Since my last article on DFH 0.00%↑ the stock has done better than I expected so I updated my assumptions and models. In this article I wanted to start with a few things that I missed or didn’t know about when I wrote the last article. Then I want to discuss market dynamics and asset light building a little deeper.

Key takeaways

2022 annual shareholders letter: Patrick has serious skin in the game.

Recent results: Better than I expected.

Overall housing market dynamics: Buckle up and prepare for a lot of new housing demand.

Asset light building: This is the way.

The building process: Asset light building take a lot of discipline.

Thoughts on valuation: Dream Finders valuation is reasonable.

2022 shareholder letter

Reading through DFH 0.00%↑ 2022 annual shareholders letter I realized Patrick Zulupski basically has his entire net worth tied up in DFH 0.00%↑. I knew he owned a large stake in the company but I didn’t know 99% of his of his personal net worth was tied up in the stock. Thats the kind of inside ownership that gets my ears perked up.

If that was impressive enough, he also mentioned that a lot of his friends and family have money tied up in DFH 0.00%↑ stock as well.

I’m not sure he could have any more skin in the game. Founders like this are faced with two choices, succeed or destroy the net worth of yourself and your loved ones. Thats a tough place to be in but it certainly forces accountability in decision making. I appreciate this sort of commitment from founders.

Recent results

Their recent results indicate there is still demand for housing, at least in some of the areas they operate in. New orders increased 16% which is a key indicator of future revenue growth. Revenue increased 19% and home closings increased 12%. This is great but its a little out of character for a home builders in an environment where mortgage rates are over 7%

So the question is why have they done so well? and can they sustain the momentum?

Housing market dynamics

Housing markets are cyclical and therefore home building is cyclical as well. Housing booms often begin when home prices are increasing. Under normal circumstances, this sends a signal to builders to build more homes because there’s profit to be made. This increases the supply of homes and which eventually decreases prices, which leads to less homes being built and eventually a housing bust. This creates a low supply of homes which increases prices and starts the process over again.

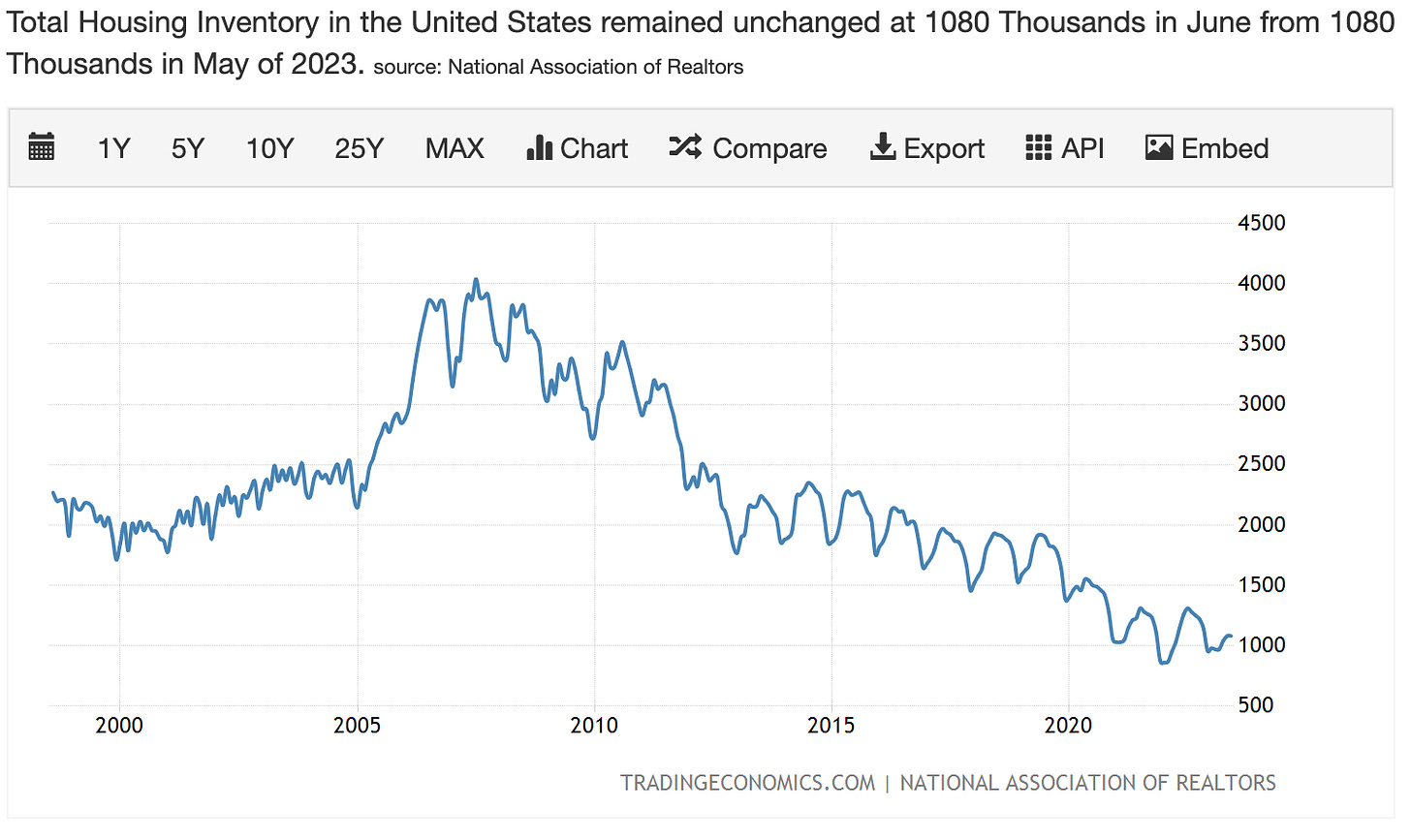

But something strange has happened since the great financial crisis. Although there have been a few housing cycles, inventories have declined and the production of new homes have not been able to keep up with demand—pushing prices higher. This can be attributed to a few things.

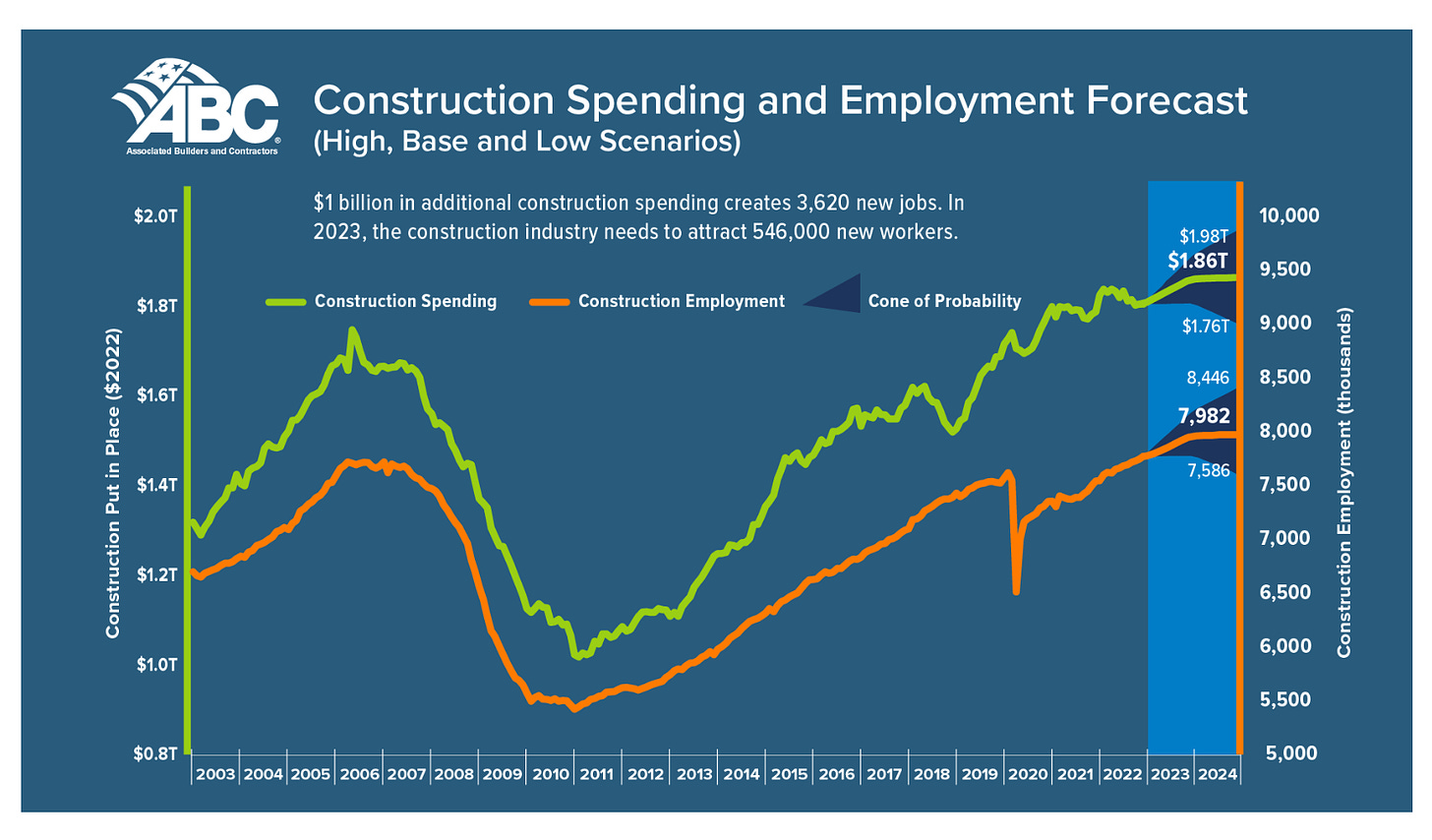

During the great financial crisis many home builders and construction workers went out of business and left the industry and never came back. We’re just now getting back to the labor and spending levels that we had before 2007.

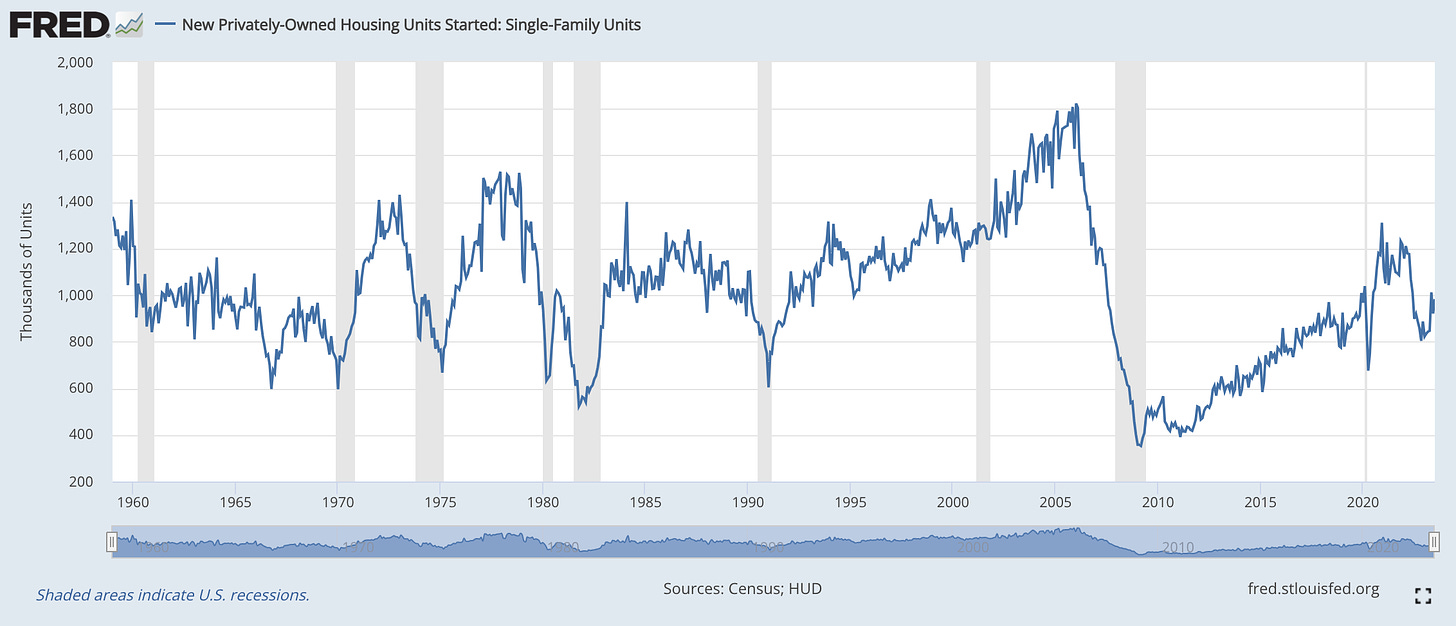

The lack of skilled workers and builders has contributed to the lack of home building, especially in the single family market. Below you can see the the average number of new housing starts, it’s been been roughly 1.4 million per year since the 1950’s. However since 2008 they have been way below average, almost touching it briefly in 2020 and 2021.

This has created a gap between the growing number of housing formations that need homes and the actual number of homes being made available. The gap between single family housing starts and household formations sits at about 6.5 million according to some estimations but some estimations are a bit lower.

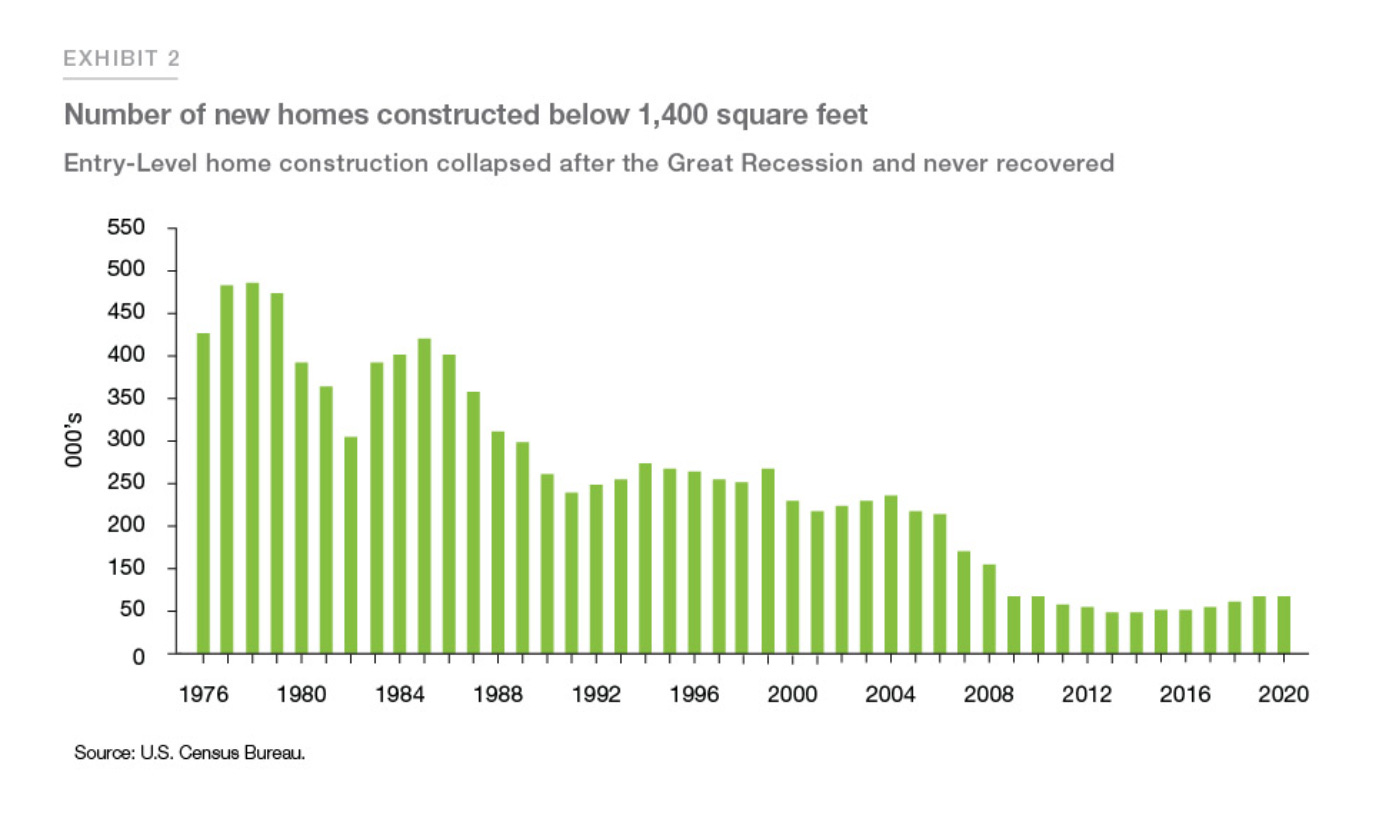

Below you can see the number of single family (entry level) homes dropped after the great financial crisis and has remained under built since.

So while this has certainly contributed to the shortage of homes, more recently the existing supply has become increasingly unavailable for sale. People are simply not willing to part ways with their homes because they locked in very low mortgage rates over the last decade and especially the last few years.

So it seem there’s two main forces at work currently in the housing market

Low total supply relative to demand

Fewer people willing to sell that supply

So what do you do when the demand for housing is outpacing the supply and the existing homeowners are unwilling to sell? You build more homes. This probably explains why many home builders experienced growth over the last few years and continue to grow even in the face of higher mortgage rates.

It’s hard to say how long this housing supply shortage will play out but I don’t think it will be resolved in the near term. In order to fix it in a few years, the rate of housing starts for single family homes would need to triple in order to close the gap within 3-4 years. This is very unlikely because construction is not an industries that can simply triple its production capacity in a few years, especially since theres is a shortage of skilled laborers and regulations around land permitting. I personally think the new single family home market could be booming for quite a few years.

Which brings me to my favorite builders, DFH 0.00%↑ and NVR 0.00%↑. Now don’t get me wrong, there’s a lot of fantastic home builders out there like DR Horton and Lennar, and I may even buy one of these companies as well in the future. However, Dream Finders and NVR are my favorite because they utilize an asset light model which mitigates some of the the balance sheet risk of home building.

Asset light

In the home building industry “asset light” or “land light” refer to a strategy where a builder outsources the business of land development which has proven to be a long, capital intensive process that’s often times risky and economically unappealing.

Land development typically consists of buying raw land and clearing it of and large rocks, roots and brush. Then the earth must be graded and re-shaped to a specified elevation and made into flat buildable lots. Then water, power and sewer must be drawn from the closest municipal source to each lot. Last but not least, the earth must be compacted so as to withstand the load of a home so settling doesn’t occur later on. Often times roads are also paved along side these “finished lots.” All of this is a very capital intensive and time consuming process that isn’t the best use of time and capital for a builder.

Dream Finders has chosen to opt out of this grueling process by utilizing a land light strategy. They essentially pay a small fee—under an option contract or purchase agreement—to a land bank or developer who undergoes the task producing finished lots for them or acquiring finished lots on their behalf. Then Dream Finders acquires these lots from them only after they’ve sold a home and collected a deposit.

This liberates them from the burden of land development and allows them to focus on selling homes and increasing their building efficiency. This stands in contrast to the more traditional “asset heavy” model where builders acquire large plots of raw land ahead of time then develop it themselves before building. Almost all major home builders utilize some combination of asset light and asset heavy, but only $NVR and $DFH utilize a 100% asset light model.

The biggest benefits of the land light model are

It doesn’t require large upfront investments in land inventory. This affords DFH industry leading inventory turnover and ROE.

It frees up cash that can be used to acquire competitors and buyback stock, which tends to be a far better use of capital than land development.

They can control large amounts of land without buying it upfront.

It manages down side risk during recessions and creates opportunities for acquisition since more capital is available.

Growth drivers

In their recent quarterly report they grew 19% YOY and much of that is due to growth in key markets like Orlando and Texas. Orlando in particular grew revenue almost 140% from $60 million to $144 million and grew its pretax earnings 259% from around $5 million to $19 million the revenue growth is a mixture of new closings (12%) and increased average home sales price (9%)

As far as future demand for single family homes, I think DFH 0.00%↑ will be busy over the next 5-10 years + and I suspect the majority of their revenue will come from their biggest markets like Texas and Florida.

Valuation

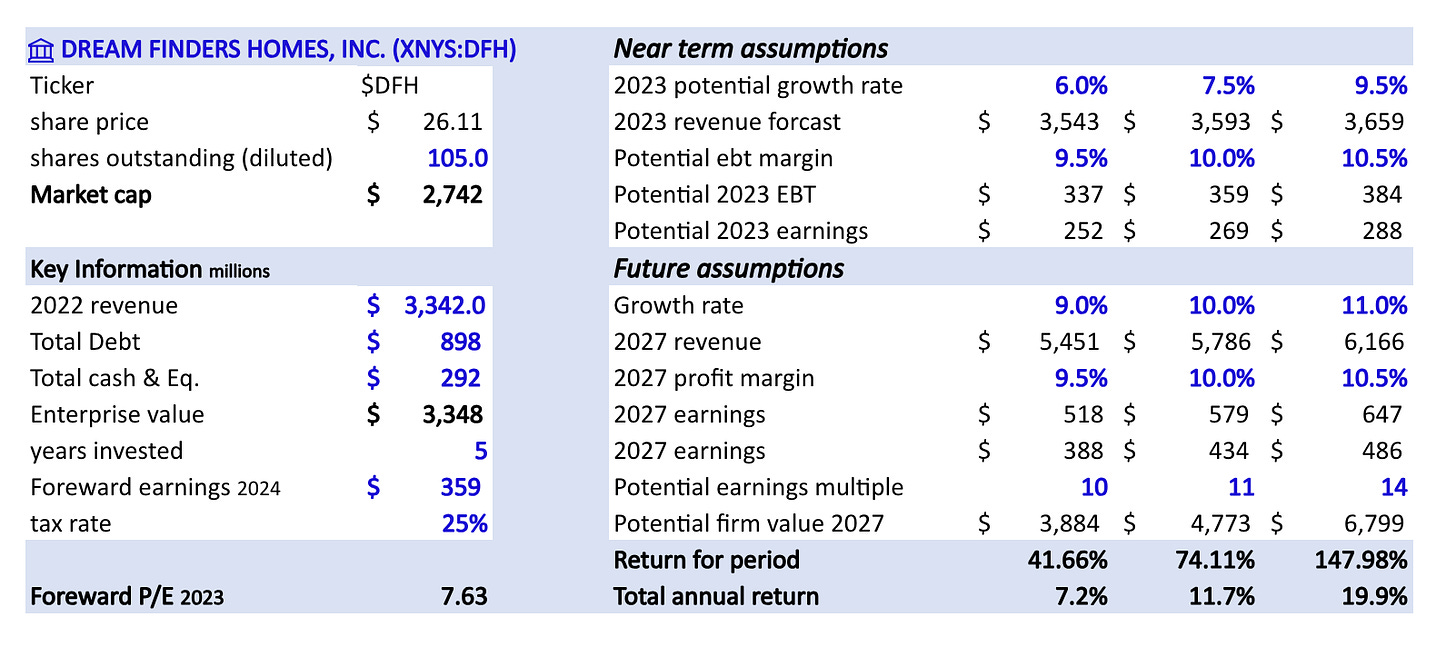

I kept many of my original assumptions in tact except allowed for growth this year seeing as how they continue to grow revenue and orders are increasing. I still think this company will command a higher P/E in the long term like NVR, somewhere in the 10-15x range because their asset light model mitigates risk and improves returns on capital.

The bull case assumes the housing market grows and structural demand wins out over higher interest rates. It also assumes investors will be willing to pay a 14x multiple for a home builder, which isn’t abnormal for premium builders like NVR, but then again this isn’t NVR, yet at least. Regardless all three scenarios are fairly conservative, assuming modest growth and modest end multiples.

Conclusion

I initially bought this stock at around $10 and I did increase my position a tiny bit at $26. Although I’m not gonna make a bigger commitment unless shares fall a bit lower. For now I’m waiting to see if mortgage rates continue to climb. Despite structural demand for housing, I’m hesitant to assume higher mortgage rates don’t matter because the evidence suggests they do, higher rates make people hesitant to buy homes and higher rates increase the cost of capital for builders.

All in all this stock is close to my sweet spot, and I’m weighing other investments against this, If I cant find anything else I like I might add more to my position.

Thanks for reading!

Buenos días,

Enhorabuena por el artículo. Muy bien explicado el negocio ligero en activos y los contratos de opción sobre terrenos. Para un inversor que empieza, como yo, es oro puro. Ánimo y un saludo desde España!