certain matters at the general meeting concerning

Incentive programs: for key managers to support the achievement of business objectives. This is important, if they implement the Constellation incentive model, or something similar, it would drastically improve the shareholder alignment within the company.

Dividend policy: Although dividends will continue per the agreement, the influence of TSS board members could change the dividend policy to a lower payout ratio than they’ve had historically. > 50% is just too high and not beneficial for shareholders nor is it tax efficient.

“Ambitious” business and financial goals. It’s safe to assume this will entail some sort of efficiency goals such as margin expansion, cost reduction, and/or acquisition goals.

Details about Asseco Poland

Asseco Group operates primarily in Central and Eastern Europe. They provide software and services to the banking and finance, public administration, as well as industry, trade, and services sectors. Below are some of their bigger customers.

Asseco is a federation of companies spanning 62 countries. They acquire both controlling and non-controlling stakes in other IT firms without acquiring 100% so as to avoid completely integrating them. They target well-run, profitable software companies with recurring revenue, and they’ve acquired over 140 since 2004 (6.6 acquisitions on average per year).

They have three operating segments

Asseco Poland: Consists of operations of the parent company in Poland, tasked with growing the company globally.

Asseco International: Consists of their operations in central, south, and westerns Europe.

Formula systems: Subsidiary operating primarily in Israel, North America, Middles East and Africa.

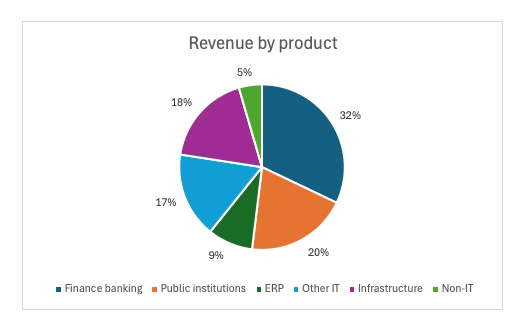

70% of Asseco’s revenue is derived from customers in the finance/banking, public, and infrastructure sectors. Banking in particular is a key aspect of their offering, accounting for 32% of revenue. Their core banking system covers all day-to-day management processes for financial institutions, such as accounting and daily closings, credit and deposits, and administration of clients.

These offerings are all extremely sticky, mission-critical services that keep financial institutions running smoothly.

In 2024, 40% of revenues were generated in Israel, 15% in the US, 14% in Poland and the rest from Serbia, Slovak Republic, Germany, Spain , Czech Republic, UK, Croatia, Turkey, Romania and other countries.

They describe themselves as a “federation” of companies because they have a decentralized organizational structure, which is undoubtedly one the reasons why TSS has taken an interest in them.

Like Constellation, Asseco’s decentralized model provides its group members with the operational freedom to preserve their brand and business culture, while also providing them with access to the capital, marketing, and other resources of a multinational organization with a very strong global market position.

The existing decentralized model at Asseco paves the way for TSS to come in and begin implementing their practices, which require a decentralized culture.

Market opportunity

Asseco has a very large addressable market that provides a long runway for acquisition and market share growth. The public IT market is USD 557 billion and expected to grow 12% annually to 2023, and the global IT service market is USD 1.2 trillion and expected to grow 9% annually to 2030.

Over the last few decades, Central Eastern Europe— where Asseco operates— has seen impressive economic growth that has outpaced Western Europe. This is a function of increased skilled labor, foreign investment and the collapse of communist governments in the region. Since joining the EU and and adopting a more democratic governance, the region has seen incredible growth in GDP per capita.6

All of this amounts to a long runway for Asseco to grow in central easter Europe and they are well positioned to do so.

Financials

I estimate that Asseco did PLN 17 billion in revenue in 2024 and will do PLN 17.5 - 18 billion in 2025.

After the sale of the treasury shares they will have an additional PLN 1 billion in cash on the balance sheet.

Side note: From what I understand, some of the proceeds may be used for dividends, or at least they will vote on whether to use some for that.7

“The Shareholders’ Agreement contains provisions on joint actions of shareholders (subject to the General Meeting’s approval) concerning voting on the payment, in the form of dividends directed to all shareholders of the Company, of the net proceeds from the sale of treasury shares in two tranches starting from 2026”

However, it’s unlikely they will use the majority of proceeds for dividends with TSS members on the board. It’s more likely that much of it will be used for acquisitions, buybacks, or debt service.

Profitability

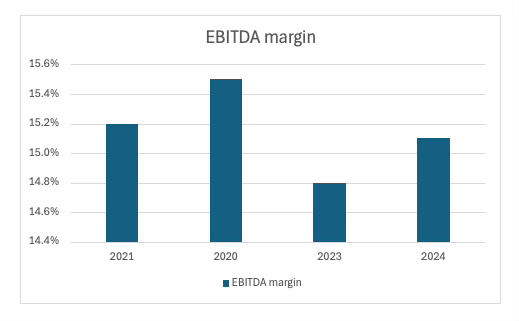

Asseco’s EBITDA margins are fairly stable between 15% - 15.5%. However, if TSS succeeds, margins will likely expand. TSS was able to effect change at Sygnity that resulted in significant improvements in a short period of time. As previously mentioned, EBITDA margins expanded from 17% to above 21% in the first year, and they have only continued to climb.

It is reasonable to assume something similar will occur with Asseco. I could see a scenario where EBITDA margins could be north of 20% + over the next 3 - 5 years.

Debt

2024 annual results haven’t been reported yet, but I estimate Asseco did PLN 2.5 billion in EBITDA in 2024 against PLN 4 billion in total debt, implying a leverage ratio of only 1.6, which is actually very low, indicating modest leverage and a healthy financial position.

Risks

There a few risks that should be noted.

TSS failure: The thesis is based on the assumption that TSS will improve the operations of the business. If TSS doesn’t deliver, or influence the company in a significant way, the stock will almost certainly underperform.

Slight concentration risk: Top customers represent 11% of revenue and the largest customer is about 2% of revenue. This is not a big concentration risk but it’s something to pay attention to.

War in Israel: Although they are nicely diversified internationally, they do have significant operations in Israel, which could be problematic if the war in Israel were to take a turn for the worse.

Currency exchange risk: They’ve recently experienced currency headwinds and this may continue to be a problem in the ear term.

Valuation

Assumptions:

Revenue growth between 6% - 9%, below 10y average as they deal with FX headwinds.

For base and bull case, EBITDA margins expand over the next 2 years to 17% - 19%, primarily through TSS involvement. This is reasonable considering improvements at Sygnity after TSS involvement. For the bear case, margins essentially stay the same.

Base and bull case reflect EV/EBITDA multiple expansion, bear case does not.

Treasury transaction provides extra liquidity but dilutes shares outstanding by 12.3 million shares.

Conclusion

A bull case appears to present a great opportunity; the question that remains is how much one is willing to bet on the future execution of management. At the end of the day, this is undoubtedly a bet on management and the expertise of TSS board members. It is a bet on something they will do, not something they have already done. Nothing currently in the fundamentals of Asseco Poland implies that it is currently an extraordinarily special company. The expectation is that there will be a change in capital allocation, incentives, and M&A framework, resulting in better fundamentals.

The degree to which TSS can influence the growth/margins and so forth is just speculation at this point. So, if you aren’t comfortable with that, the stock is not for you.

Other Asseco associated public companies

Here are some other companies (Asseco subsidiaries) that may be interesting.

Sapiens International: Nasdaq SNPS 0.00%↑ - Leading global provider of IT systems for the insurance sector.

Magic Software Enterprises: Nasdaq MGIC 0.00%↑ - Specializes in providing platforms for building and implementing business applications, software, consulting, and implementation services.

Formula systems: Nasdaq FORTY 0.00%↑ - I.T. solutions primarily in Israel

Asseco Business solutions: $ABS.WA on the Warsaw Stock Exchange - Offers Suite of ERP systems supporting business processes in mid-sized and large enterprises.

Asseco Southeastern Europe: $ASE.WA on Warsaw Stock Exchange - comprehensive solutions and proprietary products for running a bank, advanced payment solutions under the Payten brand, and integration and implementation services.

That’s it for this week. Thank you for reading!

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am an $ACP.WA shareholder at the time this was written

https://www.csisoftware.com/category/pres-letters

https://topicus.com/news/constellation-software-inc-reaches-agreement-to-combine

https://topicus.com/news/constellation-software-inc-completes-spin-out-of-topicuscom-inc

https://topicus.com/news/topicuscoms-subsidiary-total-specific-solutions-tss-acquires-majority-share-sygnity-poland

https://inwestor.asseco.com/files/investor/uploads/03_2025_Disclousure_of_deleyed_information.pdf

https://cee.pwc.com/cee-in-the-spotlight/introduction-to-the-cee-growth-story.html#:~:text=Our%20goal%20is%20to%20demonstrate,drivers%20of%20growth%20and%20transformation.

https://inwestor.asseco.com/files/investor/uploads/03_2025_Disclousure_of_deleyed_information.pdf

Very good company and research

Awesome post mate! Congrats!