Business Overview

Sky Harbor Group is an aviation infrastructure development company. They develop and lease luxury hangers for private and business aircraft at airfields in targeted markets. The hangers have amenities such as lounges, office space, and bathrooms and include on-demand services from staff. They are designed as home base solutions intended to provide a permanent or long-term home for aircraft.

How Their Model Is Differentiated

At its core, Sky Harbour operates as a real estate development and management business—considering it’s peers to be a handful of industrial and specialty REITs. The company’s CFO mentioned in their Q3 2023 call that they intend to eventually convert into a REIT and begin returning cash to shareholders after expanding their campus footprint.

Their operations can be divided into three components:

Site Acquisition: Analyzing markets, selecting locations for campus

development, and executing ground leases at prime airports.

Development: Constructing and delivering completed hangers.

Leasing and Management: Leasing space and providing ongoing management services for tenants.

The most common storage solution for private jets at airports is fixed-base operators (FBOs), which handle transient aircraft traffic and are often described as hotels for aircraft.

In contrast, Sky Harbour offers a permanent “home base” solution for aircraft. FBOs earn the majority of their income from fuel sales while also charging for aircraft parked on the tarmac. Sometimes FBOs have shared “community hangars” available for aircraft.

Sky Harbour is very different than the FBOs. FBOs aren’t necessarily competitors to Sky Harbour because, unlike the FBOs, they do not service transient air traffic. Also, rather than making money primarily from fuel sales, Sky Harbour focuses on rental income and add-on services to generate profits. While Sky Harbour does provide fuel to their customers, they deliberately sell fuel at a low margin to differentiate themselves from the FBOs.

Severe Supply / Demand Mismatch Provides Strong Tailwinds for Sky Harbour

The private aviation industry is projected to continue experiencing strong growth due to a large backlog of private jet orders. However, the availability of space to house these jets cannot be increased as no new airports are being built. This supply / demand mismatch creates a strong tailwind for Sky Harbour.

The private aircraft industry is projected to grow at a compound annual growth rate of 4 - 5% over the next decade. It should come as no surprise that 65% of the world’s private aircraft are based in the United States, although there’s a growing market outside the United States as well. 30% to 40% of private aircraft trips are for business purposes, leaving a significant portion for leisure and personal use. There are over 5,000 public use airfields in the US. However, Sky Harbour’s medium-term goal is to expand to thirty to fifty airports (just in the United States alone).

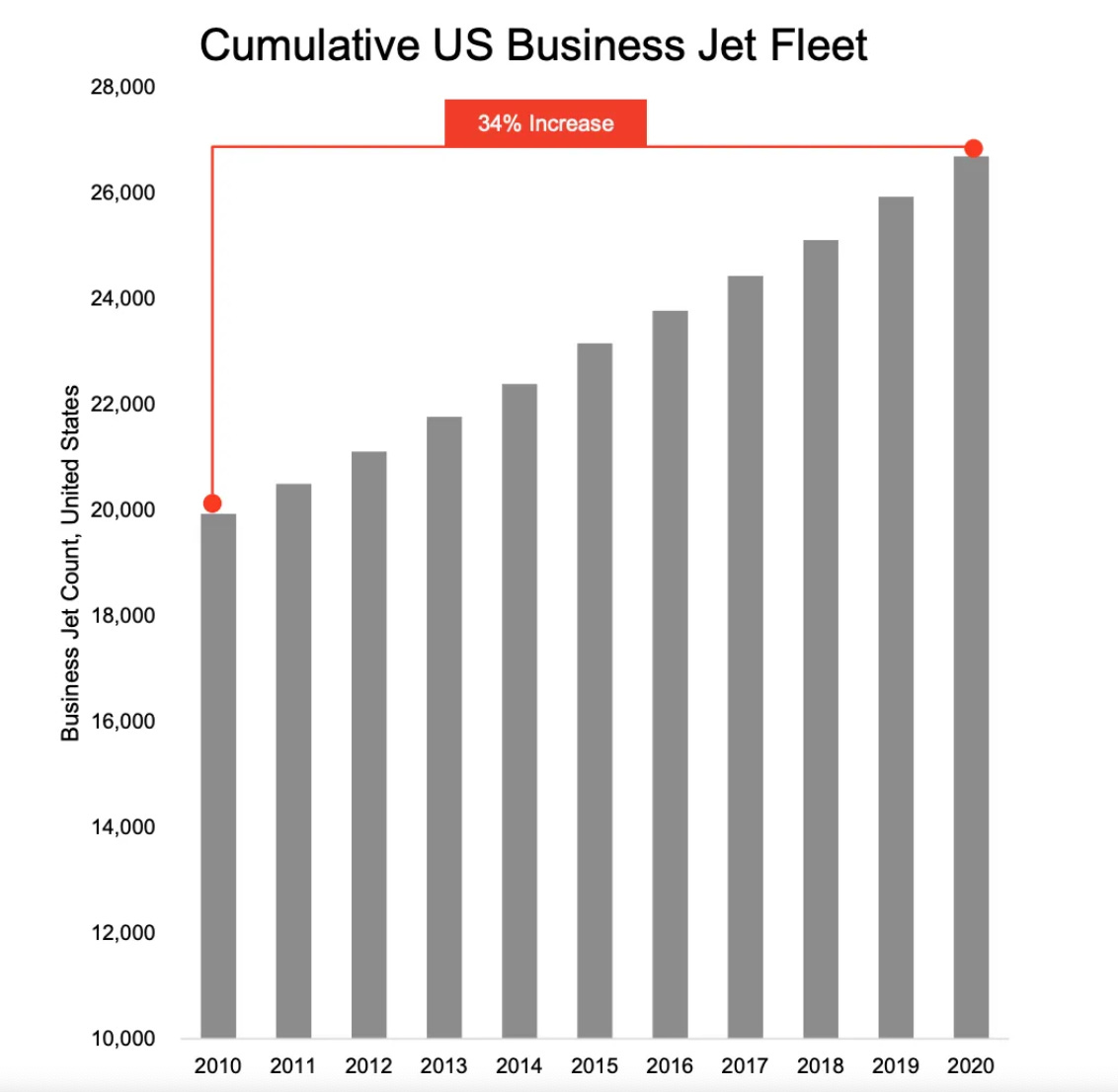

Sky Harbour measures market growth in terms of net growth in United States business aviation fleet square footage (new aircraft minus retired aircraft). In the 10 years prior to COVID-19, square footage reached 30 million. This growth has only accelerated since 2020.

Put simply, a lot of private airplanes have been manufactured and acquired over the last decade and it appears this trend will continue, benefiting Sky Harbour.

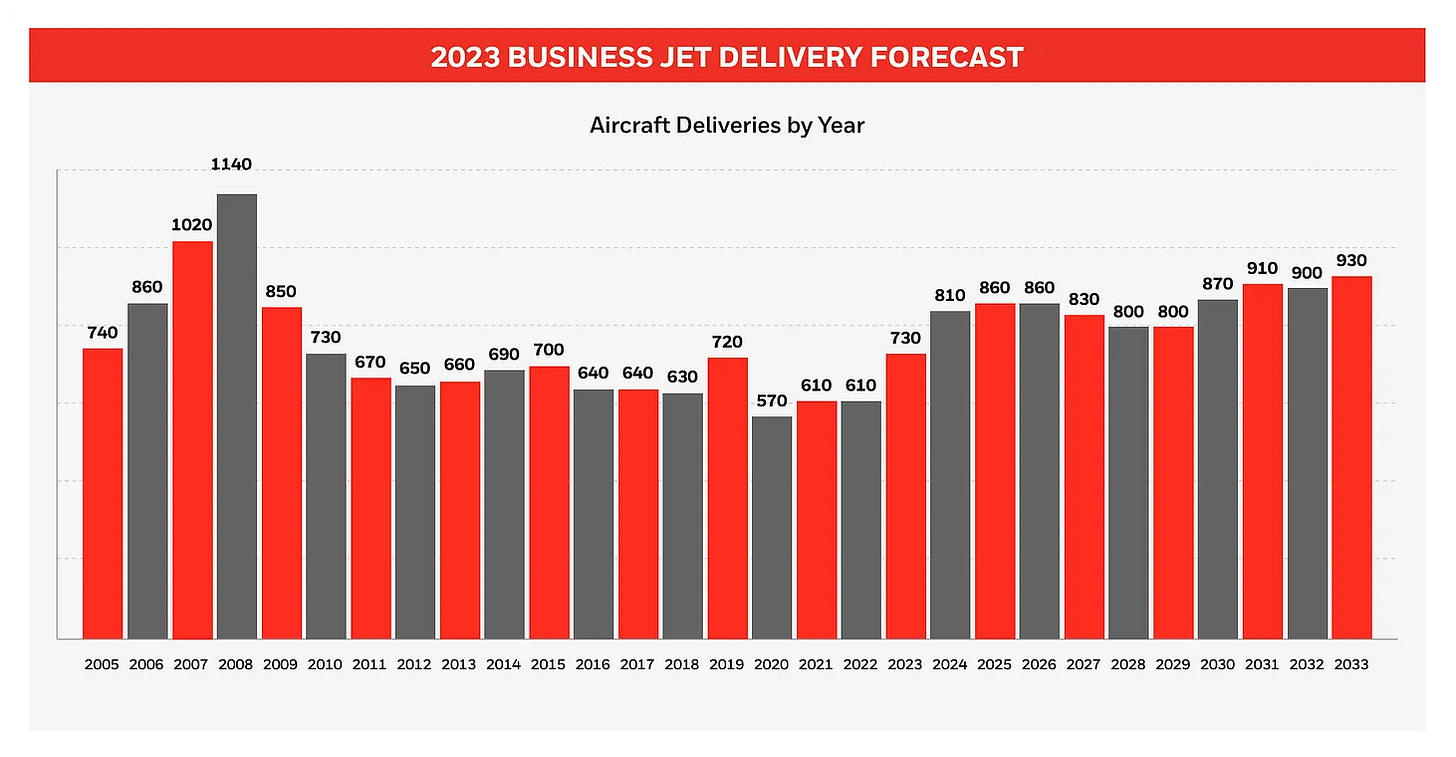

Below is an aircraft delivery forecast provided by Honeywell. Since 2020, there’s a clear upward trajectory, as more people have sought out private chartering and business class aviation for their travel needs. This trend is likely to be permanent. “Once people experience private aviation they typically don’t go back,” according to Sky Harbour’s CEO Tal Keinan.

According to Honeywell’s 2023 business aviation outlook, an estimated 8,500 new aircraft will be acquired and added to the existing fleet by 2033. Below are a few excerpts from Honeywell’s report:

“There is an air of confidence in the industry as operators share ambitious plans to acquire new aircraft and new buyers enter the market. The OEM supply chain is catching up with demand and we foresee several years of growth to reach a higher long-term delivery baseline.”

“Demand for business aircraft continues to be strong with business aviation operators planning to acquire an estimated 8,500 new business jets valued at $278 billion between now and 2033.”

“Business aircraft purchase plans in the next five years will be equivalent to 19% of the current 2023 fleet, which is up from 16% reported by interviewed operators in last year’s survey. Many of these new jets will replace aircraft already in operators’ fleets, but 3% of the purchase plan rates will come from operators increasing the number of aircraft they own.”

Most existing hangers provided by FBOs have a tail height limit of less than 24 feet because they were designed decades ago when private jets were smaller. New private jets are taller, with tail heights exceeding 24 feet, rendering them unable to be housed in many of the existing hangars. This provides an opportunity for Sky Harbour, which builds hangars to accommodate the largest and most modern private jets with tail heights up to 28 feet.

The number of private jets is forecast to grow significantly. Additionally, no new airports are being built. All of this means that demand is increasing, while the supply of aircraft storage space is not. This should give Sky Harbour pricing power.

Sky Harbour’s medium-near term goal, 50 campuses

Sky Harbour’s growth opportunity is substantial. Their medium-term goal is to reach fifty airports in the United States, which is certainly achievable. However, there are hundreds of airfields in the US that would fit their criteria. Sky Harbour also has an opportunity to build hangars internationally if the first 50 prove to be successful.

Sky Harbour has already raised sufficient capital to fully build 9 to 10 campuses with plans to raise additional capital over time as they grow. If they continue growing their campus footprint by 6 campuses per year they would reach 50 campuses within 7-8 years and full stabilization in a decade.

Additional growth avenues

Sky Harbour is primarily a real estate infrastructure business but they plan on offering many additional services which may prove to be growth drivers. The company is currently working on one to two dozen add-on services they can provide, which would enhance the companies earning potential.

Sky Harbour has significant pricing power to raise rents and offer new hangers at higher prices. Just one year after opening, Keinan noted the following about average rents at their Miami campus, which is a great market, but not a tier 1 market.

“What I can say is if you take and airport like Miami, where we began leasing in the low 30’s per square foot, we’re now leasing in the mid-40’s per square foot”

The implication is that there is demand for hanger space that can handle higher rents. If they began leasing the Miami campus at $33 PSF and raised it to $44 PSF, thats a 33% increase which is incredible considering the campus has only been open since late 2022. They could end up having much higher average rents than anticipated in the valuation at the end of this article.

How They Determine Which Airports To Target

Sky Harbour has a thorough due diligence process process for selecting airports. They first consider supply and demand dynamics and evaluate whether the market is suitable for aircraft owners looking for long-term aircraft storage. For example, in an interview, CEO Tal Keinan mentioned that Aspen, CO (despite its concentrated wealth) is more of a tourist destination than a permanent residential location, making it a great FBO market but not a lucrative market for Sky Harbour’s home base solutions.

In addition to these qualitative aspects, Sky Harbour’s leadership is very focused on unit economics, allocating capital only when the returns are compelling. According to Keinan, they ask themselves two questions when analyzing a given market:

“Given the market rent rates, can we build a campus and still generate double digit yield on cost?”

“What are aircraft paying in fuel margin in that market?”

Sky Harbour is targeting airports where they can earn at least a double-digit yield on cost, which is calculated as net operating income (NOI) divided by the total cost of the project.

It’s important to note that Sky Harbour intentionally limits its margins on fuel to further differentiate itself from the FBOs.

Existing Campuses

Sky Harbour currently has three completed campuses, all with over 95% occupancy:

Sugar Land Regional Airport (SGR), Sugar Land, TX (Houston metropolitan area)

Nashville International Airport (BNA), Nashville, TN

Miami-Opa Locka Executive Airport (OPF&), Opa Locka, FL

The following campuses are in various stages of development.

Addison Airport (ADS), Addison, TX (Dallas metropolitan area)

Bradley International Airport (BDL), Windsor Locks, CT (Hartford metropolitan area)

Centennial Airport (APA), Englewood, CO (Denver metropolitan area)

Chicago Executive Airport (PWK), Wheeling, IL

Hudson Valley Regional Airport (POU), Wappingers Falls, NY (New York City metropolitan area)

Phoenix Deer Valley Airport (DVT), Phoenix, AZ

San Jose Mineta Airport (SJM) San Jose, CA

Stewart International Airport (KSWF), New Windsor, NY (New York City metropolitan area)

Dulles International Airport (IAD), Washington D.C

Orlando Executive Airport (KORL), Orlando, FL

Customers

Some of Sky Harbour’s tenants are verifiable through publicly available resources. Current tenants include Lane Bess, DJ Khaled, Rick Ross, Jeff Bezos, NetJets, and Chevron.

Notably, Rick Ross’s Instagram page is filled with pictures and videos of him hanging out at his Sky Harbour hangar. Additionally, Ross recently filmed two music videos in his Sky Harbour hangar, Champagne Moments and “Shaq and Kobe,” indicating his satisfaction as a tenant.

Hanger Design And Building Process

The company has developed a prototype hanger, called the Sky Harbour 34, which has been continuously improved over time and serves as a template for the development of future hangers.

This prototype has several benefits: it speeds up city permitting approval times, reduces the probability of delays during the inspection process, and minimizes the chance of costly design flaws that need to be corrected.

They’ve designed their hangers to accommodate the latest private aircraft and fit the hangers into a regulatory category that is cost efficient. The National Fire Protection Association (NFPA) publishes fire codes and standards for hangers. Having a few thousand pound of jet fuel parked in a tight space with little ventilation presents obvious safety risks. Therefore, foam fire suppression systems are mandatory for certain hanger sizes, but they’re also extremely expensive. These systems essentially dump a massive amount of fire-retardant foam into the hanger when they are set off.

Sky Harbor designed their hangers to be large enough to accommodate the most modern private jets but small enough to fit into a classification category (group 3) that doesn’t require these foam systems.

This is an important factor in their development strategy. Foam suppression systems can cost up to $200,000- $500,000 per hanger and sometimes add 30 - 40% to the building cost. In Sky Harbour’s case, a $500,000 dollar system would add 17% to their $3 million dollar hangers. With 15-20 hangers per campus, that would be $7 -$10 million in additional build costs per campus, a price investors don’t want to pay.

Further, if the system is accidentally set off (which is a very common problem), it can cost operators up to $40,000 per incident and far more if an aircraft is damaged. This inevitably leads to lawsuits between aircraft owners, hanger operators, and fire system providers. This can create an enormous headache, so Sky Harbour made the right choice by complying with group 3 hanger requirements.

Construction Process

Complexity is the enemy of any construction or real estate development business. Fortunately, airplane hangars are surprisingly easy to erect compared to a commercial or industrial building.

They’re typically PEMBs (pre-engineered metal buildings) where components are prefabricated offsite by a manufacturing company and then easily assembled onsite, reducing labor costs. They’re basically large steel beams wrapped in steel sheeting. The most time-consuming and expensive part of the process is sitework, which includes grading the ground, compacting the soils to prevent settling, underground drainage, and building the concrete foundation, which must be massively reinforced to bear the load of an airplane.

However, once you get above ground, the process is much faster and cost effective.

RapidBuilt acquisition

Sky Harbour acquired RapidBuilt in 2023, a pre-engineered metal building manufacturer, which will streamline the building process while speeding up construction times. CEO Tal Keinan said in a press release:

“As part of this effort, we are happy to welcome the RapidBuilt team into the Sky Harbour family. Vertical integration will produce considerable development cost advantages, More importantly, RapidBuilt brings the best engineering talent we have ever encountered in the Aviation PEMB and hangar-door spaces into the Sky Harbour prototyping process, yielding a constantly improving hangar, with outstanding quality consistency and a more efficient construction cycle.”

The integration of RapidBuilt is an intelligent move in my opinion. There doesn’t appear to be any FBOs in the industry that are both manufacturing and developing hangers. This should optimize Sky Harbour’s build costs as they’re able to manufacture and deliver prefabricated, pre- engineered materials, without any middleman or markup.

Also, keep in mind that Sky Harbour is accountable to the NFPA, which sets the fire code for hangers, and regulations are updated every four years. The RapidBuilt integration means that they can easily make design changes and immediately implement a new prototype.

Fantastic Unit Economics

The economics of a real estate development business are straight forward. Ideally one would want to produce net operating income as high as possible relative to the total project cost. Before we delve into the economics, here is a key point: Sky Harbour’s tier one airports have significantly better unit economics than the non-tier one airports.

The construction costs and property operating expenses are relatively similar across Sky Harbour’s markets. However, the rents can vary dramatically. At their tier one airports, the rents are going to be significantly higher than at the non-tier one airports. As a result, the unit economics are significantly better at their tier one airports.

“We continue to target 13-15% yield on cost in our unleveled NOI yield, please note that as we move from twelve airports to twenty airports, we expect the unit economics to be enhanced as the next twelve airport on average are expected to be more profitable than our first six”

- CFO Q3 2023

“We’re very happy in airports where we are getting $30 - $40 per square foot in rents, but as we get into more Tier One markets, where OpEx and CapEx stays the same, and revenue increases significantly, those unit economics will respond accordingly”

- Tal Keinan Q4 2023

“San Jose is the first tier one airports in Sky Harbour’s portfolio, and most of our site acquisition focus over the next 24-36 months in tier one airports.”

- Tal Keinan Q1 2024

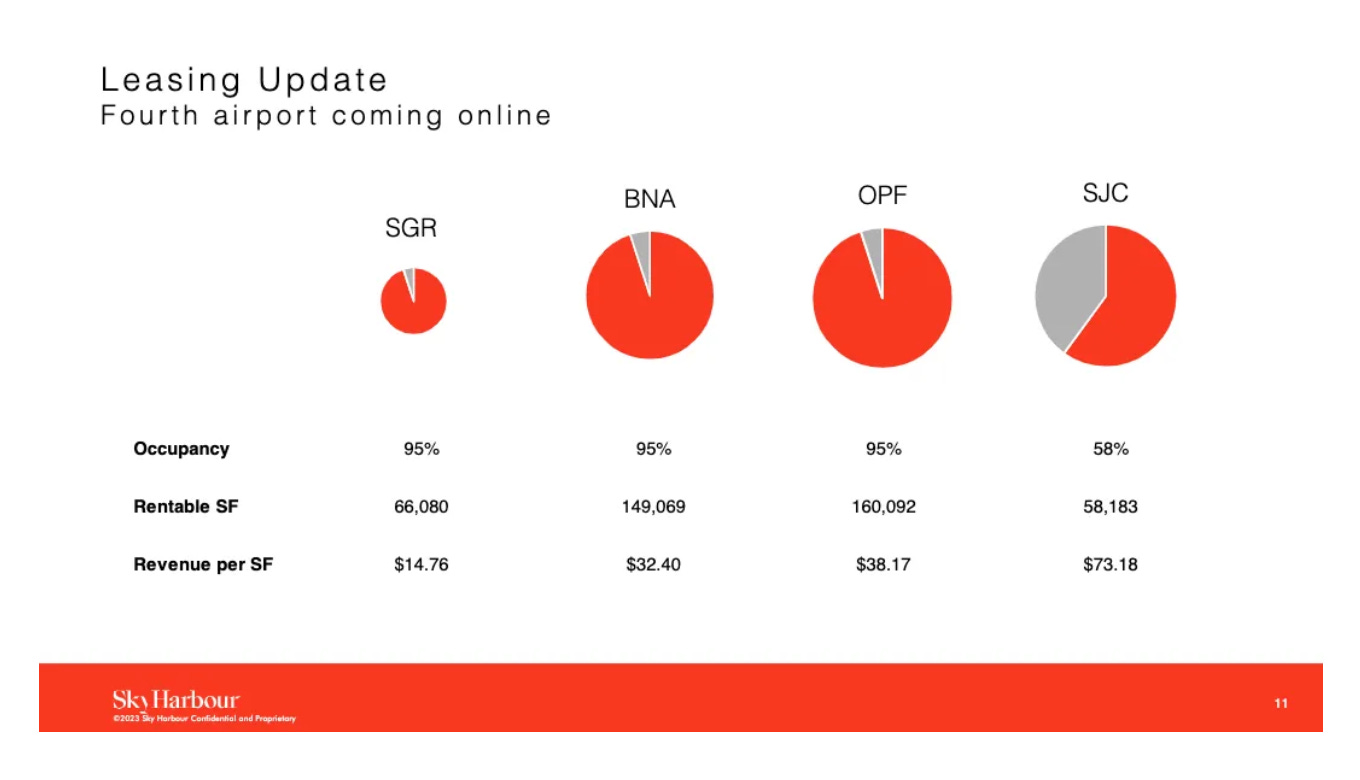

San Jose is their first tier one airport and is almost 60% leased. It’s generating annual tenant rents of around $73 per square foot. In their Q1 2024 call, Sky Harbour announced that some of their San Jose (SJC) leases are exceeding $80 per square foot. As illustrated below, rents are significantly better at San Jose, when compared to the non-tier one airports:

It’s important to keep in mind that SGR (Houston Sugarland Airport) is not representative of Sky Harbour’s other airports. This was Sky Harbour’s first airport, and it simply doesn’t reflect the higher lease rate they will be getting at their other airports, especially the tier one airports. Both BNA and OPF airports are also not tier one airports, which is why their rental rates are lower.

The bottom line is that investors should not be extrapolating SGR, BNA or OPF because these are not tier one airports, and the rental rates are below what Sky Harbour will be collecting at their tier one airports going forward.

As it stands today, Sky Harbour has ground leases at thirteen airports. Not even one of Sky Harbour’s first six airports is a tier one airport. The airports they are signing are getting better. In airports seven through thirteen, five of the airports are tier one: San Jose, Washinton Dules, all three New York Metropolitan airports, and Chicago Executive. Annual NOI per square foot will likely exceed $50 at the tier one airports, which is meaningfully above the non-tier one airports. In their 2022 presentation they stated that their OpEx per square foot would be around $4.50 in 2025.

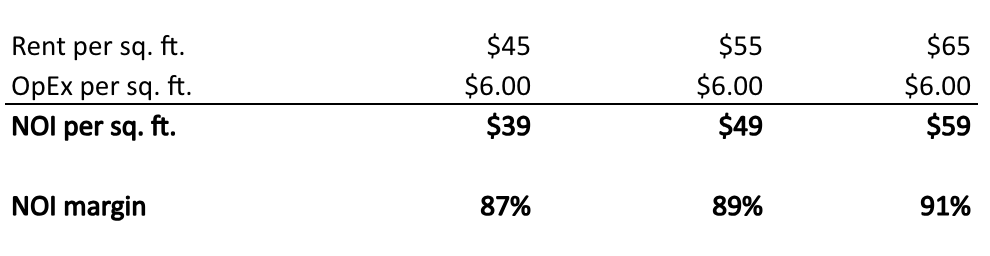

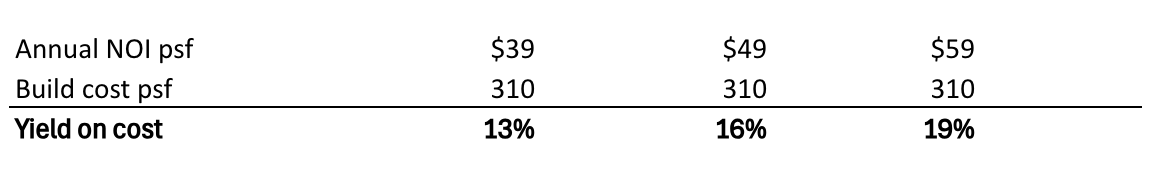

Here is the range of NOI outcomes expected assuming a higher OpEx of $6 per foot

In Sky Harbour’s Q1 2024 earnings call, management noted that they have an average build cost of between $240 - $300 per rentable square foot.

Now we can look at the different yield on cost scenarios. As you can see below, in the bear-case scenario they produce $40.5 per square foot in annual net operating income on $310 construction costs per foot, yielding an unlevered return of 13.5%. On the other hand, if they generate higher rents with tier one airports they could generate a 19.8% yield on cost.

It’s reasonable to assume they can maintain mid to high teens unlevered returns if they continue enhancing their construction efficiency, hanger prototyping, and pushing into tier one airports. My base case is around 16% but it’s entirely possible that their average yield on cost ends up on the higher end of this range.

Management

Tal Keinan served in the Israeli Airforce as an F-16 pilot and combat air instructor for 18 years before founding Clarity Capital and eventually Sky Harbour. He was leading Clarity Capital at the time when he founded Sky Harbour. Keinan had trouble finding hanger space for his own private jet and realized there was an extreme supply/demand imbalance in the market. After discovering this was a nationwide problem, he founded Sky Harbour.

Keinan also has considerable ownership and voting power in the company, owning 18 million class B shares for voting power of 27%. His compensation is modest at $1.6 million (roughly $800,000 salary + $800,000 bonus). Interestingly, there’s a team of ex-military pilots involved in the founding and ongoing operations of Sky Harbour. The site acquisition specialists who analyze, identify and secure the airfields are ex-pilots with extensive experience in the field.

Competitive advantages

Sky Harbour has several competitive advantages:

Once they lock down a ground lease at an airport, there is often little or no additional space for any potential future competitor to come in and compete with them at that location. Land scarcity may well be their biggest advantage.

It would be tough for competitors to compete with Sky Harbour due to their head start in building relationships with municipalities. The process of talking to municipalities, obtaining a ground lease, construction permitting, building process and tenant lease up can take a long time. From beginning to end, this process takes at least seven years to reach stabilization of the first project. This could dissuade would be entrants if Sky Harbour is much further ahead.

They are pursuing a luxury image that attracts wealthy tenants who value privacy, service and convenience. This could prove to be a competitive advantage in the long term as more wealthy people want to be associated with them.

Risks

Sky Harbour faces several risks, including:

Site Acquisition: The most challenging aspect of Sky Harbour’s business is securing attractive leases at prime airports. Failure to obtain leases at tier one airports could limit future growth.

High Capital Requirements: Sky Harbour relies heavily on raising debt and equity capital to fund expansion. Currently they are funded by 65-75% debt, however this may decrease as they are expected to become profitable in the next year or two. In Q2 2023 Tim Herr, vice president of finance, mentioned that it costs about $45 - $60 million to build each campus. This implies $2.2 - $3 billion for the total cost of 50 air fields. After synergies from the Rapid build acquisition I estimate it is likely to be around $2.5 billion or ($50 million per campus), of which 15% - 20% will likely come from equity financing. Issuing at an average of $10 - $15 per share, its possible they issue another 30-40 million shares over time. If there is a recession and stock prices are lower they may need to issue more shares at lower prices.

Future Competition: Today, Sky Harbour has no direct competition, however, Tal Keinan acknowledged in an interview that he expects competition in the future. The economics of the business are fantastic, at some point this will draw one or multiple competitors. But by the time any competitors enter this space, Sky Harbour will have scale, a strong brand, and will likely be operating at least a few dozen campuses.

Valuation

The key to the thesis on Sky Harbour is that they are investing capital at 13% to 20% unlevered returns (yield on cost). This is very good for Class A real estate.

The model below assumes that they’re able to develop in more Tier 1 markets over time. The average rent may be much higher than whats represented depending on pricing power and lease rates at new campuses. The model also reflects higher build costs and OpEx per foot and incremental equity raises.

Here’s how the economics could pencil out at fifty locations:

The base case is around $40 per share at full stabilization. It should be noted that these are very conservative estimates. If Sky Harbour continues to execute, they could create significantly more value for shareholders than what is represented above.

Conclusion

Sky Harbour is a very promising and unique business. It’s largely ignored because it’s currently unprofitable and remains riskier than its peers. However, the unit economics are compelling and the supply/demand mismatch provides a strong tailwind. If they can execute in Tier 1 markets they may very well end up doing much better than anticipated. This is an exciting company to watch and I’m eager to see how they execute over the next 5-10 years.

Thanks for reading!

How many years do you think it will take to get to the 50 locations you mention? Im thinking that some institution with a large amount of capital to put to work may buy this as a platform because there is a long runway of investment opportunity at excellent cap rates. It would be good holding for a Berkshire or an insurance co that has a lot of cash to put to work.

Great write up on this obscure company. I am a big fan of the comapny and rooting for it. A few more things to discuss in the followup may be is how they raised capital- Municipal Bonds, PIPE and finally equity. Also owning this have a few options, Common stock, through BOC, and finally Warrants.