Overview

International General Insurance Group is an international P&C insurance company with a diverse niche book of business. IGIC is also diversified geographically as they have a presence in 200 countries. They operate out of the Middle East and write the majority of their insurance lines out of Europe, Middle East, Bermuda, North Africa, and Asia Pacific.

Their business done in the following geographic regions.

22% in UK

18% in North America

11% in Continental Europe

11% in Asia

10% in the Middle East

10% in Central America and Caribbean

5% in Africa

9% worldwide

2% Australasia

3% South America

They write insurance lines in energy, construction, engineering, property, ports and terminals, political violence, general aviation, professional lines, financial, financial institutions, contingency, and treaty reinsurance.

The majority of their business is written in Energy and professional lines.

Company history

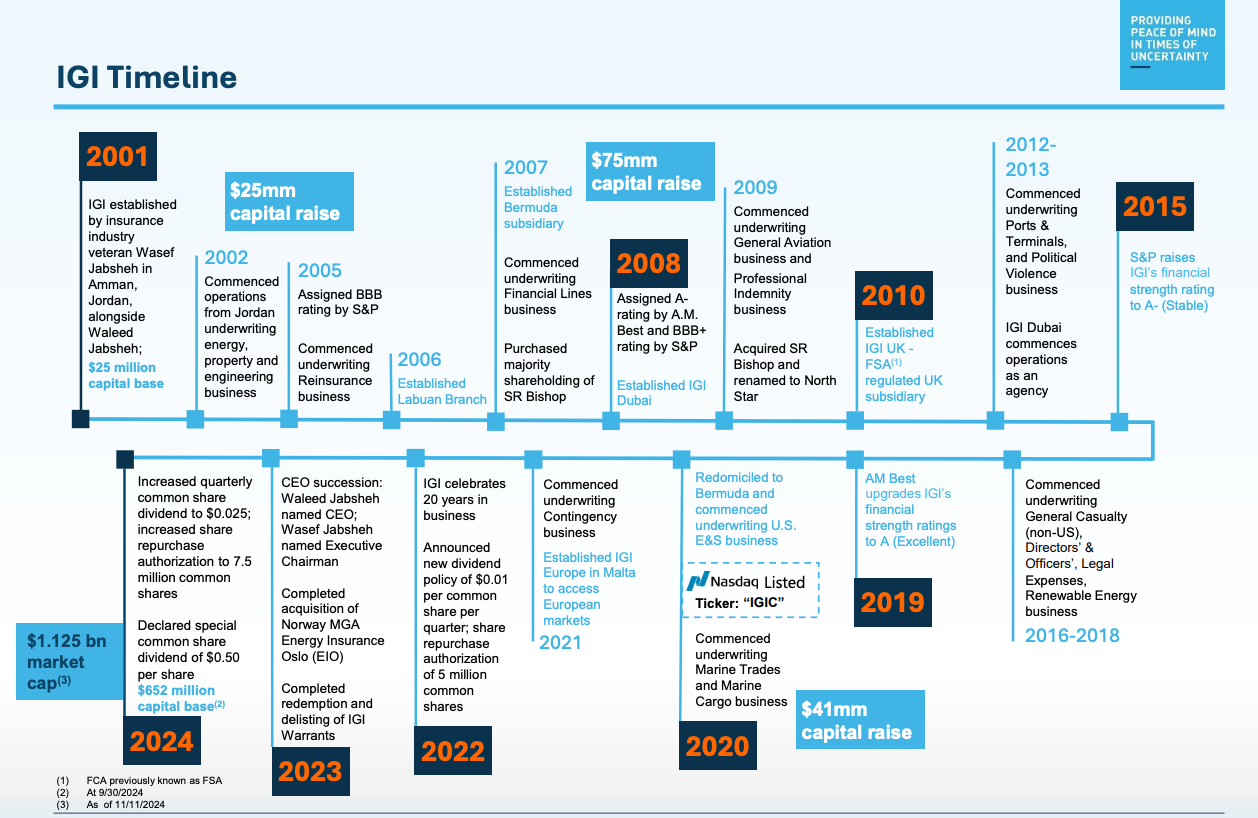

The company was founded by Wasef Jabsheh, who currently holds 31.2% of the company’s outstanding shares. His son, Walid Jabsheh, serves as the current CEO and owns 1.1% of the company’s shares. Together, they hold approximately 35% of the company’s outstanding shares.

Wasef Jabsheh is an industry veteran, having been in the industry for 60 years and building multiple insurance companies along the way for others and himself. He has specialized in energy insurance for over 50 years.

In 1989, he founded Middle East Insurance Brokers, and in 1991, he established International Marine & General Insurance Co. Both companies were eventually sold to Houston Casualty Company, which is now owned by Tokio Marine, Japan’s largest property and casualty insurer. He spent a few years on the board of Houston Casualty and was a major shareholder. Eventually, at the age of 61, he decided to go in a different direction and established IGI in 2001 with a $25 million capital base and built it to a $653 million capital base in just 23 years, an organic CAGR of 15%. They began in year 1 writing $ 10 million in premium and just crossed $ 700 million in gross written premium in 2024.

Wasefs son, Walid Jabsheh, is currently the CEO and owns 1.1% shares outstanding. He was educated in Canada and moved to Boston and began his career in 1998 at various insurance companies. When his father established IGI, Walid joined in 2002 and moved to Jordan to help set up IGI.

Segments

Their segments are broken down as follows.

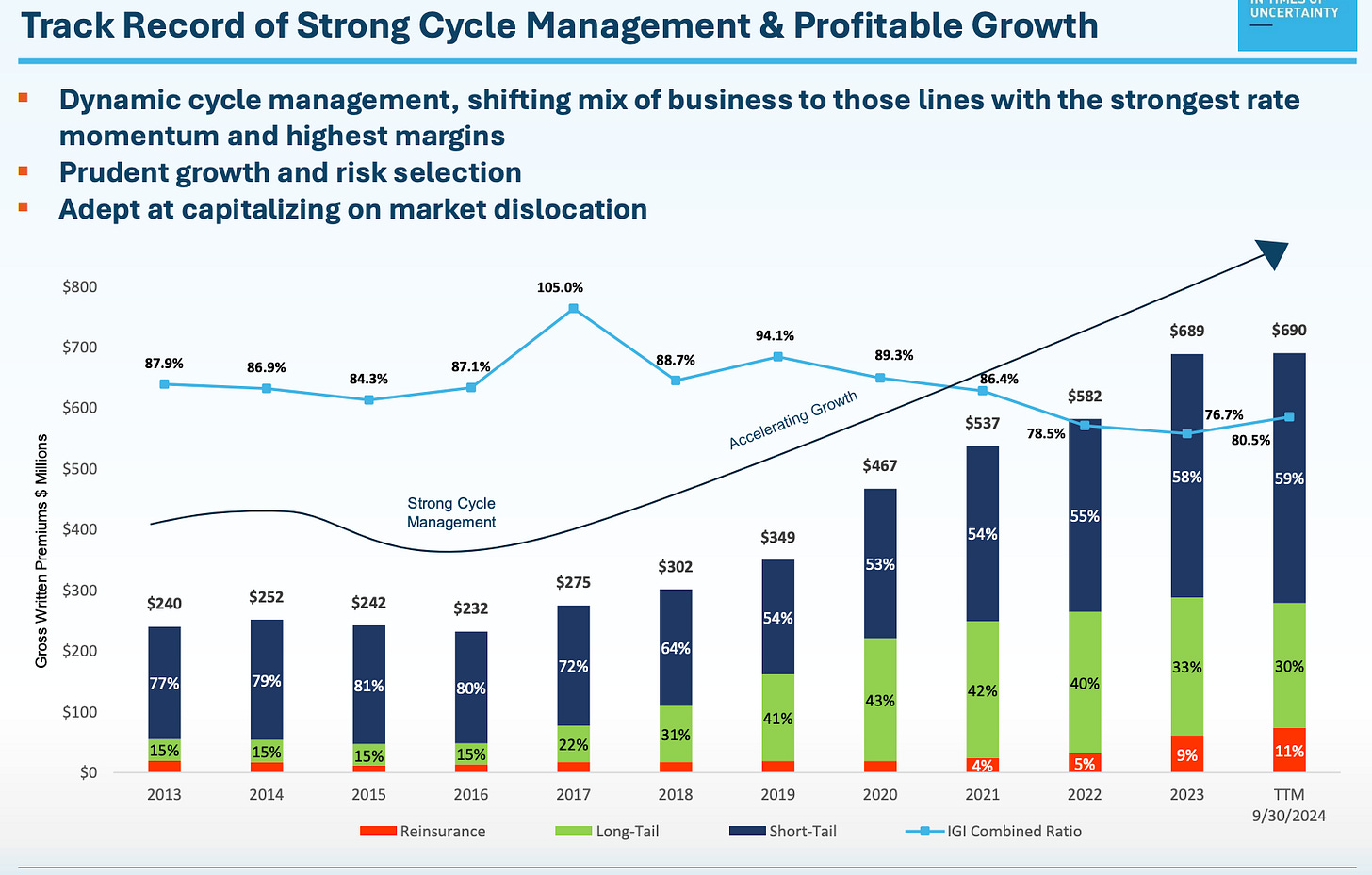

Specialty long tail: 30%

Specialty short tail: 59%

Re-insurance: 11%

Disciplined cycle management

As you can see, their long-tail segment has grown from just 15% of total GWP in 2016 to 43% in 2020, then back down to 30% as they have managed their cycle and shifted their business mix towards more profitable lines. Above you can also see their combined ratio has incrementally come down from the high 90’s down to 80%, indicating increasing profitability.

They have also grown gross written premiums from just $10 million in 2001 to over $700 million today, an organic CAGR of 20%.

Since going public in 2020, they’ve grown their gross written premium by 13% annually and generated a 17% unlevered return on equity and an average combined ratio of 82% and a 10-year average combined ratio of 86%.

Competitive strengths

Very effective management with average experience of 30 years.

Long standing relationships with key brokers who have been with them since inception. Their top 5 brokers produced 64% of their premiums in 2023.

Highly specialized and diversified book of business and disciplines risk selection.

Strategy

IGIC’s strategy is fairly simple and straightforward.

Expand in existing markets,

Expand in new markets and lines.

Maintain a conservative balance sheet.

Maintain a conservative investment portfolio.

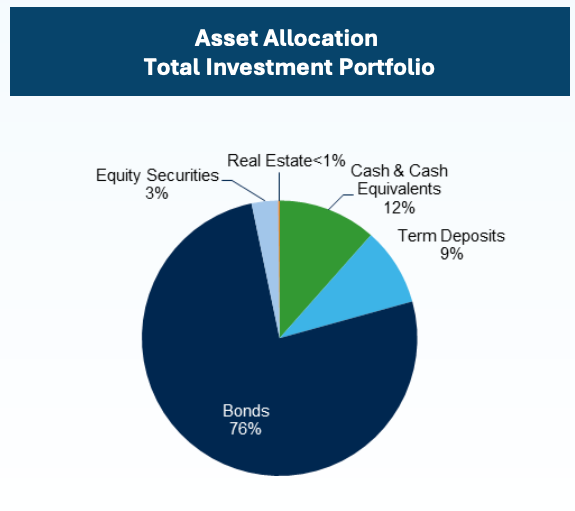

IGIC’s investment portfolio is about $1.3 billion, consisting primarily (76%) of investment-grade bonds with an average credit quality of A and a duration of 3.4 years. The remainder is cash, term deposits, and equities.

Management

IGIC Inside ownership is very high with a few key people holding large stakes.

Exective director Wasef Jabsheh: 31.5% valued around $350 million

CEO Walid Jabsheh: 1.3% valued around $15 million

Director Michaeal Gray, Tiberius Acquisition Corp founder: 5.9% valued at $67 million.

Director Andrew Poole: CIO and Director of Tiberius Acquisition Corp: 1.4% valued at $16 million

Total inside ownership for all executives and directors is 41.4%. Its clear that inside alignment is very strong with IGIC.

Risks

Aside from the typical risks associated with Insurance companies, theres a few risks should be discussed with IGIC.

Cyclicality: The P&C insurance market is cyclical, cycling in and out of hard and soft markets, depending on supply and demand for insurance. IGIC, and many other specialty insurers, have benefited from the hard insurance market that began about 6 years ago. However, 6 years is historically longer than the average of 4 years, which could indicate a softening may be on the horizon. A softer P&C insurance market could affect IGIC negatively, and some expect the market to begin to soften in 2025. It should be noted that some also expect the market to stay hard in 2025.

Increasing frequency or severity of claims: One of the main drivers of hard insurance markets is increasing claims. Large claims or increasing catastrophic losses could adversely affect IGIC.

Valuation

Assumptions

Book value growth rate 5% - 10%

P/B end multiple between 1.5x - 2.5x (currently at 1.7x)

Share reduction of 2 million from repurchase program. As of Q3 2024, the company had approximately 2.5 million common shares remaining under its existing authorization to repurchase 7.5 million common shares.

Final thoughts

One final aspect, which is far more subjective, is the character of CEO Walid. He has a very solemn character and a direct communication style that I appreciate, so does his father. I’m always wary of the obnoxious salesman-type CEOs, so I pay attention when I see good and honest character.

In the presentation, Walid said something that struck me.

“First and foremost, we're a profitability driven business. We work in the business of taking risk. That requires a lot of discipline. That requires a lot of patience. We are not a top line driven company. I try to send this message as clearly as possible to our existing investors as well as any new investors. so were all on the same page here, no false pretenses. The most important measure of success and always will be growth in book value, growth in book value per share.” - Walid Jabsheh, November 2024, Southwest IDEAS Conference

No corporate PR fluff, just honesty. He is intentionally trying to attract a certain type of quality investor by sending a clear signal. I like it.

I don’t currently own this company but I have thought about buying many times. I really like the shareholder alignment and the management, however, I am saving my capital for better opportunities.

Thanks for reading.