Simpson manufacturing $SSD

A secret monopoly

I own a construction business in California. Construction is a difficult and complex industry that requires a mixture of skill, knowledge, attention to detail and the ability to work with many moving parts at once. It’s also a cyclical industry which is why many investors and analysts avoid it.

With that being said Simpson manufacturing SSD 0.00%↑ is one of those companies that you would never know about unless you are in the construction industry, particularly if you build new homes or do rough framing like I have.

I noticed years ago that Simpson barely had any competitors but I just couldn’t figure out exactly why. It struck me as odd because most of their products are just metal straps and connectors, but I spent some time digging and found some interesting things.

SSD 0.00%↑ Simpson is primarily an engineering and manufacturing company that operates in two main categories, wood construction and concrete construction. Within the wood construction category they make over 15,000 specialized wood construction products. These products including connectors for residential and commercial building applications, specialized screws and fasteners, and different lateral load solutions. The concrete category consists of concrete and pavement repair products and strengthening systems and adhesives. They recently expanded into a few new categories including the structural steel.

Wood construction and building connectors

Let’s start with the wood construction building connectors because it makes up the bulk of revenue and helps to understand the story of the business. This category should be poised to grow over the next few decades due to a US housing shortage because of years of under building. This is partially why home prices grew 75% between 2010-2022 and wages only grew 54% in that same period. This will need to be corrected by building more housing stock, which would help housing prices soften relative to wages.

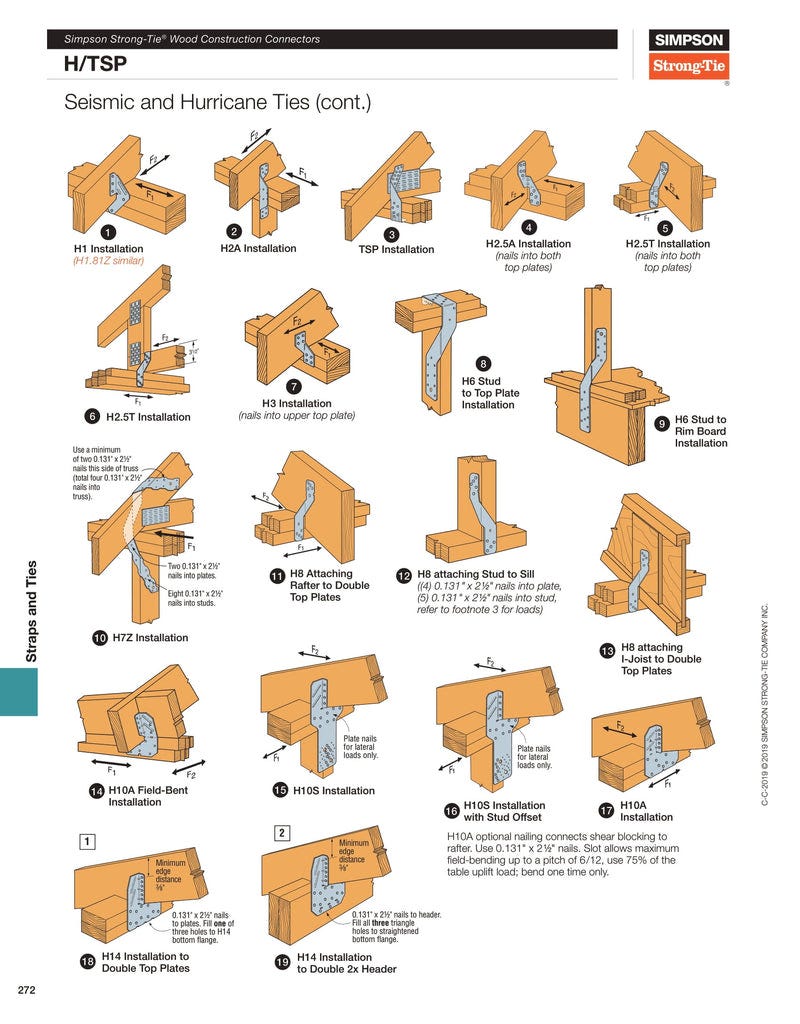

The wood construction category consists of many types of specialty metal connectors and straps for connecting the structural framing members together in any house or commercial building application as seen above.

They technically have some competitors here, but I’ve never met one engineer or architect that used any of the competitors products in their plans. Nor have I ever used any other product or even seen another product at the major hardware stores like home depot. They have a huge share of this market.

I asked a group of structural engineers why Simpson seems to be the only dominant player in their space. This is what they had to say

“Simpson has done a very good job of cornering their market. They have connector products that cover feasibly almost any connection situation. These products also almost always have ICC approval. They're acceptable in many building codes, and they're an easy, reliable method to make connections.'“

“Its the info availability, from engineering, drawings, and load capacities. I don’t want/need to search far for the info needed. Probably the biggest is the drawings. I can download any product and view from them without fanfare.”

“It really is a rare case of a quality product with reasonable pricing and great support. The fact that I can download detailed CAD files of almost any hanger completely free of charge is astounding. That's not even mentioning all the seminars and PDH courses. We even have a point of contact I can call up anytime and ask questions free of charge.”

It’s important to understand the building process before we move forward. Everything in construction is regulated according to the building code, which means the contractors, engineers and government inspectors are always trying to make sure everything is built safely according to the code. This is obviously so that buildings don’t collapse and hurt anyone, but it’s also to protect contractors and engineers from being sued for building something unsafe.

When someone approaches an architectural engineer and asks for drawings, the engineers job is to make the customers request a reality so long as they can keep everything within the safety of the building code. So this can become an increasingly difficult and complex task as they are juggling two things, what the customer desires and what the building code requires. In any modern house you will have thousands of metal straps and connectors with dozens if not hundreds of different shapes, sizes and applications. Simpson simplifies the process of finding the right connectors for the right application by offering products and catalogues and showing the load capacities they can resist. They also provide software and customer service that easily allows engineers and contractor to integrate their products into their plans and projects.

So, in order to do this, Simpson has kept a close relationship with the International code council, making sure all their products are approved, which gives the engineer the confidence they need to incorporate the connectors into their plans. Then Simpson keeps a close relations ship with the architects and engineers through excellent customer service. This builds loyalty amongst engineers. Lastly they make the job of the contractor easier by making products that are efficient and effective. It takes a lot of work to become this entrenched into the building process and Simpson has done it so well that most homes don’t even get built unless Simpsons products are in it.

Below are some different wood framing applications. Note, these are simply metal straps with screw holes that are engineered in a certain way to assist in connecting one piece of wood to another. The point of these are not to replace traditional nails and screws but to allow for building structures to better withstand loads from earthquakes, winds, hurricanes and such. This is just a few of many thousands of wood applications.

Another engineer I asked mentioned the testing faculty they had. This allows them to give accurate design values to their products from real testing.

“Simpson has intense systems to test its components from the start. They can assign value based on those tests. Not many companies can set up an entire house on an earthquake disaster platform for testing all the connections but Simpson does.”

“They have their own testing lab near the Bay area. This means they can publish design values based on testing, not on calculation methods. Calculation methods are normally conservative, so it's not unusual to get 200% of the calculated value from the tested value.”

So this is also important, they have a massive lab called the Tyrell Gilb research lab where they build structures with their products and test them under different disaster scenarios, this allows them to offer a accurate strength values for their products and help builders and engineers have an accurate understanding of the products they are using. Here is a video of one such testing in which a six story building supposedly withstood the equivalent force of a 7.5 earthquake.

According to Simpsons 2022 annual report they stated they were the only manufacturer with this kind of testing capabilities.

“The Company( Simpson) believes it is the only U.S. manufacturer with the capability to internally test multi-story wall systems”

That is a huge advantage. Sure, other companies calculate strength values for their products. But Engineers and code authorities want to see these things tested on real life applications with accurate strength values assigned to products.

The other main part of the wood construction category is fasteners. They make specialized structural screws, bolts and epoxy for anchoring homes to their concrete foundation. They also recent acquired a European company called Etanco which allowed them to enter the European market. Etanco manufactures specialized screws and fasteners for many types of applications.

concrete construction

This category is smaller but growing much faster. It consists of concrete reinforcement systems, concrete repair systems, and pavement reinforcement systems. These are basically an assortment of different repair and underlayment products that go underneath the pavements, roads, concrete walls and different concrete applications. These strengthen the concrete and stop them from cracking and becoming structurally compromised.

Today, there are 164,000 miles of federal highways and over 4 million miles of public roads in the US. In a 2021 report published by the American Society of Civil Engineers, the US public roads received a “D” rating because of the awful condition of the roads. They also found that there is a $786 billion backlog for road and bridge capital needs. In other words, the roads and bridges are in very poor condition and and there is a huge need to repair and rebuild them. I cant attest to this, I live in San Diego, arguably one of the richest places in the world, and some of the roads here are more compromised than some of the roads I’ve driven in brazil and Mexico.

Over the next century US infrastructure will need to be repaired and reinforced, it’s not really an option to keep neglecting it. This will likely be a bipartisan issue that wont be fought over like so many other issues. This could provide a lot of room for growth in the concrete construction category.

Leadership

As of this year the company has a new CEO after the previous one stepped down. She served for 38 years and stepped down to retire. The new CEO Mike Olosky previously served as Simpsons Chief operating officer. Personally this makes me a little uncomfortable because I don’t know Mikes capital allocation skills and whether he will be any good at his new position. I am encouraged by his previous experience at the company but only time will tell if he can step up to the plate and play ball with shareholders.

The previous CEO was a decent capital allocator but not my favorite. She preferred to pay out excess capital to shareholders in the form of a dividend which I’m not a huge fan of. I would have preferred to see the them acquire other companies or buy back stock with their excess capital. Their last acquisition of Etanco, a specialty fasteners company, was purchased at a somewhat decent price. They paid about $800 million USD for the acquisition which added approximately $291 million to sales and approximately $57 million to operating income which equates to something like 14-16x EBIT multiple. Essentially they paid 14$ for every 1$ of earnings before interest and taxes.

Valuation

The current valuation is fair at 18x earnings. Their P/E multiple has been between 18-34x throughout the last decade, hitting a temporary low in 2020 during the pandemic and another low last year at 11x. The share price has bounced back and gained almost 76% since hitting its low in September 2022.

Simpson recorded high sales growth last year coming in at 34% yoy but much of this was due to the acquisition of Etanco which doesn’t excite me so much unless acquisitions are going to become a regular part of their growth strategy. Again, personally I would welcome a more acquisitive strategy, I think their dividend should be cut and they should focus on buybacks and acquisitions.

But If we go back before their acquisition, their revenue was growing in the 6-13% range so I’m going assume growth somewhere in this range, but maybe a bit lower because interest rates have chilled the housing market, which I’m assuming will continues for a few years. Their margins have steadily risen over the last decade and have been in the 12-17% range throughout the last 5 years. Although they remain just under 16% I want to make a conservative assumption that they will get squeezed a bit before the end of the year.

So on the high end we could potentially looking at a 70% total price return over 5 years plus the 0.79% dividend. This doesn’t excite me very much at the moment. This could have been a great investment if bought at the September low of 78$ which would have skewed the odds in favor for a double or triple.

As for me right now, Im going to hold off and watch the stock, regardless of the amazing company behind it. Considering short term us treasuries are yielding over 5% and there are many savings accounts paying over 4% It doesn’t make sense to put my money into SSD 0.00%↑ at this time.

If the stock tests the 100$ level again I will consider it. I would also like to see them cut their dividend and buy back stock or use that capital to acquire more companies. But time will tell.

Thanks for reading.

It's valuable to read the report about a company from a person, who is involved in the industry. Thanks for a nice write-up!