Intro

Atkore is a well run manufacturer and distributor of electrical components and equipment in the U.S. and internationally. The stock has been quite the compounder since going public, although it really gained steam after the pandemic as commodity prices soared and construction picked up. As they received a new flood of cash proceeded to use it for buybacks and acquisitions that pushed the stock higher. However, more recently the trend has reversed and the stock has been punished because of a few bad earnings reports and pressure from commodity prices.

The stock is currently down over 50% and has a forward FCF yield of roughly 15%.

In their recent quarterly call they mentioned that pricing and construction demand was softer than expected. They’re also facing more competition from conduit importers from Mexico.

“We did not see a noticeable summer construction uptick in demand as is generally the case. Pricing was softer than expected due to the slower end markets, particularly for our PVC conduit business and higher concentration of large projects where pricing tend to be competitive.”

“Pricing was softer than expected due to slower end markets, particularly for our PVC conduit business and higher concentration of large projects where pricing tends to be more competitive.”

“Another challenge we are facing is an increasing amount of imported steel conduit from Mexico.”

Q3 2024 President and CEO William Waltz

The stock remains at 52 weeks lows and many, including myself consider Atkore to be a well run company with a long runway for growth. Could this be an opportunity to buy a great company that is facing a short term headwinds?

Company and products description

Atkore’s history can be traced back to a small company called Allied Tube And Conduit. They patented the first in-line tube galvanization process, which is the process of attaching zinc to a metal tube in order to make it weather resistant. Over the years Atkore acquired a handful of conduit and pipe companies and eventually expanded their way into cable management, High-density polyethylene pipe (HDPE), polyvinyl chloride pipe (PVC) and electrical cables.

Atkore’s products are easy to understand but most people wouldn’t know they exist because they are found in inconspicuous locations around commercial buildings. Atkore’s products may go unnoticed but they’re crucial in keeping businesses running and electricity flowing. 90% of their products are considered “electrical infrastructure” which means they assist in managing and protecting different forms of electrical systems and wiring. The other 10% are safety related products such security bollards, perimeter security solutions and sign support systems.

They have significant exposure to high growth areas of the economy such as renewable energy and digital infrastructure, which should be a tailwind for them over the long term.

Customers

Distribution sales account for 83% of the revenue as they primarily sell to distributors from their own distribution centers and manufacturing facilities. Atkore’s customers include global electrical distributors, independent electrical distributors, super-regional electrical distributors, buying groups, industrial distributors and big box retailers.

Atkore’s top 10 customers accounted for 38% of their sales which is a clear risk in my view. A company called Sonepar alone accounts for around 10% of sales. This is something to pay attention to.

In 2023, 90% of their sales were sold to customers in the US while the other 10% were international.

Business system

In order to understand Atkore one must first understand the Atkore business system and by extension the Danaher Business system it’s modeled after. Atkore’s previous CEO John Williamson spent over 10 years as the senior vice president-global operations at Danaher Corp, he also spent time at Jennings Technology Co. LLC which is a subsidiary of Danaher Corp. Because of this Atkore was very much influenced by Danaher which is why the Atkore Business System is modeled after the Danaher Business System. This is essentially a system for continuous development and improvement at all levels of the company. Both the Danaher and Atkore Business systems are a derivatives of Kaizen manufacturing. If you’re not familiar, Kaizen is a lean manufacturing system that originated in Japan after world war 2. The purpose is to eliminate waste and improve productivity, which it does quite well.

The Kaizen philosophy is based on the idea that businesses can continuously improve if they are held accountable to implementing small, consistent, incremental improvements over time. Improvements are carefully measured through daily accountability, targets, inspections and goal tracking. Many great businesses have used some form of Kaizen process such as Nordson NRDS 0.00%↑ , Idex IEX 0.00%↑, Danaher DHR 0.00%↑ and many more.

The important thing to understand about is that there is typically no end to the improvements. It’s a perpetual process of optimization. There is never a point at which the company says “ok we’re done improving”. I imagine this is difficult for some employee’s, but over the long term it should theoretically makes things easier for them by eliminating unnecessary hard work and optimizing every process.

The result is a truly high quality company and high quality people within the organization.

Competitive advantage?

I’m hesitant to say that Atkore has a wide moat but I do think they have a few advantages that are worth noting.

First, as we’ve already discussed, the Akrore business system is the core of their operational strategy and in my view counts as a some form of competitive advantage. The business system provides them with a company culture that is aligned, focused and constantly accountable to growth and improvement. If a competing organization is already accustomed to operating a certain way, it would be very difficult to begin implementing something like the Atkore business system because it requires a complete cultural shift and intense accountability. It would likely meet internal resistance.

Second, Atkore has 49 manufacturing facilities and 7.5 million square feet of manufacturing capacity in eight countries, most of which is located in the US. They have 38 dedicated distribution centers that afford them shorter order cycle times and faster delivery than competitors—making them a darling in the eyes of their distributor customers.

Keep in mind, much of the building industry—which Atkore ultimately serves— is in a perpetual time crunch. Most of the industry operates on fixed price contracts, which means the only variable is time. In other words, the faster a project is completed the more profit per hour that is produced. Therefore, contractors abhor wasting time and wont waste it shopping at an electrical distributor that doesn’t have a broad product offering that’s consistently available. This means distributors primarily care about service times, product consistency and brand— all of the areas in which Atkore shines. Atkore has a motto “one order, one delivery, one invoice” which captures their speedy service times and simple value proposition.

Atkore distributed their products through over 13,000 electrical-distributor branches in the United States, they also have strong relationships with big box retailers such as Home Depot.

Capital allocation

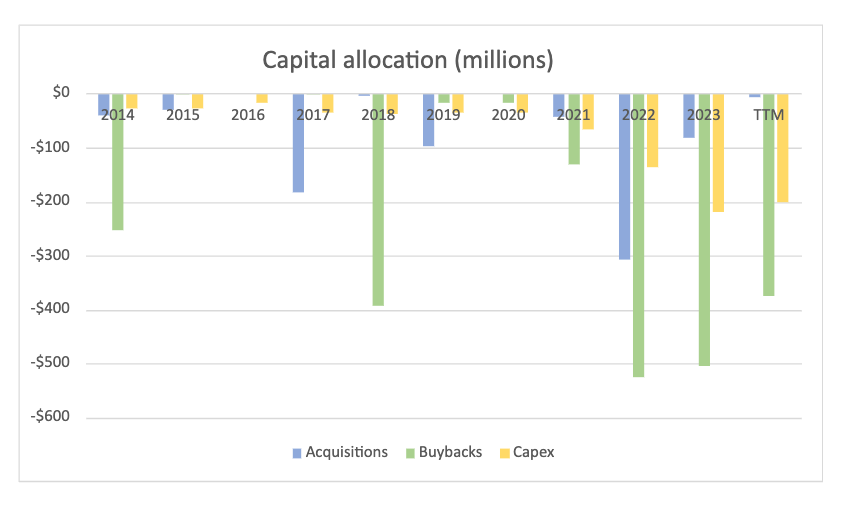

Atkore’s capital allocation model has consisted of buybacks, CapEx and acquisitions up until January 2024 when they began paying a quarterly dividend as well. Below you can see the majority of their capital (58%) has been spent buybacks over the last decade, followed by CapEx (22%) and acquisitions (21%).

Through an impressive repurchase program Atkore reduced shares outstanding by 42% between 2017 - 2023 or 9.5% annually. The vast majority of this was done between 2021 and 2023 when industry tailwinds afforded them enough cash to repurchase around $1.5 worth of stock. In May 2024 they authorized another $500 million program that will begin when the current program concludes. Thats 16% of the current market cap as of today when this was written, Sep 5.

“On that note, I want to remind everyone that as we near the end of our previously approved multiyear $1.3 billion share repurchase authorization, our board of directors authorized a new $500 million buyback program in may, which will be available upon the completion of our existing plan.”

William Waltz President, CEO and Director Q3 2024

Atkore continues to produce large amounts of cash flow. CapEx is on average 20% of operating cash flow, leaving significant FCF for buybacks going forward. In my view, they could easily continue to repurchase 2% - 3% or more of shares outstanding over the next few years.

Acquisitions

They’ve acquired 18 companies since going public, or 2.25 per year on average. Atkore slowly expands their total addressable market via acquisition. They target companies in attractive markets that they believe will provide them new manufacturing capabilities, product solutions and beneficial geographical reach. CapEx is invested into newly acquired companies as they leverage the Atkore Business to “unlock synergistic value.” This is right out of the Danher playbook.

In 2024 they expect to have CapEx of $200 million, of which 70% is going towards growth initiatives for their facilities and sites and digital capabilities. The remaining 30% is for routine CapEx.

Return on capital

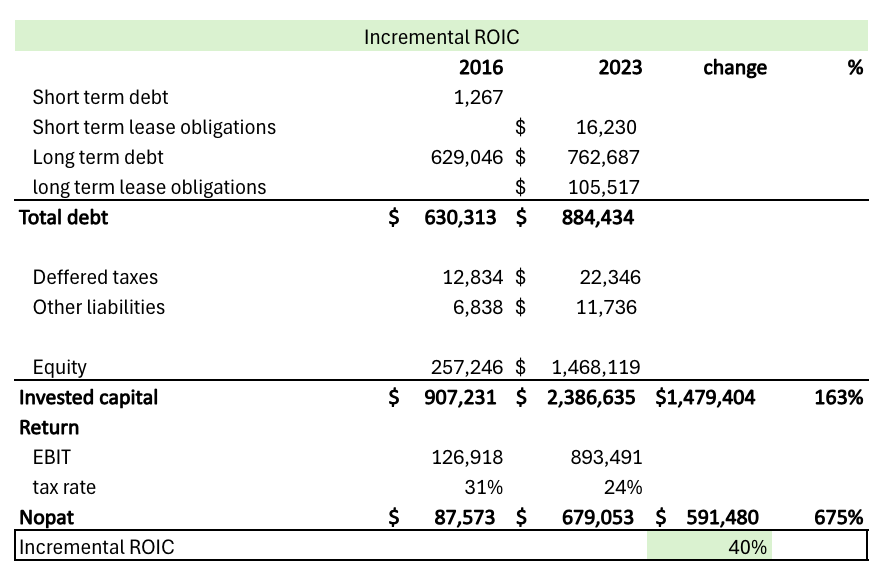

Below you can see that between 2016 - 2023 Atkore invested an additional $1.49 billion into the business and produced an additional $591 million in NOPAT as of 2023—an incremental return of 40%.

However, some may argue that Atkore’s returns have been abnormally high due to inflated commodity prices and increased demand during the pandemic. I generally agree but would also point out that Atkore was generating mid-teen returns prior to 2020 and those returns had been slowly increasing since Atkore became profitable in 2016.

Management

William Waltz has been CEO since 2018 and has been with Atkore since 2013. He currently owns around 1.26% of the company. All directors and officers collectively hold around 2.6% of the company which isn’t very much however Waltz’s ownership is enough for him to be aligned.

Waltz’s stake in the company is currently worth around $40 million. His total compensation package was $6.9 million in 2023 and his base salary was only $1 million, meaning 85% of his compensation is performance based and at risk. It also implies that his stake in the company is around 40 times larger than his base salary and 5 times larger than his total compensation. I personally think a CEO’s equity stake should be at least 5 - 10 times larger than his/hers base salary in order to be considered “aligned.” Atkore checks this box.

Financials

Atkore has a clean balance sheet which is necessary as it operates in a cyclical industry. Atkore’ current assets are larger than total liabilities, meaning Atkore is able to service all of its long term obligations easily. With operating cash flow around $600 million and total debt at $760 million, the company could easily pay off all debt obligations if they were determined to do so.

Margin pressures and growth

It’s helpful to think about Atkore before and after the pandemic since this was such a pivotal moment in the companies history. It was around this time that margins expanded and sales increased fairly dramatically. However, the important thing to note is before the pandemic occurred Atkore was a cyclical company with secular tailwinds and improving margins, even during the down cycles when revenue was decreasing and material costs were increasing (2016 - 2017). Below is an excerpt from a 2016 press release. Revenue was down 12% that year.

We were also able to demonstrate our ability to manage and grow margins during a period. in which our raw material costs were sequentially increasing.

John Williamson 2016 Q3 press release

Pandemic boom

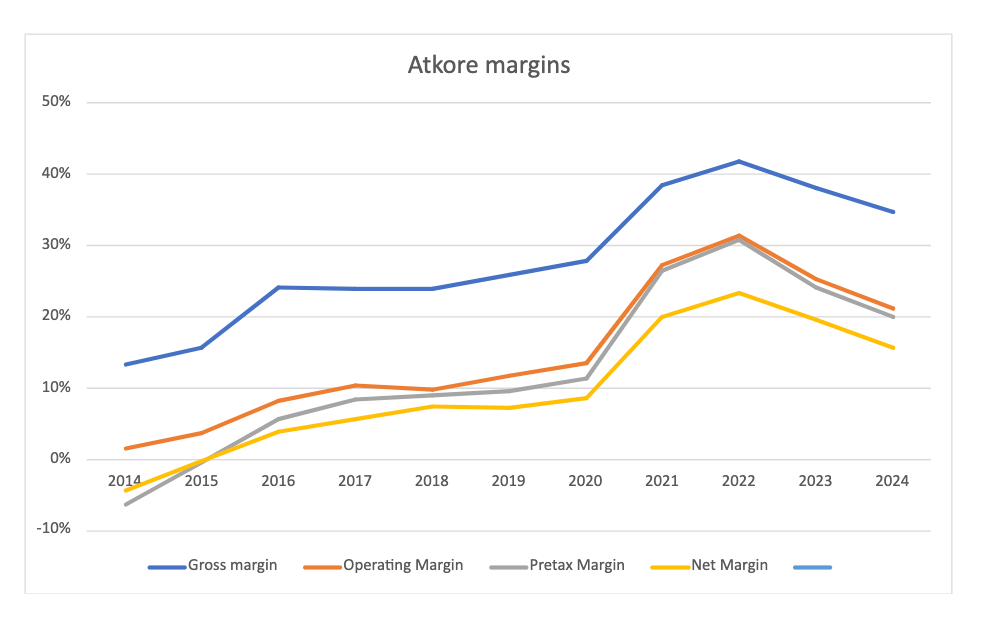

However, their sales and margins did in fact see an abnormal increase after the pandemic due to a construction and commodity bull market. Below you can see their margins over the last 9 years, and also where I project they will be for FY 2024. Margins peaked in 2022 and then began to decline as commodity prices and construction demand softened. Part of the big decline in growth and margins for the company has been due to normalization after a few big years of abnormal growth.

It’s hard to predict where exactly their margins will stabilize over the next few years but it’s reasonable to assume they will continue to be under pressure at least into next year. However its also reasonable to assume they will eventually stabilize and continue their pre-pandemic trajectory.

Risks

There are a few clear risks in my view.

Atkore is cyclical: Although cyclicality isn’t necessarily bad because it creates creates opportunities to buy during down cycles. However, Atkore has different variables driving its cyclicality and it makes it hard to know when the stock is cheap or expensive relative to future growth.

Competition: Atkore competes with manufactures from other countries where they may be able to produce pipe and conduit at a lower cost. They have recently been pressured by imports coming in from Mexico.

Customer concentration: Atkores top 10 customers’s account for 38% of their revenue and just one customer accounts for 10%. This would present a big problem if their top distributors stopped doing business with them.

Atkore was only a pandemic darlin: Its possible that Atkore is simply a mediocre business that was the beneficiary of a one off construction and commodity boom between 2021-2023.

Valuation

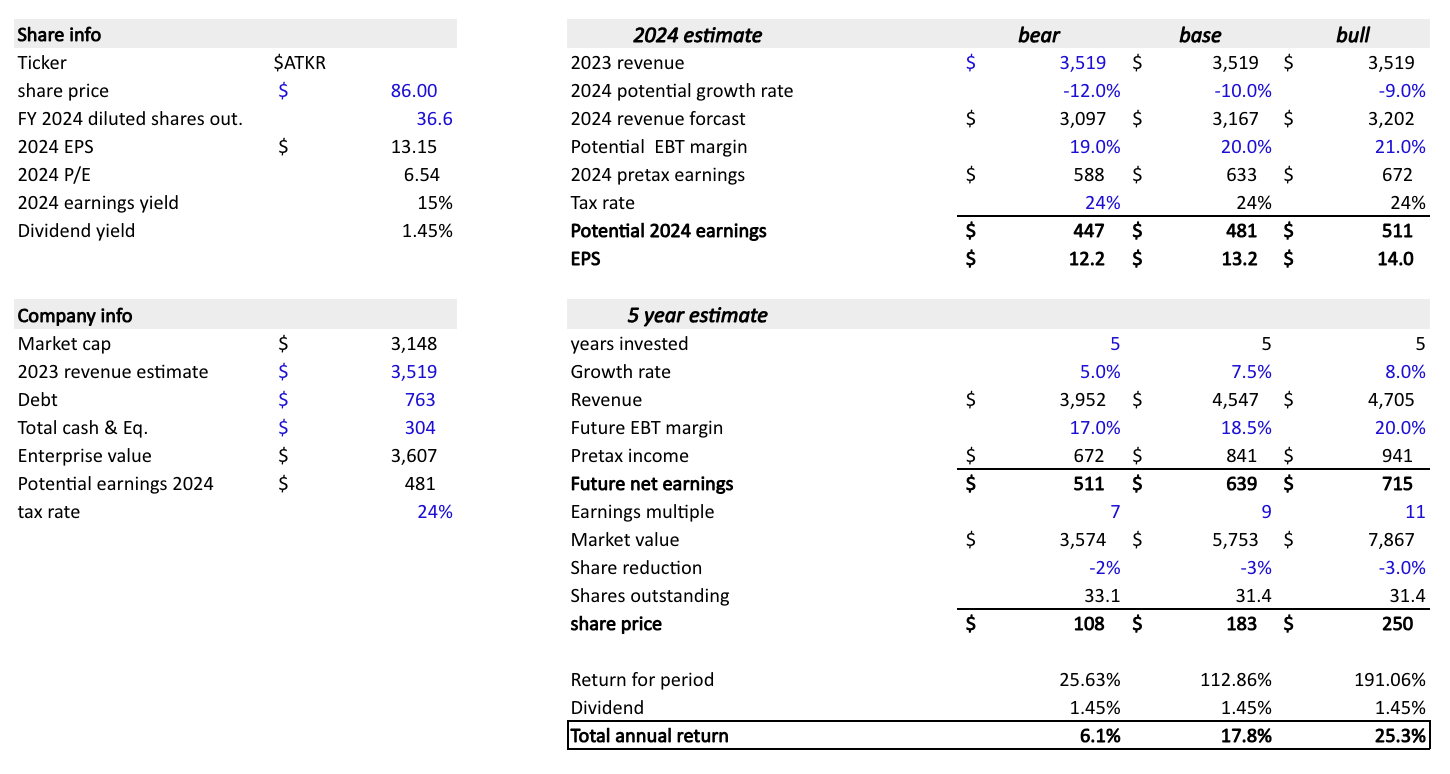

This valuation rests on a few key assumptions.

The company will grow somewhere below its historical average of 11%. In this case between 5% - 8%

Margins will normalize at a lower level than they are now, somewhere between 17% - 20%.

The company will continue to reduce shares outstanding, although at a far lower rate than they have historically. Around 2-3% instead of 9%.

An end multiple that is between 5-10x.

The bull case could potentially outperform the market over the next 5 years. The base case could offer a decent return and the bear case isn’t very exciting at all. My best guess is that Atkore will underperform in the short term and then begin to rebound in 2026 or late 2025.

Conclusion

Atkore is a good company that has a lot going for it. If the base or bull case plays out this could provide a great return. However, investors who want to own this company shouldn’t be scared of volatility and cyclicality. I personally don’t know if I’m ready to pull the trigger on ATKR 0.00%↑ . It’s a little too hard for me and too volatile for my taste and the bear case only appears to offer slightly more than US treasuries.

Hi Kairos, thank you for the article - it was a good read. A couple of questions; why do you think they do manufacturing? And what is your opinion of this? Typically a distributor is not also manufacturing products - it sounds like Atkore is more a manufacturing company then a distributor - quite large CapEx with ~50 factories around the world doesn’t excite me much - seems like they sell a commodity so am surprised they have 20%+ operating margins. CFO has recently left the organization and I believe there is also a short report indicating that Atkore has participated in collusion / price fixing - what is your opinion of this? Anyways thanks again!