Summary

Key details

Market cap: $1.3 billion

Share price: $11

Ticker: TIC 0.00%↑

Post-merger EBITDA: $350

Estimated post-merger EV/EBITDA: 10.7

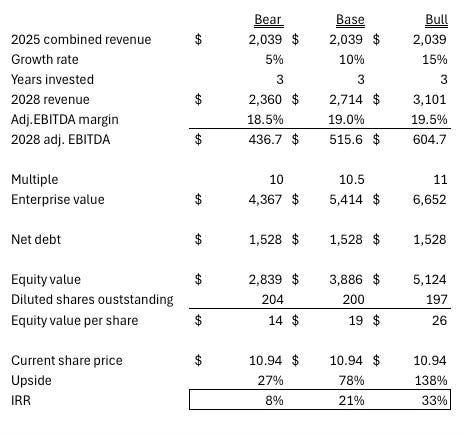

Estimated upside post-merger - 2028: 27% - 138%

As of May 25, 2025, Acuren Corporation and NV5 Global, Inc. have announced a definitive agreement to merge, forming one of the largest companies in the Testing, Inspection, Certification, and Compliance (TICC) and engineering services sector.12

The combination will create a global TIC and Engineering Powerhouse that does $2 billion in revenue and 350 million+ in EBITDA.

Below is a summary of both companies and key details of the merger.

Acuren

I recently wrote about Acuren. You can find it here.

In summary, Acuren is an engineering, testing, inspection, and certification (TIC) company that primarily specializes in asset integrity. Acuren’s revenue is 95% recurring in nature as the company conducts routine testing for critical industrial assets to ensure their efficiency, durability, safety, and compliance with regulations.

Acuren helps customers detect and prevent damages to industrial assets due to corrosion, leaks, cracks, and manufacturing flaws. Essentially, they find things before they blow up, leak, or fail.

Acuren serves the pipeline, refinery, manufacturing, power generation, chemical, oil sands, automotive, aerospace, mining, renewable energy, and pulp and paper industries.

Acurens CEO, Tal Pizzey sums up the company nicely in a recent interview called Essential Dynamics.3

“Every nuclear plant, refinery, power plant, chemical plant— these things are built for a 25 year lifespan, and they’re probably more than 50 years old on average. Those CEO’s don’t keep their jobs for replacing assets all the time, they want to extend the life, so were the kind of company that helps them extend the life of those assets”

They provide various forms of Non-destructive testing such as radiography, phased array ultrasonic, laser scanning, infrared, and various other techniques. These techniques allow them to test large industrial assets without compromising them, similarly to the way a doctor can look at a human with an X-ray without compromising the body.

Acuren also provides consulting/engineering services, lab testing and rope access services.

Rope access technicians perform inspections in very difficult and hard to reach places, from ropes. This may seem like a strange niche trade but its actually an important fast growing industry set to grow at over 8% annually4 . Renewable energy and massive energy demand from artificial intelligence have brought tailwinds to this industry as more technicians are needed to service industrial assets.

They acquired the rope access company when it was doing $25 million in revenue in 2010 and it has since 10x’d in revenue, according to Pizzey.

Franklin

The industry is interesting, but the most interesting part about Acuren is that it was brought public by Martin Franklin, a guy who is known for his investing track record. Martin typically brings companies public via SPAC and then optimizes the companies, sometimes divesting poor-performing assets, cutting corporate bloat, and acquiring other companies that could transform the operation. As the son of a banker, Franklin grew up overseeing the liquidation of assets of conglomerates for his father. As he grew older, he realized it was much more rewarding to build companies5 and he has quite the track record doing so.

His most recent deal, prior to Acuren, was a company I also own called API Group APG 0.00%↑ which, like Acuren, provided regular compliance-driven testing and inspections, except for commercial fire safety systems. Franklin divested some of the poor-performing and more cyclical assets from API Group and then oversaw the large transformational acquisition of Chubb Fire and Security. Over the last 5 years, API’s revenue is up, margins are up, returns on capital are up, revenue is less cyclical, and the stock is up 359% and I believe there is still room to grow.

Clearly, Acuren and API Group have many similarities, and it’s clear that Franklin has found an industry he likes and he is deploying a similar playbook. He is looking to do a transformational deal and he may be getting it soon with the announcement of the Acuren-NV5 merger. The deal was just announced on May 25th 2025.

NV5 Global

NV5 provides tech-enabled engineering, testing, inspection, and consulting solutions. The company specializes in engineering, design, asset management, and geospatial data analytics. They focus on mandated infrastructure services in high growth and high barrier to entry industries.

NV5’s clients include the U.S. Federal, state and local governments, public and private institutions such as airports, education institutions, hospitals, health institutions, transportation departments, military, water, power and utilities.

NV5 Global provides a wide range of services and they operate in three segments;

Infrastructure: 43% of revenue. This segment largely focuses on electrical utilities, transportation, waterways and other infrastructures. Services primarily revolve around engineering, testing, and inspections that support the reliability, safety, and longevity of infrastructure assets. This is the biggest segment and the driver of growth is aging infrastructure in the US. This segment is compliance driven and very non-cyclical.

Building, Technology & Sciences: 27% of revenue. This segment revolves around data centers, building systems & technology, clean & efficient energy. Services include mechanical, electric and plumbing design, data center IT, building program management, energy performance and environmental services.

Geospatial Solutions: 30% of revenue. $21.6 billion total addressable market. Geospatial solution practices. This segment provides data analytics and remote sensing to enable asset management, reliability and maintainability of assets, safety, and predictive modeling. This segment is also 96% recurring revenue.

NV5-Acuren Deal Structure and Value

Under the terms of the agreement, NV5 stockholders will receive $23.00 per share, split between $10.00 in cash and $13.00 in Acuren common stock.

The transaction values NV5 at approximately $1.7 billion, or about 10.3x times its projected 2025 adjusted EBITDA or 9.2x post-synergies.

The cash portion of the deal will be funded by a fully committed $850 million term-loan facility and Acuren’s cash on hand. All existing NV5 bank debt will be repaid and re-financed.

Combined entity

Initially, the combined company will be highly levered with net debt at 4.4x EBITDA, however, they have made it clear that getting that figure down to 3x as soon as possible is a key priority. This is similar to API Groups Chubb acquisition, which had a very similar post-acquisition leverage profile, but which was expeditiously brought down by growth in EBITDA and servicing their debt. In my view, leverage is less of a concern because, like API Group, the company has a very reliable stream of cash flow from compliance driven services.

The combined company will do $2 billion in revenue and $350 million adjusted EBITDA with a combined post-synergy adjusted EBITDA margin of 17.2%. Dickerson However, Wright said that there is no reason the combined company can do 20% + EBITDA margins in the future.

The company will also have minimal CapEx of only 2.7% of revenue, implying very low capital needs.

The combined company will have an expanded total addressable market with a nice m&a pipeline and a broader platform for inorganic growth. Acquisitions have historically been a large part of both businesses and they will continue to serve as a driver of growth going forward. Acuren operates in a $4 billion market.

Ownership and Leadership

Upon completion, Acuren shareholders will own about 60% of the combined company, while NV5 shareholders will hold the remaining 40%. Key NV5 leaders, including Executive Chairman Dickerson Wright and CEO Ben Heraud, will join Acuren’s board, along with an additional independent director.

Strategic Rationale

There are a few reasons why this acquisition would make sense.

Immediate synergies and accretive benefits.

Acuren will share best practices with NV5.

Together, Acuren and NV5 will create a global TIC company, and because they are complimentary businesses, they will benefit mutually from cross-selling.

Let’s briefly look at these individually.

Immediate synergies

First, the companies expect immediate financial benefits, including a “conservative estimate” of $20 million in near-term cost synergies and significant long-term revenue synergies. The combined entity’s adjusted EBITDA is projected to reach $350 million with the benefit of these synergies, positioning it for further organic growth and future acquisitions.

2. Acuren (and Franklin) will share best practices and cost discipline

Overall, NV5 is a great company, but it has seen a few years of deteriorating returns from slower revenue growth relative to SG&A and potentially slightly overvalued acquisitions, which have led to deteriorating returns on capital. The merger with Acuren is likely to change this as Martin Franklin assumes some level of influence over the combined company and Acuren is able to share its cost disciplines with NV5.

Acuren is also apparently more disciplined in this way— “throwing nickels around like manhole covers” as Tal Pizzey said in a recent interview.

Robert Franklin also mentioned something to this effect in the M&A announcement

“What we found when we were diligencing Acuren in the beginning was it's a very efficiently run business. So you have a corporate function that really supports leadership at the branch level, managing profitability by technician at the branch level. And I think there's a series of cost disciplines that we can really share with the NV5 team. The strategy here is not to disrupt what's working. It's to share best practices”

Global Complimentary anti-cyclical TIC powerhouse

The merger will create a global leader in TIC and engineering services, offering a diversified portfolio of recurring, anti-cyclical, and tech-enabled services. Together, the two companies will be able to extend their offerings to each other’s existing clients—penetrating new end markets, growing faster, unlocking new geographies.

“Leveraging what NV5 does best in technology enabled engineering, highly complements our testing and inspection services. Together we believe we can grow faster and generate higher margins and cash flow than either business could achieve on a standalone basis.”

- Robert Franklin Acuren Q1 conference call M&A announcement

“The combination of NV5 and Acuren will create an industry leading TICC and engineering platform, offering adjacent services to each of our respective customer bases, unlocking new geographies, end markets and customers. Together, we’ll be able to provide greater solutions to the full lifecycle of our customers’ assets.”

- Robert Franklin Acuren Q1 conference call and m&a announcement

“We expect accelerated top line growth, significant operational efficiencies and a greater services platform on which to build through an expanded total addressable market and M&A pipeline.”

— Tal Pizzey Acuren Q1 call and m&a announcement

The two companies are very similar, and serve a very similar type of customer, yet they have very little customer overlap, creating the opportunity for cross-selling.

Both companies have some elements of engineering/consulting and some elements of compliance-driven testing and inspection. However, NV5 is more engineering and technology-oriented and focused on infrastructure, while Acuren is more oriented towards testing and inspection in the industrials sector. This means that NV5’s infrastructure customers can be sold Acuren’s rope access or NDT testing service, and Acuren’s industrial customers can be sold NV5’s engineering consulting services.

Both companies will be able to expand their geographical foot print as Acuren has a large presence in Canada, where NV5 has none, and NV5 has a small presence internationally (UAE, Singapore, Hong Kong, Malaysia) where Acuren has none. This will allow each company to expand into each other’s geographical areas.

Ben Heraud, CEO of NV5, laid out a few other examples of cross-selling synergies from the combined companies.

“in utility infrastructure, NV5 is largely dedicated to supporting the reliability and safety of electrical transmission and distribution, but our capabilities in power generation are limited. Acuren’s work in power generation provides an opportunity to support utilities from electrical generation all the way to delivery of electricity to customers.”

“Another area of synergy that we’re looking forward to is leveraging our geospatial data capabilities to support asset management in the energy and industrial sector. Remote sensing geospatial technology can support corridor mapping, leak detection, and digital twin technology for asset inventory and infrastructure assessments at scale, which we believe will benefit Acuren’s clients.”

Deal Closing Timeline and Conditions

The transaction is expected to close in the second half of 2025, pending regulatory and shareholder approvals. I believe there is a high likelihood that this deal NV5 also has a 60-day “go-shop” period to solicit alternative proposals.

Valuation

Given Martin Franklins track record, Acuren’s cost discipline and comments made by Dickerson Wright, I think it’s reasonable to assume Acuren’s EBITDA margin could potentially expand from 17% to 19% over the next few years.

I don’t want to lean into Wright’s speculation of 20% EBITDA margin, so I think a 200 basis point increase is reasonable from here.

The valuation assumes the following

EBITDA margin of 19% for base case, 18.5% for bear and 19.5% for bull.

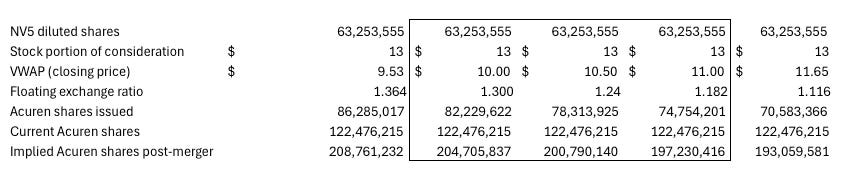

Shares outstanding of between 197million and 204 million. Below is a chart detailing equity issuance from NV5 merger where floating exchange ratio is applied at various closing prices. The valuation assumes an average closing price of $10 - $11 which implies 74 million - 82 million additional shares could be issued, which creates a total post-merger share count of between 197 - 204 million.

Net debt of $1.5 billion, including $850 million in new debt raised from merger.

EV/EBITDA multiple of 10x - 11x, a conservative figure when compared to API Groups EV/adj EBITDA multiple of 15x - 16x.

The result is actually appealing, at least for me. If my assumptions are correct, the bear case offers upside of 27% over the next few years and the bull case offers 138%.

Final thoughts

This is not an investment for those who need the affirmation of the crowd. CNBC will not be broadcasting bullish price targets for Acuren and Twitter will not be humming with bullish sentiment for Acuren, unless the results hit the P&L over the next few years. The company is hardly discussed, and broadly ignored at this point, aside from a few hedge funds that have taken notice and placed sizable bets.

This investment carries a handful of unknown variables, and much like the Asseco Poland thesis, it hinges on the future performance of management. Therefore, this is not an investment for everyone and it is inherently more risky.

However, often times talented managers and dedicated board members can be reliable bets. People are creatures of habit, and if their habits have allowed them to win in the past, they will likely continue those habits and yield similar results. These are the kinds of people I want to partner with as an investor.

If Acuren follows a similar path as API (margin expansion, cost discipline, revenue growth, multiple expansion), shareholders will be rewarded nicely. I will add that Martin Franklin has been known to beat expectations in the past, and even though he isn’t the CEO, he does have significant influence as a major shareholder and board member.

That’s is for this week! Thanks for reading.

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Some investments I discuss are very risky, so please do your own research and consult a financial advisor before buying or selling any securities.

Full disclosure: I am an Acuren TIC 0.00%↑ shareholder at the time this was written.

https://s205.q4cdn.com/259715303/files/doc_news/2025/Acuren-Corporation-and-NV5-Global-Inc-Announce-Merger-with-2-Billion-Combined-Revenue.pdf

https://ir.nv5.com/news-events/news-releases/news-details/2025/Acuren-Corporation-and-NV5-Global-Inc--Announce-Merger-with-2-Billion-Combined-Revenue-2025-qonDz7_kBi/default.aspx

https://www.grandviewresearch.com/industry-analysis/rope-access-services-market-report#:~:text=Rope%20Access%20Services%20Market%20Size%20&%20Trends,blades%2C%20and%20other%20critical%20components.

https://www.thecorpraider.com/2020/07/20/the-spac-daddy-sir-martin-franklin/

I am a big fan of Bradley Jacobs (very heavily invested in QXO) and was looking for a similar investor to follow. I think Martin Franklin has a similar track record of mergers and acquisitions and was happy to find your article on TIC. My question is being a spac, once the merger is finalized later this year could there be a significant price correction? I noticed with APG the price cratered from $12 down to $3.70 before going on to reach over $50. I'm wondering if there will be a similar price reaction to this stock when the merger is announced. Spacs tend to come loaded with lots of garbage like cheap shares and warrants and many people do a quick exit to lock in profit. Kind of leery to buy at current price and wonder what the chances are of a price correction happening later this year. Thanks for bringing this excellent company to my attention!

Thx for sharing boss