AAON

A unique and innovative HVAC manufacturer

Intro

AAON has been on my radar for a few years. The company has a long history of generating high returns on capital and has a talented founder with high inside ownership. It also benefits from a very strong position in a growing market.

The stock has returned more than 100,000% since going public and is currently down almost 45% from the high of $140 in November 2024. This comes as revenue from their AAON-branded equipment segment has declined due to weak bookings and a broader industry slowdown in the HVAC industry. Their BASX segment, however, is fire on all cylinders as it’s tied to growth in hyperscale data centers.

AAON is not my typical value pitch at 40x earnings, but considering the company’s competitive position and historical performance, it’s worth a quick look to see what kind of returns investors could potentially expect going forward.

AAON overview

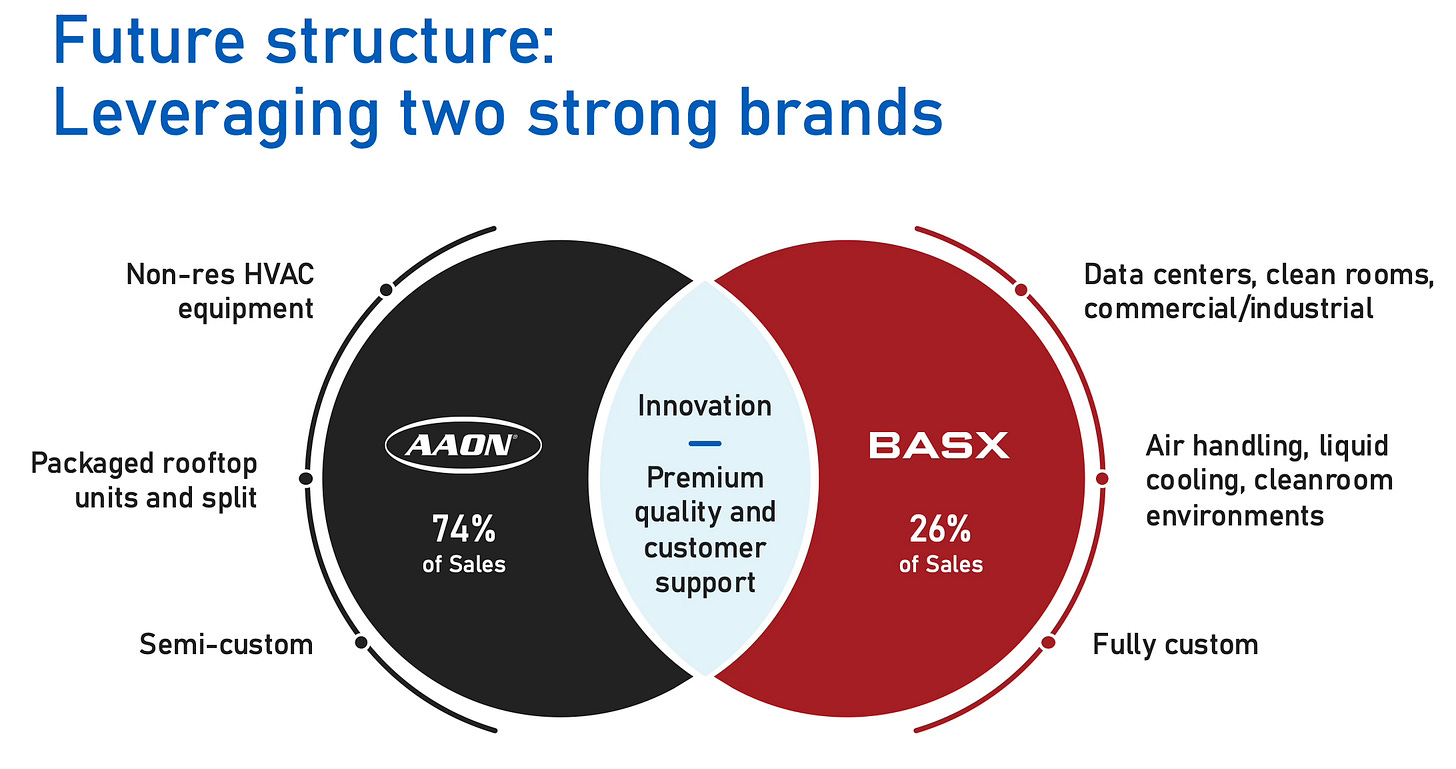

AAON designs and manufactures semi-custom and fully custom HVAC equipment to meet the custom needs of their customers. The company operates through two brands: AAON and BASX. It targets large commercial customers such as education, healthcare, data centers, institutions, and industrials. AAON is increasingly focusing on the replacement HVAC market, where demand is less tied to new construction and the general economy.

AAON’s customers typically have high ongoing energy costs, which is the primary concern for them. Because of this, AAON’s value proposition lies in their high level of customization, which provides their customers with lower total lifetime cost because of energy consumption savings, despite a higher upfront cost.

AAON’s founder, Norman Asbjornson, founded the company with the intent to bridge the gap between fully customized and standardized production HVAC products. These semi-custom systems were both built at scale but also highly configurable for customers, leading to a product that is energy-efficient and competitively priced.

Competitors do not offer the same level of customization that AAON does, nor do they target the niche market that AAON does. Instead, competitors deliver mass production units with minor customization.

Segments

AAON operates in three segments: AAON Oklahoma, AAON Coil Products, and BASX. However, they are increasingly viewing the company as two brands, AAON and BASX, which constitute 74% and 26% of sales TTM, respectively. I suspect in the future they will organize their reporting segments around these two brands, but for now it remains three. Practically, AAON Oklahoma corresponds to the AAON brand, along with a portion of AAOn Coil Products. BASX corresponds to the BASX brand, along with a portion of AAOn Coil Brands.

Since they still report in three segments, I’ll review all three. I’ve added some context as to how the Brands and reportable segments correspond.

AAON brands & AAON Oklahoma

AAON Oklahoma is the largest segment. The segment did $858 million in revenue in 2024, down from $897 in the prior year. Adding $117 million from AAON Coil Products would make AAON brands’ total revenue $975 million.

AAON Oklahoma engineers, manufactures, and sells semi-custom and custom HVAC systems and control systems. The decline in revenue (and the stock) follows challenges in this segment related to the regulated refrigerant transition, and a general weakening of nonresidential construction activity.

Despite being down year over year, the segment has grown at a 22% + CAGR over the last 3 years due to secular trends and growth in nonresidential construction and higher demand for systems.

AAON has historically charged a 15% - 20% price premium over competitors because the customization of its offerings. Customers don’t mind paying a premium because, as mentioned earlier, AAON often has the lowest total costs of ownership, which accounts for decreased energy costs and less equipment repairs. AAON’s equipment is designed to be easy to repair and the lifespan is 1.5x - 2x competitors, leading to fewer repairs and replacements.

AAON increasingly targets the replacement and planned replacement market where the property owner is often the purchasing decision-maker, and long-term operational costs are a big concern. AAON’s lower total lifetime cost is a significant advantage for in the replacement market because existing building owners consider their future operational costs more than initial costs. This is in contrast to new construction, where the decision-maker is often a developer. Some developers build to sell, others are already burdened by building costs; therefore, the initial price of the HVAC system becomes a selling point, putting AAON at a slight disadvantage in new construction.

However, as manufacturing capabilities have improved and regulatory requirements have pushed up competitors’ costs, AAON’s price premium has narrowed to 10% over competitors. This is expected to further narrow, making AAON’s value proposition more attractive and allowing the company to take market share and sell to customers who wouldn’t have previously considered them.

AAON Coil products

AAON Coil Products engineers, manufactures, and sells heat pump and HVAC coils. These are the most important part of any HVAC system. These coils facilitate what is called a heat exchange, which is the removal and expulsion of heat and moisture from the air. This segment partially serves AAON Oklahoma and BASX. It does $144 million, but roughly 27% of this is derived from inter-segment sales that are eliminated and therefore not counted in net sales.

BASX

BASX was founded in 2014 and acquired by AAON in 2021. It is similar to Veritiv’s VRT 0.00%↑ thermal management business, which has benefited greatly from the Ai data center build out. BASX primarily provides fully custom ventilation and cooling systems for data centers, accounting for 84% of BASX revenue. They also provide cooling and HVAC systems to clean rooms, pharmaceutical companies and companies in the semiconductor industry. One big difference between BASX and AAON is that AAON is semi-customizable, whereas BASX goes in with a “clean-sheet” and creates a fully customized solution for their customers. The higher level of customization for BASX results in higher cost of sales and a less efficient manufacturing and procurement process. BASX isn’t able to source materials or streamline manufacturing as well as AAON, as evidenced by their 25% gross margin, which is well under AAON’s 35%, and AAON Coil Products 31%.

Given that some data centers don’t require such high levels of customization, management recently talked about taking a page out of the AAON playbook and creating a semi-custom solution, which would increase margins and make the manufacturing process more efficient.

BASX is growing at a 40% CAGR and operates in a market growing at 10% annually. It did $225 million in sales in 2024, which was 18% sales as of year-end 2024. The BASX brand, including that from Coil Products, accounts for 26% of net revenue as of March 2025.

The growth in BASX is tied to increased data center demand from artificial intelligence, but also cloud computing. This segment is key to the growth prospects of the business. With backlogs growing exponentially and a growth expected to be 40% over the next three years, BASX could be quite large, potentially accounting for 50% of AAON’s total revenue 5 years out, and management has actually confirmed this.

“as we look into the future, that 1-quarter, 3-quarter split is really 3 to 5 years out, going to look more like an even playing field between 2 of these brands.”

CEO Matthew Tobolski

BASX has a $625 million backlog as of Q1 2025, which is up 123% year over year.

Growth opportunity

Data Centers: Data center demand is a clear source of demand for BASX and will continue for the foreseeable future. There is not a ton to say about this other than ai is the big story here and will continue to be for quite some time.

National Accounts: AAON has some opportunities to grow through expanding national accounts which they have historically de-emphasized. These accounts represent quality repeat customers and management believes they’re sitting on hundreds of millions of dollars of pipeline and opportunities in national accounts, particularly as it pertains to their innovative heat pumps. They believe they have the most capable commercial heat pump and portfolio of products that cannot be matched in their niche.

Decarbonization: The AAON brand as a whole benefits the decarbonization trends and environmental regulations. Regulatory trends require incrementally more efficient HVAC systems to be installed and AAON is a leader in efficiency standards.

AAON’s competative advantage

AAON has a competitive advantage in product development and validation. It has an integrated engineering and manufacturing process that is very difficult to replicate. The company largely avoids direct competition by remaining in niche areas of the market where customers need configurable systems.

The company has one of the most advanced engineering departments and manufacturing facilities, along with the single best research and development facility in the world, the Norman Asbjornson Innovation Center (NAIC).

At the NAIC innovation center they can simulate every possible weather condition possible between -20°F - 130°F , including snow, rain, heat, 50 mph winds, and any humidity level. Competitors can only test up to 63 ton air conditioner units, while the NAIC can test systems up to 300 tons. Below is a video tour of their innovation center to give a better idea of just how serious they take innovation.

At AAON’s Tulsa manufacturing facility, the longest production line is 900 feet long and has the ability to produce 30 units in any 12-hour period, and not one of them is identical; in fact, there are often significant differences. Competitors cannot do this in a single production line. AAON has mastered semi-custom mass production.

To be fair, most HVAC manufacturers do have somewhat advanced and semi-integrated engineering and manufacturing processes, but what sets AAON apart is full production integration, their ability to push boundaries and the their speed and flexibility when it comes to rolling out new technologies and meeting regulatory compliance.

Below are a few examples of products and technologies that AAON have been faster to market or better than competitors;

Commercial heat pumps operable at much lower temperatures (Alpha Class, EXTREME Series) The 2023 Alpha Class was the leading heat pump when it rolled out in 2023— with no other competitors able to operate at -20°F. The newer Extreme Alpha Class series is also a market first—maintaining 100% capacity at 5° F and operates below -20°F.

AAON was very early in adoption and shipment of low-GWP refrigerant equipment.

AAON met and exceeded new energy efficiency standards years ahead of deadlines.

Their emphasis on engineering affords them product differentiation and manufacturing processes that are very hard to replicate. Not only is it hard to replicate, but competitors aren’t trying to replicate it because AAON is largely focused on a part of the market where others don’t want to compete. Competitors such as Trane Technologies, Carrier, and Lennox emphasize high volume, mass market, and have a far more diversified customer base who is more sensitive to price.

AAON also makes the most possible use of automation and technology in manufacturing and they have become highly efficient. One would assume that AAON has lower gross margins considering that it produces highly customizable units but its actually on par with competitors at 33% - 34%, with a goal of reaching upwards of 35% by 2027.

Financials

CapEx and cash flow

The cost of pushing the boundaries on innovation has been occasional large investments in manufacturing plants and equipment, and these have only accelerated in recently years as AAOn look to increase capacity. AAON recently acquired a new facility in Memphis, which will support both BASX and AAON brands, and another 237,000 square feet was added to the Longview Texas plant.

Below you can see that AAON spends more CapEx as a percentage of revenue than some competitors.

AAON CapEx exceeded operating cash flow by $3 million in 2024, leaving free cash flow negative. Another $220 million will be invested in capacity in 2025, implying another year of negative or low free cash flow in likely in the cards.

Revenue

With the help of BASX, AAON’s revenue has grown at 16% annually between 2022 and 2024, despite AAON Oklahoma’s sales being down 4.4% in 2024. In the first quarter of 2025, net sales for AAON Oklahoma were down 23% year over year due to a slowdown in non-residential HVAC activity and temporary supply chain issues arising from new refrigerant regulations, which management believes is behind them now.

Working capital and debt

AAON’s working capital and CapEx needs are generally met by cash from operations without debt, which explains why debt is so low. Management has historically held a very conservative financial philosophy and has been intentional about keeping a rock solid balance sheet. Total debt is $155 million against EBITDA of $272 million and operating cash flow of $192 million, implying that all debts could be theoretically paid off within a year or less.

ROIC

Despite heavy CapEx, the returns have been very good because those investments were very productive. If we look at the period after the BASX acquisition, which has been characterized by notably higher capital investments, it becomes clear that AAON is earning high returns. Between 2021 - 2024 AAON invested an additional $517 million into the company and earned an additional $112 million in net operating profits after tax (NOPAT) from those investments, implying an incremental return on capital of 22%.

Management has said that their long term ROIC target is 20% or more, and it’s reasonable to assume this is achievable considering they average around 19% - 20% as it is.

Management

Born in 1935 in Winifred, Montana, Asbjornson grew up in a farming community with limited resources but a strong work ethic instilled by his parents. He worked random jobs early on and learned financial management at a young age. He went on to study engineering at Montana State and graduated with a degree in mechanical engineering after doing a brief stint in the Army.

Norman really only had three goals in life, raise a good family, lead an organization and make a million dollars. 1 Given the 17% ownership in AAON 0.00%↑, it’s safe to say he achieved the last goal a thousand times over. He took a job at American standard and built his reputation in the HVAC industry.

He founded AAON in 1988 after buying a busted and rusted manufacturing plant. Below you can see the picture of the plant as well as his narration from the video, “A lot of people had though I lost my sanity”2

Norms vision was to build semi-custom HVAC units with computer technology.

He caught his big break in 1989 where he signed a deal with WalMart that eventually lead to doing 100% of Walmarts HVAC business 3. He eventually signed with Kmart, Target, Home Depot and various other large retailers sealing AAON’s success.

Norman stepped down from CEO in 2020 but remains on the board and retains his ownership interest. He is quite the founder and operator, but at the age of 89, I’m not entirely sure how much longer he will be alive to influence AAON.

The new CEO, Matt Tobolski, originally came on as president of BASX after the acquisition, then moved up to COO and finally CEO as of May 2025. I am not convinced that Matt is on the same operational level as Norman, but it’s reasonable to assume he is a great operator and understands the markets where AAON’s growth will come from going forward.

Tobolski owns 331k shares of AAON 0.00%↑ worth $24 million. His salary will likely be similar to the previous CEO, Gary Fields, which was $790k.

Risks

Economic risks: AAON is dependent on non-residential HVAC activity. BASX will likely continue to see strong demand for years to come, but AAON Brand is a bit more susceptible to cyclicality and economic conditions.

Customer concentration: AAON’s largest customers account for a very large portion of net revenue in 2024, which would be disastrous if they lost any of them.

Texas AirSystems LLC accounted for approximately 16.4% of total sales.

Ambient (through portfolio groups) accounted for approximately 14.9% of sales.

Meriton-affiliated groups (additional to Texas AirSystems' direct sales) accounted for an additional 8.0% of sales.

AIR Control Concepts (through portfolio groups) accounted for approximately 9.2% of sales.

Valuation

As I said in the beginning, this isn’t a typical “value pitch”, but the company has some strong tailwinds, a moat, and the stock has been cut in half recently.

Assumptions

Revenue growth of 8% - 12%. Slightly below 10 year average and managements three year target of 12.5%. Within a few years BASX may begin to contribute considerably to revenue growth as it makes up a larger portion of revenue, but for now, it remains small.

Pretax margin of 15% - 20%. Higher margins are likely not on the table if BASX, which is lower margin, becomes a larger portion of revenue.

Multiple of 35x - 45x. Reflects a range just below and above historical average. AAON is likely deserving of a higher multiple due to its competitive advantage and growth prospects.

Final thoughts

I am personally going to pass on this one. It remains a watch list stock for me, but the combination of a few things turns me off

The founder left his positions as CEO and Executive chairman in recent years.

Very high customer concentration doesn’t sit well with me.

I’m too cheap to pay 40x earnings. If a company checks all the boxes, I wouldn’t mind paying 40x earnings. But this one just doesn’t fill the bill at this time.

If anyone is interested more in HVAC technology companies to study, here is a few names

Lennox International- Mostly residential.

Trane Technologies- Commerical and industrial.

Carrier- Residential and commercial

Johnson Controls- Global commercial and industrial.

Vertiv (BASX competitor)- Data center infrastructure

Most of these companies (except Vertiv) haven’t grown much and have instead relied on margin improvements and buybacks to grow EPS. Nonetheless, they are all very interesting to study.

That’s it for this week, thank you for reading!

Disclaimer: I am not a financial advisor and nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Some investments I discuss are very risky, so please do your own research and consult a financial advisor before buying or selling any securities.

Full disclosure: I am not an AAON AAON 0.00%↑ shareholder at the time this was written.

https://coe.montana.edu/norm-asbjornson/marriage-and-children.html

https://coe.montana.edu/norm-asbjornson/

https://coe.montana.edu/norm-asbjornson/business-success.html