Key points

Nubank grew sales 67% last year and trades at less than 30x analyst estimates for 2024.

They are one of the most efficient banks operating in the most profitable banking market in the world.

Their digital model affords them favorable unit economics and allows them to pass savings on to customers and investors.

They are one of Brazils most admired brands and growing mindshare rapidly in other regions of LATAM.

Business Summary

Nubank is a digital bank that offers bank accounts, credit cards, loans, mobile payment solutions, insurance products and an investment platform. They currently have 95 million customers including 53% of the adult population of Brazil and a growing number of adults in Mexico and Columbia.

They generate revenue in a two primary ways

Fee’s: Fees and commissions make up about 19% of their revenue. These come from card transactions, payments, loyalty programs, fees and premiums from investments and insurance products and services, and money transfers.

Interest incomes: Interest incomes makes up the other 81% of their revenue. This comes from credit card balances, personal loans, as well as interest earned on deposits, government bonds and other interest-earning instruments.

Inception

Nubank was founded in 2013 by David Velez, a columbian who earned an MBA from Stanford and later became a partner at Sequoia Capital.

Nubank’s founding and initial product offering was like a cold glass of water in the middle of a desert. The products were easy to use, low cost and they addressed the pain points of the Brazilian population in a way that created a viral demand for their products.

Many variables that had to come together perfectly in order for Nubank to succeed. I don’t know if it was luck or just extremely well planned, but they seemed to have pulled off something special with impeccable timing. The three big variables that led to Nubanks success.

First, Nubank launched their mobile first credit card and banking product right as smart phone adoption was gaining steam in Brazil, particularly among younger generations. By 2020 Brazil was in a league of its own, with smartphone adoption far higher than any other country in Latin America.

Second, because they had a low cost structure, they were able to essentially addressed the exact pain points of their target market by offering the first no annual fee credit cards, along with easy to use and easy to open accounts. This was perfect because Brazilian credit cards have notoriously high interest rates/fees due to very low banking competition and higher inflation. They also offered easy to open/use accounts which were previously difficult to open, particularly for the lower class.

Third, they managed to pull enough financial and human capital together to challenge one of the biggest banking cartels in the world—the biggest banks in Brazil— consisting of Itau, Banco do Brazil, Banco Bradesco, and Banco Santander. These banks controlled 80-90% of the market and had become comfortably run by technocrats who prioritized stability and showed little concern for innovation or customer service.

NuBank’s success and Brazil credit culture

To understand Nubank’s radical success in Brazil you would first need to understand Brazilian financial culture. Brazilians love credit.

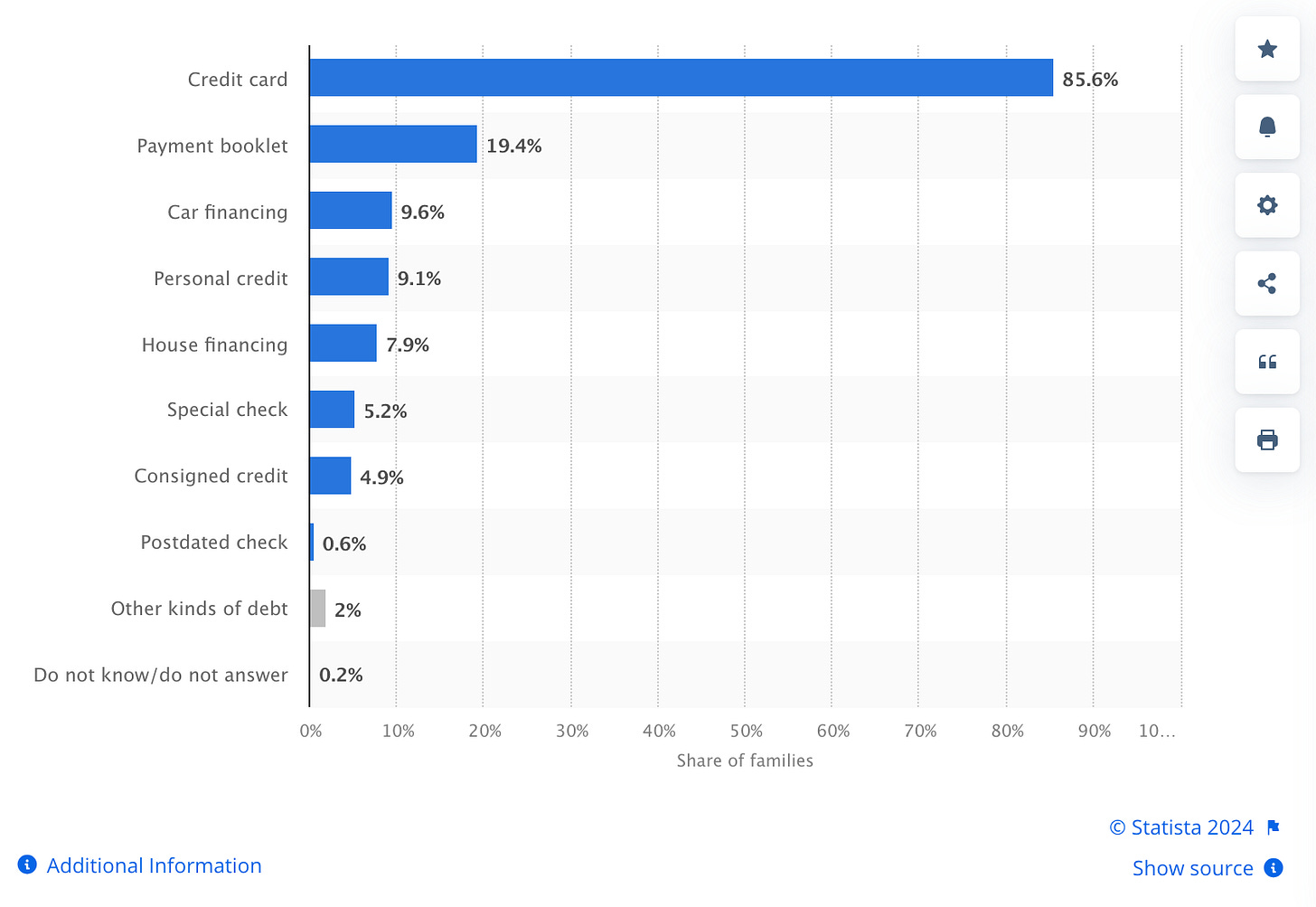

Now, there’s no shortage of people in the United States who regularly run up their credit cards, but Brazilians, however, are far more inclined to fund every day expenses on credit. As a matter of fact, 85% of total household debt comes in the form of credit card debt in Brazil.

This is in stark contrast to Americans who’s debt is made up of only 6% credit card.

Nubank’s credit mix

By far the most common way that Brazilians finance their every day expenses is through installments. Most Brazilians have combo cards—functioning as both debit and credit cards— that offer the ability to pay in fixed installments. Nubank offers this form of credit.

Installments are a form of credit that is extended to the consumer where the money is payed back in a predetermined number of payments or months ( usually 3-12 payment/months). This form of payment has become very popular because it can offer rewards or little or no interest. Something like 79% of credit card purchases are in the form of installment payments.

The other form of credit commonly used in Brazil, which Nubank also offers, is revolving credit. This is where an item is purchased on credit and the card remains open ended, meaning you only pay the minimum amount due and carry the balance until it’s paid off. This form of credit carries a very high interest rate if that balance is carried the entire year (100% - 400% APR!) Most people who choose to pay this way try to pay their balance down as soon as possible, abut those who don’t end up paying very high APR. According to Velez some customers get credit cards from Nubank with rates that are 50% lower than some tradition banks.

As Fede Sandler— Ex investor relations officer at Nubank— recently pointed out on X, Nubank attempts to minimize revolving credit in their portfolio.

Only 7% of Nubank’s interest earning portfolio is derived from revolving credit, when you compare this to the rest of the market at 15% it becomes obvious they try to limit revolving credit. This seems counterintuitive seeing as how a higher percentage of revolvers would generate more income for Nubank. But this is part of Nubank’s over all strategy to save customers money which they’re able to do because of their low cost operating model. This ultimately earns the trust and loyalty of consumers, which is extremely important in a country where most banks have a very poor reputation with the people.

Cost advantages and unit economics

Cost advantages

Low customer acquisition cost

The vast majority of Nubank’s customers (80% - 90%) have come through word of mouth, leaving their customer acquisition costs minimal. The viral nature of Nubank’s products have saved them on marketing costs. For one of the fastest growing brands in Latin America, it’s impressive that marketing only accounts for 2% of revenue.

It’s worth mentioning, even though they’re are growing rapidly Columbia and Mexico, they may not have the same extreme viral success that they had in Brazil.

Low cost to serve

Nubank most important cost advantage comes from their operating model itself.

In order for a bank to grow they have to take on more depositors and open more branches. These show up as larger interest expenses (paid to depositors) and larger back office expenses. While Nubank can’t avoid paying interest to depositors, they do have significantly smaller back office expenses flowing from their cloud native model which affords them an industry leading efficiency ratio of 36%. This simply means out of each dollar in revenue they earn they only spend $0.36 on back office expenses. Compare this to Brazil’s largest bank Itau with a ratio currently almost 14% higher at around 40%, or Banco Santander with a ratio of 44%.

Below is a spreadsheet I made with the average customer to employee ratio for Nubank and incumbent banks in Brazil. You can see that Nubank is just vastly more efficient.

Even more telling, over the last 12 months Nubank’s revenue per employee was almost 4x as much as the industry average, indicating their ability to maintain a lean employee base as they grow they monetize those customers.

Unit economics

Over the last few years Nubank has grown their average revenue per customer per month from $3 to $10, with some mature customers averaging $26 per month.

If thats not impressive enough, they’ve done this while maintaining an average fixed cost to serve those customers— $1 per month— which is 85% lower than incumbent banks. As the spread between their revenue and cost to serve widens, so do their margins. This is why we’ve recently begun to see their operating leverage flex as they’ve swung to profitability.

I want to zero in on a few graphics that I believe are more indicative of Nubank’s future.

The first one below captures how quickly they’re able to monetize new customers. The lightest lines in the graph below indicate that customers who joined in 2017 started with only 1 product and slowly moved to using almost 4 products over a period of multiple years. The darkest lines represent customers who joined in 2023 but started with about 3 products and then subsequently moved up to using 4 products within a year.

This implies that customers are increasingly engaged with Nubank’s offerings and Nubank is able to monetize them at an incrementally faster rate each year.

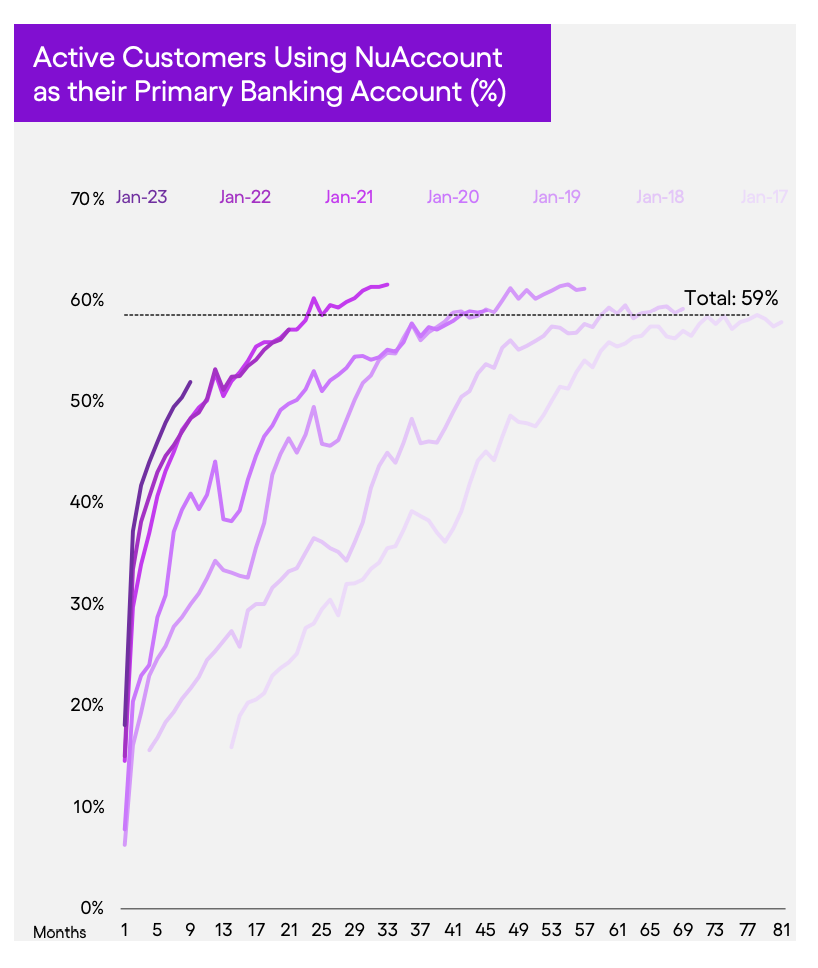

Another graphic that is interesting is the one below. It shows how long it takes for a cohort of customers to begin using them as their primary account.

Again, the light purple line represents a cohort beginning in 2017, where it took about 5 years for 60% to use Nubank as their primary account. The darkest purple line represents a cohort beginning in 2023 and within 9 months over 50% were using it as their primary.

Nubank’s current market share in Brazil

According to David Velez, Nubank has captured the following portion of the various markets in Brazil

30% of the credit card

5% of personal loans

3% of investments

2% of insurance

This implies impressive penetration in credit cards, but still room to take market share in investments, insurance and personal loans. It also wouldn’t surprise me to see them continue to take share in credit cards seeing as how popular their zero fee credit cards have become.

Mexico, Columbia and Latin America

Mexico

According to David Velez, 88% of Mexico still has no access to credit and only 40% of Mexico’s population has a bank account while 60% still uses cash. This is the highest unbanked population in Latin America by far. Mexican banks have also gone the way of Brazilian banks— focusing on the middle and upper class while largely ignoring the lower class. Although this is more due to the fact that Mexico has such a large cash based economy.

Putting this altogether, Nubank potentially has a huge opportunity in Mexico if they bring their products to the Mexican market successfully. However, like I mentioned earlier, theres no guarantee they will be able to replicate the explosive success they’ve had in Brazil. Mexico’s consumer behaviors are not necessarily the same as Brazil’s.

Since 2020 they’ve launched their credit card, personal loans and savings accounts in Mexico. Astoundingly, they reached a total of 3.6 million active customers in just a few years. Whats even more impressive, they reached 1 million saving accounts just one month after launching it in Mexico.

They’ve also applied for an official banking license which would allow them to offer a bigger selection of services such as payroll portability, investments, and higher deposit limits.

Columbia

Columbia also has a large unbanked population with about 40% - 45% of the population having no bank account at all. Only 37% of adults in Columbia have access to a credit product and only 15.8% of micro-enterprises have access to credit as well. This also presents a great opportunity for Nubank.

They currently only offer a credit card in Columbia but they recently received approval to launch a saving account, of which they’re currently building a waiting list for.

Nubank entered the columbian market in 2020 and already has around 800,00 customers.

Management

David Velez is certainly a great leader who has taken the company on a wild ride since the founding. Although David was an investment banker before founding Nubank, he thinks like a problem solver and an innovator, which have been instrumental in Nubank’s success. Aside from his talent, there are a few things I like about him.

He owns 21% of the company which obviously indicates he’s incentivized to create shareholder value. He hold himself accountable to shareholders by being one himself.

He’s 42 years old which means he’s old enough to be mature and wise, but young enough that can run the business for decades before retiring.

Risks

Aside from competition from big banks and a growing number of smaller digital banks, I think theres a few things that stand out that could be cause for concern.

Customer demographics

Theres plenty of risks when investing in banks or financial institution, more risks than most people can understand, including me. But with Nubank I think it’s especially important to keep in mind who Nubank is lending to. Much of their loan book is exposed to lower class customers, which poses a higher risk of non performing loans.

Nubank has various ways of limiting their delinquencies, such as starting customers with very small loans and working their way up after proving themselves or starting them with other products before extending credit.

They also use 60+ machine learning algorithms to enhance their underwriting which has afforded them 90 day delinquencies that are basically in line with their competitors, so far.

Regardless, if there were to be a major economic down turn, many of their customers would be more venerable due to their socioeconomic status..

Regulatory

Considering most of Nubank’s business is currently in Brazil, there could be regulatory risks. Banks in Brazil have been high on the hog for many years, charging disproportionately higher rates—up to 445% on revolving credit— and enjoying supernatural returns. This is because regulators have essentially allowed oligopolies to thrive under the guise of “financial stability” which has helped create the conditions for high interest rates.

Although Nubank is trying to buck this trend with lower fees and rates where possible, they still enjoy the privilege of operating in Brazil and therefore run the risk of regulators enacting changes that would be less favorable for banking in Brazil. They’ve already began to cap revolving credit rates.

Valuation

Nubank recently swung to profitability after hitting an inflection point. It’s hard to know whether they’ll remain profitable, but my best guess is that they will. Most analyst say they will be doing $10 - $12 billion in revenue for FY 2024.

If Nubank can grow 20-30% over the following 5 years it could ultimately become a $100 - $200 billion dollar company in my view. $200 billion may seem high, and I’m not betting the farm on this scenario, but I wouldn’t be surprised considering how much this company has continued to grow and take share, even during rough economic times.

Conclusion

I initially bought Nubank in 2022 below $4 and continued buying in January 2024 buying around $9. It was psychologically difficult to buy again after having such a low cost basis but I’ve been impressed by their profitability. I would love to keep adding and make this a larger position so I will be looking for opportunities to buy more.

Thats it for this week. Thanks for reading!

Great writeup! I'm also invested in NU and my average share price is 7.50.

My only mistake investing in NU was not making it a bigger position earlier on.

How did you first find out about NU?