Key Info

Market cap: $1.4 billion

Share price: $36

TTM EPS (diluted): $2.73

TTM P/E: 13

P/B: 2

3 year premium CAGR: 24%

A brief overview of the bull thesis

With inflation and high interest rates persisting, it makes sense to look for companies that have stable operations and may benefit from higher rates. Insurance has the potential to be a stable business, and many insurers have a large portfolio of interest bonds that benefit from rising interest rates. Plus, in case of a recession, most insurers are less correlated to the broader health of the economy.

Skyward is a specialty insurer that went public in 2023 and has almost doubled since. It is somewhat of a competitor to the incredible growth company, Kinsale Capital. The big difference between the two is that Kinsale focuses solely on non-admitted (E&S).

Skyward overview

Skyward is a commercial property and casualty insurer that operates in the United States. They formally operated under the name Houston International Insurance Group (HIIG). They rebranded in 2020 just before going public, at which point they refocused some of their operations more on E&S.

Skyward underwrites in 8 specialty markets through a mixture of admitted and non-admitted (E&S) lines. As of December 2023, 43% of their policies were written on an admitted basis, while 57% were written on a non-admitted basis. If you’re not sure what these are, I’ll briefly explain what they are in a moment.

Skyward focuses on profitable and underserved markets where customers have specialized commercial property and casualty insurance needs.

A brief primer on specialty insurance and E&S

Property and casualty insurers operate in a few different markets. The standard and the specialty (non-standard) market, and they are written on an admitted and non-admitted (E&S) basis. In researching Skyward, I studied some of their more successful competitors, such as RLI Corp., W.R. Berkley, and Kinsale Capital. I came across a good explanation of standard and specialty markets in RLI Corp.’s 10k.

“In the standard market, products and coverage are largely uniform with relatively predictable exposures and companies tend to compete for customers on the basis of price. In contrast, the specialty market provides coverage for risks that do not fit the underwriting criteria of the standard carriers. Competition tends to focus less on price and more on availability, coverage, service and other value-based considerations.”

So specialty insurers are able to offer niche, higher-risk insurance solutions for people who fall outside of the underwriting criteria of other standard carriers. These categories of “specialty and standard” can be divided into two more categories: admitted and non-admitted. Specialty insurance is often written on a non-admitted basis, and standard insurance is written on an admitted basis. However, insurance carriers can write on both admitted and non-admitted bases.

Non-admitted insurance products are also known as excess and surplus (E&S) and cover a variety of special insurance needs that fall outside of the standard market but also don’t meet the regulation requirements of the state. This means they’re less regulated and not backed by the state’s Guarantee Fund if the insurer should happen to fail. Companies who participate in the E&S market have much more flexibility in their pricing because the state doesn’t regulate their rates.

On the other hand, admitted insurance products are regulated by the state and are therefore backed if the insurer fails. This comes at a small price as their rates are regulated and set by the Department of Insurance (DOI).

Hard and soft markets

E&S insurance has been in somewhat of a boom over the last few years, as evidenced by the enormous success of Kinsale Capital, a well-run E&S insurer. E&S typically does well in a “hard” insurance market, which we’ve been in since 2019.

A “hard” market is one where demand for insurance exceeds the supply of insurers willing to underwrite policies. Typically, rates go up, and underwriting standards become more strict. This occurs for various reasons, such as increasing catastrophes and claim frequencies. Also, higher interest rates—as we’ve experienced lately— soften the risk appetite of admitted insurers, which drives more business into the E&S market.

A “soft” market is the opposite. After periods of lower claim frequencies and less insurance losses, underwriting becomes less strict, rates stabilize or go down, and there is more availability and easier access to coverage. Typically admitted does well in this environment. We may be entering into a softer insurance market over the next few years.

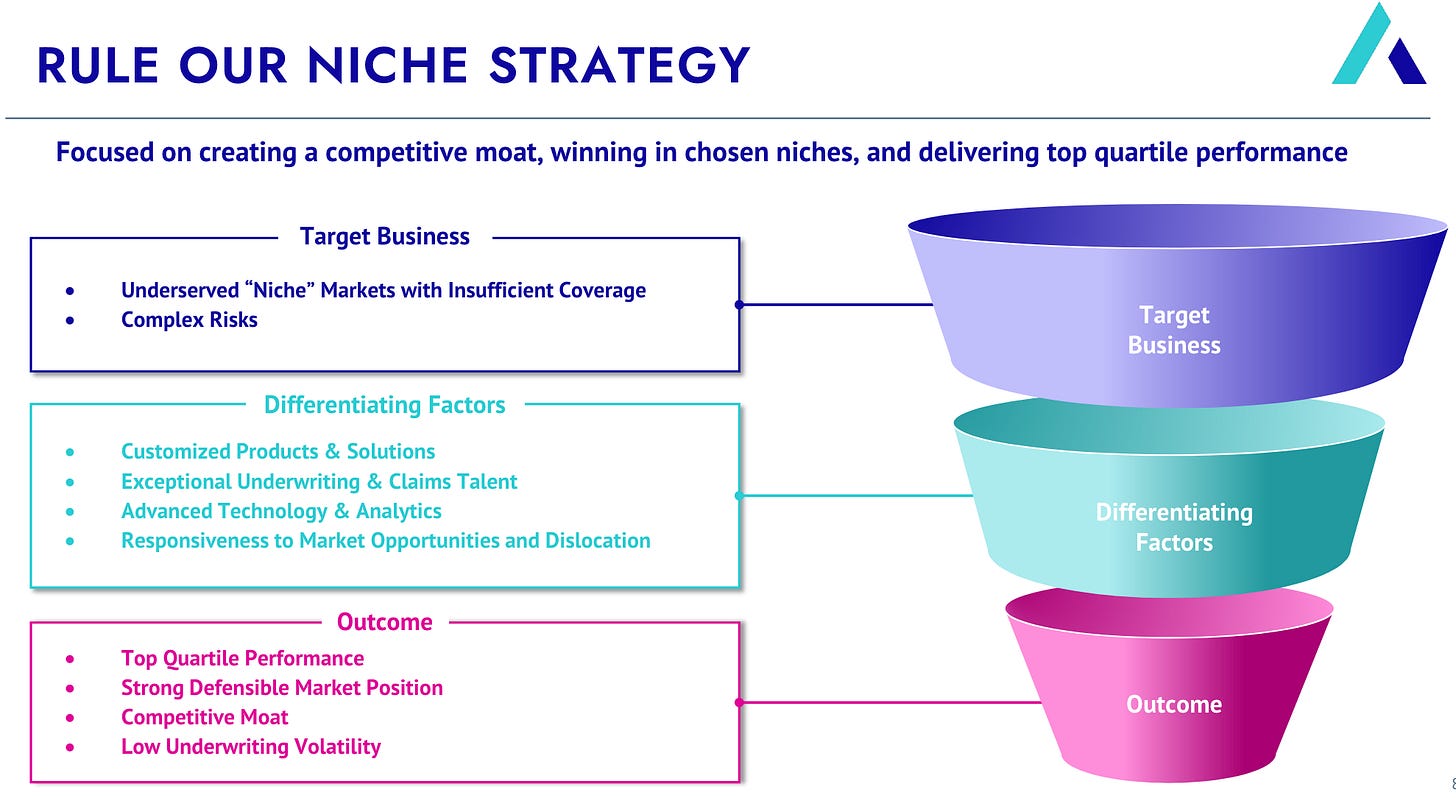

“Ruling their niche” and competitive advantage

Insurers usually gain an edge by either earning more in niche areas of the market (differentiation) or by having a low-cost model, or a bit of both.

Most insurers that operate in standard markets tend to focus on keeping their expenses low. Geico is a prime example of an insurer that has done a great job of maintaining an expense advantage with their direct-to-consumer model. Other specialty-oriented insurers may find their advantage in underwriting higher-risk or niche lines of insurance that they can charge more money for.

Skyward is aiming for an underwriting advantage. They refer to their strategy as “ruling their niche” and they believe it forms the basis of their competitive advantage. In an interview from “The Voice of Insurance,” the CEO, Andrew Robinson, describes their strategy.

“The idea here is, lets go focus on parts of the market, that by their very nature are tougher, with more complex risks, that are distressed, things that have attributes where its harder to do it very well, but if you can do it well, our view would be, that’s where the profit pool is”

Because Skyward offers very specialized insurance needs that are hard to replicate, it keeps competitors away who would rather not write lines in these areas.

You’ll often hear insurance companies—including Skyward, Kinsale, and others— basting about how they differentiate themselves by “leveraging technology”. Personally, I take this with a grain of salt because all insurance companies are leveraging data, analytics, and technology to improve their underwriting.

There are some interesting insurance companies that may be able to utilize artificial intelligence and proprietary technology, but for Skyward, I believe a competitive advantage primarily comes through sound underwriting and cost discipline.

Relative performance

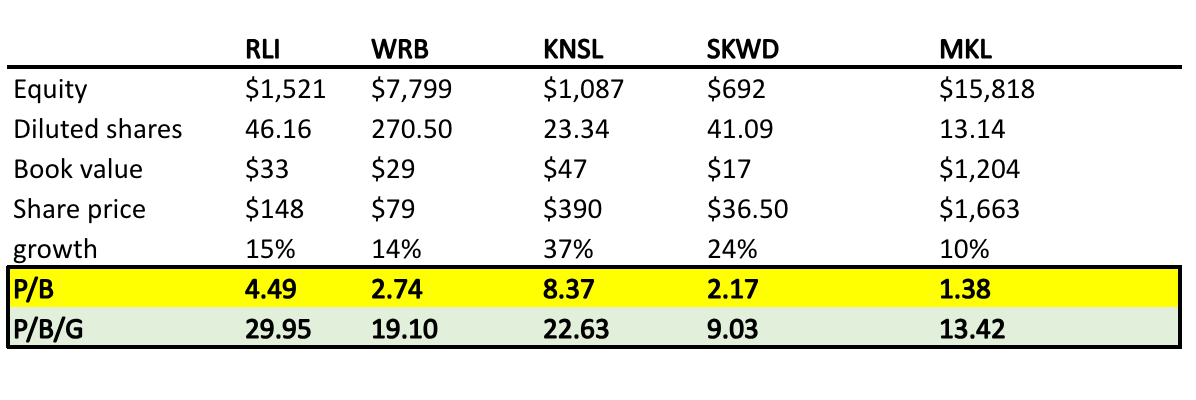

Below is a chart comparing a few different competitors. Obviously, Kinsale is the clear winner in almost every area. In researching Skyward’s competitors, I inadvertently discovered how great of a company Kinsale is. So, I may have to cover them more at a later time. But for now, let’s continue looking at Skyward’s progress over the last few years.

One thing to notice is that Skyward’s trajectory is going in the right direction in every area, with the exception being the expense ratio. The companies return on equity is incrementally increasing while their combined ratio is decreasing. If you’re not familiar, the combined ratio measures losses and expenses as a percentage of earned premium. A lower number is always better.

Their premium growth also continues to outpace the others, especially in the last quarter.

What I personally want to see over the next few years is Skywards combined ratio stabilizing well below 100 while their premiums continue to grow. Since Skyward is a newly public company, we don’t have a long history of data to track their long-term performance like the others on this list, so it’s important to monitor their progress.

The competitors listed above have compounded shareholder value over the years by consistently generating underwriting profits and keeping their expenses at a minimum. If Skyward can do the same, I don’t see any reason the stock wouldn’t do well.

Overview of their niches

Skyward has a diverse assortment of niche underwriting divisions.

Accident and health- Admitted basis. They provide medical stop loss solutions for organizations with less than 2,500 employees, as well as group and single-employer captive solutions.

Captives- E&S and admitted basis. They provide group captive solutions for companies that are looking to self-insure.

Global property and agriculture- Non-admitted. Global property provides property-only solutions to large multi-jurisdictional entities and Global agriculture provides reinsurance solutions for livestock, crop and renewable resources.

Industry solutions- E&S and admitted. Provides solutions for Construction, Energy and Specialty Trucking.

Professional lines- E&S and admitted. Professional Liability, management Liability (which includes cyber insurance), and Allied Health.

Programs- E&S and admitted. They underwrite and partner with program administrators. These programs are where members or participants are protected from losses.

Surety- Admitted. Sureties are a form of insurance where the underwriter assumed responsibility if the insured doesn’t perform or doesn’t fulfill their financial obligations.

Transactional E&S- E&S. provides primary and excess non-catastrophe prone property and general liability solutions

Market size and opportunity

Skyward operates in the commercial P&C insurance market. The total P&C market was about $888 billion in the United States in 2023 and growing at just 0.07%. The commercial portion is about $400 - $500 billion, according to Michael Kehoe, CEO of Kinsale.

Even though Skyward is focused on a smaller subset of the P&C market, they still operate in a massive and mature market. The P&C market won’t be growing much over the next decade and therefore much of the insurance winners will do so by taking market share from others. The P&C insurance market is competitive and crowded at times, with some companies doing horrible over time and others going to on create massive shareholder wealth.

Management

Andrew Robinson is the CEO of Skyward. He has many years of experience in the specialty insurance business, including a decade at The Hanover Insurance Group. However, looking through his stock ownership, I’m really unimpressed. Although some mercy should be extended to him because he is not the founder of the company and was only hired in 2020. His total stock ownership, as of now, is about 83,154 shares valued at about $3 million. This is really nothing considering his total compensation was over $9 million in 2023. However, it should be noted that the entire management team—including Robinson— are incentivized with long-term and short-term incentives tied to the growth in book value and underwriting returns.

91% of Robinson’s compensation was in the form of awards, options, or incentives. So it’s good that he has a significant portion of his pay at risk if he doesn’t perform, but even so, I wouldn’t say that I am impressed with his tiny ownership in the company.

There is however a board director—Jim Hayes— who owns owns 7% of the company worth roughly $100 million. Interestingly, Jim was the founder and CEO of Hays Companies, an insurance broker which he grew to be the 22nd largest in the US. In 2018 Hays Companies was acquired by the incredible serial acquirer Brown and Brown BRO 0.00%↑ , at which point Jim Hays became a board director of Brown and Brown until he resigned in April 2024. Jim has quite the resume and his ownership and presence on the board could potentially be an indicator that Skyward is a quality business.

Fundamentals

Skyward has grown its earned premiums at about 24% since going public and compounded its book value 15% in that same period while maintaining a combined ratio below 100 and an expense ratio below 30. These are exciting numbers for certain, but the question is whether they can continue doing this for the long term.

Another thing to watch when looking at insurance companies is the debt on the balance sheet relative to their total capital. Debt is important for many reasons in the insurance business, but just like any business, it must be kept under control. Below is a comparison of Skyward’s debt/cap ratio with competitors, and we can see they’re as levered as some of their competitors and rank right in line with Kinsale.

Risks

Underwriting risk

Underwriting risk is easily the single biggest risk for any insurer. An insurer can’t survive long term if they don’t assess their underwriting risks accurately. I will be keeping an eye on SKWD’s loss ratio, expense ratio and combined ratio. At the end of the day these are the metric that are most important in the insurance business.

Misalignment

In my view, It’s always a risk when a CEO owns such a small stake in the company. Ideally the person steering the ship should have significant skin in the game. Another way to put it, the cook should be eating his own cooking, otherwise he might end up serving you a bowl of slop.

Risk in specialty insurance

Specialty insurance is harder to predict and is more prone to blow ups. It’s more profitable, but it’s also more risky and underwriting standards need to be kept tight.

Valuation

I prefer to value insurance companies based on book value because they’re very dependent on and driven by their balance sheet. Skywards book value is around $17.44 per share, meaning they trade right around a 2x book at $36 per share. Relatively speaking, this is ok for a P&C insurer growing premiums at a 24%.

Below I constructed another chart comparing the book value of a few of competitors. I also formulated a sort of “PEG ratio.” Instead of dividing P/E by the growth rate, I divided P/B by the growth rate. The lower the number the better. You can see that SKWD is the second cheapest on the list in terms of its book multiple, right after Markel. However, in terms of cheapness relative to growth, Skyward easily takes first place.

Now, in terms of an actual forecast for SKWD 0.00%↑ I’m going to assume growth between 15%-25% and a book multiple of between 1.5x - 2x , which seems reasonable. If the multiple contracts, I could be looking at a much smaller return. But if the multiple remains at 2x, I could potentially be in for a nice return over the next few years.

Final thoughts

I own a small position in SKWD 0.00%↑ around 2%.

To be clear, I don’t think this is “the next Kinsale Capital”. I don’t think it’s going to be a 20 bagger over a few years, although wouldn’t be surprised to see this company outperform. Kinsale went public at around 15x earnings and 2-3x book, but it also went public just before the E&S market began to boom, so it rode the hard market quite nicely and established itself as a premium 100% E&S carrier.

However, the E&S market may be slowing down as the markets may soften. In this sense, Skyward may be more balanced and prepared for that situation because they also write on an admitted basis, which typically does better in softer markets.

In general, I like the set-up. It’s growing, profitable, and relatively cheap at 2x book or 13x earnings. I’m not sure if I’m going to scale up my position at this particular moment, but I’m certainly going to continue watching this company.

Thanks for reading! Consider subscribing if you liked this write-up.

Interesting write-up. Has delivered on profitable growth and shares have done well. I agree that these types of specialty lines can be attractive. But I have also seen these types of insurers implode - unlike bank failures P&C insurers don't end up on page 1 of the news when they get it wrong. One concern I have is that some of these product lines (health, liability) are not really short-tail exposures. Hard for underwriters to predict ultimate losses. Also would like to see a shorter duration bond portfolio. But perhaps it wants to match asset duration to liability duration?