Paycom: Bargain or value trap?

Intro

Paycom is a cloud based human capital management (HCM) company. The company operates in this space with various other players such as ADP, Paycor, Paylocity, and Paychex. Despite being a crowded industry, Paycom has managed to develop a differentiated product and grow at a rapid pace— carving out 5% of the market. The company has a growing net promoter score of 67, which is an industry leading score, indicating above normal customer satisfaction. Paycom has also grown its client base 13% annually and compounded revenue at 32% and EPS at 85% over the last 10 years.

The stock seemed unstoppable for the first 7 years as a public company as it grew 4,000%. However, after peaking in 2021 at $535 per share, the stock sold off as some of the covid-19 bull market euphoria wore off. The stock then began a second wave of selling in summer 2023 due to an industry slowdown, management resignations, and an internal competition problem stemming from their Beti product launched in 2021. The stock traded at over 100x earnings at the covid highs and now trades at just 20x after being brutalized by 3 years of selling.

It’s no surprise that I and many others are interested in this stock, despite the problems Paycom is having.

Business

Paycom offers an end-to-end cloud based solution for human capital management. The platform is designed to manage the entire employment lifecycle for employers and employees. Paycom generates revenue by charging a fixed fee in each billing period plus a fee for each employee or transaction.

The platform manages all of the following aspects of the employee lifecycle

Talent acquisition: Cloud based applicant and candidate tracking, enhanced background checking system (including verification of education, employment, driving history, criminal history, and drug and health screening, among others) onboarding, E-verify, and tax credits calculations

Time and labor management: Time and attendance services (including mobile clock in), Employee scheduling, Time-off requests, labor allocation and management, Employee tracking services.

Payroll: Beti (better employee transaction interface), payroll and tax management, Vault Visa, Daily payroll services, Client action center, expense management, mileage tracking, garnishment administration, GL concierge.

Talent management: Employee self service, compensation budgeting, performance management, position management, analytics, learning management, manager on-the-go, direct data exchange, documents and checklists, government and compliance, benefits administration, benefit enrollment, CONBRA administration, Paycom surveys, 401K reporting, ACA services, vaccination and testing data.

As you can see, the list is long and it’s only getting longer. They add new modules and services continuously in order to stay ahead of business HR and HCM needs. R&D makes up around 11.7% and is spent on building out new offerings for their customers.

Value prop/ Moat

Most of the solutions provided by HCM companies have become somewhat commoditized. There are of course small differences between them, and virtually every HCM software provider has it’s critics and cheerleaders. Reading reviews on all of the big HCM names, it became obvious that Paycom has one of the more intuitive solutions, but still has some critics, especially concerning customer service. However, all of Paycom’s competitors are criticized for the same exact reason, which indicates an industry wide problem rather than a problem specific to Paycom.

With that being said, Paycom does have a few differentiated products (Beti and GONE) that have the potential to change the way the industry does payroll and processes time-off decisions. Beti is Paycom’s employee driven payroll solution that automatically identifies payroll errors and guides employees in correcting them. The goal of Beti is to save their customers on HR costs by having employees do their own payroll, reducing errors and automating certain parts of the process. I will expand a bit more on this later.

GONE is Paycom’s automated time-off product that helps facilitate time-off decisions. This is more helpful than one would initially think, especially considering companies typically make “20 - 30 decisions per employee, per year on time-off requests and denials and approvals that go into staffing decisions” according to CEO Chad Richison.

Proprietary platform with high switching costs

I do think it’s fair to say that Paycom has a competitive advantage that comes in the form of switching costs, although some Paycom bears would argue this is a small moat and that is no bigger than the other players in the industry. I generally agree, but I would note that Paycom has a slight advantage because all of their software is proprietary and built in-house into an integrated platform. Paycom has a closed API that limits integration with outside software and third party software, but it also increases their switching costs by keeping all the users within the platform. Their ecosystem is designed to be easy to use and intuitive but you must stay within the confines of their system and use their products. Richison noted that Some customers had “previously left Paycom because their lack of integration with 3rd parties only to return after realizing the competitors platform was far more labor intensive and time consuming to operate.”

Thinking about industry switching costs more broadly, it helpful to understand that once a business has established their payroll, documents, tax and expense management, training resources and compensation budgeting solutions on a platform, it can be a nightmare to switch to a new system. Switching requires training HR staff to use the new platform and transferring all the information from the old system into the new one, and integrating and implementing it into the daily operations of the business.

This all comes with a low ROI considering the new competing solution will be marginally better. It’s like going through the hassle of switching to a new bank just to earn 0.05% more interest on your savings account, its best just to stay. Because of this high cost and low return dynamic, the industry has high customer retention rates, somewhere in the range of in 85% - 95%. Paycom has maintained a customer a retention rate of around 90% since going public in 2014.

One of the complaints about some of Paycom’s competitors (ADP, Paychex) is that they are a collection of acquisitions strung together into a platform, which has resulted in a less than optimal user experience. Paycom’s proprietary cloud-native model enables them to develop new intuitive products in-house and deploy them immediately. Because of this, Paycom has been able to take market share from some of the legacy HCM providers. They typically pick off customers from ADP and Paychex.

Below is a comparison of revenue growth between some of the bigger players in this space. Paycom and Paylocity have clearly been growing much faster the rest, although they are much smaller in comparison.

Avenues for growth

Paycom operates in a large and growing market. According to Fortune Business Insights, the HCM market is around $31 billion, other sources put it closer to $34 billion in 2025. Regardless, it’s a large market and projected to grow to $63 billion by 2032, a CAGR of 9.1%. Paycom’s current market share is 5% of the HCM market, leaving plenty of room to take share.

Paycom’s growth strategy is simple.

Further penetrate existing markets (take share)

Expand internationally (Paycom launched in Canada, Mexico and Uk during FY 2023 and 2024, still in early stages)

Increase existing customer spend.

Move up market to larger customers.

Paycom has 36,800 clients (19,500 under parent companies) with none of their customers making up more than 0.50% of revenue. Paycom traditionally targeted companies with between 50 - 1,000 employee’s (SMB’s) but they have recently begun moving upmarket to larger organizations with 5,000 - 10,000 employees.

Small and midsized businesses

Small and midsize business still represents a large opportunity for Paycom. According to the Small Business Administration, 99.9% of businesses in the US are small which is about 33.2 million total small and midsize businesses. However, according to NAICS, 16 million of those businesses have less than 50 employees, which would mean they’re smaller than Paycom’s target customers and are probably better suited for Quickbooks or another small payroll provider. So it’s more reasonable to say that Paycom’s small and midsized business opportunity is represented by about 17 million businesses in the US, and they currently have less than 1% of that market.

Large businesses

Larger organizations also represent a large opportunity because they have more HR allowances which provides Paycom an opportunity to to cross sell. This is an important strategy because they once they have secured these customers they are essentially able to increase revenue per client at a minimal incremental cost as they roll out new products.

Beti: The good, the bad and the ugly

Beti is one of Paycom’s newer products launched in 2021. It is designed to be a do-it-yourself payroll product for employee’s. It’s the industries first do-it-yourself solution with the ultimate goal of automating payroll as much as possible. The solution is designed to produce less errors and eliminate time consuming processes for HR departments. It also has an automation features built into it as well.

Beti has seen a lot of success with customers, below is an excerpt from the Q2 2023 call and another from the Q1 2024 call

“We recently commissioned a total economic impact study from Forrester Consulting that quantified the saving from using Paycom and Beti, including a 90% reduction in labor for payroll processing and saving HR and accounting temas more than 2,600 hours per year.”

“A recent client told us that prior to implementing Beti, it would take over 2 days to process payroll. With Beti, they now complete payrol in only 90 minutes”

Q1 2024 CEO Chad Richison

Problems arose when Beti began fixing errors and preventing errors that Paycom was previously being paid to fix, causing them to lose some of the fee’s associated with correcting errors. Below is the moment Paycom CEO revealed this problem.

“For most employees, the value of the perfect payroll is oftentimes immeasurable. If their check is perfect, they don't need to borrow money from a friend or family member to get through the weekend or make a bill payment.

How do you measure the value of that? We're getting better and better at helping employers measure the full value available to them when payrolls are perfect. A portion of that value is easy to calculate because it's the value they receive by the elimination of after-the-fact payroll errors that require correction payroll runs, manual checks, voided checks, direct deposit reversals, additional wires, tax adjustments, W2Cs, et cetera, et cetera. Perfect payrolls eliminate these common after-the-fact payroll corrections that would otherwise be billable. So the more employees do their own payroll, the greater the savings delivered to the client from Paycom future billings, which results in lower related revenue recognized by Paycom. I’d like to thanks our employee’s for their consistent execution and their commitment to our long term strategy. I also want to wish Paycom a very happy 25th birthday.CEO Chad Richison Q3 2023

This is an unnecessarily long winded way of saying “We know how valuable Beti is to our customers because the amount of money they are saving with Beti is also the amount we are losing in revenue”

The CFO goes on to clarify a bit.

“As Chad mentioned, Beti adoption and usage creates tremendous value to clients as they experience perfect payrolls and eliminate errors, corrections and unscheduled payrolls, which would otherwise be billable items. In addition, our CRR teams continue to focus on Beti adoption and overall system usage, which resulted in lower cross-selling revenues.”

“Now that more clients are achieving the ROl that Beti has to offer, it has eliminated certain billable items, which is cannibalizing a portion of our services and unscheduled revenues.”

So Beti is a big win for Paycom’s customers—increasing their ROI and automating many aspect of their HCM processes. However, Beti’s rollout has been a thorn in Paycom’s side because it created internal competition between their offerings. Beti is apparently very good at reducing errors and corrections that Paycom would normally bill for.

To make matters worse, co-CEO Chris Thomas resigned due to personal reasons just 3 month after being internally promoted. The CFO Craig Boelte also announced that he will step down in the Q2 conference call. Both of these were unexpected and only served to cast more doubt on Paycom’s future.

There was also a leaked staff meeting in January where Richison is heard talking about fixing Paycom’s product in a rather distressed manner.

“In 2024 all I want to do is fix our product, I don’t want to go skiing, I don’t want to go on vacation, I don”t want to go on a sales call, I don’t want to talk to any investors, I don’t even want to have any board meetings to be honest, All I want to do is fix this product.”

Despite how bad this sounds, this is exactly what I would want to hear if I was considering taking a position in PAYC 0.00%↑ for the first time at a five year low. The stock is down 70%, the multiple is compressed, the CEO is a large shareholder, and he is desperate to turn the ship around.

In my view, there is a good chance that Paycom will be able to re-accelerate growth as Beti’s value is recognized and draws in new customers from other HCM providers. The industry is commoditized and currently Paycom is the only company with a truly differentiated payroll and time-off product that saves HR departments time and money. Of course, this is at the expense of Paycom’s sales growth in the short term, but in the long term it should pay off.

In fact, they’re already seeing new customers coming over to Paycom specifically for Beti, according to Richison.

“what's happening with new clients coming in, that's why they're coming in to use it. I mean they're coming to Paycom to actually utilize Beti. I did talk about a client on the call who have been with us for 6 years. They have 2,500 employees. They implemented Beti, and they were able to reduce their payroll department by half. And it went from 4 days they've been working on payroll to mere hours.”

CEO Chad Richison Q2 2024

So it appears that maybe, just maybe, the ship is starting to turn although I can’t be sure for certain. Try to imagine looking back on this whole drama 5 years from now, do you think this will have been fatal blow to Paycom’s business? or just a temporary set back? I think it is more likely that the latter is true.

Management

After working for ADP Chad Richison went on to found Paycom in hopes of creating more efficient platform for processing payroll. Richison has grown the company into much more than a simple payroll processor over the years and has remained a large shareholder as well. Today Richison owns 11% of the company.

Richison stake in the company is currently 300 times bigger than his total compensation of $3.1 million and over 1,000 times bigger than his salary of $800k. It’s worth noting that his total compensation is considerably lower over the last few years compared to previous years due to poor stock performance. In 2020, his salary was $700k and he had over over $20 million in performance based compensation. Regardless, even if he were to return to getting all his incentive pay back, his ownership is still many multiples larger, ensuring shareholder alignment.

All of this is good news for potential investors because Richison has everything to gain (net worth, compensation, reputation) from a better performing stock. This explains why he seemed so distressed and focused on turning the company around in that leaked staff meeting.

Now, I do think its a red flag that Richison has been selling PAYC 0.00%↑ hand over fist over the last year non-stop. In my estimation, he has sold somewhere around $55 - $60 million dollars worth of stock. It reasonable to think that now would be a good time to start buying PAYC 0.00%↑ if he really believes in the company’s future. However, over the last three years he has missed out on roughly $50 - $60 million in incentive compensation so it’s likely that he’s been selling his personal stock in order to compensate for that missing income.

Risks

There are some clear risks with Paycom.

External competition: As I mentioned before, Paycom operates in a crowded industry with many formidable competitors. Over the long term this could put pressure on margins and pricing power as they have to continuously invest in more sales, marketing, research and development just to keep up with competitors.

Internal competition from Beti: There is no getting around the fact that Beti has done damage internally within the company by creating internal competitive pressure. If Beti’s value proposition isn’t enough to continue taking marketshare and adding new customers, its may spell bad news for Paycom.

Hack risk: Paycom has massive amounts of personal employee data from 36,800 companies. If there were to be a large data breach Paycom could lose a large amount of customers which would be detrimental to their business.

Business cycle risk: Paycom bill’s customers per employee, per transaction. If there were to be a deep recession, lay-off’s would be inevitable for their customers resulting in lower payroll runs and transactions.

Fundamentals and valuation

I have no complaints about Paycom’s balance sheet and financials. The company is debt free and has $346 million in cash on balance sheet and they’re generating $300+ million in FCF annually. The company has high returns on capital as they really don’t require much CapEx to grow. However due to the competitive nature of the industry, Paycom relies on large sales and marketing and R&D expenses which can be seen as investments that eat up 36% of revenue together. I don’t see this number decreasing any time soon because they need to continue innovating and selling in order to attract new clients.

Concerning valuation, Paycom is at down 21% over the last 5 years which has compressed the stocks multiple significantly. This low starting multiple could potentially provide the perfect conditions for multiple expansion if the company begins to show signs of improvement. If the narrative shifts, this company could re-rate higher fairly quickly.

In my view, it’s not likely that Beti will cannibalize the company for much longer and if Beti is as good as Richison and Forrestar research says, it should provide long term tailwinds for Paycom.

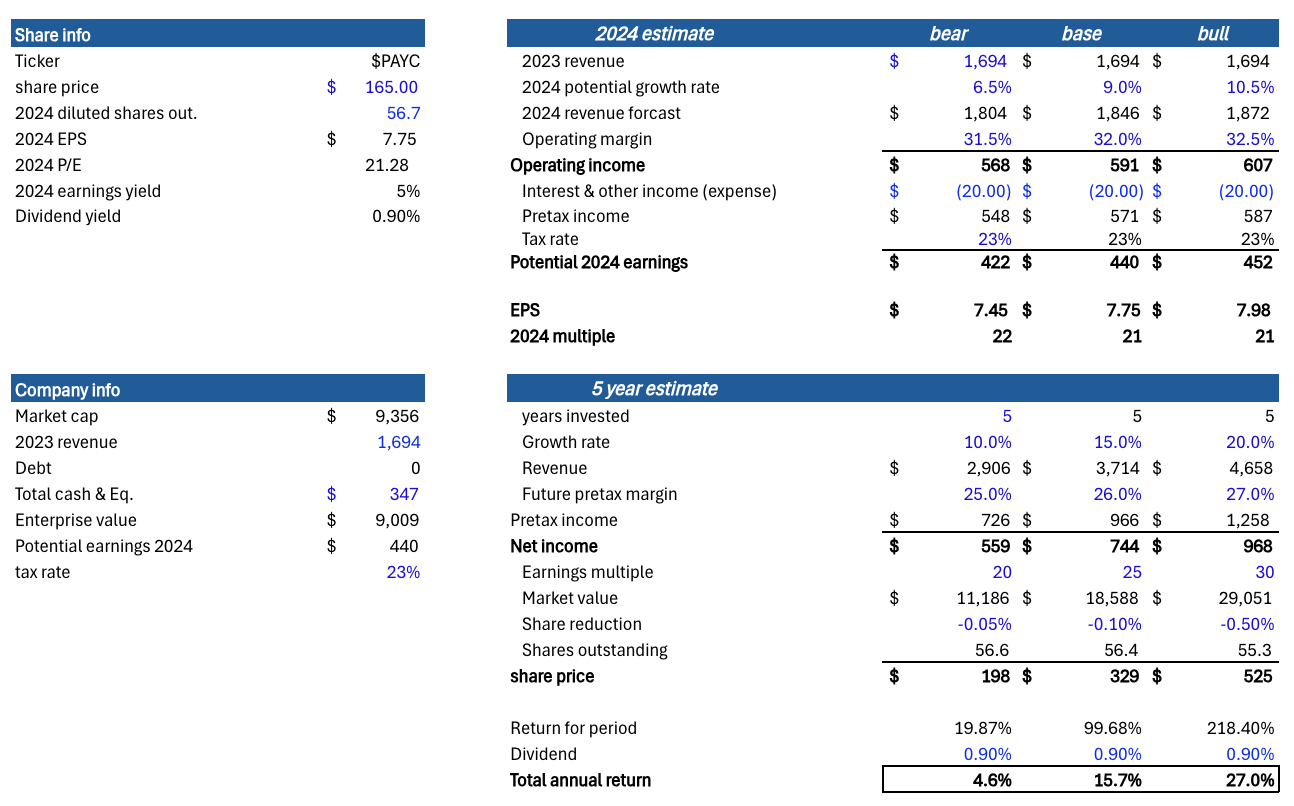

Valuation

For the model, I’m assuming growth between 10-20%, which is well below the historical average of 30% annually and margins that either stay the same or contract slightly. In 2022 Paycom authorized a $1.1 billion repurchase plan of which $799 was still available at year end 2023. The plan was recently increased to $1.5 billion as of the last quarter. I’m assuming Paycom will continue reducing shares outstanding but not in a meaningful way. I do however believe their dividend is sustainable at a 19% payout ratio and will likely continue to grow.

At the end of the day, this investment will come down to whether they can return to growth again, which will drive both earnings growth and potentially multiple expansion. If the company continues with the same growth and multiple is has now, it will not end so well for investors.

Final thoughts

I do own a 1% position in PAYC 0.00%↑ and I’m unsure of whether I want to increase it or sell it and put the money to work in another name in my portfolio. If there are tangible signs of a turn around, I may add, if not, I will probably sell. If you put a gun to my head and demanded that I tell you the odds of a base case outcome, I’d say there is a 60% chance, in my opinion, that Paycom hits my base case assumptions, but I could be wrong.

Thats it for this week, thank you for reading!