APG

API Group is an industrial services company that has acquired 100 durable niche businesses with a focus on fire safety inspections and monitoring. Many of their companies have the benefit of being recession-resistant because their services are required by fire building code regulators.

In my SkyHarbour write-up, I mentioned that SkyHarbour specifically designed their airplane hangers to avoid the costly fire suppression systems that are mandated by the National Fire Protection Association (NFPA). Well, those fire systems and regulators may be a nuisance to companies like SkyHarbour, but they’re key to driving revenue for fire safety companies like API. Regulations require fire systems to be installed, tested, and inspected annually through ITM reporting (Inspection, testing, maintenance). These inspections occur annually, if not quarterly.

Segments

API has two segments: safety services and specialty services. The largest share of revenue flows from safety services (70%), particularly the inspection service and monitoring aspect of that business, which now makes up 53% of API’s revenue. This part of the business has been API’s focus as they have built it up over the last decade. It’s higher margin, less cyclical, recurring in nature, and mandated by building code authorities. The other segment, specialty services, has seen some divestment and typically involves more cyclical and lower-margin contract work.

Safety services: This makes up 70% of revenue and has become the driver of growth more recently. They design, install and do ongoing inspections for fire protection solutions, Heating, Ventilation, and Air Conditioning (HVAC), and entry systems.

Specialty services: Specialty services: This makes up 30% of revenue. They design and install critical infrastructure such as underground electric, gas, water, sewer, and telecommunications infrastructure. They also provide maintenance and repair. The best way to think about this segment is that it’s an infrastructure construction business. This segment has become a smaller share of revenue over time and I expect it will continue to shrink.

The majority of this write up will be focused on inspection service and monitoring because it is the backbone of the business and its future.

Customers

API has long-standing relationships with their customers who range from global Fortune 500 companies to customers with only one location. No customer makes up more than 5% of their revenue. 67% of their customers come from commercial, education, entertainment, telecom, utilities, government, infrastructure, industrials, and manufacturing industries. All of these represent stable sources of revenue as these industries must set aside a budget for fire safety inspections and services in order to operate.

A unique organic strategy

API shifted its business mix to be increasingly focused on fire safety through a series of bolt-on acquisitions and divestitures. Fire safety really is the backbone of this company, and they’ve sought to build out this segment as much as possible, although they have inverted the typical fire safety business model.

The typical business model for a small or midsized fire protection company would be to compete for a spot on a large construction project to design and install the fire safety system for a building. Typically, they would submit their bid proposal to a general contractor who manages the project. If selected, they would then install the fire protection systems and pitch their inspection and testing services near the end of the project.

Some time after the Great Financial Crisis, API began reversing this model by deploying a large sales team to find and book inspection services in pre-existing, occupied buildings. They changed the business from a contracting business to a more service-oriented, inspection-led model. These inspections inevitably reveal deficiencies that need to be fixed and brought up to code and back into compliance with regulators.

There are multiple benefits of this approach.

First, the inspection services are typically low-ticket, ranging between $1,000-$1,500, and the typical ticket size is $5,000 for the entire safety services segment. Compare this to $75,000 for their specialty services segment. They aim to raise inspection prices by 5% each year, resulting in only $50-$75 increases, which is immaterial considering the annual facility budget of their customers. Their customers “willingly” take these price increases, according to Adam Fee, vice president of investor relations. When they have multiyear contracts, these 5% price escalators are built into the contract.

The project times in safety services are typically short, allowing them to avoid certain consequences of long term projects such as unforeseen inflation in materials and labor.

The inspections allow them to get a foot in the door and establish a relationship with the customers. Once they are on site and have established a relationship with the customer through the inspection process, it’s very likely that the customer will use API to provide the service required to bring the building back into compliance. The odds of a competing bid are extremely low at that point, giving them pricing power. Management estimates that every $1 of inspection revenue generates $3 - $4 in additional service revenue that accrues to their income statement at a 10% higher gross margin. It also affords them higher operating margins as they don’t have to spend any additional sales and marketing to acquire that additional $3 - $4 in service revenue.

Lastly, the inspection-first model gives them the stable cash flows they need to be more selective on the installations/projects side of the business. As inspection and services cover the overhead at each branch, they can afford to be more selective, choosing only the most profitable projects, therefore expanding margin on that side of the business.

Putting it all together, the strategy has allowed the company to incrementally grow its recurring revenue and develop a business that is higher margin, less cyclical, and more recurring in nature. Currently, 53% of revenue is recurring, flowing from inspection, service, and monitoring, and they aim to grow inspection revenues by 10% annually.

Side notes on changes in reporting

The two most common inspections that are enforced annually are NFPA 25 (fire sprinkler systems) and NFPA 72 (fire alarm systems).

Traditionally, inspections, testing, and maintenance (ITM) have been done by a fire sprinkler contractor, and the report was kept at the site of the inspection. Then, at some point in the future, the fire marshal or government authority having jurisdiction (AHJ) would visit the place of business to ask to see the report. If there are any corrections or deficiencies that need to be brought into compliance, they would ask them to bring them to do so.

With the rise of cloud infrastructure, third party software applications have been developed that allow contractors to upload the inspection results directly to the cloud where they can be viewed by code authorities almost immediately. This saves code authorities staffing expenses and allows them to enforce compliance much faster through automated letters, often without having to step foot at the building or business site. Because of the ease of this system there has been an increase in compliance1 with inspections and repairs, which is great for fire safety companies.

13/60/80 2025 targets

API has targeted 13% EBITDA margins, 60% of revenue from inspections and monitoring, and 80% free cash flow conversion. They aim to have a 13% EBITDA margin by 2025, and it looks like they will easily achieve that as they are on track to do 12.7% this year.

I believe they can expand margins beyond 13%, and they have tip-toed around this in quarterly calls. They aren’t giving any guidance further out than 2025; however, they will release an investor update that will outline their new targets and goals in 2025. There are some clues as to what they think they can achieve. When asked about EBITDA margins beyond their 2025 goal, CEO Russell Becker said,

“I’m not going to give you a target but what I will tell you is, do we think collectively that there’s opportunities to be 14%, 15% business? Yes 100%. At some point, most likely next year, we will have an Investor Day, and we will share where we're moving that goalpost. We're actually planning right now.”

CEO Russell Becker- BofA 31st annual transportation, airlines and industrials conference.

In my opinion, they should divest the entire specialty segment and focus solely on fire safety and inspection services which is a 15% - 20% EBIDTA margin business.

M&A

APG has a disciplined M&A strategy. They’ve acquired over 100 companies since 2005 and 25 since going public in 2020. Acquisition is very much a vital part of their overall growth strategy, and they plan to continue consolidating the industry. There are somewhere around 4,033 fire safety companies in the US, and API has identified a potential pipeline of around 300. 90% of their acquisitions come via their own proprietary channels and network.

Management aims to pay 4x - 7x EBITDA for acquisitions, although they have paid more for some acquisitions more recently, such as Chubb 14x EBITDA. However, their weighted average Adj. EBITDA multiple for bolt-on acquisitions has been 6x or less in each year since going public, and all of them have been accretive to adj. EBITDA margins.

They aim to optimize the EBITDA margins of acquired companies by shifting the strategy from a contract-to-service-oriented model. Synergies occur through procurement and integration as well as optimizing the revenue mix and the pricing power that comes with an inspection-led model.

API typically has two kinds of acquisitions, smaller bolt on acquisitions and larger transformational acquisitions.

Bolt-ons acquisitions go through a rigorous screening process to ensure that they will benefit API through geographical reach/density and shared corporate values and vision. Shared values are important. They place a strong emphasis on cultural alignment and making sure that the culture at API is undivided. They have a podcast here on building great leaders, which gives a bit of insight into how they think about culture and leadership. They have different interviews with managers of different companies within API’s family of businesses.

Larger acquisitions are used as a platform to build on and acquire smaller companies into the fold. A few examples of these larger acquisitions would be their acquisition of Chubb in 2022 and Elevated in 2024. Both Chubb and Elevated were important acquisitions for API.

Chubb

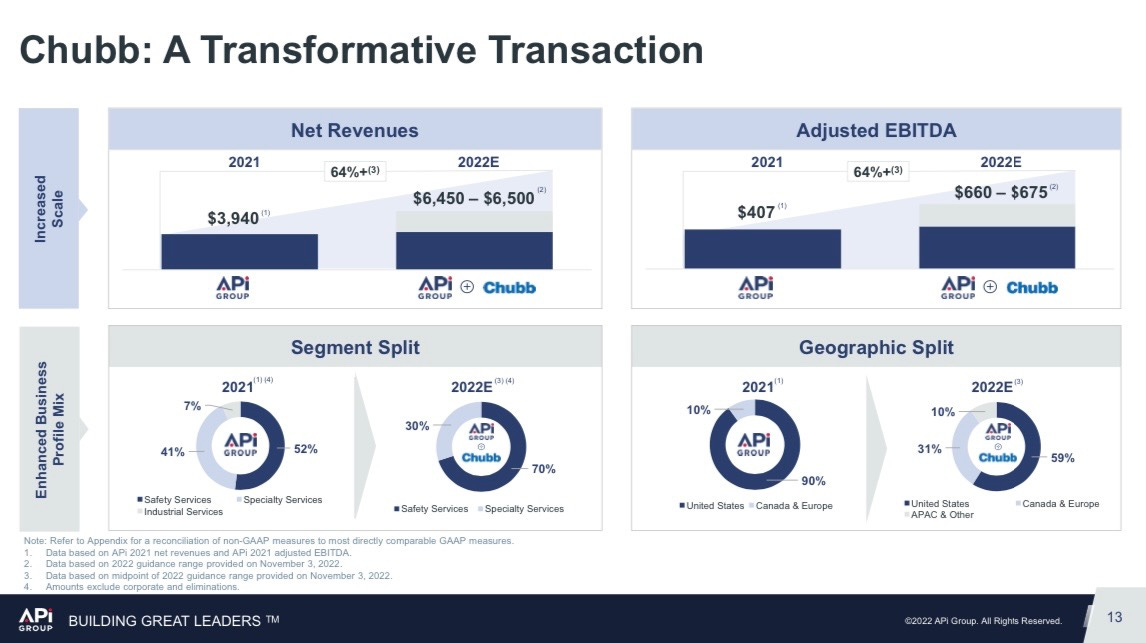

Chubb was acquired from Carrier Global Corporation in 2021 for $3.1 billion. It’s a global fire safety brand that operates in 17 countries, offering fire safety, monitoring, and security services. It enhanced API’s segment split and diversified its geographical reach. The Chubb acquisition provides API with a platform to build on internationally, and it expanded its footprint significantly in Western Europe. West Europe in particular offers a large opportunity for inorganic growth.

“Western Europe, we see it as a really fantastic opportunity to bring our inorganic model to it, which for those not familiar with the story, is we're the largest player in the markets we're in, but we largely have 5% of the market. So it's highly fragmented and there's a significant opportunity continue to do inorganic growth through bolt-on tuck-in M&A.”

Executive VP Kevin Krumm, Barclays 41st industrial select conference

After acquiring Chubb, API began a multi-year restructuring process that drove efficiencies and optimized operating margins. They trimmed the loss-making branches that weren’t able to improve their performance and then began implementing their inspection-first model. They acquired Chubb at a 9% EBITDA margin and have a 2025 target of 15%, which flows from a $125 million value capture, of which $40 million had been realized in 2023 and the remaining $85 million to be expected in 2024-2025.

Elevated

Elevated is an elevator maintenance and service company that operates in 22 US states and 58 markets. This offers a similar dynamic to API’s fire safety segment because the elevator space legally requires routine annual inspections to be done in order to operate. There are around 30,7512 elevator installation and service businesses in the US. It’s not clear exactly how many of these fit the criteria for their pipeline.

Competition

API’s different segments have different competitors and peers.

Safety

On the safety side of the business, API really only has a few big public competitors such as Cintas’s fire safety segment (Cintas Fire Safety), FirstService’s Fire safety subsidiary Century Fire, and Johnson Control’s Fire segment (Johnson Control Fire Safety). In a $25 billion US market, Cintas has 3% ($728 million revenue), Century Fire has approximately 2% or less ($160-$500 million in revenue), and Johnson Control has approximately 4% - 12%. Comfort Systems also has a very small fire safety division that isn’t disclosed in their financial reports.

Specialty

API has more competitors on the specialty side but some of the bigger ones are Mastec, Quanta Power, and Emcor and Dycom collectively make up around 30% of the market in the US.

Moat

Inspection first

Scaled service businesses like API aren’t ever going to have an enormous “monopoly” like moat. The barriers to entry aren’t huge. In California, for example, all one has to do to become a fire protection contractor is work for a fire protection company for 4-5 years, maybe go to a contractor school for a month, and pass an exam. The point is, there’s always going to be smaller players who are competing with API in this part of their business. However, this doesn’t mean that API doesn’t have a competitive advantage.

Leaving aside API’s specialty segment, API’s moat for its safety segment is fairly simple to understand if you get the basics of the industry. They have a disciplined approach that requires sacrificing easy, big-ticket projects for higher-volume small-ticket inspections and services that require large investments in back-office infrastructure.

As I said before, the typical fire safety contractor will compete to secure big installation projects that provide multi-month revenue streams. They may have between 1-5 projects going at once, which don’t require a large advertising spend or administrative team. It’s low volume, big ticket, less chaos, less headache, and less admin expenses.

API on the other hand has thousands of inspection contracts going at once and must employ a large inspection sales force that secures them and a large administrative teams to manage them. With most inspections they require the following

A salesman

A dispatcher

An inspector

An invoicing person

A invoice collections person

If the inspection is turned into a deficiency report then they will also need the following.

Estimator to write a service proposal

Technician

More dispatchers

More invoicing professionals

This isn’t a bulletproof moat, but it’s not hard to see why this model isn’t popular especially when the majority of their competitors are largely family owned businesses with limited access to capital.

Russell noted in the BofA conference earlier this year that competitors try to employ this inspection first model, but they find themselves going right back to projects-first model at the first sign of slow business.

“And what happens is they try to -- when things get slow, they try to transition to the space. And as soon as a project opportunity comes around, they snap right back, like immediately. And if you don't have dedicated resources for inspections, dedicated resources for service, dedicated resources for fire alarm, dedicated resources for your contract work, you won't work. And if you're trying to move people back and forth, you'll never get the momentum that you need.” - Russell Becker

At the end of the day, it’s just easier to deploy a “projects-first” model, which is why competitors fall back into it. It’s easier to avoid the headache of so many moving parts and instead seek out the big, juicy contracts that provide large lump sum cash flows for months at a time. Most of API’s competitors aren’t run by well-funded MBAs trying to conquer the world; they’re construction workers who quit their jobs to start their own companies. Most of them make great money as small companies, and some of them go on to build small and medium-sized businesses that can compete with API, but they don’t utilize the same inspection-first model.

National reach/Geo footprint

Another advantage is their geographical reach. They have the broadest footprint in the space, which gives them a greater ability to sell inspections and cater to national customers. With API, their customers can simply contract with them instead of having to deal with multiple companies in different geographical regions.

Low CapEx, high free cash flow conversion

API’s minimal CapEx (less than 1.5% of sales) and working capital needs allows them to generate large amounts of free cash flow. Over the long term they are targeting 80% free cash flow conversion, although they haven’t been clear as to exactly when they will be able to achieve this, they are well on their way. As of the third quarter 2024 they are guiding to around 75% FCF conversion for FY 2024 and it appears they will achieve that. This last quarter they’ve achieved FCF conversion of 92%. Assuming they do $900 million—per guidance— in adjusted EBITDA, they could do $675 million in free cash flow in 2024.

Below you can see their FCF conversion has increased over the last few years.

If they are able to do $675 million in adjusted free cash flow for 2024, this implies the company currently trades at about 15x forward adjusted free cash flow.

The adjustments made to API’s free cash flow reflect one time non-operating expenses related to restructuring, acquisitions, integration and re-organization costs. However, even before these adjustments, which are reasonable, they still produced $520 million in actual free cash flow LTM indicating the company still trades at 19x.

Management

Theres a few key people involved in API’s story.

CEO Russell Becker joined API in 2002. Prior to that he was president at one of API’s subsidiaries, Jamar group. Before that he was a project manager at Ryan Companies. He owns 1.2% of APG 0.00%↑ common stock worth around $123 million which is far more than his base salary of $1.4 million and his total compensation of $10 million. Becker is heavily incentivized both in the short and long term as 84% of his pay is at risk, with short term incentives tied to adjusted EBITDA targets. One thing to note, Becker hasn’t been selling any stock over the last few years even as the stock continued to make all time highs.

Sir Martin Franklin is another key person involved, who is arguably the more important figure here. If you aren’t familiar with Martin Franklin, he’s founded a handful of companies and is known for bringing several companies public via SPAC, including API Group. He has an impressive track record and has been involved in many SPAC IPO’s such as Burger king and MacDermid. He was a really important figure in popularizing the use of SPAC’s. Of course this was long before the SPAC boom of 2021-2022.

There is a good interview here on Masters in Business detailing his life and track record. I highly suggest listening if you’d like to get an idea of just how successful Franklin has been. Franklin founded, Mariposa Capital, Admiral Acquisition Corp, Jarden Corp, Nomad Foods and Element solutions.

He’s been involved in so many start ups and transactions that it’s hard to keep track of them all, however, he’s done a handful of deals that have been huge wins for investors. Franklin owns 12% of APG 0.00%↑ and remains on the board of directors and heavily involved in the company. Although he has been selling stock over the last year ($71 million worth of stock) its really not that large considering his stake worth $1.1 billion.

All in all the 18% of the company is owned by executive officers and directors.

Capital allocation

There isn’t a long public track record for API since the company went public in 2020. However, there is some evidence of intelligent capital allocation. API has divested a handful of their poor performing assets and customers, particularly from the lower margin, cyclical segment of the business.

They’ve instead invested in quality fire safety to build out their higher margin safety segment. As a result of investing in a better revenue mix, along with pricing power and accretive M&A, API has been able to incrementally increase margins, and they think there is still room to grow.

They’ve done this while also deleveraging the company down to 2.4x net leverage ratio. They’ve also authorized a $1 billion dollar buyback program, of which they have around $400 million remaining (4% of market cap).

Return on invested capital is optically low and bogged down by goodwill and debt. This isn’t unique to API. However, we can subtract cash from the the assets, since idle cash isn’t consuming any capital or contributing to the operating earnings of the business, and we can use the adjusted tax rate that management uses of 23% and we would yield an roic of around 7%. I believe returns could be higher going forward as they continue to improve their revenue mix and margins. Below you can see gross margins in their safety segment are much higher than the specialty segment. As they lean into safety the margins will respond.

Again, this company hasn’t been public longer than a few years so I’d like to watch it over a longer time frame in order to make a better judgment concerning their returns on capital. There are many scaled service companies such as Otis Worldwide OTIS 0.00%↑ , Top Build BLD 0.00%↑ and Installed Building Products IBP 0.00%↑ that have similar business economics and characteristics, and yet they are able to pull off higher returns on capital. I think it’s reasonable to assume API could have returns on capital in the ballpark of some of these names (10% - 20%)

Risks

Thinking through how this company could blow up, I think there are a few key risks worth noting.

Changes in regulation: API is dependent on building codes and regulations that drive statutory inspections and service revenue. Although, as a professional in a similar industry myself, in my opinion, it’s more than likely that regulation will increase, not decrease. However, there is always the chance that a law is passed that deregulates some aspect of fire safety that could substantially impact API’s revenue.

Cyclicality in specialty services: Although a smaller portion of their revenue, the specialty segment of their business is prone to cyclicality and economic down turns. Losses and poor performance in this segment can distort API’s consolidated performance and margins, leading the market to place a lower valuation of API 0.00%↑

Poor acquisitions: Every now and then they make large “transformational” acquisitions such as Chubb. While these have the ability to create value they can also destroy value if they pay too much or don’t integrate successfully.

Valuation

Safety will inevitably grow faster than specialty as they focus on growing that higher margin part of the business. The model implies that safety becomes a larger portion of the business (81% - 83% of revenue) by 2030 as specialty revenue grows as a slower rate 3% - 5%, compared to 10% - 15% for safety.

For safety revenue growth, I’m not factoring in another transformational acquisition but instead smaller bolt-on acquisitions combined with some organic inspection growth. I’m assuming their net debt remains at or below their target of 2.5 x adjusted EBITDA.

Conclusion

3-10% may not seem like an exciting return and I would consider passing on this investment if I hadn’t got in a bit lower. I began writing about this company when it was trading at $32 and its already above $37. If the bull case plays out 18% is a very good return, but they would have to get busy to get there. I own a 3% position at around $32 per share. I’d like to own more of this company and I’m confident that they will continue to grow their asset light safety business and customers will continue to buy their inspection services.

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am a APG↓ shareholder at the time this was written

https://nfsa.org/2018/12/05/third-party-itm-reporting/

https://www.ibisworld.com/industry-statistics/number-of-businesses/elevator-installation-service-united-states/#:~:text=There%20are%2030%2C731%20Elevator%20Installation,increase%20of%202.5%25%20from%202022.

I bought a few shares two weeks ago. When I buy new shares, I quickly realise whether it will be a long-term or fluctuating position. I sold APG again after a few days, as it is neither one of the best companies nor does it have many question marks. The market in which they operate is also not particularly fast-growing and the ROIC will take forever, if they manage to become attractive at all. I wish all those who want to invest here in the long term every success, but see it more as a value stock for the medium term.