Key points

VST 0.00%↑ and a hand full of other IPP’s have gone parabolic after Amazon and Microsoft ink deals to have data centers powered by nuclear power.

Demand is expected to grow for the first time since 2010 as data centers are predicted to consume 8% of US power by 2023. Tech companies are looking primarily to nuclear to provide power.

Vistra has a portfolio of assets producing both traditional and zero emission power.

Utilities

Utilities usually aren’t at the top of my list of stocks to own but they do occasionally provide good returns. I tend to prefer less capital intensive businesses but I have no problem investing in them if they fit my investment criteria.

Typically there’s a competitive relationship between utilities and bonds because they compete with each other as income producing assets. When interest rates are high, people have less incentive to own utilities because they can get a similar yield in bonds with less risk. Another reason utilities do poorly when rates are high is because they require large amounts of debt to fund capital expenditures.

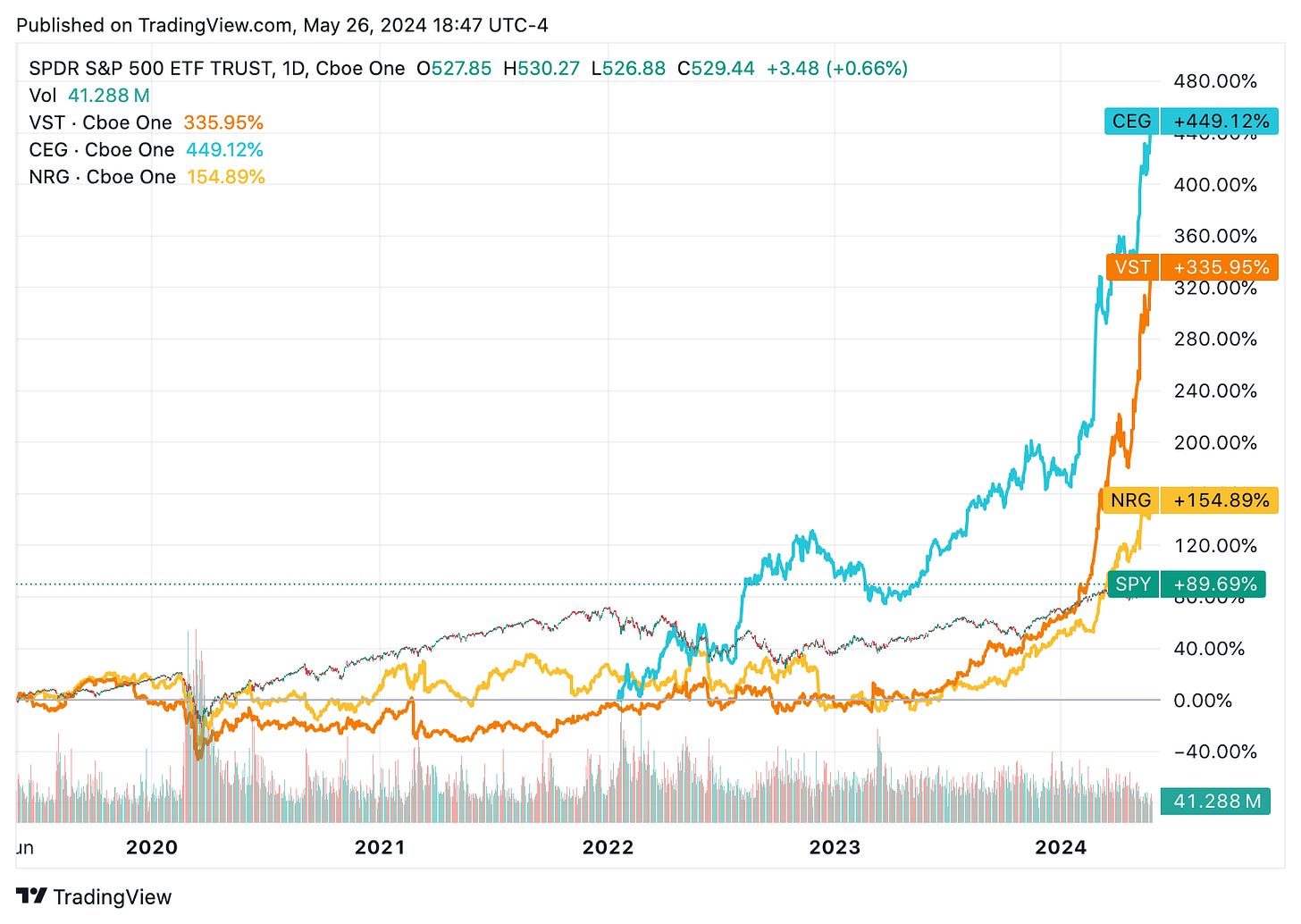

A lot of utilities haven’t done very well over the last few years. However, this has recently reversed course and there have been a few outliers who’ve bucked the trend in a significant way, namely, CEG 0.00%↑ , VST 0.00%↑ and now NRG 0.00%↑ and $TLNE just to name a few. Below you can see that these companies have put the broader market to shame. Talen isn’t shown but it’s up 140% over the last year.

They all have one thing in common, they’re independent power producers (IPP’s) and they’re expecting increased demand from data centers, which I’ll get to later. IPP’s are unregulated power producers that sell power to utilities.

Lucky me

I borrowed the idea from Howards Marks and I picked up shares of VST 0.00%↑ $16.38 sometime in 2021. It wasn’t a huge position and I bought it mainly just to track the company.

Luck certainly played a role in this investment. My thesis was initially based on the companies FCF and capital return program, but it quickly became obvious that there’s an Ai story here. 500% later and a dividend paying 5.2% yield on cost, I’m happy with the returns but I’m also skeptical of the returns going forward.

Regardless, I want share what going on with VST 0.00%↑ and some of these other names, and see if there’s still have some value to be had in VST 0.00%↑

What Vistra does

Vistra produces power through nuclear, coal, solar and natural gas fuel sources. They also have a retail side of their business that deals with sales and customers service and so forth. They operate in 20 states plus the D.C. area— serving 5 million customers and producing 41,000 megawatts.

Retail

Their retail operations is comprised of TXU Energy, Ambit Energy, Dynegy Energy Services, Homefield Energy, and U.S. Gas & Electric. The bulk of their retail operations is in Texas where they serve 2.5 million customers.

Generation

Their power generation capacity is represented in the follow categories and their share of revenue.

Natural gas (60%)

Coal (21%)

Nuclear (16%- Including recent Energy Harbor acquisition)

Solar/battery (3%).

Geographic

Their generation operations are found in the following markets

Texas: (49%)

East: (33%) Various states on the east coast.

West: California (5%)

Sunset: (13%) Various states in the south and midwest

Vistra’s recent success

At one point in 2021 VST 0.00%↑ went as low as $16 then relentlessly marched higher, hitting $102 on May 21 2024 for a whopping 85% CAGR. Surprisingly this hasn’t really caught the attention of a ton of retail investors except a few traders and a hand full of institutional investors.

The returns have been driven by a few different things.

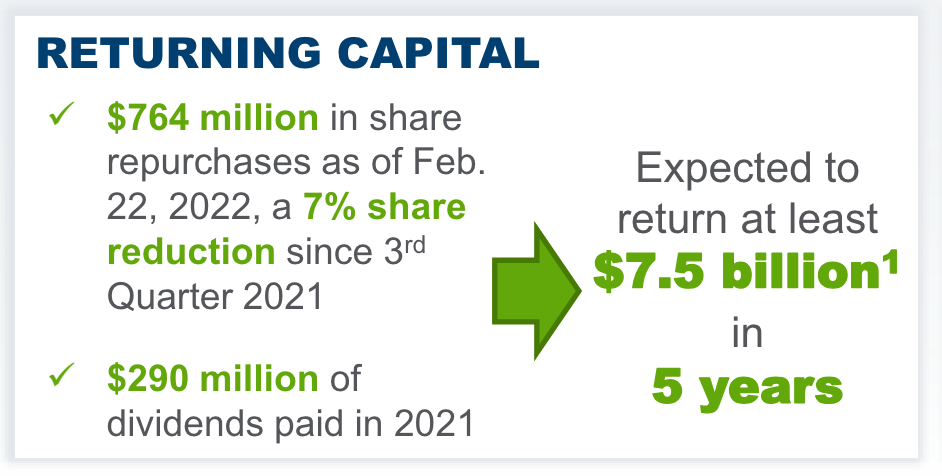

Vistra was undervalued and printing cash as they began a series of share repurchase programs in 2020. Additional programs have been announced since. By Q1 2022 they estimated they could return $7.5 billion via buybacks within 5 years. At the time the company was only valued at around $8 billion. This is what initially caught my attention.

As of today they’ve returned $4.6 billion and have repurchased around 30% of their diluted shares outstanding since 2019. They still have $2.25 billion left to return through 2025. They also expect to continue returning all excess cash to shareholders for the foreseeable future.

Multiple expansion has certainly played a role.

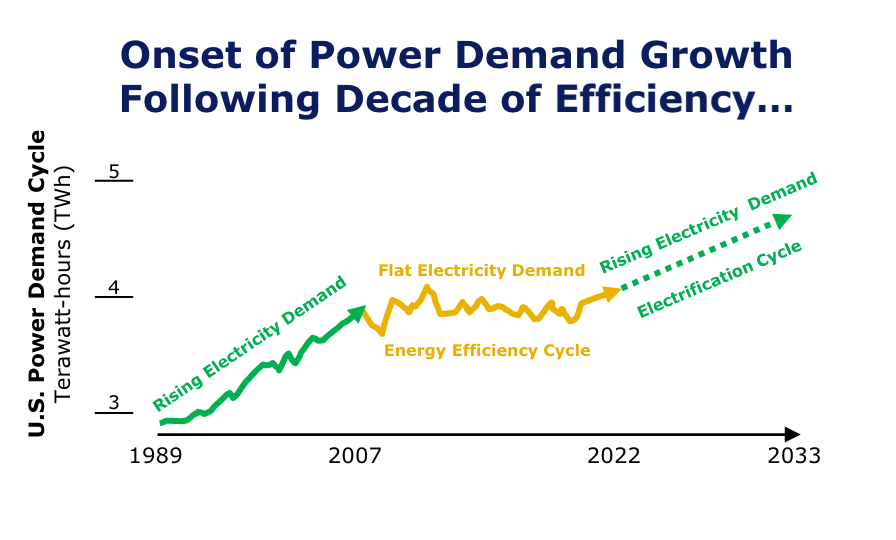

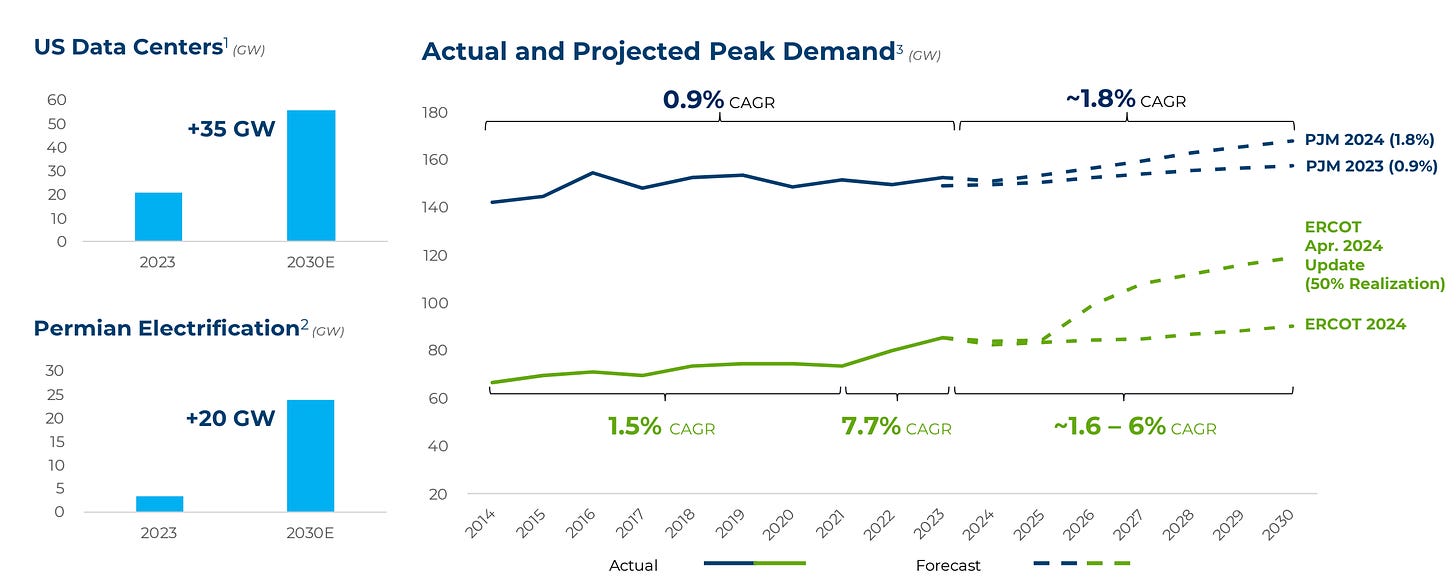

Paradigm shift in power demand. Since around 2010, demand has been flat, many coal plants have been shut down, gas and nuclear power has been stagnant or dwindled. But recently demand has emerged, especially in Texas, the permian basin and a few other areas. Data centers are also predicted to need 35 gigawatts of power because of AI.

Particularly natural gas and nuclear producers are planning for a surge in demand over the next decade as battery and semiconductor manufacturing is supposed to increase. Goldman-Sachs projects that 8% of US electricity consumption will be come from data centers alone by 2030. Below you can see that the projected load demand in Texas jumped quite a bit.

Another reason VST has done so well is that gas and coal prices also skyrocketed between 2020-2022. They’ve subsequently come down, but still remain higher than pre-pandemic levels.

Vistra has one foot in the past and one in the future. Their portfolio of assets consist of both traditional and zero emission energy sources such as solar and nuclear. They are well positioned to transition.

Nuclear providers in particular are beneficiaries of the Inflation Reduction Act which incentivizes nuclear facilities to remain open by effectively limiting their downside with a tax credit.

Vistra is an IPP independent power producer which is means they generate power and sell it to utilities. IPP’s aren’t regulated like utilities and therefore can sell power at market rates rather than regulated rates like utilities. More on this later.

Putting this all together, Vistra has grown nicely over the last few years and returned a boat load of cash to shareholders and plans to continue raising dividends and repurchasing shares. However, I do think the price has gotten away from the fundamentals, likely because of the hype surrounding Ai and the data center demand. If I had to guess I’d say that 50- 70% of the returns in VST 0.00%↑ have come from the actual fundamentals, multiple and share repurchases, and the other 50% - 30% has been from the market attempting to price in future demand.

Other IPP’s

I’m not going to cover these in detail but I think its at least worth investigating a few names such as

CEG 0.00%↑ Constellation Energy,

$TLNE Talen Energy

GEV 0.00%↑ Ge Vernova (IPP spinoff from GE)

NRG 0.00%↑ NRG.

Most of these had quite the run up so they may be fully priced. NRG is an exception trading at 12x earning and 10x forward FCFBG. They’re set to buy back $825 million of stock which could return 4% to investors in 2024 and they currently pay a dividend of 1.9%.

GEV 0.00%↑ GE Vernova is a spin off from GE. I haven’t gone through all the spin off documents and I don’t think its an actual power producer from what I can tell. They do however sell various products and technologies that are crucial for producing power, namely in the nuclear, gas, and renewables space.

Nuclear

Government support and Ai demand has peaked interest in the nuclear industry.

Some of the companies listed above have inked deals with big tech names. In December Constellation did a carbon matching deal with Microsoft to support a clean nuclear powered data center.

Talen Energy also struck a deal with Amazon to sell them a 100% nuclear powered data center.

It appears some of these big tech names have come to the conclusion that nuclear is likely the best fuel source to power data centers. Solar and wind—which would be their obvious clean energy choice—simply isn’t reliable enough. The sun doesn’t always shine and the wind doesn’t always blow, leading to unstable and inconsistent power, which is unacceptable for data centers that need constant power. Nuclear on the other hand can provide 24/7 clean base load power.

Vistra stands out as a company that has a large portfolio of both nuclear and gas, and operates in one of the most booming power markets in the US Texas, providing something like 20% of power to the state of Texas.

SuperInvestors

I originally borrowed the Idea from Oaktree Capital Management— Howard marks firm. Since then, Marks sold the position but a handful of other super-investors such as Dan Loeb, Stan Druckenmiller, Stephen Mandel, Howard Marks and Harry Burn have picked up shares. Most of them (except Harry Burn) deploy some kind of event driven strategy and only hold shares for a few years at the very most. The event in this case is obviously increased power demand for data centers.

Daneil Loeb in particular has been praising the energy market and Vistra in Third Points recent Q1 report.

“We shared our views on AI’s transformational potential in recent letters and it is a key element of the thesis for nearly half of our equity positions today”

Then he goes on to praise Vistra’s capital allocation.

“we believe Vistra’s capital allocation strategy has been brilliant. The company shut down unprofitable coal plants to improve its carbon footprint and mitigate oversupply. Given the market was valuing its remaining gas assets at pennies on the dollar relative to the cost of new builds, management patiently invested in maintaining the existing fleet and deployed excess cash flow into share purchases, reducing its share count by ~33% from 2018 to 2023 at an average purchase price of about 1/3 of current trading levels.”

“In March of 2023, Vistra made its latest smart capital allocation move, acquiring the nuclear generation assets of Energy Harbor (yet another bankrupt IPP), which served as the catalyst for Third Point acquiring shares. The timing of this deal was prescient, as nuclear is finally being recognized for its merits as the only carbon-free source of 24/7 power generation.”

Then he explains how some nuclear operators (Talen) have the ability to price above market for providing nuclear power to hyper scalers.

“For example, Amazon recently signed a 20-year agreement with nuclear operator Talen to buy power at a ~60% premium to market prices.”

So it appears a few investors have picked up on this trade and some institutional investors have discovered that Vistra has a talented management.

Vistra had an enormous run over the last few years and was the best performing stock in the S&P over the last year. Because of this incredible run, I imagine there will be a pull back at some point. In fact it may have already begun.

Many investors expect Vistra to do similar nuclear deals like the ones Talen and Constellation did with Microsoft and Amazon, which is a reasonable assumption after they acquired Energy Harbor. The acquisition makes Vistra one of the largest nuclear operators in the US.

Valuation

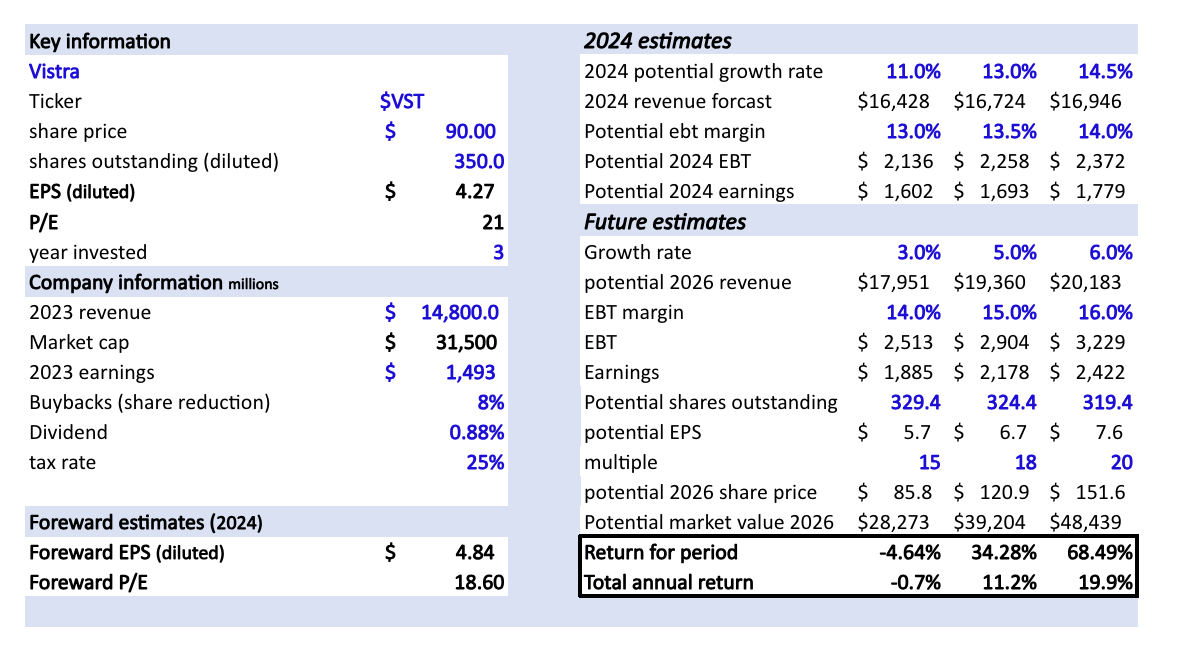

I suspect that demand for power in Vistra’s key market Texas will drive revenue higher next year. They guided to around $2 billion in pre-tax earnings for 2024, with a similar pretax margin as last year this implies their revenue will be somewhere around $16-$17 billion in 2024.

A few things I’m assuming here.

Buybacks will continue but for obvious reasons (price) they won’t be reducing shares at the same rate as the last few years. I’m assuming 2-3% share reduction per year, hopefully more but I’m not counting on it.

Growth will continue, I’m assuming less than most analysts.

Considering demand for power is increasing and utilities typically have high operating leverage, it’s likely that Vistra is able to squeeze out higher margins over the next few years. My bull scenario will reflect that more.

Weighted average P/E ratio for the utility sector is around 20, I’m assuming the multiple could end up between 15-20

I’m not forecasting out any more than 2026 because I just don’t have the confidence in doing so.

Conclusion

At this point VST 0.00%↑ doesn’t fit my investment criteria as far as adding to my position. First of all, I’m not exactly sure how much Ai will increase power demand, Daniel Loeb mentioned something like and addition 1-2% per annum but we will have to see. If the stock was a bit cheaper it wouldn’t matter as much because the buybacks and dividend could carry the returns. Normally I’d want something that I think can return at least 8-10% on the low end. At $60-$70 it could potentially fit that criteria.

I may sell some or all of my position if I find a better opportunity but for now I’m holding. Since I bought the stock so low and they’ve raised their dividend, I currently get a 5.2% dividend yield on my cost and thats growing so I don’t feel any urgency to sell unless the company begins to perform poorly.

Thanks for reading!