ContextLogic

From failed e-commerce platform to capital allocation vehicle

Summary

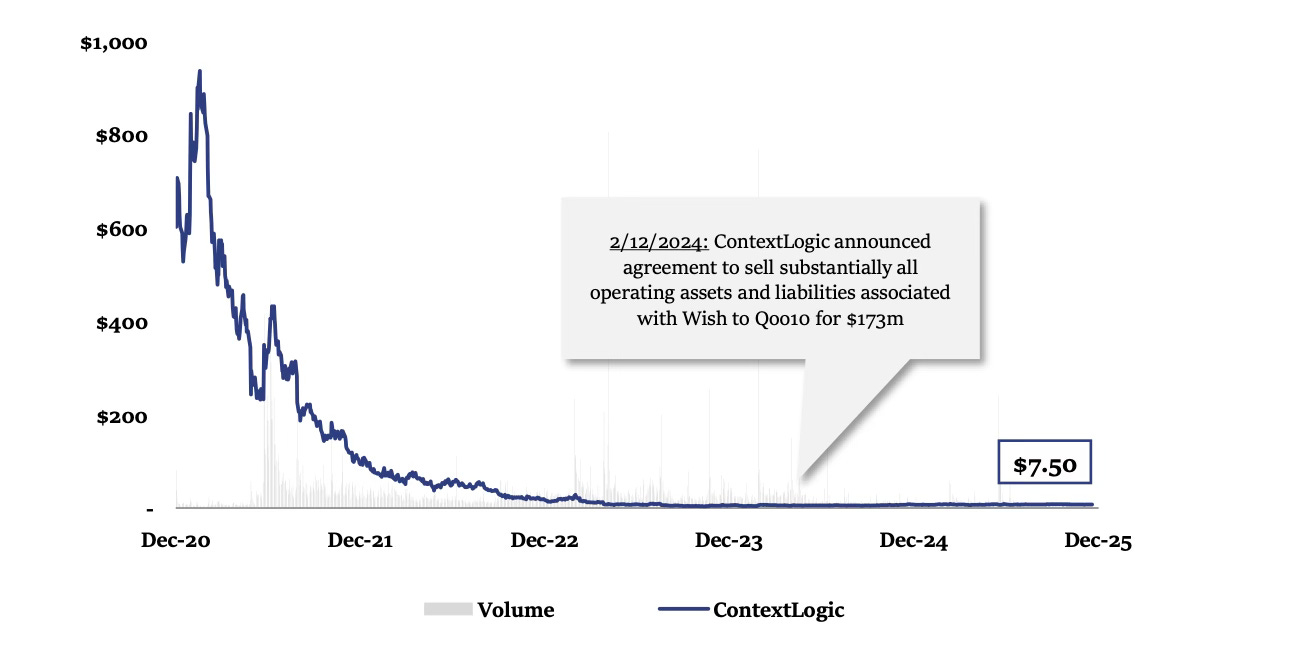

LOGC sold its legacy e-commerce assets in 2024 for ~$170m

The public shell retained ~$2.9bn of NOLs

Control and capital allocation shifted to Abrams Capital and BC Partners Credit

LOGC is being rebuilt as a a tax efficient public acquisition platform, modeled around long-term owner-operator principles rather than quarterly EPS optimization.

LOGC acquired US Salt, the 132 year old high purity evaporated salt producer, led by a talented management team

The stock was delisted and trades on the OTC, but will uplift to NYSE after US Salt closing.

I estimate LOGC to be worth ~$8-9 per share; US Salt ~$7+ per share and the NOL’s are worth ~$1-2

ContextLogic, previously known as Wish, is no longer an e-commerce business. It’s now a capital allocation vehicle controlled by a few talented investors. The company also has a very large tax voucher that can be monetized going forward.

The easiest way to think about the companies history is in three chapters or phases.

Chapter 1: The Wish implosion

Wish was probably one of the more dramatic public failures over the last decade. Founded in 2010 by Peter Szulczewski (a former Google engineer) and Danny Zhang, Wish aimed to avoid competing with other e-commerce platforms with personalization and discovery. The idea was unique and contrarian.

The problem was that management burned through billions on Facebook and Instagram ads, all the while the platform itself was a quality control nightmare, and quite frankly, just an awful experience. Rampant counterfeit products were common, and 50% of the products showed up late or not at all. The end result was a failing business with enormous Net Operating Losses (NOLs).

Chapter 2: Transition and preserving the tax assets

CEO Rishi Bajaj (from hedge fund Altai Capital) was brought on the board of directors and CEO in late 2023/early 2024. He was tasked with assisting the transition and restructuring of the company. In February 2024, the Board adopted a Tax Benefits Preservation Plan to preserve and monetize the NOL’s.

Net operating losses (NOLs) occur when a company loses money and can’t fully use its tax deductions in the current year. Those losses can be carried forward and used to reduce taxes in future profitable years, and for accounting purposes they show up as a deferred tax assets DTA.

However, tax rules prevent companies from being acquired for their tax losses, helping ensure the tax benefit goes to owners who actually incurred the losses.

Under IRC section 382, a change in ownership will impair the ability to use the NOL’s. A “change in ownership” is defined as

“More than 50 percentage points of stock ownership shift among 5% shareholders within a rolling 3-year period.”

So the key to preserving NOL’s is to limit ownership changes in the top owners (5%+). The first vital step the board took was choosing to sell the assets of Wish rather than the equity in order to avoid an ownership change. After the asset sale, the company essentially became a shell with ~$292m in investable cash and $2.7 billion in NOL’s.

Management outlined a further poison pill designed to avoid an ownership change by make it irrational for anyone to acquire 4.9% + by immediately diluting them. That plan was later replaced with permanent restrictions embedded directly into the certificate of incorporation, prohibiting any person or group from acquiring 4.9% or more of the company.

Chapter 3: building the platform

In February 2025, Context Logic announced a $150 million strategic investment and capital commitment from BC Partners to execute an acquisition-led strategy. The explicit goal is to“capitalize on the embedded value within ContextLogic”, especially the NOLs.

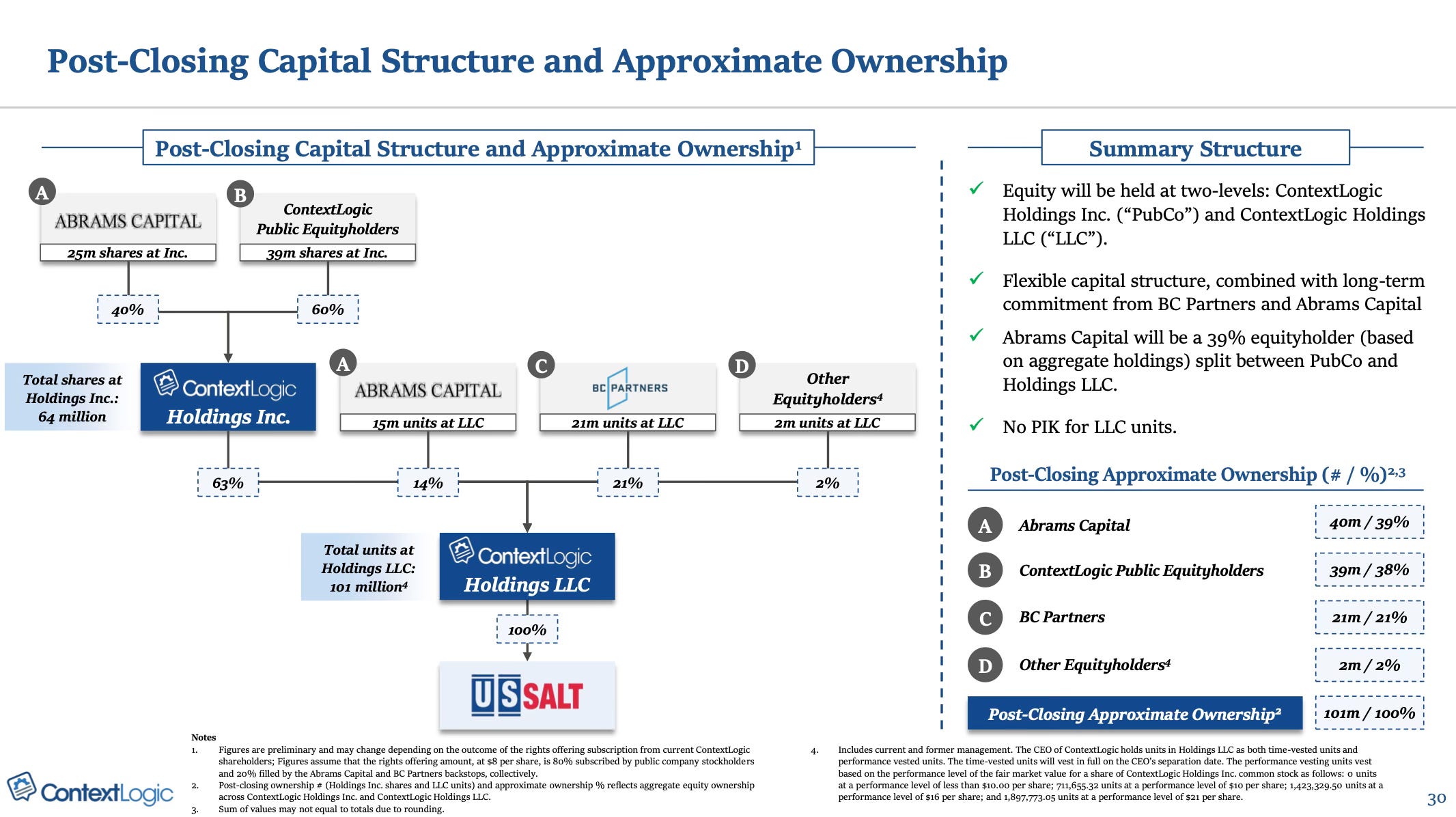

The company then reorganized into a two-tier structure consisting of a publicly traded holding company (PubCo, $LOGC) and an underlying LLC where operations occur and investments can be made.

US Salt acquisition

In early December 2025, Mark Ward (BC Partners) was appointed President and an agreement was reached to acquire US Salt Parent Holdings, LLC for an enterprise value of $907.5 million. Post-closing, the board will be expanded to seven directors, including two from Abrams Capital (David Abrams and Raja Bobbili), two from BC Partners (Ted Goldthorpe and Mark Ward).

TheUS Salt financing package totals approximately $922 million:

Cash: ~$292 million provided by Context Logic, including the $150 million investment at in convertible shares from BC Partners. These can eventually be converted into class common shares in the public company.

Debt: A $215 million senior secured and a $25 million revolver led by Blackstone.

Rights offering (equity): ~$115 million expected proceeds. Existing shareholder are given pro-rata rights, meaning, they can buy more to maintain the same % ownership after the new shares are issued. BC and Abrams Capital also backstopping the offering at $8, implying that institutional investors are willing to commit at that price.

Abrams equity rollover: ~$315 million. Abrams rolls all of its existing US Salt equity into ContextLogic rather than cashing out. This materially reduces cash needs and signals long-term ownership intent.

Post-acquisition, public shareholders will own 60% of the TopCo (public company), and the TopCo will own 63% of the subsidiary (the LLC), so on an aggregate basis, public shareholders have about a 38% economic interest across both levels of the company. Ownership is concentrated at the public parent level between public shareholders and Abrams Capital, while operational control and capital allocation flow through an intermediate LLC where BC Partners holds a significant interest, reinforcing sponsor-led governance without a full change-of-control.

At this point, ContextLogic is a full-on capital allocation vehicle with ownership-oriented board and management. The company defines it self as “A publicly traded business ownership platform designed from first principles around a true ownership mindset—run for owners, by owners.”

The acquisition platform

ContextLogic is attempting to build an extremely tax-efficient, owner-run compounder, borrowing heavily from the playbooks of Berkshire Hathaway and the Swedish serial acquirers, but applied to smaller, niche industrial and essential-service businesses.

The acquisition of US Salt serves as an “anchor asset” and a foreshadowing of what’s to come. Management views US Salt as the perfect prototype for future acquisitions, adhering to a strict “strike zone” of specific business characteristics. They will be looking for businesses that are;

Niche with high barriers to entry and a strong likelihood of being relevant 20–30 years from now.

“Small enough to avoid the competitive spotlight”

Cash-generative, high margin, and difficult to replicate.

Management is explicit that they will not pursue large TAM narratives, multiple expansion, earnings momentum, speculative growth, synergy-driven rollups, or trend-based investments (“AI winners”).

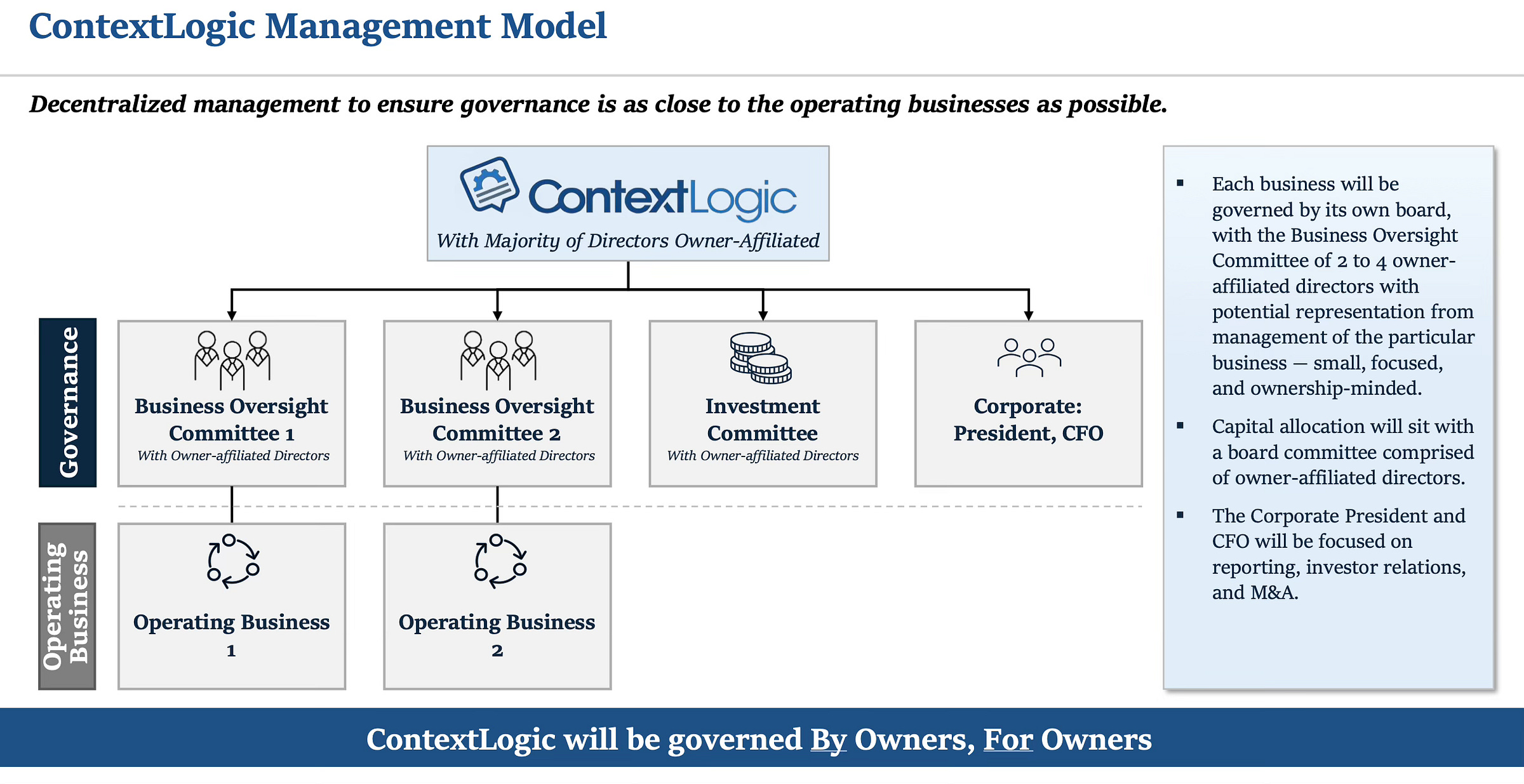

Operationally, the platform will be decentralized. Each operating business runs autonomously with its own management team, while governance is kept close to operators through small, owner-affiliated Business Oversight Committees. Capital allocation decisions are centralized at the board level via an Investment Committee composed primarily of major equity owners (via BC and Abrams), Ted Goldthorpe, David Abrams, Raja Bobbili and Mark Ward.

The financial objective is 9–18% long-term free cash flow per share growth, driven by 5–10% organic growth at subsidiaries, 5–10% incremental growth from acquisitions, and enhanced by ContextLogic’s ~$2.9 billion of net operating losses, which shelter cash flows from taxes for many years.

US Salt

ContextLogic acquired US Salt for 14.5x NTM Adjusted EBITDA. US Salt sounds generic and commoditized. However, upon closer look, it’s clear why they acquired it. First, the company has adjusted EBITDA margins of 40-45% and high free cash flow conversion. Second, Salt production has some competitive advantages flowing from geographical constraints, long permitting times and large CapEx. Salt is also very heavy and low in value, making long-distance shipping uneconomic, and local dominance very likely.

US Salt is located in Watkins Glen, New York. This gives them a big freight advantage for the entire Northeastern U.S. and Mid-Atlantic. Competitors from the midwest or oversees would have trouble competing with US Salt on price because of shipping costs.

The company is a vertically integrated producer of various evaporated salt products. They produce everything from industrial-grade salts to table salts and have been in operation for 130 years. Because it’s the highest-quality salt, and it’s produced by evaporating brine, evaporated salt typically has stable demand compared to other forms of sale. The company will almost certainly be profitable and selling salt at incrementally higher prices in the future. Salt has increased in price by an average 3% per year over the last 25 years.

Leadership And Alignment

The corporate holding company will have a team of serious investors on board who oversee investment decisions. The structure will be lean with a focus on capital allocation and M&A rather than day-to-day operations. There will be no CEO, but rather, a president and a board of 7, including Mark Ward, Ted Goldthorpe, David Abrams, and Raja Bobbili, all of which will receive no salary or director compensation. This is obviously rare to see.

There will be two new committees formed;

Investment committee: Responsible for determining how the company's cash flow and capital are deployed. It will be chaired by Ted Goldthorpe, and includes Raja Bobbili, David Abrams, and Mark Ward.

Business oversight committee: Functions as a focused board for the subsidiary, working closely with US Salt CEO David Sugarman to approve budgets, review financial performance, oversee key hires, and make compensation decisions. Composed of Raja Bobbili and Mark Ward.

David, Mark, Ted, and Raja will be aligned through their interests in BC Partners and Abrams Capital, and the performance of those funds. Because the SEC does not require disclosure of G.P. economics, carry splits, or individual partner exposure inside the fund, it’s not possible to say with precision just how much $LOGC these individuals are exposed to. However, both firms own an aggregate 60%, and according to Mark Ward, Ted, David, Raja and himself are the largest owners.

“It is worth underscoring, the four of us represent the largest owners of the business. To reiterate, the whole structure is designed to keep governance focused and ownership minded.” - Mark Ward, IP Transcript 1

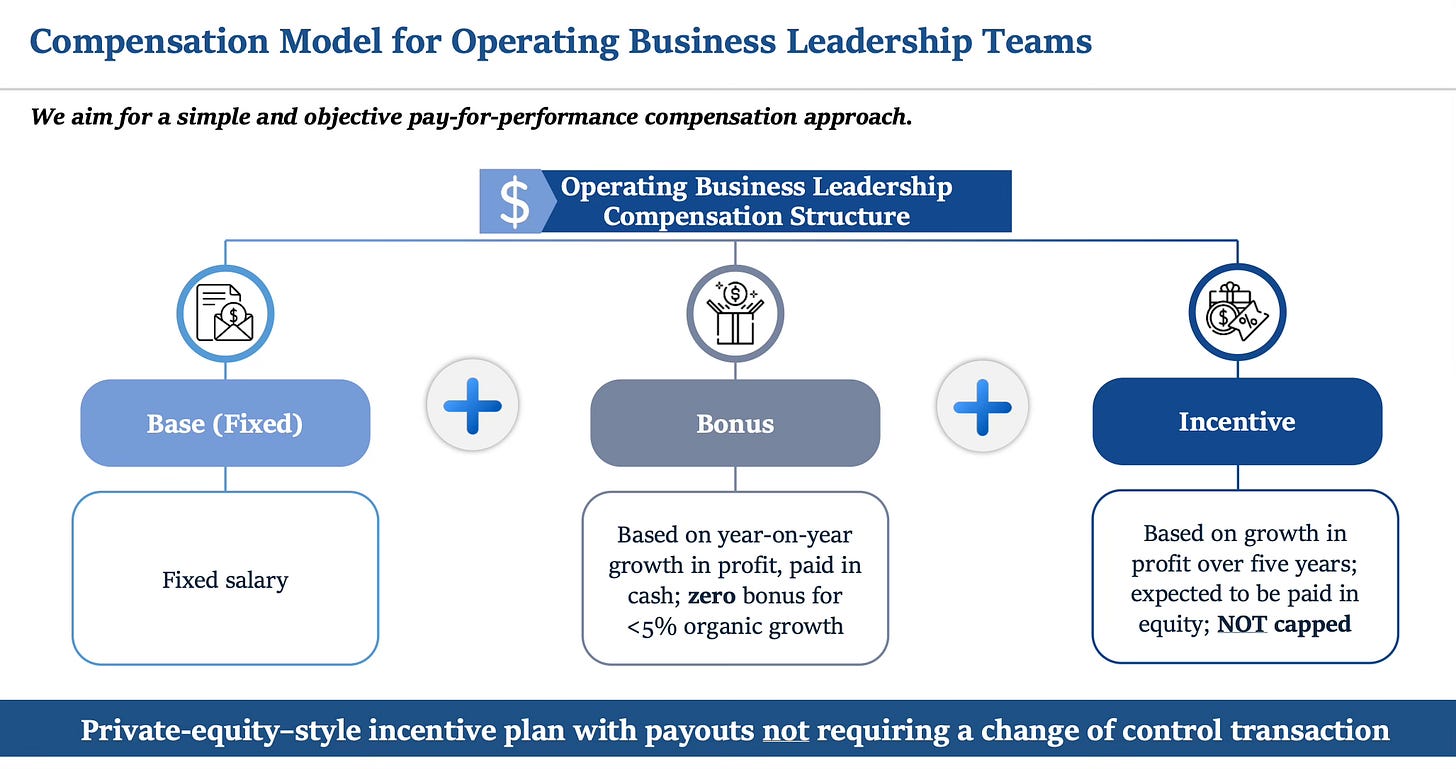

Operating management is paid through modest base salaries, cash bonuses only if organic profit growth exceeds a threshold, and long-term equity incentives tied to five-year profit growth. Dilution is capped at roughly 1–2% per year and only occurs if real economic value is created.

Below are some more management/board members details, and their affiliation with ether BC Partners or Abrams Capital.

BC Partners

Mark Ward, President and Director: Mark is a private equity/private credit guy. Previously an analyst at Houlihan Lokey doing corporate restructuring, he’s now a director of credit at BC Partners. He has agreed to take no salary from ContextLogic and he is aligned through his interest in BC partners.

He serves on the newly formed Investment Committee, alongside Ted Goldthorpe and David Abrams, where he is responsible for making all material capital allocation decisions to ensure the company compounds free cash flow effectively

Ted Goldthorpe, Outgoing Chairman: Ted is finance veteran with a distressed / credit / capital allocation background. He, along with Abrams, are the architect of the “NOL monetization + acquisition platform” strategy. Ted has built a few private credit businesses from scratch. Prior to founding BC Partners Credit arm, he spent 13 years at Goldman Sachs in special situations, and 4 years leading Apollo’s credit US opportunities platform.

Ted’s skin in the game is primarily through his interest in BC Partners Credit, which owns a large stake in ContextLogic LLC. Also, as the head of that arm, he is responsible for the $150 million investment they made in the LLC. If ContextLogic succeeds, he likely earns a large portion of the performance fee, although his exact share is unknown.

Abrams Capital

David Abrams, Director: David is another seasoned value investor with a 30+ year career, including foundational experience at Baupost and decades running Abrams Capital. He has a value-driven philosophy, similar to Seth Klarman, whom he worked for early in his career. He is typically long term and concentrated, but is also known for special situations, and investing across different assets classes as opportunities arise.

David’s alignment comes through his interest in Abrams Capital, of which he is the founder and GP. While David Abrams does not hold this stake directly, he most certainly has substantial economic exposure through his role as founder and GP.

Raja Bobbili, Incoming Chairman: Raja is a Managing Director/partner at Abrams Capital. He has been a key in managing the firm's portfolio. His expertise covers financials, communications, retail, and special situations. Raja will oversee the integration and performance of US Salt. Raja said ContextLogic is his single biggest personal holding.

Other key figures

Recently departed CEO Rishi Bajaj was granted 600,000 Class P units that only vest if the company’s 20-day average closing price reaches $30 per share by December 31, 2030. He will remain a key equity holder going forward, but he will not be economically decisive.

Thoughts on Valuation

I will leave you with some thoughts on the NOL’s and what I think the stock could be worth, assuming the US Salt deal closes.

Equity ownership is held at two levels: the PubCo shares and the LLC units. The LLC has a total of 101 million units, of which the PubCo owns 63% = 64 million units. The PubCo will have a corresponding 64 million public shares outstanding after the deal closing. The remaining ~37 million LLC units are held by BC Partners and Abrams Capital and may be exchanged into PubCo shares at their election, so long as there is not an “ownership change” as defined by the IRS. While these exchanges would increase the PubCo share count, the economic value per share will remain the same as non-controlling interest is adjusted. In the meantime, BC and Abrams enjoy the tax benefits associated with owning the LLC, which is a pass-through entity.

More importantly, the LLC-PubCo share exchanges generate a tax basis step-up at the PubCo level, creating incremental depreciation and amortization deductions that reduce future taxes. This tax efficiency is a core benefit of Up-C structures. In the long run, as units convert to shares, the PubCo's value per share often ends up slightly higher because of these accumulated tax benefits.

US Salt sits entirely within the LLC and is expected to generate levered free cash flow of ~$35 million (mid-point). 2 Because the PubCo owns ~63% of the LLC, its share of that cash flow is roughly ~$22m, or ~$24m on the high end. With 64 million PubCo shares outstanding, this equates to about ~$0.35-$0.37 of free cash flow per share. This would be ~$5.5-$7.5 per share with a 15x-20x multiple. I think US Salt alone is worth around $7+ per share given the companies pricing power, EBITDA CAGR of 14%, and competitive advantage.

ContextLogic also has $2.9 billion in NOL’s. There’s a few things to understand about NOL’s. First, NOL’s are worth the present value of future taxes you are realistically confident can be avoided. Second, they can only shield 80% of the taxable income in any given year. Third, the faster ContextLogic can grow its taxable income, the more the NOL’s are worth today.

If US Salt does ~$40m in pretax income in 2026, ~$25.6m is allocated to the PubCo due to 64% ownership. Applying the 80% usage cap gets us to ~$20.5m that can be sheltered, then we apply the corporate tax rate (21%) and we get the annual tax savings of ~$4.3m. Not much, but again, this can grow as the taxable income grows. This is the key.

If we assume the company grows its taxable income by 10% annually for 15 years, (incremental years contribute very little to present value), the tax saving would look something like this.

Year 1 tax savings: $4.3m

Year 10 tax savings: ~$11.2m

Year 15 tax savings: ~$18.0m

With 10% growth, the total tax savings by year 15 will have been around ~$150m, discounted at 10% gives a present value of ~$80m, or ~$1.25 per share. This of course could be higher or lower depending on how fast they acquire new pretax income. But between $1-2 is probably a reasonable estimate. There is also another thing to consider, as ownership (BC, Abrams) is converted from the LLC to the PubCo, the PubCo is allocated a larger portion of the taxable income, and therefore, the NOL’s can be monetized more, potentially increasing the value of the NOL’s. Although this would need to occur sooner than later for the tax savings to not be discounted away.

Lastly, the $8 rights offering that is backed by BC and Abrams indicates what sophisticated institutional investors believe is a fair price for the stock. $8 will likely act as a center of gravity in the near term.

The bottom line: At today’s price, you are basically paying a fair price for US Salt and getting some potential NOL’s for free, all while waiting on management to turn the company into a quality acquisition platform. The stated aim is to grow free cash flow at 9-18% annually, which includes both organic and inorganic growth after incentive dilution. If the company demonstrates a few years of consistent free cash flow growth, the market will stop viewing the company as a single asset industrial holding company and start pricing in a well-run serial acquirer.

Final thoughts

The ContextLogic story is barely beginning to shape up. It is certainly early for this idea considering the company has no operations today, so keep that in mind. Currently, the stock is not well known, its trades on the OTC (until the deal closes) and very few institutional investors are involved. It’s not dirt cheap, but it’s also not so expensive that it won’t do well if management executes. Potential catalyst includes another acquisition announcement, and uplifting to the NYSE when the US Salt deal closes.

I personally own shares at an average price of $7.60 and I am considering buying more.

Thanks for reading, that’s it for this week.

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am an $LOGC shareholder at the time this was written.

2026 free cash flow of ~$31–35 million reflects US Salt EBITDA of ~$60–65 million, less ~$15–17 million of cash interest on acquisition financing, ~$6–8 million of maintenance capital expenditures, minimal cash taxes due to NOL utilization, and modest public-company and holding-company costs.

New sub, am I following what you said that LOGC is worth 9 ish and trading around 8?