Enphase Energy and notes on 380 baggers

My Enphase investment

In 2018 I was tipped off about ENPH 0.00%↑ by a respectable friend who was an electrical engineer. Now, I usually don’t take stock tips from friends, especially ones that aren’t serious investors, but he assured me that solar demand was going to increase exponentially and ENPH 0.00%↑ was the future of solar inverters.

So I did some research and found an unprofitable company that was growing at 10% and had previously posted negative growth for several years. I wasn’t impressed at all, but my friend continued pounding the table on Enphase so I did a little more research and decided to take a small position when it was only few dollar a share.

After a few months I sold the position for a small profit, reasoning to myself that the money could be invested elsewhere in a better opportunity or at least a more profitable company.

In the following months and years, in what seemed almost like a sad episode of Seinfeld, I watched ENPH 0.00%↑ literally explode to the upside like nothing I’d ever seen before. Not only did the company swing to profitability but the multiple exploded from 1x sales to more than 17x sales.

Just to give you an idea of the massive gains that Enphase produced; between June 2017 and November 2022 ENPH 0.00%↑ compounded at around 210% per year. A mere $1,000 investment would’ve been worth something like $381k by November 2022, a 381 bagger in just a few years.

But of course reality doesn’t work that way because very few people, if any, bought the stock at its all time low in 2017. Even a year later, when it was first brought to my attention, Enphase still appeared to be a sluggish, unprofitable solar company. There simply wasn’t enough fundamental information to indicate that this was the investment of lifetime.

Even though I had pre-priced information from a legit source, my skepticism couldn’t be overcome because the facts and numbers weren’t available to confirm the information I had been given.

It wasn’t until the first quarter of 2019 that it became obvious that there was something serious going on. Revenue accelerated to 46% yoy and their profit margin expanded from 0% to 2%. Then over the next few quarters they posted incredible growth and by the end of 2019 their profit margin jumped to 26% from -3.7% a year earlier.

Over the next few years all of their margins expanded as the stock soared and ultimately the stock became over valued.

I suppose in 2019 I could have taken a position when it was at 20x earnings, or maybe even during the pandemic sell off in 2020, but I didn’t. As a matter of fact I stopped following the stock so closely and focused my attention elsewhere.

Did I make the wrong decision? I don’t know, but I made a decision and thats life.

Dreams of avarice

We all wish we could discover the next Enphase, a stock that turns every $1 into $381 in a matter of 5 years. A stock that would pay for our child’s education and usher in an early retirement.

Once or twice in a lifetime you’ll may come across an investment opportunity like that and 9 times out of 10 you’ll pass on them because they’re too risky or difficult to spot in the early stages. Even If you did invest in one and made 10,000% in a few years, do you think you’d be willing to continue holding after the first time it sells off 20%? How about 50%? Nope. You’d want to sell in order to lock in those sweet gains.

See, these kinds of explosive gains are amazing if you can find them but don’t count on them to get rich, especially if you don’t have total control over your emotional nature.

The good news is you don’t need a 381 bagger to get rich, and also you don’t need the shiniest new tech stock either. Buffet got rich on boring companies with stable cash flows and high returns on capital. None of us will become as wealthy as him, but thats ok because we don’t need to.

Ok moving on to the Enphase Energy.

Company overview

Enphase designs, develops and manufactures solar home energy solutions in the United States and internationally. They have an entire ecosystem that allows you to generate power, store power and monitor it.

They have a few core products.

Micro inverters

Solar inverters convert DC power, which is produced by solar panels, into AC power, which is the standard form of electricity used in most homes and buildings.

Traditional solar inverters, called string inverters, work fine but they have a few limitations. First, the power and performance of each panel is linked to the rest of the system. For example, if one panel is producing less energy because it happens to be in a shaded area, the rest of the panels will produce less energy as well. Also, similar to the old Christmas lights, if one stops working the rest stops working as well.

Micro inverters solve this problem since they function in a parallel circuit and work at the individual solar module level. This means if one panel is having issues or working at a lower capacity, the rest of the panels will remain free to operate at maximum capacity.

Enphase designs, makes and sells the worlds number one micro inverter for solar systems. This is where the majority of their revenue comes from.

Battery systems, AC modules and more

Enphase also sells various other hardware products such as battery storage systems for storing solar power. They also make an AC module which is a solar panel with a micro-inverter build into it so the power is already in AC form and ready to be distributed.

They also sell electric vehicle chargers, grid services and various other services that help installers and customers organize the design and solar sales and installment process.

Segments

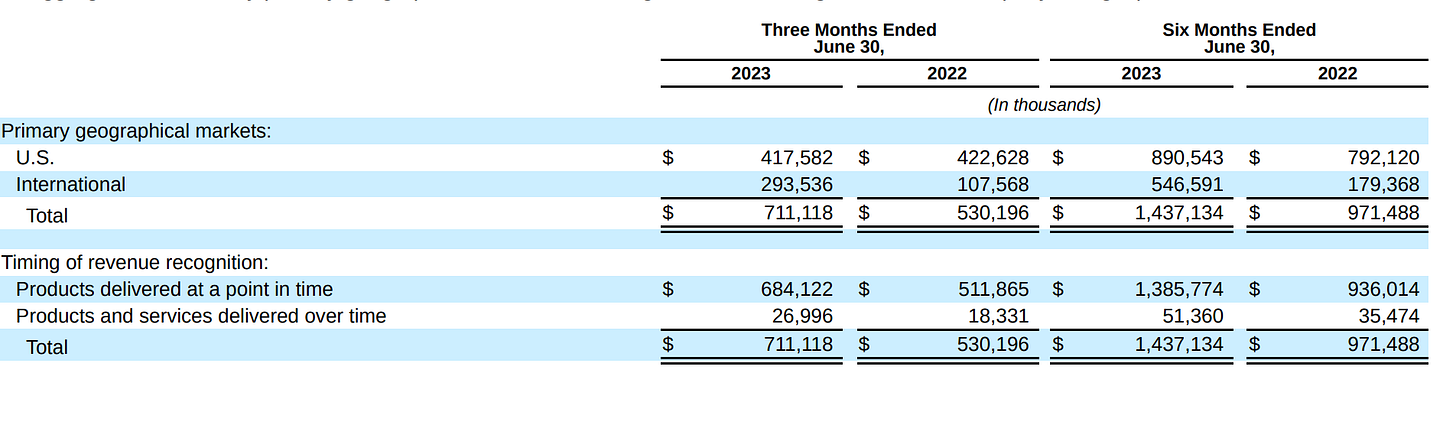

United states currently makes up the biggest portion of sales at about 59% followed by international sales at 41%. International sales are clearly growing year over year while US sales were down about 12%

Management said that macroeconomic conditions have put pressure on their sales.

The sell off

In November 2022, Enphase was priced as if it would continue growing revenue at 52% per year, as it did between 2017 and 2022. The problem is that solar systems are often financed because they are so expensive. Depending on where you live and which products you use, most systems would cost between $10k-$30k but could be even more if the roof or electrical panel needs to be updated.

So obviously higher interest rates would cause more people to put off their solar projects if borrowing costs have increased the way they have recently.

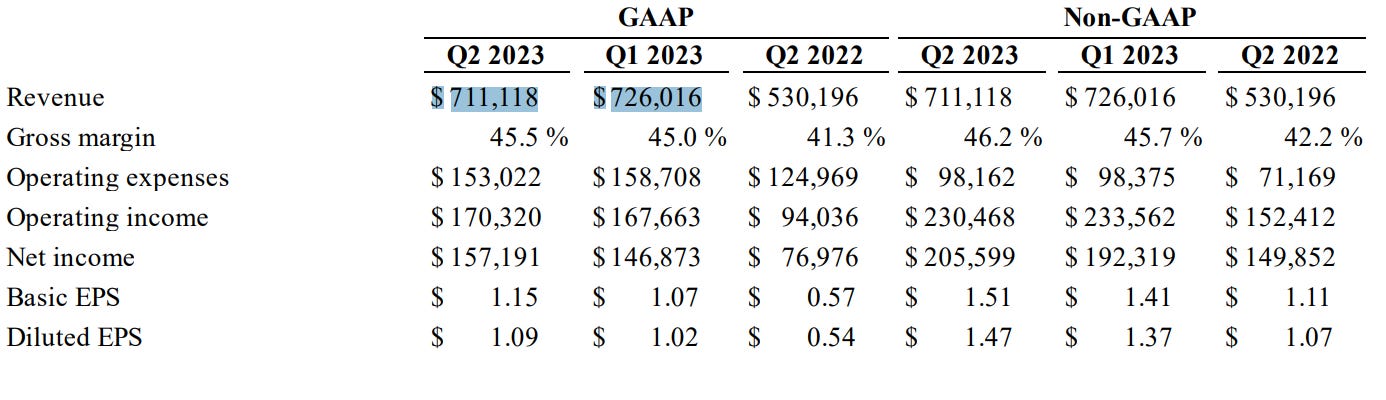

Their quarterly revenue indicated a 12% decline quarter over quarter which is actually the third quarter in a row where sales haven’t grown. The peak was the fourth quarter of 2022.

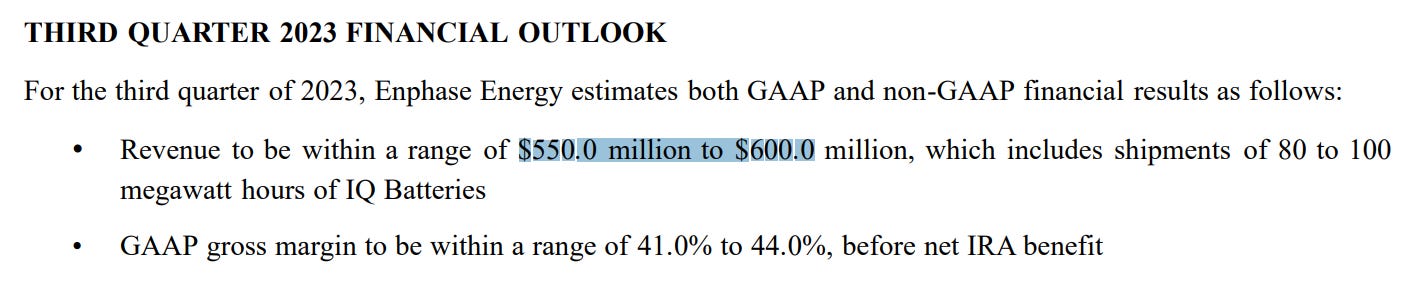

They’ve also indicated much lower revenue for the third quarter along with lower gross margins.

This is the big surprise that the market didn’t like and I think it’s a legitimate concern in the short term. I’m assuming this means lower sales for the rest of the year, especially considering the fed just announced they would keep rates “higher for longer.”

In the long term it’s obvious that solar demand will continue to grow as it become a more viable option for people around the world.

Risks

Below are a few obvious risks that caught my attention

Customer concentration

Enphase currently has one customer, who is unnamed, that makes up about 30% of their revenue. This is probably a large solar distributor that has a very close relationship with Enphase but regardless, I personally don’t like to see that kind of customer concentration because it posses a huge risk if that customer were to ever stop doing business with Enphase. It doesn’t seem like they have made much of an effort to reduce this concentration either.

Competition

Enphase competes in a very competitive market. Most items they sell have formidable competitors selling similar products.

They compete with other central and string inverter manufactures like solar edge SEDG 0.00%↑. Solar Edge sells string inverters with optimizers that function similarly to the micro-inverters sold by Enphase.

Although Enphase arguably sells the best inverters on the market, and doesn’t have any serious competition in the “micro inverter” space, it is however one of the most expensive brands. I imagine during tough macro environments, people may not be willing to pay more for premium solar products, possibly allowing less expensive competitors to grab marketshare.

In their battery segment they compete with Tesla, LG, Sonnen, Panasonic, BYD and various other battery manufacturers. Tesla is probably the biggest concern here.

They also compete with many companies in the EV charging market such as Tesla, Charge point, and Wallbox.

Prolonged higher rates

I’ve already touched on this but its worth rehashing. Higher rates clearly have a negative affect on solar sales, and its starting to look like higher rates may roll into next year. We will see how this plays out.

One time purchase products

Enphase is a hardware manufacturer and that means they make money from one time sales of their products. Their growth strategy is largely dependent on

Geographical expansion into other markets, which they are doing.

Increasing their product offering and selling more products to existing customers which they are doing.

Price increases which I’m somewhat skeptical about in the long term.

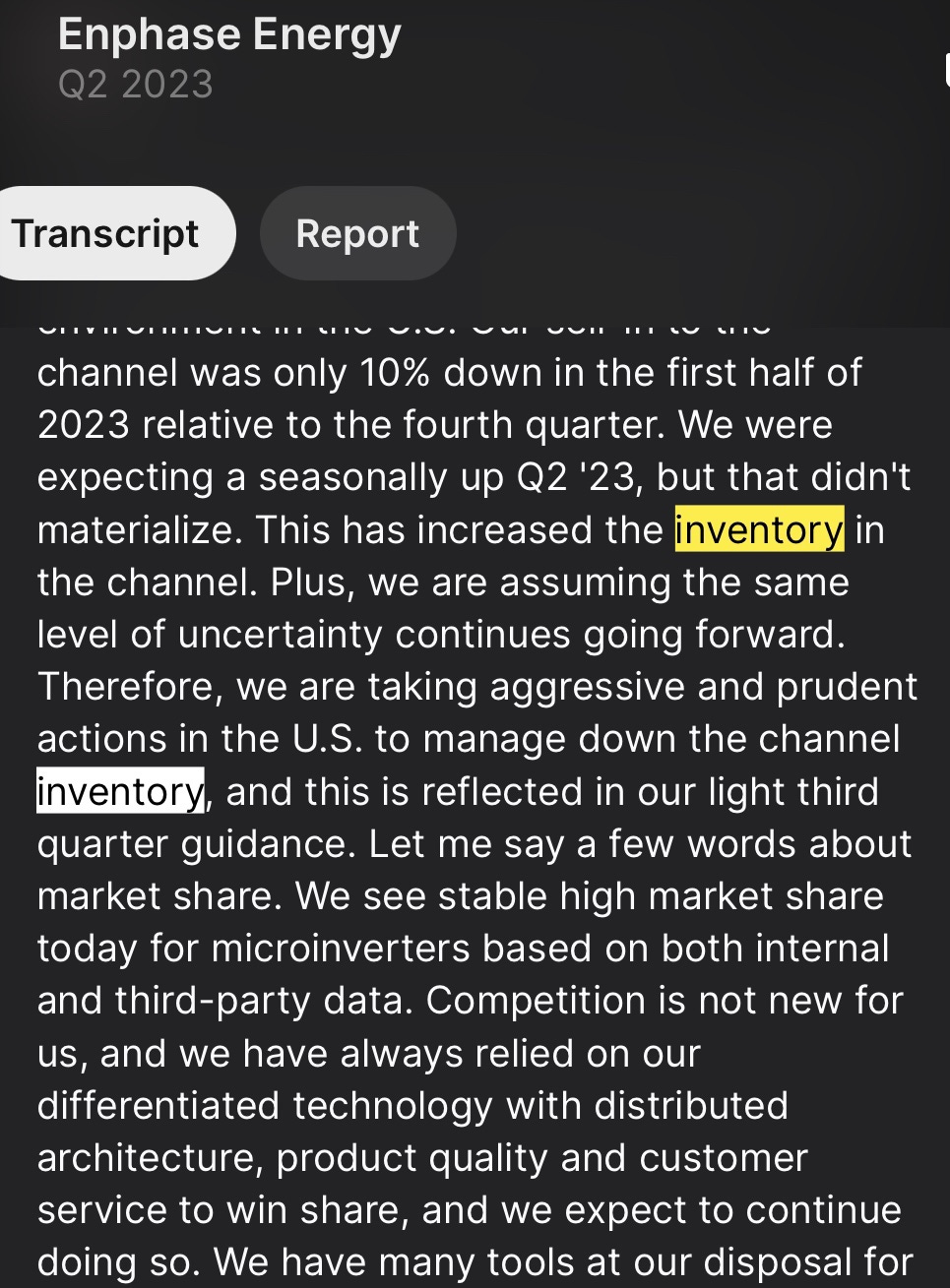

Inventory build up

In their Q2 earnings call they said they plan to “manage down” their inventory, which is reflected in their “light Q3 outlook.”

In simple terms, this means inventory is building up because they didn’t sell as many products as they had planned to, so now they need to lower their prices in order to sell their product inventory down, which is partially why their revenue will be lower in the third quarter.

Below I mapped out their inventory turnover ratio by year. Im excluding 2020 because it was an anomaly due to the lockdowns.

For those who don’t know, the inventory turnover ratio shows how often a company clears out its inventory, so higher numbers are normally better. The 2023 figure is my estimate assuming COGS and inventory grows at the same rate.

2019 17.9

2021 15

2022 11

2023 10.15

You can see they aren’t turning over their inventory as much in recent years which is concerning.

Financials

When I’m looking at Enphase’s financial statements I really like what I see. They have $1.8 billion in cash, equivalents and short term investments, they have $1.3 billion in total debt and they generated almost $700 million in free cash flow last year. They’ll probably generate between $650-$750 million in free cash flow again this year.

valuation

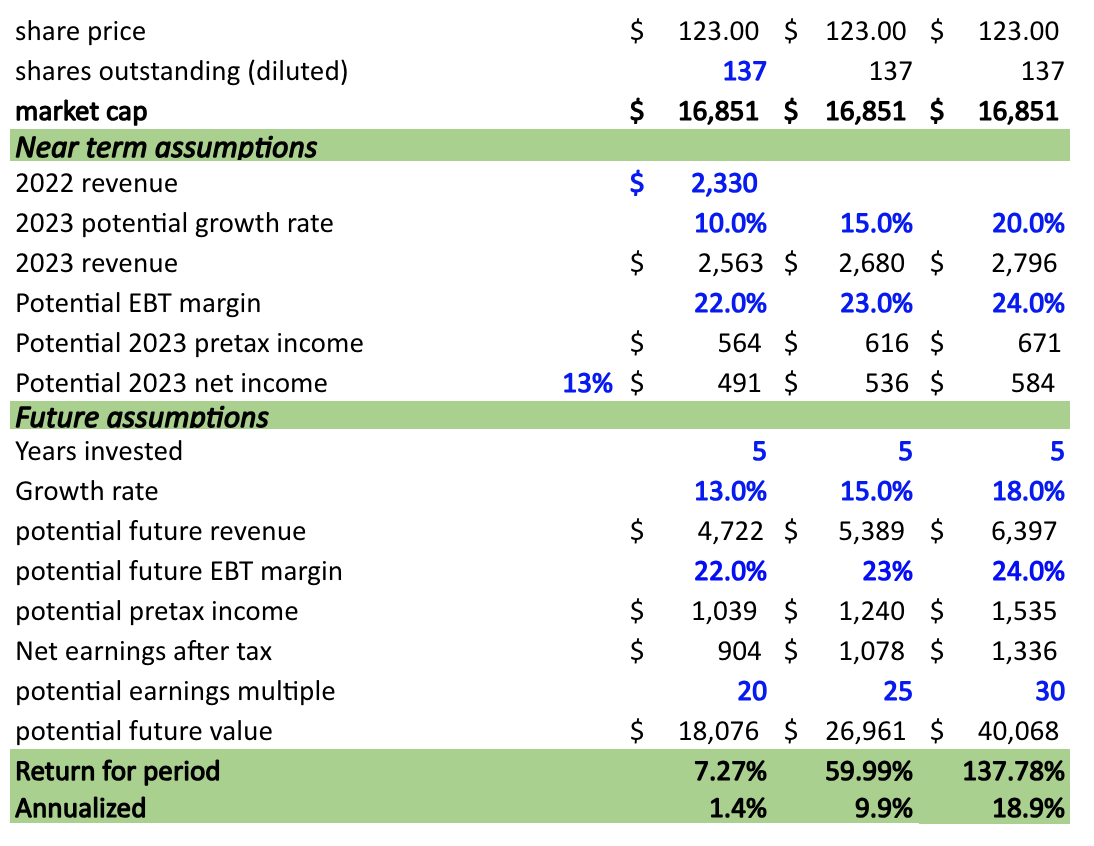

For my valuation, I’m assuming their margins drop slightly this year and their revenue grows between 10%-20% and continues growing between 13%-18% over the next 5 years. The end multiple I’ve assigned is between 20-30x earnings because I think this could potentially still be a decent growth stock 5 years out.

Final thoughts

Honestly, this one is just too hard for me right now, I’m not extremely confident in my valuation assumptions because I just don’t have a strong conviction about different variables.

I can’t fully wrap my head around the supply and demand dynamics of the industry, I know there are government programs that are creating demand and I don’t know how long those will continue. I also don’t know how long interest rates will stay higher and whether that will continue to cause serious problems in the solar industry. Lastly, the competition and concentration risks don’t sit very well with me.

This doesn’t mean I will never invest in the company, It just means I’ll be thinking more about this company and watching it for now. If the price drops low enough I would revisit it.

Thanks for reading!