A few months ago, I wrote about API Group, a compliance-driven fire safety company that offers annual inspection services and monitoring. Martin Franklin took it public via SPAC, and it’s up 276% since going public in 2020. Taking a page out of the same playbook, Franklin recently took a similar company public called Acuren. Acuren is a compliance-driven testing, inspection, and certification (TIC) company that Franklin also took public via SPAC.

For those who aren’t familiar with Martin Franklin, he is known for bringing companies public via SPAC and creating value for shareholders by improving the operations and economics of the businesses. He typically holds large positions in the companies for long periods of time rather than dumping them on the market after going public. He has a very good track record. Here is a good article describing his career with a few interviews attached if anyone is interested.

Acuren overview and business model

I discussed UL Solutions ULS 0.00%↑ in my last report. UL Solutions is the world’s leading TIC company that performs safety certifications on billions of products annually. Acuren operates in a different part of the TIC market called asset integrity management. Asset integrity is concerned with routine testing and maintaining critical industrial assets to ensure their efficiency, safety, and compliance with regulations. Acuren essentially helps customers detect and prevent damages due to corrosion, leaks, cracks, and manufacturing flaws.

Acuren serves the pipeline, refinery, manufacturing, power generation, chemical, oil sands, automotive, aerospace, mining, renewable energy, and pulp and paper industries. These inspections and services are often recurring, compliance-driven, and enforced by regulatory authorities.

Acuren has three segments

NDT: NDT stands for non-destructive testing. NDT is a set of inspection methods that don’t damage the infrastructure being tested. They offer radiographic testing (RT), ultrasonic testing (UT), visual testing (VT), penetrant testing (PT), and magnetic testing (MT), and various other inspection and testing techniques.

RAT: RAT stands for rope access technician. They provide rope access technicians who are able to perform various testing services for critical assets in very difficult-to-access places, such as on the side of buildings, infrastructure, and various other industrial applications. They also provide various niche rope access services such as insulation, coatings, blasting, welding, pipe fitting, hoisting and rigging, and electrical services.

Consulting engineering and lab testing: This segment provides inspections and testing of customer parts, testing of material efficiencies in lab facilities in quality-controlled environments. They also provide specialized materials engineering services such as failure investigation, corrosion engineering, destructive testing, welding engineering, fracture mechanics, and chemical analysis.

They operate from 119 service centers and 22 lab facilities in the U.S. and Canada. They have acquired 50 + companies and launched 100 + services that serve the asset integrity market.

95% of Acurens revenue is recurring due to regulatory requirements. They provided mission critical, non-discretionary services that are built into their customers operating expenses. Acuren doesn’t typically use fixed-price contracts but instead opts for a time-and-material basis. They essentially have a loaded rate that they charge plus materials and a markup.

Revenue cyclicality is remarkably low, even during periods of low oil and gas market activity. As illustrated below, Acurens’ revenue experienced minimal declines during the 2008-2009 financial crisis and the energy downturn that occurred from 2015 to 2016. Despite depressed oil prices and reduced capital spending, Acurens’ revenue remained relatively stable.

Industry overview and trends

Asset integrity is a critical part of any industrial business. There are ongoing TIC expenses for most of the assets used in large industrial settings. These small routine maintenance expenses ultimately help these companies avoid much larger capital expenditures that would occur if an asset were to fail or break. By detecting potential failures, they ensure assets continue producing, minimizing unplanned downtime that impacts revenue.

Traditionally, NDT is done by smaller local companies who may only provide a few particular services. However, more recently it has become more preferable to have larger-scale companies like Acuren provide NDT services due to their scale and ability to provide a broader list of services with better technology.

The asset integrity industry is valued somewhere around 25 billion, with North America making up 8.4 billion of the market.1 The North American market is expected to grow at around 5% annually. This is a very steady market that will exist for as long as industrial assets are in use. Although oil and gas assets may not be in use for another century due to the finite nature of of fossil fuels, as new fuel sources are brought to market, their assets will need to be inspected and tested as well.

Key industry trends

Digital transformation of asset protection: Paper-based integrity programs are making the switch over to digital. Utilizing data sets from past integrity analysis will become more common in predicting and preventing future asset failures. Acurens data analytical solutions provide customers with insights from a pool of asset integrity data.

Extending the life of existing infrastructure: Many companies have chosen to extend the life of their existing assets for as long as possible and defer replacement due to increasing costs. Aging infrastructure requires more frequent maintenance and inspection.

Increasing outsourcing of NDT services: Increasing complexity of NDT programs has led to increasing outsourcing to third-party specialists like Acuren.

Increasing use of advanced materials: Industries such as aerospace, defense, and wind power are using unique materials, some of which do not have a long history of proven resilience, and require more inspections.

Safety regulations: Industrial facility owners face strict regulations which result in government scrutiny, financial liabilities and higher insurance premiums if they are not met.

Expanded pipeline integrity regulations: The “Mega Rule” adopted in 2019 expands pipeline integrity regulations, increasing demand for integrated solutions.

“Drill baby drill”: It is widely acknowledged that the current administration advocates for domestic fuel production. The goal is to reduce oil prices by supporting oil production activities within the United States, which would certainly benefit Acuren.

Acurens growth strategy

Acurens’ growth strategy is one of a combination of organic and inorganic growth. Their organic growth strategy consists of acquiring new customers, broadening their offerings, further penetrating the wallets of existing customers, and expanding geographically.

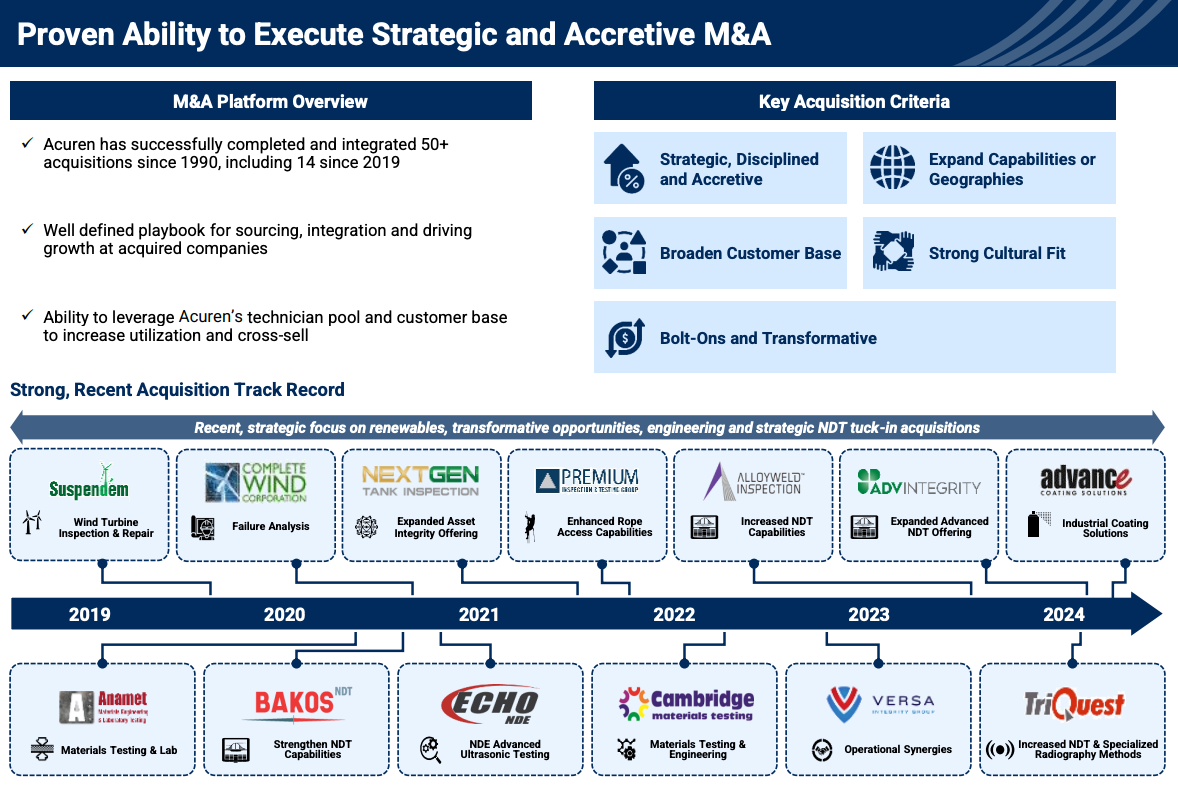

Acuren has acquired over 50 companies since 1990, with 28% of them acquired after 2019. They carefully source acquisitions that would accrue to shareholders and have a playbook for integrating and growing acquired companies. Their criteria are simple: growth at a reasonable price, integration, and accretion to shareholders.

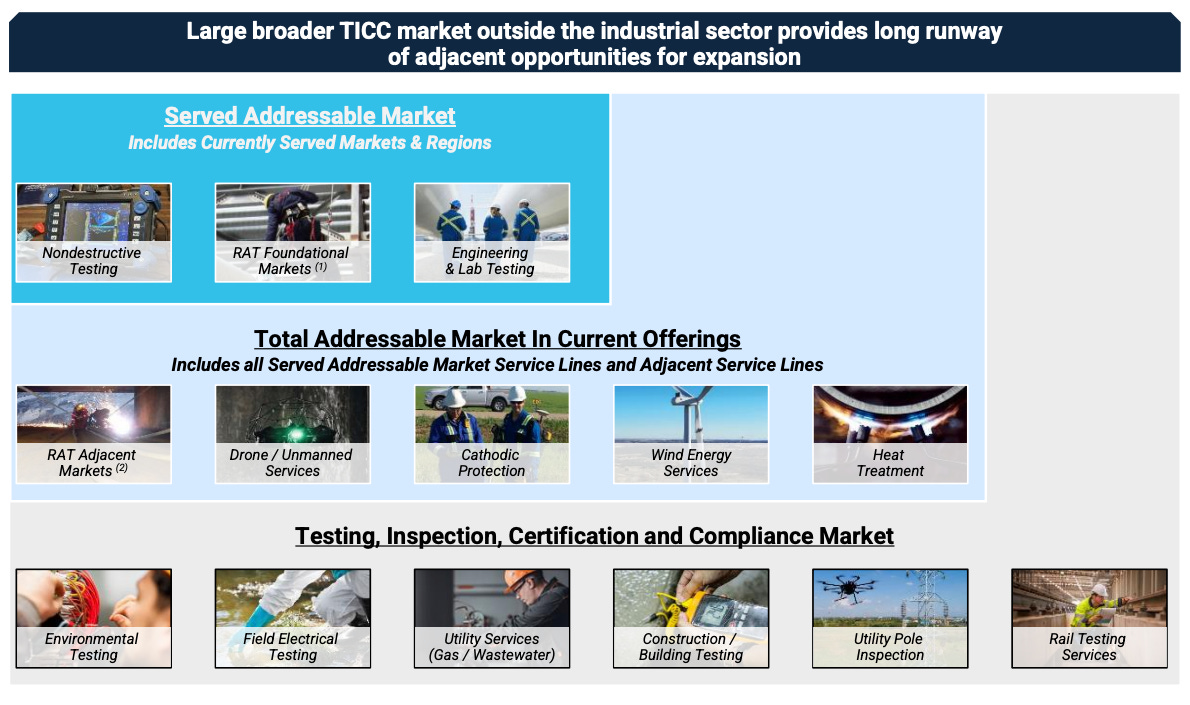

It is difficult to get an exact number for Acurens acquisition market opportunity because they offer many services in niche markets. However, some data is available that may offer some insight for their larger segments. There are roughly 1,200 non-destructive testing companies in the U.S.2 with a TAM somewhere in the ballpark of around 3.5 - 5 billion. Revenue on average for each company somewhere around 2.75 million. NO information is available for the Canadian market, which is Acurens’ second-biggest market. However, the addressable market is somewhere around 2 billion and assuming NDT companies are similar in size on average, we can conclude that there could be somewhere around 700 - 800 NDT companies in Canada. ($2,000,000,000 / $2,750,000 = 724). The rope access market in the US is roughly 800 million3 and there are a number of other markets they operate in that provide a good opportunity for consolidation. Putting it al together, they have a large pool of companies for potential acquisition targets.

Competitive advantages

Barrier to entry: Mediocre

NDT is not the hardest industry to get into, but it’s also not the easiest either. There are many licenses and certifications that go into founding an NDT shop. At the most basic level, if you wanted to found your own NDT shop, a degree and years of work-related experience are typically required. Then, you would first need to pass an NDT level 1, level 2, and level 3 exam with years of work experience between them. Level 3 allows one the ability to manage an NDT shop and oversee certifications. You would then need to acquire a handful of other licenses to provide each particular services such as radiographic testing, ultrasonic testing, rope access, and so forth. Again, this isn’t the strongest barrier to entry, but it does prevent, or at least delay a competitors from entering the market.

Scale

The more difficult part is building a client base and scaling the business, as all technicians need to be certified in some way as well. Once technicians have been experienced enough, they may want to go out and start their own firm. Therefore, obtaining talent and treating their technicians well is crucial for maintaining talent.

Once scaled, there are some advantages to being a large national provider like Acuren, particularly when large national clients need multiple forms of testing or certifications in multiple locations. Smaller firms typically don’t provide the selection or national capabilities like Acuren. This explains why there is a trend away from smaller shops and towards larger one-stop shops.

Compliance driven revenues, long standing relationships

A large portion of Acuren’s revenues are recurring and compliance-driven, with long-standing relationships with major companies in oil, gas, power generation, chemicals, aerospace, and defense. These relationships provide Acuren with recurring revenue streams from services that are statutorily required. These tests must be done routinely, followed perfectly, and then written off by a shop holding a level 3 certification. Although these customers could theoretically go to another NDT provider, Acuren’s scale affords them a comprehensive suite of testing services and technologies, which is why larger customers continue to stay with them for many years.

Management

Pizzey

Executive management comprises CEO Talman Pizzey and CFO Kristin Schultes. Pizzey joined Acuren in 1981 and became CEO in 2019. He previously served as COO of Acuren’s Canadian businesses. Below is the break down of his compensation and ownership.

400,000 shares of Acuren stock valued at around $5 million USD.

His base salary was $533,611 USD (704,366 CAD) in 2023 but they entered into an employment agreement at the acquisition, entitling Pizzey to an annual base salary of $947,810 CAD ($653,988 USD).

He is entitled to an annual cash incentive equal to 100% of his annual base salary and an long-term equity award with an estimated market value of no less than $2.2 million.

Pizzey’s equity-to-salary ratio is 7.64, meaning his ownership is over 7x larger than his salary.

Schultes

Schultes was brought over from API Group where she was Vice President of Corporate Development and held various other roles, including CFO at one of API’s subsidiaries. Her pay is as follows

Base salary of $450,000,

A 100% cash incentive

Annual long-term equity incentive with an estimated market value of at least $900,000.

Martin Franklin

Franklin owns 19,877,500 shares (16.4%) which includes 18,877,500 Acuren BVI ordinary shares and 1,000,000 Acuren Preferred Shares that are convertible to common stock at a 1:1 conversion ratio. The preferred shares also pay an annual dividend paid in common stock, depending on the share price.

Equity structure

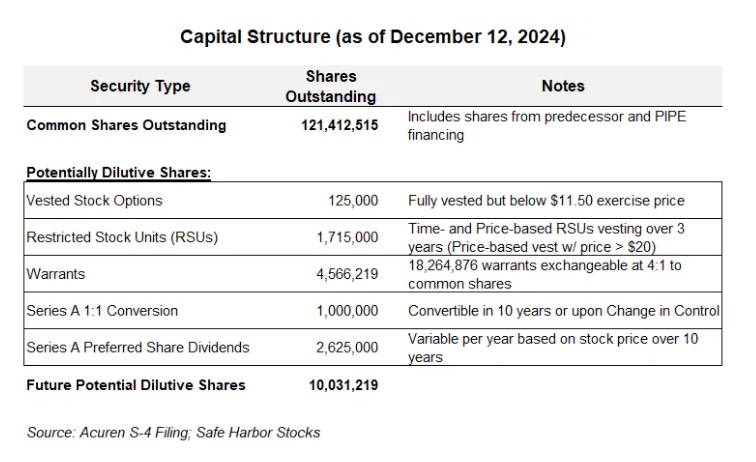

The table above is from a friends article on Acuren. You can find it here. His name is Kris Rymer, his SubStack is Safe Harbor Stocks and I believe he was the first to write about Acuren. With his permission I’ve used some information from his article.

As you can see, Kris has summed up the capital structure and potentially dilutive shares really well.

The warrants and RSU’s are the primary concern here. The RSU’s vest over the next 3 years, issuing a total of 882,500 shares, and additional shares of an equal amount if Acurens share price exceeds $20 over the next 5 years.

There are also 18,264,876 warrants outstanding, each entitling one-fourth of an Acuren BVI Ordinary Share with an exercise price of $11.50. In other words, there is a conversion ratio of 4:1, excersizable after $11.50. This could potentially dilute Acuren’s share count by almost 4.6 million (3% to 4% dilution).

As previously mentioned, Mariposa capital (Martin Franklins firm) also holds 1,000,000 preferred shares that are convertible at a 1:1 ratio at maturity (10 years out) or at change of control (merger, acquisition). These preferred shares also pay an annual dividend paid in common stock which could be dilutive, but is designed to become less dilutive as the organization grows.

Financials

There are a few things that should be discussed concerning Acurens’ finances

For the first 9 months of 2024, Acuren did $ 145 million in Adjusted EBITDA, and I estimate for the full year, Acuren will do somewhere around $190–$200 million.

Acuren has a favorable margin profile for an industrial service company with adjusted EBITDA margins of 17%, up from 16.2% the previous year, with room for more expansion. In my view, there is a good chance that Franklin will manage to improve margins and returns on capital for Acuren, but we will have to wait to see.

Historically, capital expenditures have been relatively low, averaging 4-3% of revenue, suggesting a capital-light business model.

Acurens’ earnings are at a loss due to one-time acquisition-related expenses. Their adjusted EBITDA figure adds back seller and transaction expenses, as well as non-cash expenses (preferred shares) related to the acquisition.

Assuming 190 million in EBITDA, their FY 2024 Net-debt / EBITDA is around 3.3x as you cans see below.

Key risks

Competition: Acuran competes in a fragmented market with both small and large players. Most competitors are smaller companies that lack the national reach, technology and suite of services offered by Acuran. However, a few larger competitors, such as SGS SA, Iris NDT, Mistras Group, Intertek who compete with Acuran in NDT, RAT, and engineering support activities.

Cyclicality: Acuren is a slightly cyclical company, but this cyclicality is limited due to the necessity of NDT services in all markets. Nevertheless, they do derive a large portion of revenue from the oil and gas industry, which is cyclical, although any revenue decline is likely due to companies shutting down operations in down seasons.

Valuation

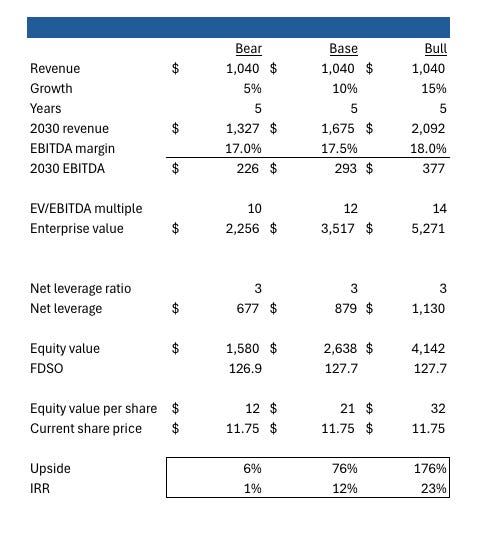

I proceed from the assumption that Acurens’ margins will either stay the same or slightly improve. I also assume an EV/EBITDA multiple of 10-14x, which is reasonable considering their major competitors are in this range. I also assume a growth rate of 5% - 15% over the next five years and a leverage profile similar to what it is today.

The result is somewhat mixed ranging from good to bad, with a base case that is decent but not extremely compelling. The bull case is very compelling, but this assumes that Franklin and management execute well and they’re able to grow at 15% and improve margins slightly.

It’s hard to say what will happen. Martin Franklin has a knack for creating shareholder value and improving the operations of the businesses he takes public. With API Group, he disposed of poor-performing assets and segments and instead changed the revenue mix by investing in highly profitable and recurring segments. Needless to say, investors were pleased.

In some sense, one must realize that Acuren is a bet on Martin Franklin. His track record is very good, but keep in mind that he does have a few poor performers on his record.

Conclusion

I do own a very small tracking position in $TICA and may consider adding more if they execute well. $TICA is listed on the OTC but is expected to be up-listed to the NYSE in the first quarter of 2025.

Thanks for reading!

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am a $TICA shareholder at the time this was written

https://www.precedenceresearch.com/asset-integrity-management-market#:~:text=Market%20Overview&text=The%20market%20encompasses%20a%20range,and%20enhance%20overall%20operational%20efficiencies.

https://www.ibisworld.com/united-states/industry/nondestructive-testing-services/5540/#:~:text=How%20many%20businesses%20are%20there,3.5%20%25%20between%202019%20and%202024.

https://www.grandviewresearch.com/horizon/outlook/rope-access-services-market/united-states#:~:text=The%20rope%20access%20services%20market%20in%20the,revenue%20of%20US$%201184.7%20million%20by%202030.