Checking in on Nubank and Dream Finders Homes

Nubank Brief overview

For those who aren’t familiar, Nubank is a digital financial services company that operates in Latin America that launched in 2013. The oligopolistic nature of the Brazilian banking market resulted in high credit card fees and interest rates. Under these conditions, Nubank launched Brazils first no-fee credit card and the intuitive Nubank app, which became a viral success almost immediately. Nubank then launched various other products such as personal loans, digital bank account, insurance and investment platform.

Nubank’s success has been sort of legendary and they’ve become somewhat of a cultural icon in Brazil, radiating a sort of “bank for the people” aura and representing a financial inclusion and technological ingenuity in a poor country.

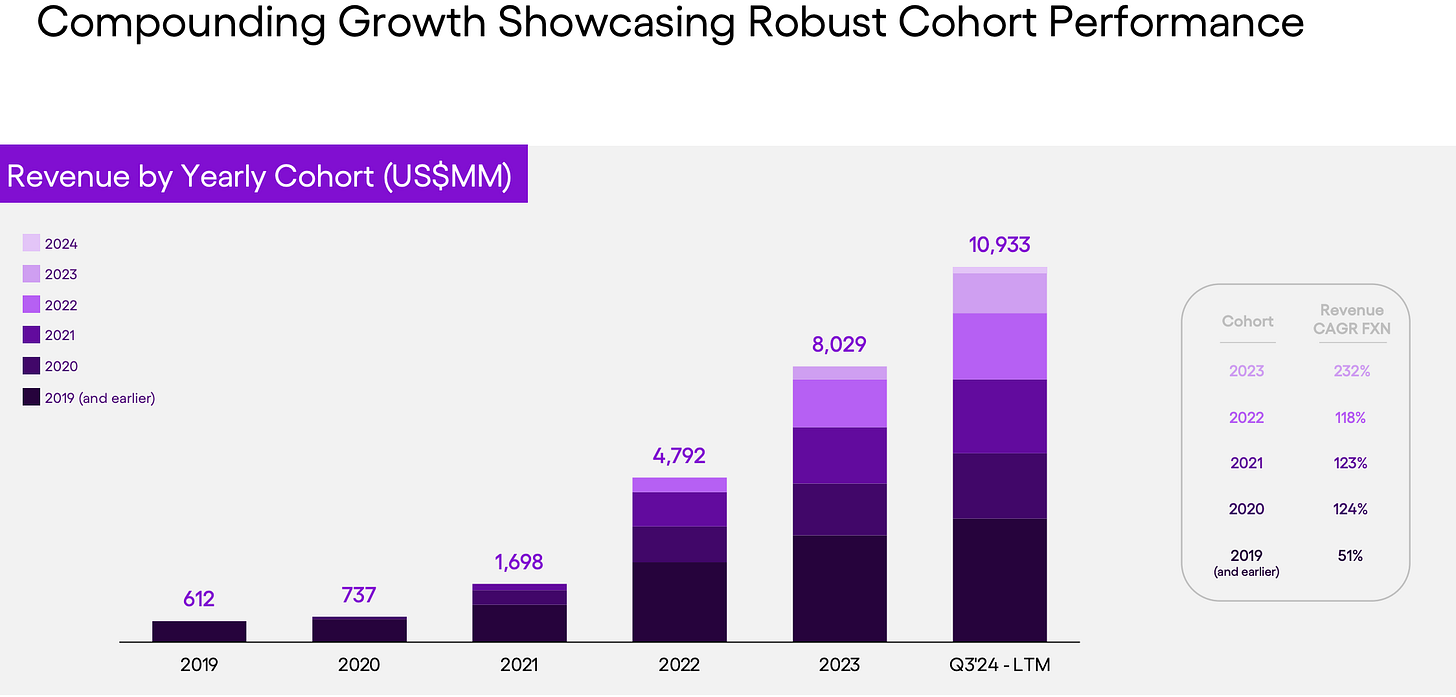

Between 2013 and 2024 they grew their customer count from 0 to 109.7 million , snatching up 56% of Brazils adult population and a growing number of customers in Mexico and Columbia, and a very high activity rate of 84%. Nubank continues to grow their customer and deposit base nicely (currently at $28 billion) and it appears that newer cohorts of customers have higher activity rates and use more Nubank products.

Latest news

What I find particularly interesting is that their customer quality is improving as they’ve moved up market to middle-high income customers. They came into the market as a low end disruptor, picking off unwanted customers from other banks, and now that they’ve earned the trust of the more affluent population, they’re moving up market and taking share from incumbents. In doing this they’re also addressing some of the concerns that they’re exposed to lower income customers, which is a legitimate concern for investors. However, evidence suggests that they’re actually serving more middle and high income customers than one would think. It’s estimated that currently two out of three of Brazilians with an income above 5,000 reais is already a Nubank customer1. The average salary in Brazil is around 3,900 Reais 2 They’ve also launched Nu Ultravioleta, which is an exclusive experience for higher income customers3.

“High income” customers have an income between 5,000 - 12,000 and “SuperCore” represents customers with incomes above 12,00 per month. Together these make up 40% of the entire in revenue pool of Brazil4 and Nubank has set its sights on them.

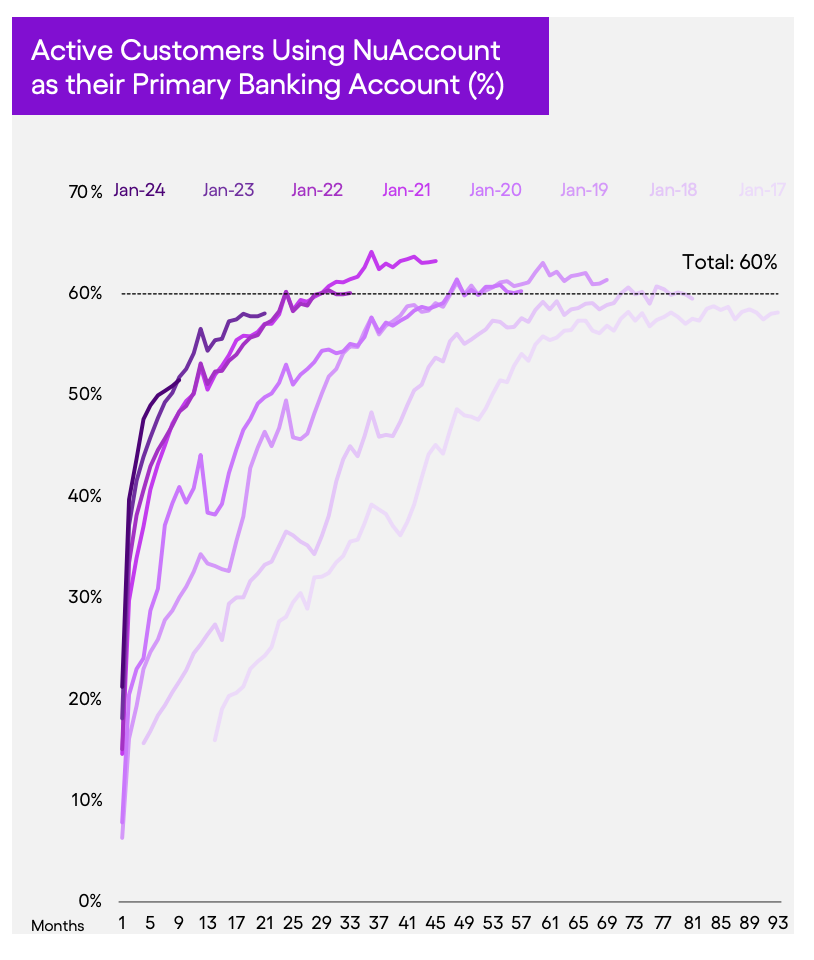

Another thing that I find interesting is that customers continue to increasingly use Nubank as their primary bank account at a faster pace. Below you can see that some of the early cohorts took 5+ years for 50% - 60% to be considered using Nubank as their primary account. You can also see that in more recent cohorts 60% were primary customers in less than 2 years. This is a good indication of the Nubank’s future as this implies people are trading out their traditional accounts for Nubank’s digital platform.

Finally, secured loans are making up a larger position of their overall portfolio which I personally like, regardless of the fact that they flow through the p&l at a lower margin.

Their recent earning release was good in my opinion but the market reacted negatively for a few reasons which I will explain in a moment. But first let’s go over the good things from the report.

Good

Customer growth: Grew 23% year over year to 109.7 million.

Deposits: Grew from 25.2 to 28.3 billion driven largely by Mexico and Columbia.

Monthly average cost to serve per customer: Down to $0.70 from $0.90 the previous quarter and efficiency ratio is down to 31.4% from 32% the prior quarter.

Improving mix: Lending is making up a larger portion of their total portfolio, 27% compared to 24% in previous quarter. Secured lending is also increasing, making up 18% as percentage of originations, compared to 16% in the prior quarter.

Asset quality indicator: 15-90 day non-performing loans continue to improved from previous quarters, dropping to 4.4%, down from 4.5% in the second quarter and 5% in the first quarter. This is a leading indicator which may imply some increased financial stability in Nubank’s customers.

Revenue: Increased 56% year over year.

Net interest income: Increased 63% year over year.

Mexico growth: Added 1.2 million customers in Mexico

Bad

Net interest margin: Down to 18.4% from 19.8%. This is largely due to declining yields on their credit card portfolio, increase in secured lending which is lower yield, and higher rates paid to depositors as they expand in Mexico and Columbia.

Purchase volume: Declined but on an FX neutral basis was actually up. Brazil and Mexico’s currencies have weakened causing a currency headwind.

Monthly APRAC: Declined due to expansion in Mexico and Columbia where the savings account is the primary product they engage with, which generates low ARPAC.

90+ day NPL: Increased to 7.2 %.

All in all I think Nubank is doing well but has also shifted its product mix that seems to reflect a slightly more defensive posture as their portfolio is comprised of more secured lending, which is lower risk and yield. The market doesn’t seem to like this because it’s moving away from a very profitable product and puts pressure on NU’s net interest margin. However, In their Q3 earnings call the CFO explained that they are trying to “add additional asset classes without necessarily diluting the unit economics of the prior ones”. He also stated that their credit products have “phenomenal unit economics” and that they are “in no way moving away from those asset classes (credit cards)”. I think this just reflects a broader strategy of diversification and risk management, both of which are good.

Conclusion

I expect to hold Nubank for the foreseeable future and I sleep well at night owning a company first mover advantage and where 94.6% of the employees own NU 0.00%↑ shares or share-based incentives and the CEO owns a 20% stake.5 I also think they will continue to take market share in the countries they operate in and push into other product categories successfully.

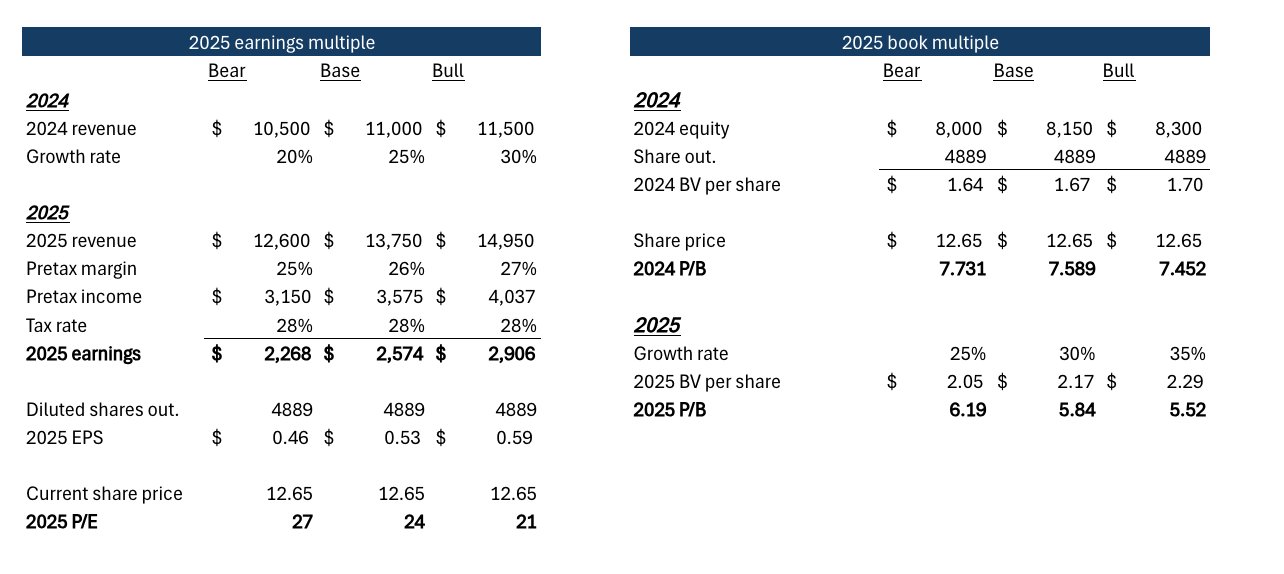

Nubank currently trades at 24x next years earnings and 5.5x next years book value and which is still pretty expensive, at least on a book value basis. For this reason I/m not adding at this moment. I’d love to see NU test $9 again and I would consider adding.

Dream Finders Homes

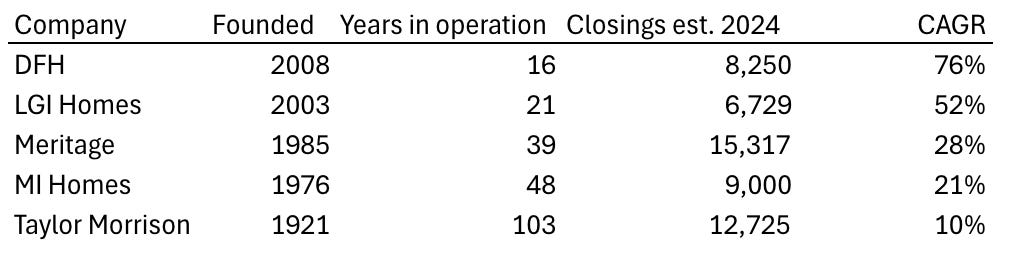

Dream Finders Homes is land light home builder with an exceptional founder/CEO, Patrick Zulupski. Patrick founded the company in 2008 and has grown the company at a breakneck speed both through organic and inorganic growth. In the early days he took the company from closing 27 homes in 2009 to 261 homes by 20126, a staggering near 10x growth in just a few years. In those days DFH was growing so fast that Zulupski’s partner became stressed out and sold his stake and left. I find this story interesting because it speaks to a reality that many men wouldn’t care to admit. Some of us are just build different. Some of us are built for business and built to handle extreme stress and growth and others aren’t. Patrick seems to be.

The company went on to grow dramatically over the next decade and is now expected to close 8,250 homes in 2024. This is impressive considering some competitors are closing a similar number of homes and yet were founded decades ago. Below is a comparison of a few competitors that have a similar sized home building operation as DFH. The CAGR figure represents how fast they’ve scaled over the period they’ve been in operation.

I say all this to say that Zalupski understands the importance of scaling the business. As home builders get larger they’re able to spread design, management and and production costs over a larger number of homes, affording them more cost efficiency and higher margins. They also have a lot of bargaining power with suppliers and manufacturers that allows them to source materials at lower incremental costs than smaller competitors. This is why some of the largest builders like D.R. Horton, Lennar and PulteGroup only seem to be getting more efficient as they’ve become larger over time. Profit margins for these companies are much higher than they were in the past. For example, during the 2022 covid building boom D.R. Horton had a net profit margin of around 17.5%, which was 65% higher than it was at its peak in 2005, during the housing boom before the great financial crisis. I do think that DFH will have profit margins in the mid teens and gross margins in the mid 20’s as the company scales and matures.

So Patrick, I think, understands the importance of size, and has grown DFH intentionally through a combination of organic growth and strategic acquisition. Over the last few years DFH has been very acquisitive—snatching up competitors and building out their regional density in key markets like Florida and North/South Carolina, Texas, Georgia and more. Patrick mentioned 7 that when they enter new markets organically it’s typically because developers come to them with favorable terms. Otherwise they acquire their way into new markets. They also recently entered the Phoenix and Charleston, Greenville and Nashville markets which I think is a great opportunity for them.

Lastly, DFH 0.00%↑ is set to be included in the S&P 600 small cap. While this provided a short term boost to the stock price, it should be obvious this doesn’t change anything fundamental about the company. It simply gives DFH 0.00%↑ more exposure to passive investors and may give off the perception of stability. Nevertheless, its good sign.

There are also good signs of capital allocation. Dream Finders Homes has modeled itself after NVR and considers them to be the “gold standard” for builders. Patrick has signaled to shareholders that he intends to maximize the economic value per share uysing the NVR playbook—buying back DFH 0.00%↑ stock whenever it’s trading at a discount.

“we remain committed to our capital allocation strategy, which includes buying back shares when we believe there is an attractive disconnect between the market price and the intrinsic value of the shares. We will remain opportunistic in all facets of growing the per share returns of DFH.”

Patrick Zulupski Q3 2024 earnings press release

This is music to my ears. At the end of the day what matters most is a CEO’s ability to pull the correct capital allocation levers so as to increase the value per share in the most efficient way possible.

Conclusion

Dream Finders Homes remains one of my favorite stocks and I believe has a bright future ahead. Regardless of the short term headwinds in the industry, there remains a shortage of housing and a housing affordability problem both of which can only be fixed by increasing the supply of new homes into the market.

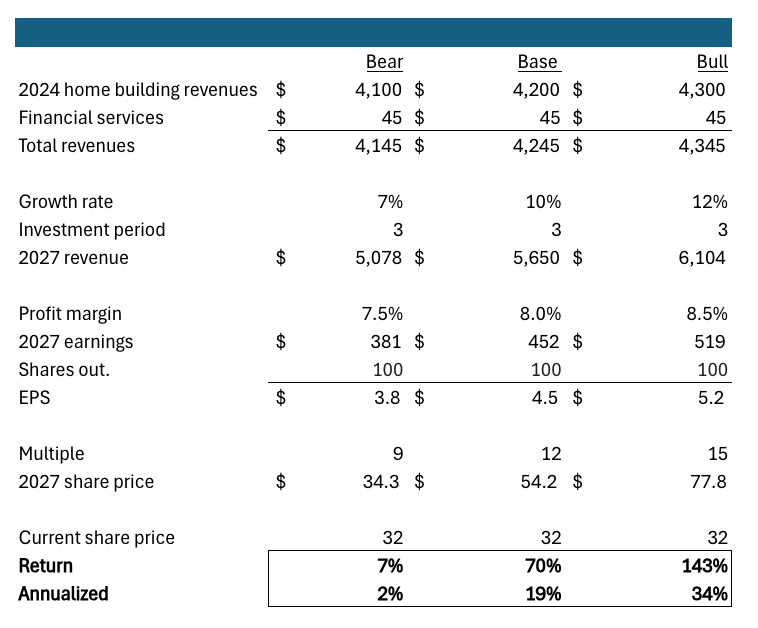

The valuation isn’t bad either and I’ve continued to add as the stock dips below $30. The following valuation doesn’t consider a huge recession, it factors in a some what slower housing market and similar growth to what DFH experienced in 2023 and multiples that are appropriate.

Thats all for this week, thank you for reading and consider subscribing if you haven’t already. Thanks!

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please do your own research and consult a financial advisor before buying or selling any securities.

Full disclosure: I am a DFH 0.00%↑ shareholder at the time this was written

Livia Chanes, CEO of Nubank Brazil. Nu Videocast

Trading Economics average Brazilian salary

Livia Chanes, CEO of Nubank Brazil. Nu Videocast