Ket Info

Ticker: BLD 0.00%↑

Market cap: $8.8 billion

Stock price: $302

EPS: $20.3

Potential 5 yr upside: 30% - 177%

Intro

TopBuild is an insulation distributor and installation roll-up. The stock is near its 52 week low because of a broader slow down in housing starts, flowing from softer demand for new housing. This comes after a few years of intense building activity and large capital investments.

In the long term, the industry is set to grow as more new homes must enter the market to service new housing formations. The National Association of Home Builders still believes there is a housing shortage to the tune of 1.5 million homes, providing an opportunity for national home builders and distributors/installers such as TopBuild. They also benefit from energy efficiency trends as national building codes increasingly include stricter insulation requirements aimed at lowering energy usage.

In the near term, however, high prices and mortgage rates have taken a toll on demand and there is considerable pessimism in the housing market and related industries. Many home builders and material suppliers are down near 52 week lows. Below are a few stocks that have been taken out the the shed.

This could potentially be the set up for an opportunity, so long as investors are willing to look through the short term headwinds.

Top Build

Top Build is a distributor and installer of insulation products in the US residential, commercial, and industrial industries. It was spun off from Masco Corp in 2015 and then the stock went on to compound at a 31% annually, beating the market by a wide margin. Anyone who bought this spin off and held on is very happy, or at least should be.

The residential market is a $6 billion market opportunity, of which they have 30% market share on the installation side and 10% on distribution. Commercial and mechanical represent an $11.5 billion opportunity, and they currently have 10% market share in each. Combined they have around 20% market share across all three segments and still have considerable white space in commercial/mechanical and are positioned nicely to continue taking market share.

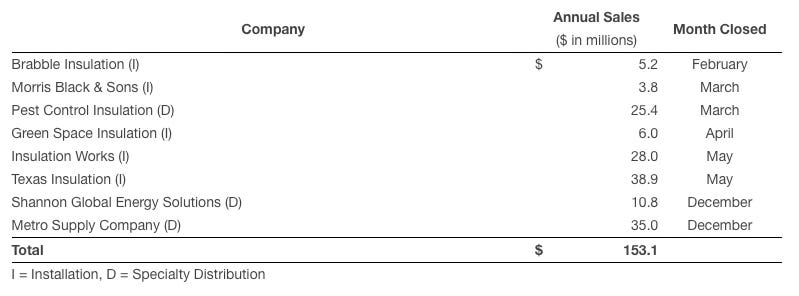

Acquisition has been a big part of the story here, and they have a disciplined team for sourcing and integrating acquisitions. Between 2019 - 2023, they allocated $ 2.4 billion, of which 63% went to acquisitions.

Management believes that acquisitions drive the greatest returns for shareholders over the long term as they’r able to drive margin improvements and returns on capital through scale-driven synergies and operational improvements.

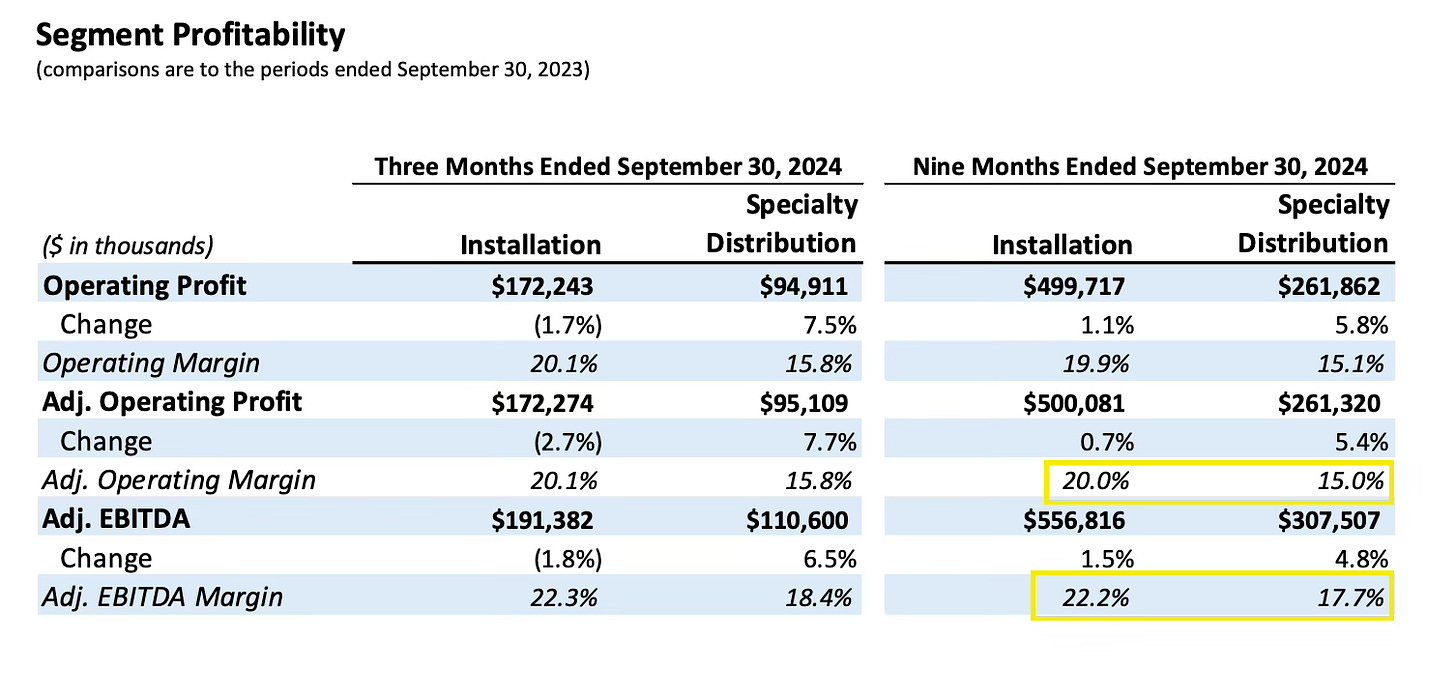

We can look at Distribution International as a case study. In 2021 TopBuild acquired Distribution International as a 10% EBITDA margin business, and about a year later it was an 17.7% margin business after operational improvements and $35 - $40 million in cost savings.

Some of this flows from their ability to lower procurements costs for smaller companies after acquiring them. As TopBuild absorbs a competitor, they’re able to share their scale and bargaining power with them. The other part of the equitation is TopBuilds culture of continuous improvement, where they’re able to incrementally improve the operations of the businesses they acquire.

They typically pay 5x - 6x EBIDTA for acquisitions, which end up around 3x - 4x EBITDA after synergies.

TopBuild made 45 acquisitions in the last 8 years, of which 8 were in 2024. They have almost an $18 billion opportunity in a very fragmented market and they are positioned to continue consolidating it.

Segments

They have two segments: installation and distribution, with installation being the higher-margin business.

Installation side of the business works with customers of all sizes but is more oriented towards larger customers such as national builders, while the distribution side works with smaller local contractors and industrial customers.

About half of TopBuilds’ residential customers are national home builders, while the other 50% consist of regional custom and multi-family home builders. Their top 10 customers make up around 11% of revenue, which is modestly concentrated, presenting a small risk if they were to lose their business.

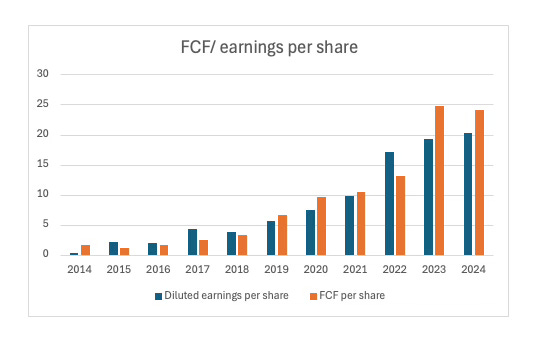

Impressive growth

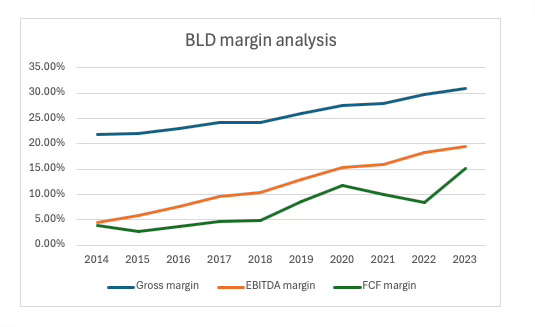

Since IPO, TopBuild has grown adjusted EBITDA from just $ 100 million to $ 1 billion, a 9-year CAGR of 29%. They’ve grown earnings per share and FCF per share at 55% and 31%, respectively.

Returns on capital have also incrementally increased in an impressive manner.

Capital allocation

As discussed, they have spent the majority of their cashflow on acquisitions but they’ve also been a big buyer of their own stock.

In 2024, they repurchased 2.5 million shares totaling $966 million, with 40% + of those repurchased in Q3 and Q4 as the stock continued to sell off, indicating intelligent and opportunistic capital allocation.

They have $200 million and remaining from their original repurchase program and an additional $1 billion was just announced, bringing the total available for repurchase to $1.2 billion, which is about (13% of market cap). I would expect the majority of this to be executed in the next year or two.

A cash machine with low debt

Top Build generated just under $ 700 million in free cash flow on a trailing twelve month basis and just over $ 1 billion in EBITDA. TopBuilds Capex is just 1.3% of revenue, freeing up more cash for buybacks and acquisitions.

The company currently has a 7.8% FCF yield as their cash flows have grown 7x over the last 7 years and industry pessimism has put pressure on the stock price.

Debt levels are very manageable at just 1.3x EBITDA or 1.9x operating cash flow. They could theoretically pay off their debt in short order if it were necessary.

Management

Robert Buck

Robert Bucks history with the company dates back to Masco in 1997. He held various operational leadership roles before becoming Chief Operating Officer at TopBuild after the spin off from Masco. He was appointed CEO in 2021.

Buck owns around 45.6K shares of BLD 0.00%↑ currently worth $13.7 million against a base salary of $970 thousand, meaning his ownership is 13x his salary. This isn’t a huge stake, but it’s enough to keep his interests aligned with shareholders. Inside ownership for all the executives and directors is less than 1%, which isn’t great; however, in this case, it appears management is talented and properly-incentivized to create value for shareholders over time.

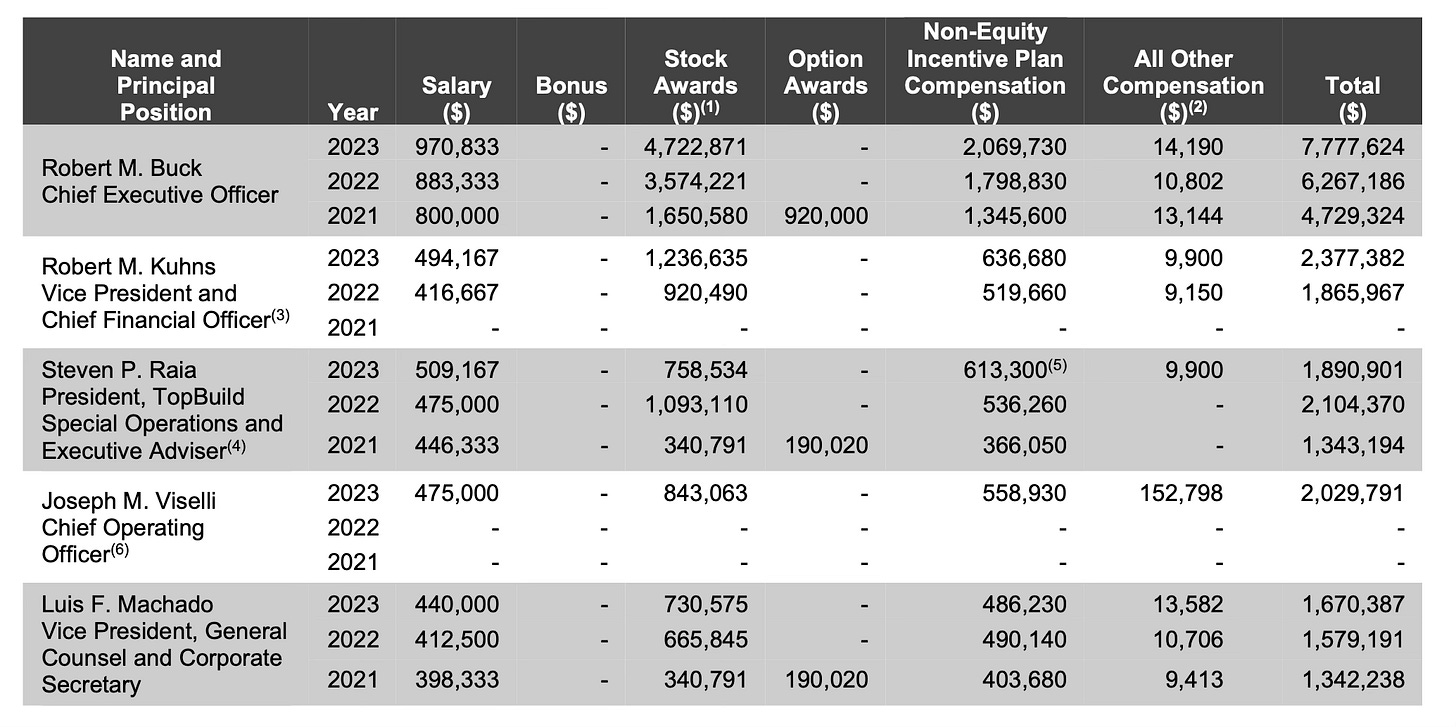

TopBuild has a typical threefold compensation program consisting of base salary, annual cash bonus and long-term incentives. Below is Robert Bucks compensation breakdown.

Base salary of $970k

Annual cash bonus of $2 million: Tied to

Operating margins (13% - 17% targeting 14.9% - 15.9%)

Adjusted operating income

Working capital management (keeping WC low as % of sales)

Safety incident rate

Long-term incentive $4.7 million: Performance base RSU’s tied to 3 year cumulative performance goals concerning

EPS

Relative total shareholder return

Needless to say Buck has done well over the last few years and he has been compensated for it. Below is the summary of his composition.

Risks

There a several risks involved here.

Cyclical industry: Although TopBuild is attempting to diversify into more industrial and commercial to offset the cyclical nature of residential, it’s not possible to avoid the inevitable cyclicality of the business completely. On the flip side, this does provide volatility and opportunities to buy shares in down seasons.

Customer concentration: Although it’s unlikely they would lose their top 10 customers, there’s always a chance they could lose business from some of them. There are other competitors such as Installed Building Products who can provide the same quality products as TopBuild. Losing business from top customers would inevitably put pressure on the top line.

Valuation

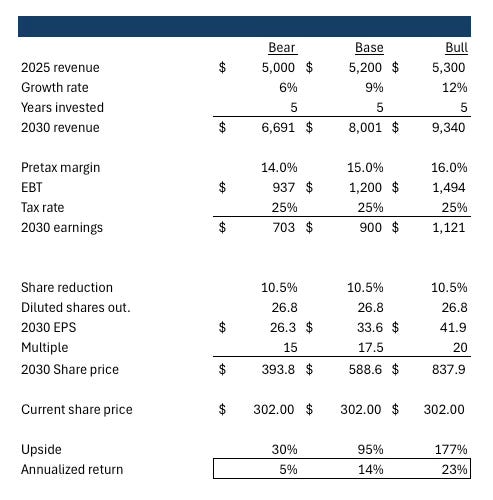

For the valuation, the following assumptions were made.

Growth: 6% - 12% revenue growth, which is lower than the 10 year average of 14%. Assumes slower growth over the next few years due to macroeconomic pressures and general slowing of growth due to the maturity of the business.

Margin: Pretax margin between 14% - 16%. Bear and base case represent a contraction; bull case is in line with today’s. Although I do believe it’s possible that they could squeeze out higher margins in the future, it’s unlikely over the next few years in my view.

Change in shares outstanding: Share reduction of 10.5%. Reflecting a $1.2 billion buyback at an average price of $375.

Multiple: Reasonable multiple between 15x - 20x. In line with historical range.

Final thoughts

TopBuild could surprise us and execute way better than expected if they continue the push for higher margins. Although this is possible, and they do in fact see more runway for margin expansion, I’m not going to bet the farm on it at this point.

Another scenario where they could potentially surprise the market: they land a few top-tier acquisitions like Distribution Partners or the like.

However, at this time, despite the compelling valuation and buyback program, I’m not taking a position, at least for now.

That’s it for this week!

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am not a BLD 0.00%↑ shareholder at the time this was written.

Very impressive write up!

For longer low risk, better to go with HD