Builders FirstSource

Key Info

Stock price: $150

Market cap: $18.9 billion

P/E: 13

ROE: 31%

Key takeaways

Builders FirstSource is a great company trading at fair price.

The market is pricing in slower growth over the next few years and it might be correct.

Long term tailwinds are still in tact for the construction industry, particularly the single family home market where they operate.

Overview and history

Builders first source is the largest U.S. supplier of building products, pre-fabricated components and value-added services for the professional builder. They engage in the manufacturing, distribution and installation of building materials.

As a contractor myself in my day job, I use their products fairly regularly through one of their subsidiaries pro-build, who owns a well known company here in San Diego called Dixieline. It’s like a smaller version of Home Depot except with better customer service, better materials and an actual lumber yard in back. This is typical of one their locations across the US.

Builders FirstSource operates 570 locations across 43 states and they’ve essentially grown their market share and geographical footprint through acquiring well run lumber yards, manufacturers and building materials distributors. They’ve acquired around 50 businesses since their founding.

They were founded in 1998 by a management team supported by the private equity firm JLL Partners. Even though their history only dates back to 1998, many of the companies they’ve acquired have a much longer history. Some of their subsidiaries were founded in the early to mid 20th century, and a handful of them go all the way back to the mid 1800’s (Lonoga, Jacobi hardware, Church’s lumber). It’s amazing to see the resilience of some of these businesses—surviving the civil war, two world wars, the great depression and every recession since.

In recent years manufacturing has become a larger part of their operation (27% in 2023, up from 20% in 2019). They manufacture various structural framing components such as pre-fabricated walls, floor joists, floor trusses, heavy duty laminated structural beams and whole house pre-cut framing package (Ready-Frame). They’ve also invested in robotics and automation over the last few years which is exciting for their manufacturing segment.

Builders FirstSource vs big box retailers

Some who are unfamiliar with the industry may be asking themselves “why don’t builders just get supplies from Home Depot?” In answering this, I think it’s important to understand some of the key differences between Builders FirstSource and their largest competitors like Home Depot and Low’s. I’m going to use Home Depot interchangeably with Lows because they are basically the same store in terms of their value proposition.

The key differences are as follows

Quality: You can think of Home Depot as the McDonalds of building supply stores. They’re convenient, they’re cheap, but often times they have lower quality lumber. Home Depot orders in bulk and stores the wood indoors in low ventilation which creates wet, moldy wood that tends to warp and twist. At times the wood is so wet it feels like it was fished right out of a river (no exaggeration).

On the other hand, Builders FirstSource typically has a much better lumber and a system for weeding out bad wood. They also store their wood properly outdoors where is can breath and dry out.

Different customer base: BLDR serves professionals, particularly larger scale home builders ranging from room additions to custom and tract home builders. In fact, 15% of BLDR’s sales come from their largest customers such as D.R. Horton, Dream Finders Homes, Lennar and more. Whereas only 10% of Home Depot’s customers are professionals and the rest are “DIY’ers”

Projects: 71% of BLDR’s revenue comes from single family home builders, which implies large scale projects with high ticket orders. Home Depot’s customer base consists of non-professionals doing weekend projects or smaller scale contractors like myself, who are picking up last minute items for renovations or remodels.

Customer service: The typical Home Depot employee is a clueless college sophomore who is skilled at dodging customers who look like they might need help. Lowes customer service is slightly better. Builder FirstSource on the other hand has much better customer service because they’re oriented towards serving pro’s only and the employees are actually knowledgeable in the building industry. For larger customers they load the order of wood and deliver it directly to the job site.

Specialty products/special orders: There are many things that you simply can’t buy at Home Depot. You simply can’t build most modern homes with the selection of lumber they have. Builders FirstSource has virtually any thing you could need to build a home.

Integration: BLDR manufactures some of their products but they also supply and install some of them as well—offering a fully integrated solution and value added products and services for builders.

Organic and inorganic opportunity

Inorganic growth opportunity

Depending on your definition of the term, one could consider BLDR a serial acquirer because one of their main growth drivers is through acquisition. Luckily this is a fragmented industry and theres no shortage of competitors to buy.

There are 9,145 lumber yards in the United States and Builders FirstSource only owns about 6% of them. According to the structural building components association, there are nearly 2,000 truss and building component manufactures in the US. This also provides Builders FirstSource with a large body of potential acquisition targets.

Organic growth opportunity

The majority of their revenue comes from the new single family home market which is about $160 billion. They currently hold only 11% of the market. This implies a lot of room to grow which I believe they are well positioned to do as an integrated manufacturer and distributor.

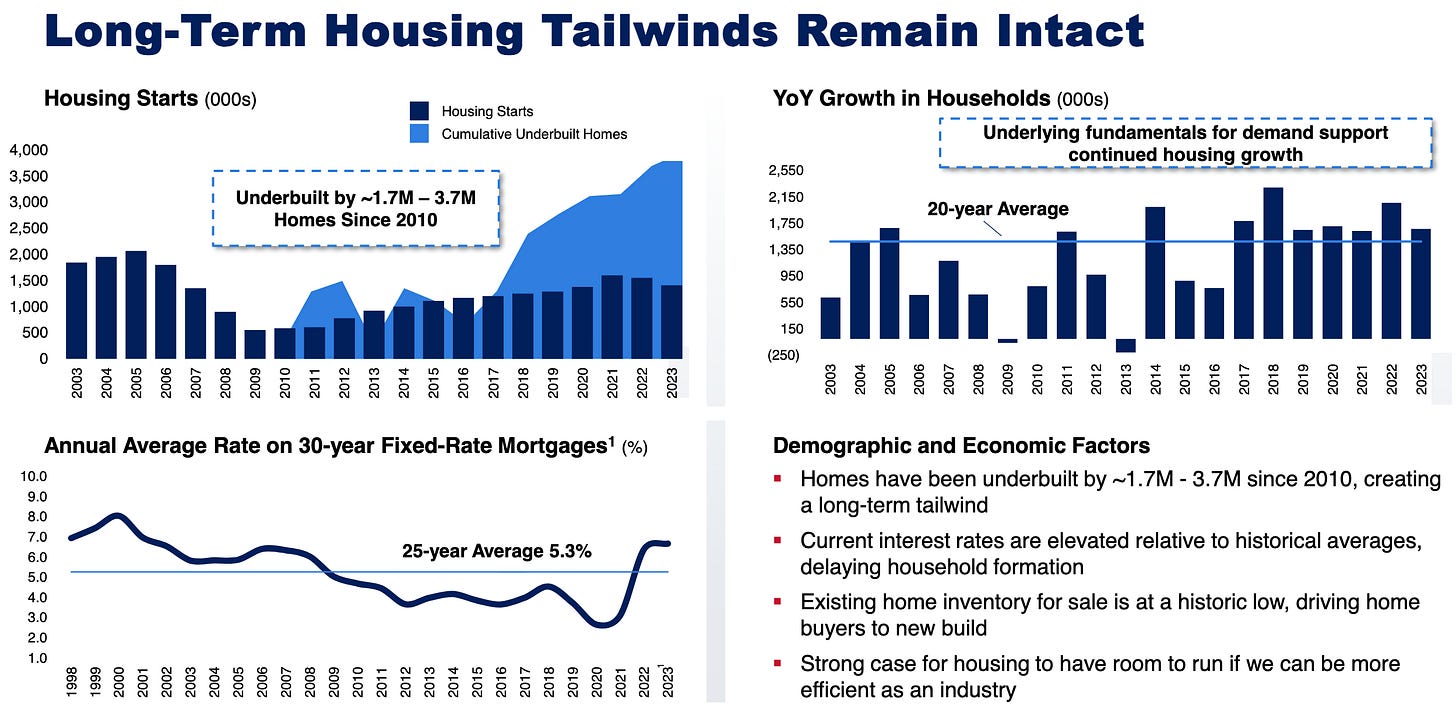

They should also benefit from the housing shortage. If you aren’t familiar, I talked about this in my write up on Dream Finders Homes. To summarize, theres a shortage in single family homes that isn’t going away any time soon and those who operate in the industry should benefit for at least the next decade in my opinion.

Material suppliers in particular have a privileged place in the home building process because builders have large unavoidable materials costs. This is great for suppliers who are able to capture this material spend.

Other markets they serve

The other markets they serve also presents an opportunity to grow their share. They only hold 2% of the $140 billion multi-family market, and 1% of the R&R (repair and remodel) market which is $175 billion. All this represents a total addressable market of $425 billion, of which they hold only 3.9%.

They have an opportunity to take share in the multi-family market because this area of construction is heavily dependent on production type building which BLDR is perfectly primed to serve. It may be harder for them to take share in the repair and remodel market because Home Depot is so entrenched there. Regardless, they have stated that they aim to expand more into both of these categories.

Strategy

BLDR’s strategy is focused on a few key areas.

Capture a larger share of builder spend by increasing high margin value-added products and services.

Optimize cost structure and efficiency to yield higher margins.

Cultivating builder loyalty through a customer centric culture.

Capital allocation.

Let’s dig into their value-added products and services and their capital allocation a bit.

Value-added

They’re focused on making life easier for builders by offering a suite of value-added products and services. These are basically products and services that would normally be done by the builder but can be conveniently done by Builders FirstSource. The value-added products tend to create customer loyalty as they make the building process more efficient for builders. A few examples would be offsite fabrication of floor and roof trusses and wall paneling, pre-cut frame packages (Ready-Frame), and millwork. Value-added services includes the installation of certain things like windows, doors, and so forth.

Ready-Frame is great example of a how they add a ton of value to the builder. They essentially have a computer aided saw pre-cut and label each individual piece of wood according to your building plans. The product arrives in a neat package ready to assemble without any cutting. This is a fantastic product/service they inherited when they merged with BMC in 2021.

Below is a break down of revenue between 2019-2023. You can see that increasingly they’ve become a manufacturing business. The manufactured products is a category in and of itself, but in all reality they also manufacture many products in the “windows, doors, and millwork” category. These together have made up an increasingly larger share of revenue, especially after the BMC merger in 2021.

They’ve invested $130 million in automation technology over the last few years. This could potentially boost margins and productivity in some of the manufactured products. This is something I’ll be watching over the coming years.

Capital allocation

They’ve been great stewards of shareholder capital over the last decade. Between 2014-2023 they invested an additional $7.5 billion into the business which produced an additional $1.6 billion in operating profit after tax (22% return on incremental capital). $5.3 billion of this went to two large acquisitions, BMC (2021) and Pro-build (2015).

These two acquisitions were very important for the company.

With the addition of Pro-build, Builders FirstSource would operate in 40 states and 24 of the top metropolitan areas. They also would benefit from increased efficiency and higher margin value-added services, which could be seen in the incremental improvements in margin and returns on capital in the years following 2015. (see fundamentals section below)

The BMC merger was even more transformational as they became the nations largest building materials supplier— expanding their geographical reach to 44 of the top 50 metropolitan areas. The deal was done for $3.7 billion. The integration of the two companies was impressive as it delivered cost savings a year early. They also raised their savings estimates from $130-$150 million to $140-$160 million. After the deal, “value added services” became 43% of the companies revenue and have continued to grow since.

Manufacturing synergies can bee seen in their truss operations where they’re now able to manufacture trusses 45% faster per board foot per hour than before the merger with BMC. The industry average for truss manufacturers is 100 board feet per man hour, Builders FirstSource does 158 per hour. It’s not hard to imagine how robotics and automation could make Builders FirstSource an even greater powerhouse in manufacturing.

Fundamentals

Builders FirstSource has become an increasingly higher quality company over the years as the integration of their acquisitions have created a fundamentally better business. This really climaxed with their recent merger with BMC where revenue leaped 130% from $8.5 billion to $19.9 billion. After all cost savings and share repurchases their EPS was up 218% while their operating margin increased 87%. Commodity prices were responsible for 44% of their revenue in 2021, therefore some of that margin improvement came riding on the back of inflation. Even so, commodity prices have come down to pre-pandemic levels and demand has softened and yet their margins have remained much higher than before. This indicates potentially long term operational improvements.

Their debt is just 1.6x their operating cash flow, which is a manageable level of debt that is easily covered. Their capex averages around 1.4% of revenue, and they have a 10 year average ROE of 37% indicating a quality capital light business.

However, a giant run up in revenue, they’ve recently seen a decline in sales (-25%) as demand has softened. It’s unclear to me how long this will continue.

Risks

In my opinion the top risks for Builders FirstSource are as follows.

Industry- Builders FirstSource primarily sells products to home builders and so they’re inherently dependent on that business. If mortgage rates remain high or go higher it would certainly be bad for home builders and BLDR..

Competition- They compete with the large retailers (Home Depot) and lumber yards across the US, both of which are increasingly offering more services to pro-customers such as delivery.

Customer concentration- 15% of BLDR’s revenue comes from their top 10 customers, if they were to lose loyalty from one or some of these customers their revenue would take a hit.

Valuation

BLDR’s revenue declined 25% in 2023 and it currently trades at a low multiple (around 12x) as the market is pricing in slow growth for a few years. It really could go either way, good or bad, so I’m going to assume a range of scenarios from bad to good.

Buybacks have played an important role in generating returns over the last few years so this needs to be taken into consideration. The company reduced its shares outstanding by 12% in 2023. They currently have a buyback program in effect right now for around $1 billion (5% of market cap) and they’re going to generate $1.2 billion in FCF in 2024 (6% forward FCF yield). With that being said, I’m assuming they’re able to buyback shares between 2-5% annually over the next few years and they grow earnings around 3-7%. They tend to average a multiple somewhere between 8-15x earnings so I’m going to assume that as the multiple range.

Final thoughts

I’m going to hold off for now on buying this one but I would certainly be interested at lower levels. However, there is one scenario that would catch me by surprise. If they made another amazing acquisition like BMC, they could potentially do much better than I anticipate, but I’m not going to bet the farm on that scenario.

This is certainly a premium building supply distributor with management that takes shareholders seriously and I’ll continue watching it.

Thanks for reading! Consider subscribing if you like the content.

Great writeup