Overview

Stone Co. is a financial technology company that primarily facilitates payments in Brazil. They offer in person, online and mobile payment channels that allow Brazilian businesses process payments. They also provide digital banking, working capital loans, customer engagement software, CRM and accounting services to customers.

They served 2.6 million customers in 2022 and their target market is the micro, small and medium sized business in Brazil which they claim have been historically “underserved and overcharged.” They estimate there are 13.9 million micro, small and medium sized businesses in Brazil.

They generate revenue in three ways.

Payment processing fees and transactional banking fees.

Financial income and interest fees related to prepayments, credit solutions and deposits.

Subscription fees from their retail software solutions.

They divide their business into two categories, financial services and software. Financial services is comprised of their payments platform and their digital banking/credit products while their software platform is comprised of their retail management software.

Financial services

Payments

This platform is fairly straight forward, they charge a fee on total payment volume so the two factors that affect revenue are the take rate (fee charges on each dollar) and total volume of payments processed.

Digital banking

This is an account for their customers which is integrated into their retail management system that allows them to make and receive payments from the account. They also act as an insurance broker providing store and life insurance to their customers.

Prepayment services

These are essentially small working capital loans to serve their customers liquidity needs.

Credit solutions

These are offered to customers who need further funding to growth their business. They leverage the data they already have on their customers in order to offer them cost effective loans. This product offers a pay back system that automatically comes out of the customers credit card receivables.

It’s important to note, their credit solutions had a very rough launch and it’s partially responsible for the sell off in the stock. They didn’t have an efficient credit scoring systems put in place and they had problems with brazils new collateral registry system which was supposed to allow them to use customers credit card receivables as collateral but didn’t. There is a detailed press release from Stone here.

It’s fairly complicated but from what I gathered Brazil’s central bank created a transparent collateral system that was intended to increase lending competition. Merchants could use a certain portion of the future receivables as collateral by registering them and converting them into something called Registry receivable unit RSU’s. These RSU’s could then be used as collateral so lenders like stone could extend credit to merchants. The problem was that the registry system didn’t work properly while migrating from the old system to the new, leading to issues such as “collateral leakage” and loopholes that certain customers took advantage of and ultimately higher NPL’s (non performing loans.) Other companies that operate in Brazil like PagSeguro and Mercado Libre MELI 0.00%↑ PAGS 0.00%↑ also had issues with the registry system and had higher NPL’s.

As a result Stone was forced to temporarily discontinue the credit solutions product in 2021. However they claim the system is fixed and they’ve improved their own credit scoring system and put new risk policies in place. They plan on re-launching their credit solutions product again this year.

Software solutions

The software business is not very interesting to me but it’s a good business regardless. It’s certainly a compliment to their payments and lending platform but I’m personally not counting on it to really move the needle in the near term. It’s a growing business nonetheless.

Notes on mistakes

My personal opinion is that the previous CEO was just a 32 year old guy who was anxious to succeed and he ended up rushing their credit product to market. He also made a really bad investment in Banco Inter which was ultimately sold at a loss. So between the credit product flop and the Banco Inter loss it seems the market had every right to dump the stock.

The new CEO has been replaced by Pedro Zinner who’s on the board of directors and known for successfully turning around businesses.

The turn around

I’ve been encouraged to see how Stone STNE 0.00%↑ has managed to dig itself out of a rather large hole. The issues at hand were

Bad credit scoring system leading to higher non performing loans

Brazils faulty registry system

Banco Inter Investment sold at a loss

These were temporary issues only affecting the bottom end of the income statement by causing temporary non operating expenses.

I usually don’t invest in turnarounds but I think the set up is promising because the business was never truly impaired. Turnarounds are a lot easier when a company experiences the majority of its issues on the bottom end of the income statement (below operating income) because these can more easily be fixed by changing out management. I like it when the core business keeps growing but there are temporary non operating problems that lead to a sell off.

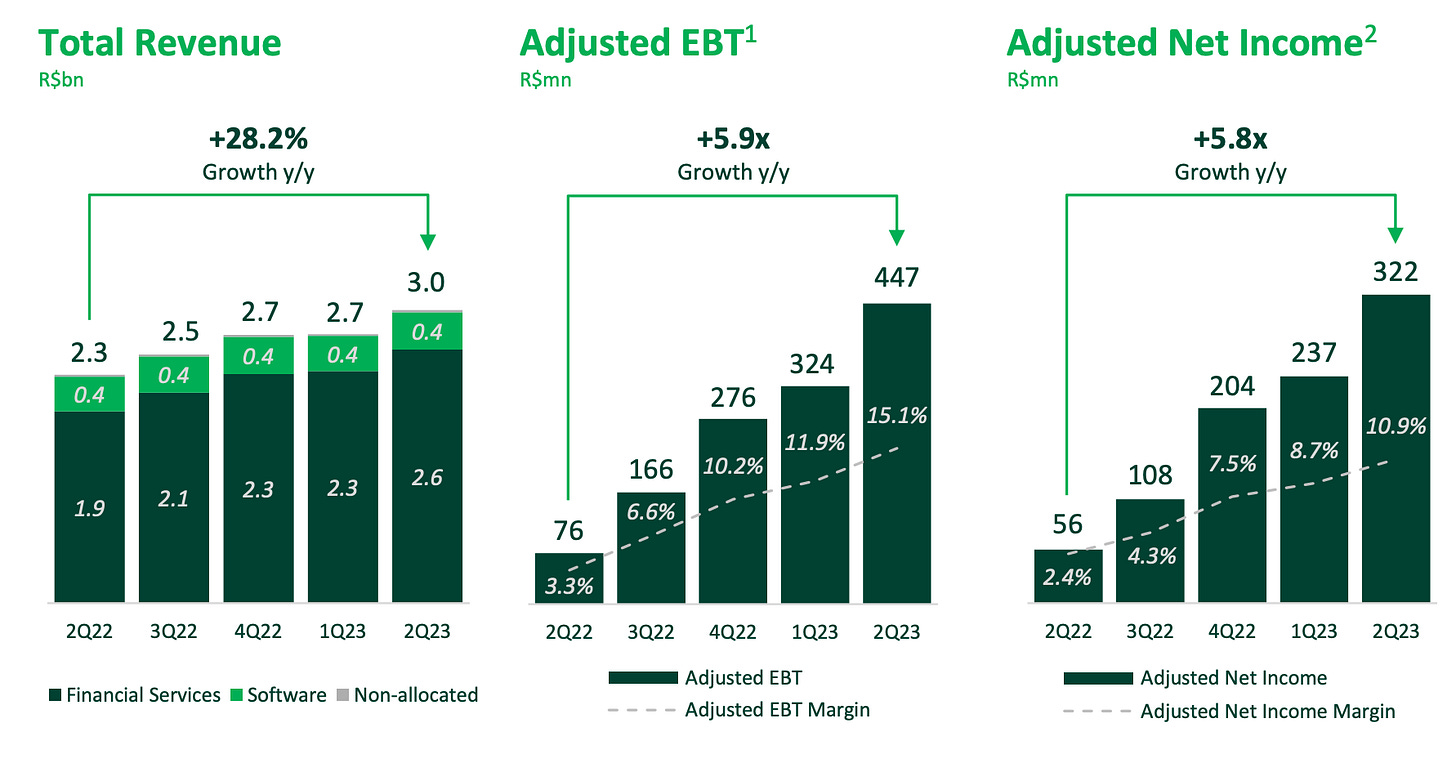

In their most recent quarter we can see that they grew revenue 28% year over year. Their earnings are up a lot (477%) but this is obviously because they were so deflated over the last few years.

They’ve also consistently grown their customer base and total payment volume (TPV) while increasing their take rate on transactions. This is not a sign of a failing business this is a sign of a growing business with pricing power.

Risks

Inflation

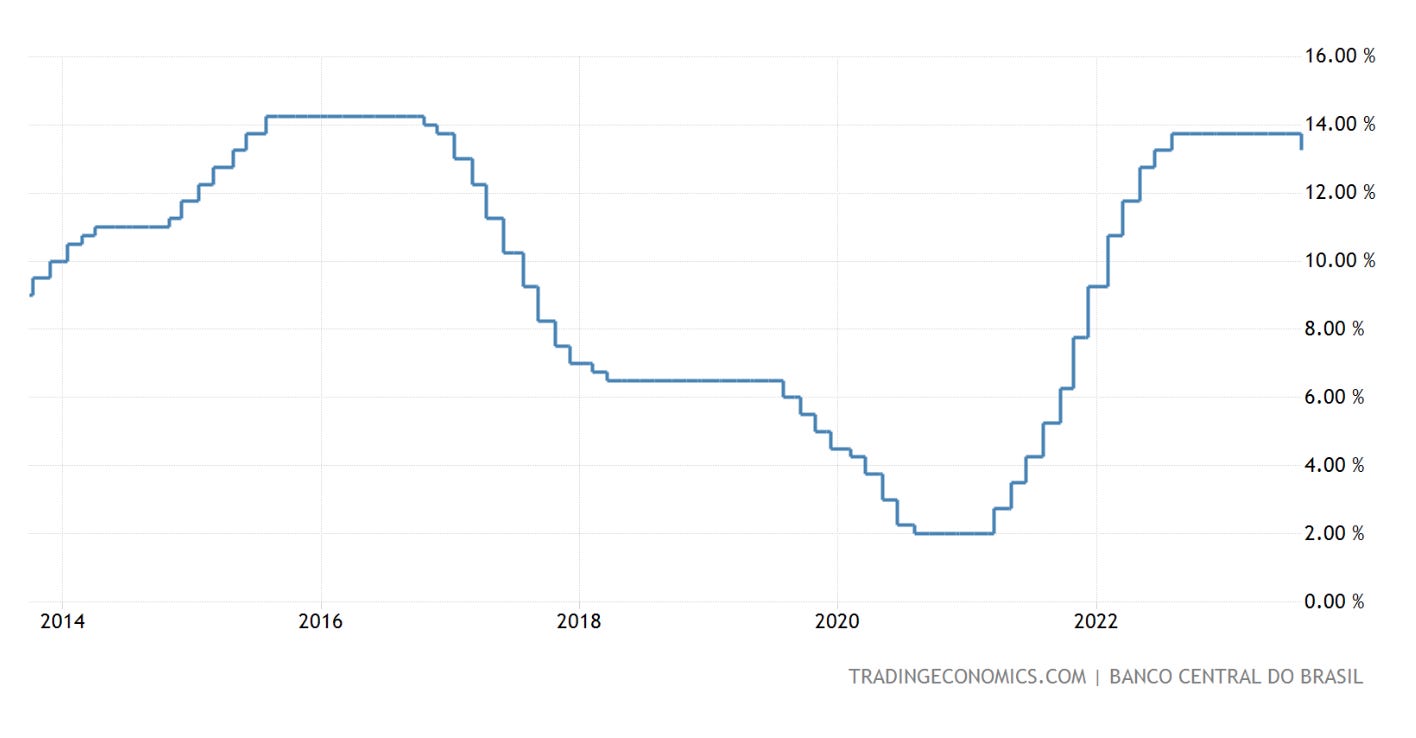

Brazil is knows for having periods of high inflation. Brazil just went through a period of high inflation in 2016-2017 and then again after the pandemic in 2021-2022.

However they’ve recently managed to get inflation back down to normalized levels around 4%

This means their central bank has the option to lower the Selic rate because it’s still well above the rate of inflation.

Lula has put pressure on the central banks to lower rates and they just began doing exactly that. The ideal situation would be if they continue lowering rates while keeping inflation under control but if inflation slips away again it would probably spell trouble for STNE 0.00%↑ shareholders.

Competition

Another risk is competition. Brazil has a lot of competition in the payments and banking sector. Although I think they have a strong position in the micro and small business space there are still competitors like PagSeguro PAGS 0.00%↑ and mercado Libre MELI 0.00%↑ who would love to take marketshare from them.

There’s also a variety of other banks they compete with such as NuBank NU 0.00%↑ and legacy banks such as Itau ITUB 0.00%↑ and Banco Bradesco BBD 0.00%↑.

Political uncertainty

The last risk in my view is political uncertainty. For one, Lula isn’t known for being a corporate sweetheart but also I don’t think he’s as “socialist” as everyone thinks.

Brazil is also in a period of civil unrest just like many other nations. I think everything will be ok so long as they don’t break out into a full on civil war or something in which case I would consider selling my position.

valuation

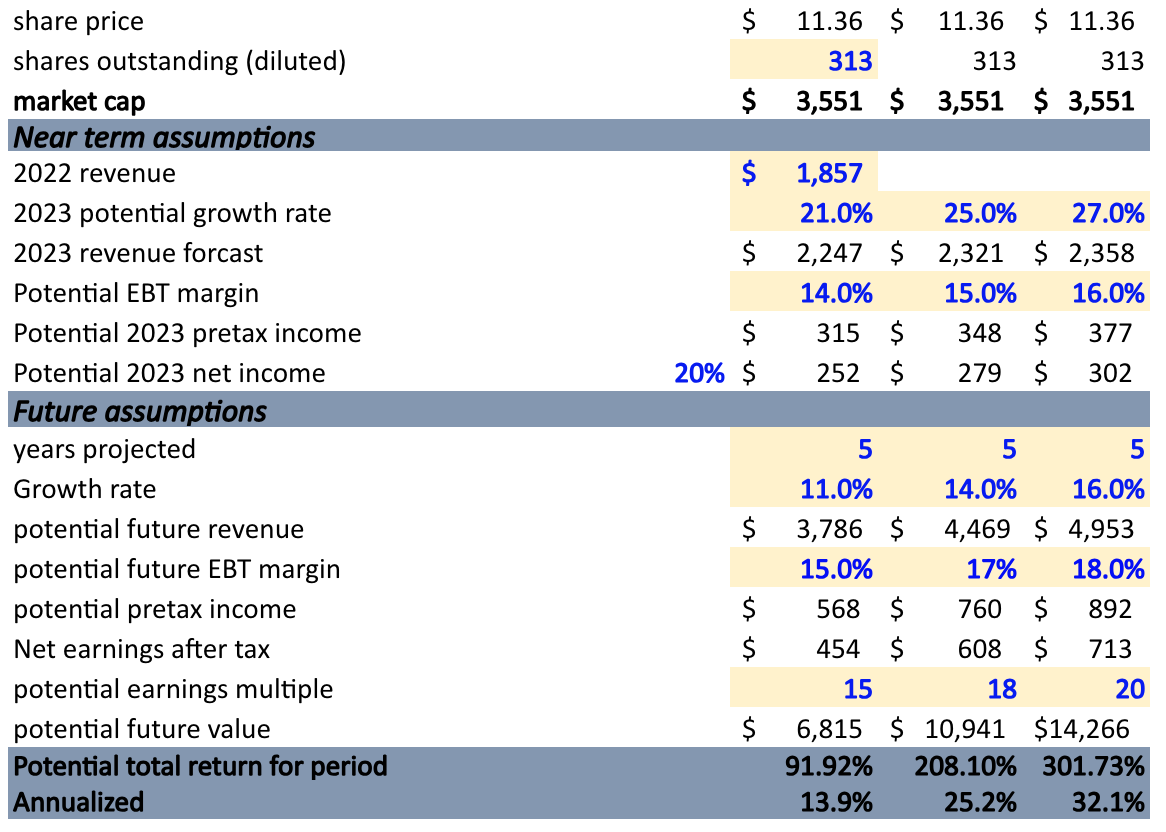

My valuation assumptions haven’t changed much, I basically see a company that’s recovering their margins after having them temporarily compromised. In the last few quarters their profit margin is back up to over 10% and the pretax margin is back over 14 % (see below right to left). They’ve historically been much higher and I expect them to keep expanding, especially if interest rates come down or they can successfully re-launch their credit solutions product.

For my valuation I’m assuming they grow somewhere between 21-27% this year and anywhere from 11-16% annually over the next few years. I think their margins will expand slightly into the future and the end multiple could land somewhere in the 15-20x earnings range.

Final thoughts

At the end of the day this is a company growing at over 20% and well on its way to earn $250 million in 2023. What would you pay for a company like that considering the risks? $250 million in earnings would mean its currently trading at roughly 14-15x forwards earnings.

They have almost $2 billion in cash, equivalents and short term investments and they have $886 million in total debt. The book value per share is roughly $8.87 meaning the price to book is only 1.28. There is a lot to like here.

I think my growth assumptions over the next few years are very reasonable (11-16%) considering how fast they’ve grown historically.

In my view the reason it’s trading at such a discount is probably because

It’s a Brazilian company.

The market wants to see the turn around more fully realized before taking a position.

I’m personally comfortable owning it here. Anyways thats it for this week.

Thanks for reading!

Good research! What do you think about the rise of Pix payments (https://www.ft.com/content/e1c7b0e7-4c17-40c4-8e03-16c698674efa) ? Wouldn't the rise of free government payment services capture the market share of private payment platform like Stone?

I’m a CEO of a Deaf access company, investor, and writer. I really like this piece, and I’m a $STNE investor myself, but the grammatical errors are blinding. This could be a great sub if the writing were clean and professional.

I edit Antonio Linares’ substack, which is focused on innovation investing. Check it out and get back to me if you’d like me to edit for you as well. Currently doing it for free. Email me at BBirnbaum@gm.SLC.edu.

https://substack.com/@antonio