Stone co. $STNE

STNE 0.00%↑ is a payments company in brazil. You could think of them as the Brazilian equivalent of Square. They offer a variety of payment services ranging from in-store, online, and through mobile channels in Brazil. They also acquired a technology company in 2020 called Linx that specializes in retail management software for medium and small retail clients in Brazil. Im not particularly interested in Linx but if it proves to be a valuable asset then its just a freebee as far as i’m concerned.

Stone makes money by charging fees for services like transaction precessing, credit products for merchants, subscription services, and renting equipment.

I’ve owned STNE 0.00%↑ for a few years and its been a train wreck ever since. The stock was down 93% at one point but luckily It was only a 1% position but I decided to hold seeing as how the core business kept growing revenue at a brisk pace while also growing its customer base.

Management stated in 2021 that they ran into some temporary problems with their loan portfolio and had to sell some of it. Apparently they also had large delinquencies due to the pandemic, and problems with the Brazilian governments malfunctioning “registry for receivables” and also some merchants took advantage of what they called “flaws in the system”

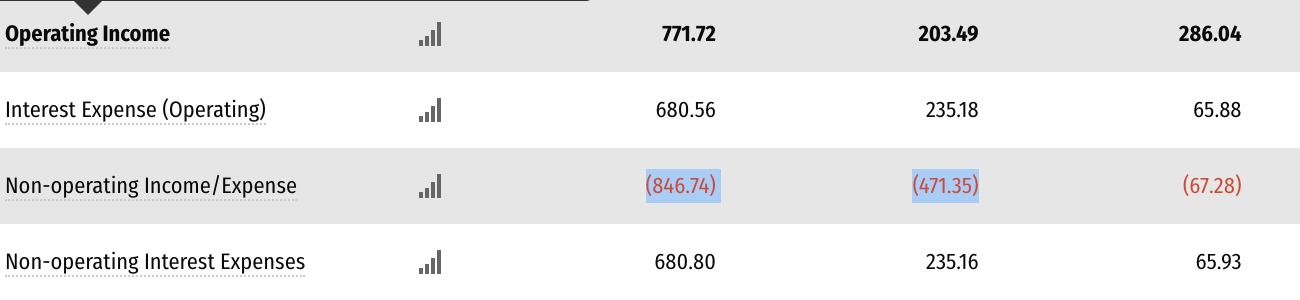

If that doesn’t sound bad enough they also had to sell their poor investment in Banco Inter at a huge loss. All this resulted in large temporary losses mostly due to non operating expenses as they wrote down the bad loans and their stake in Banco Inter and higher interest rates.

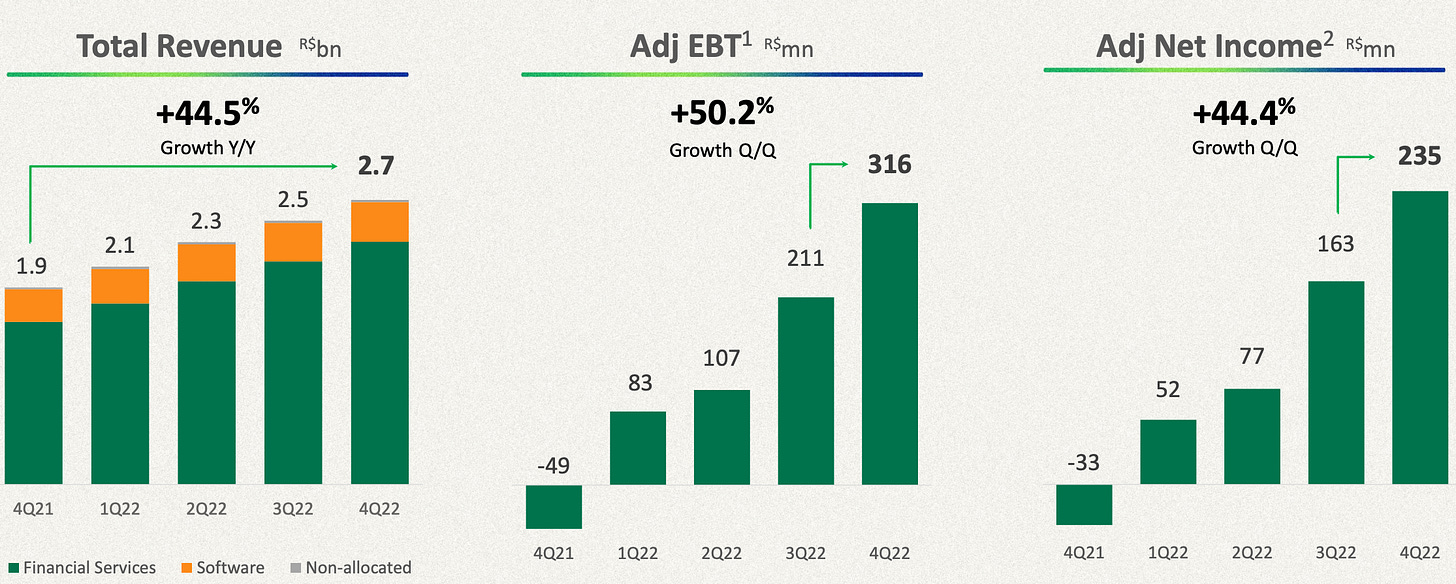

All the while their core operating business has continued to grow at a brisk pace.

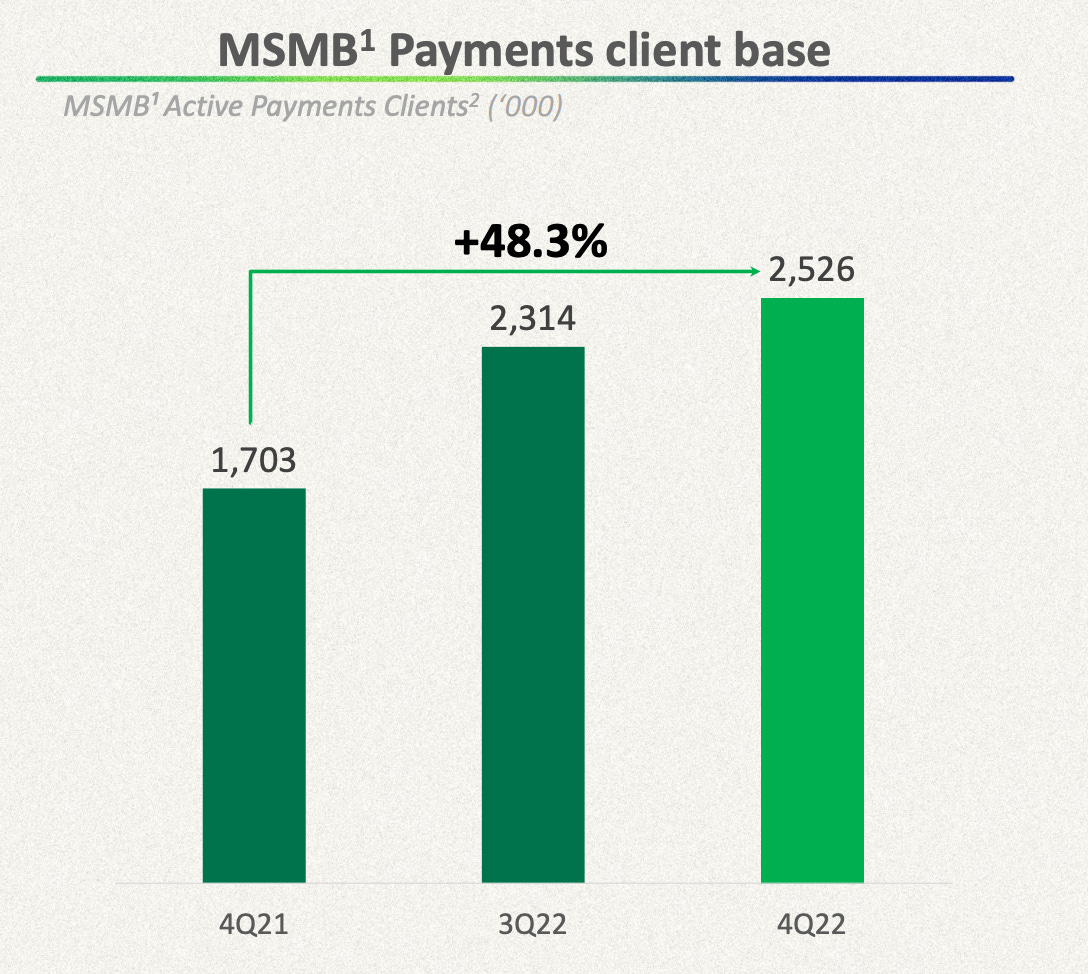

They’ve also continues to grow their client base rapidly.

The good news is they already sold out of their bad investments and most of their problems seem to be in the rear view mirror. They also hired a new CEO who has a track record for successfully leading company turnarounds.

At the end of the day the old CEO was a younger guy and just made some bad bets and rolled out new products too fast. They did the right thing by ousting him and replacing him with someone more experienced.

Competition

Stone co. competes with a few players in brazil but currently seems to be taking market share from its main competitor pagseguro. Pagseguro’s revenue slowed to 8% in the first quarter while stone continues to cruise along at 31%.

The main difference between Stone and Pagseguro is that Pagseguro is more of a legacy business comparable to something like Paypal, and stone is more comparable to square. Pagseguro is also growing at a slower pace and it is less cloud native which shows up in its lower margins. They also have a banking business called PagBank. Stone focuses on payments and has a retail software business paired with it.

One thing I don’t like about Pagbank is that it is competing with Nubank NU 0.00%↑ which seems to be gobbling up market share in South America particularly in brazil. I own some Nubank and I have an account with them. I will have to do a separate write up on this company at some point. Nubank was founded in 2013 and already has 70 million customers while Pagbank was founded a few years earlier and yet only has around 30 million customers.

I’ve personally seen all three of these business’ being used in brazil. My wife is Brazilian so we’ve been down there and used all of these companies and seen first hand how popular they are, many people and many small and medium sized business use them.

Risks

My main concern is inflation in brazil, although relative to the USD, the Brazilian real has strengthened the last year as brazil’s inflation has come down to pre pandemic levels. This can certainly turn around but I don’t expect it to currently, I expect the central bank of brazil to start lowering interest rates, seeing as how inflation has been tamed and interest rates are way above inflation. Nevertheless, inflation has always been an issue in brazil so this is something I will be watching.

Another big concern is political unrest and corruption. Lula was charged with corruption and money laundering and sentenced to 12 years in prison in 2018, by some miracle he was released and re-elected. He is way more left leaning than most Brazilian presidents which could result in higher corporate tax rates and less than friendly policies towards shareholders. However, regardless of how ‘socialist’ people might say he is, he is not a socialist. His political ideology is similar to Obama’s, his aim is to redistribute resources to the lower parts of society without fundamentally changing the way the free market works or pressing the financial elite too much. They also have a constitutional republic and a system of checks and balances which retrains corruption to some extent, but not like the US.

Lastly competition is a concern. Pagseguro is their number one competitor, but there is also the central banks payment system PIX which has become very popular. Pix is similar to zelle in the US. It’s primarily used for transferring money and payments between consumers. My wife uses Pix to send money from our Nubank account to her mother in brazil. It’s not as useful in running a business because it isn’t a fully integrated for business.

valuation

Charlie munger famously said a great company can be a horrible investment at the wrong price, it’s true, most of us have learned this the hard way.

With that being said I believe stone is undervalued but it’s certainly no risk free investment. It’s had its fair share of issues recently but they appear to be sorting it out.

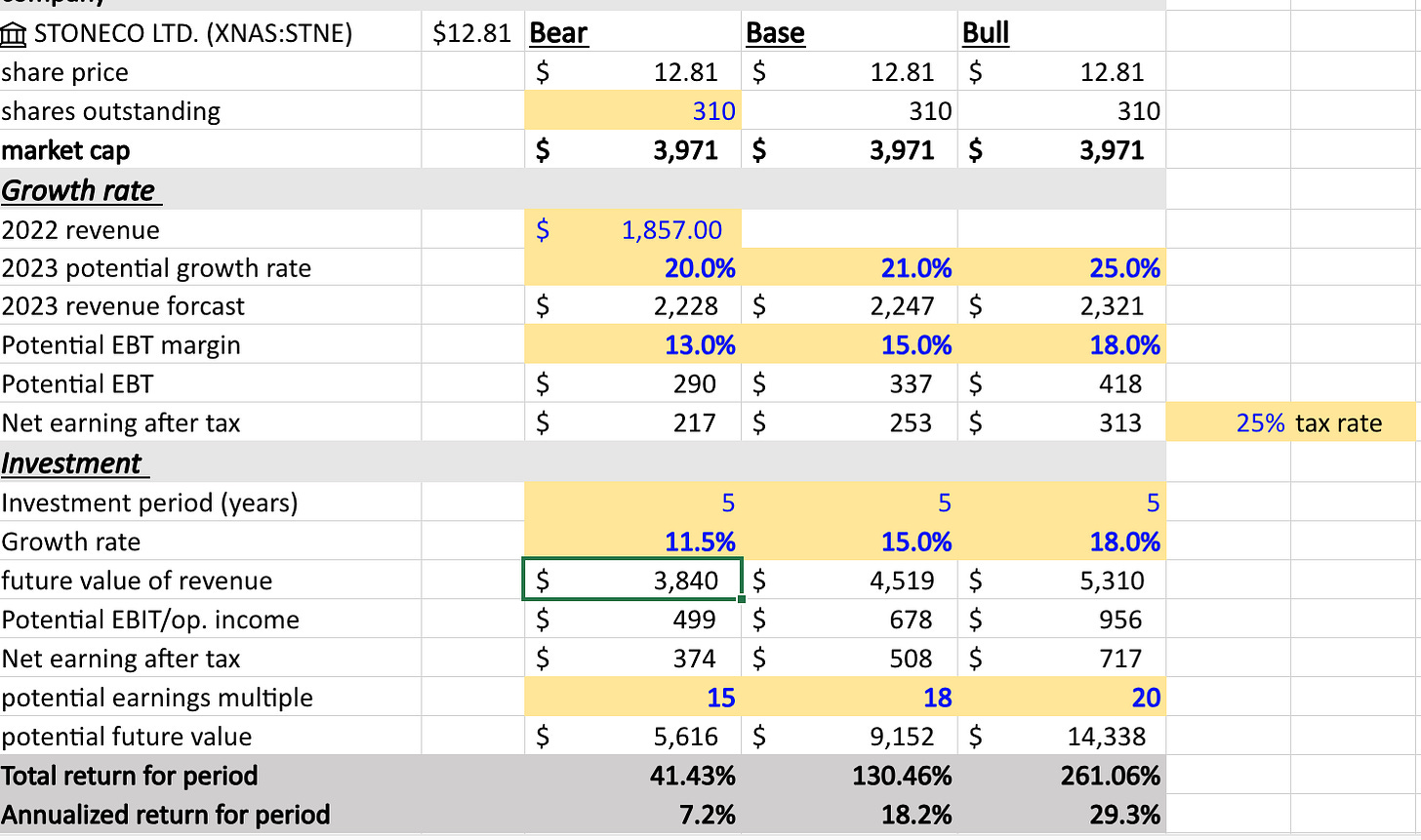

My assumptions are based on stone co’s 2022 revenue of $1,857 USD and their margin profile inching upward. All my assumptions are in USD. Stone’s EBT margins were around 30% prior to the pandemic, their margins have been temporarily punished by higher interest rates and write downs from bad investments which resulted in higher non-operating expenses. The past few quarters their EBT margins have crept back up to around 11% and my assumption is that they continue to revert to the mean. I also have their growth rate ranging from 11.5% to 18% over the next five years, with and end multiple ranging between 15-20 P/E. This is pretty conservative.

I’m long STNE 0.00%↑ it is a 4% position in my portfolio. My cost basis is 15.35 because I bought it in the 20-30$ range before the sell off. I’m considering adding to my position under 13$ a share but I’m also willing to sell some of my position if i’m not not happy with margin improvement or if management is unsuccessful in turning the business around. Im also watching inflation in brazil, if it gets away from the central bank again I may consider selling some.

In reality, I think the bear case is too conservative but hey, I prefer to bake my cake with the worst case scenario ingredients, and if the worst case scenario still looks appetizing I take a slice.

I also think this could be an easy double or triple if everything goes according to plan. Time will tell.

Good luck. Thanks for reading.