Construction industry overview

Definition

Construction refers to the erection, maintenance, and repair of any residential dwelling, commercial dwelling and public or private infrastructure.

Global overview

Im a general building contractor who specializes in residential remodels. I think this industry is often overlooked and thought of as unimportant, unsexy, unintelligent, and low paying work. In reality is honest work that pays very well and it’s a very important part of the global economy. Global construction GDP was about $100 trillion in 2022 it’s estimated that construction made up approximately 10.5 % of it, or 10.5 trillion dollars.

I’ve seen different estimates of the size and growth but it seems like most estimates predict the market to grow at 5-9% per year and be worth roughly 14-16 trillion dollars by 2030.

The total cumulative spend on construction over the next decade is estimated to be roughly 135 trillions dollars.

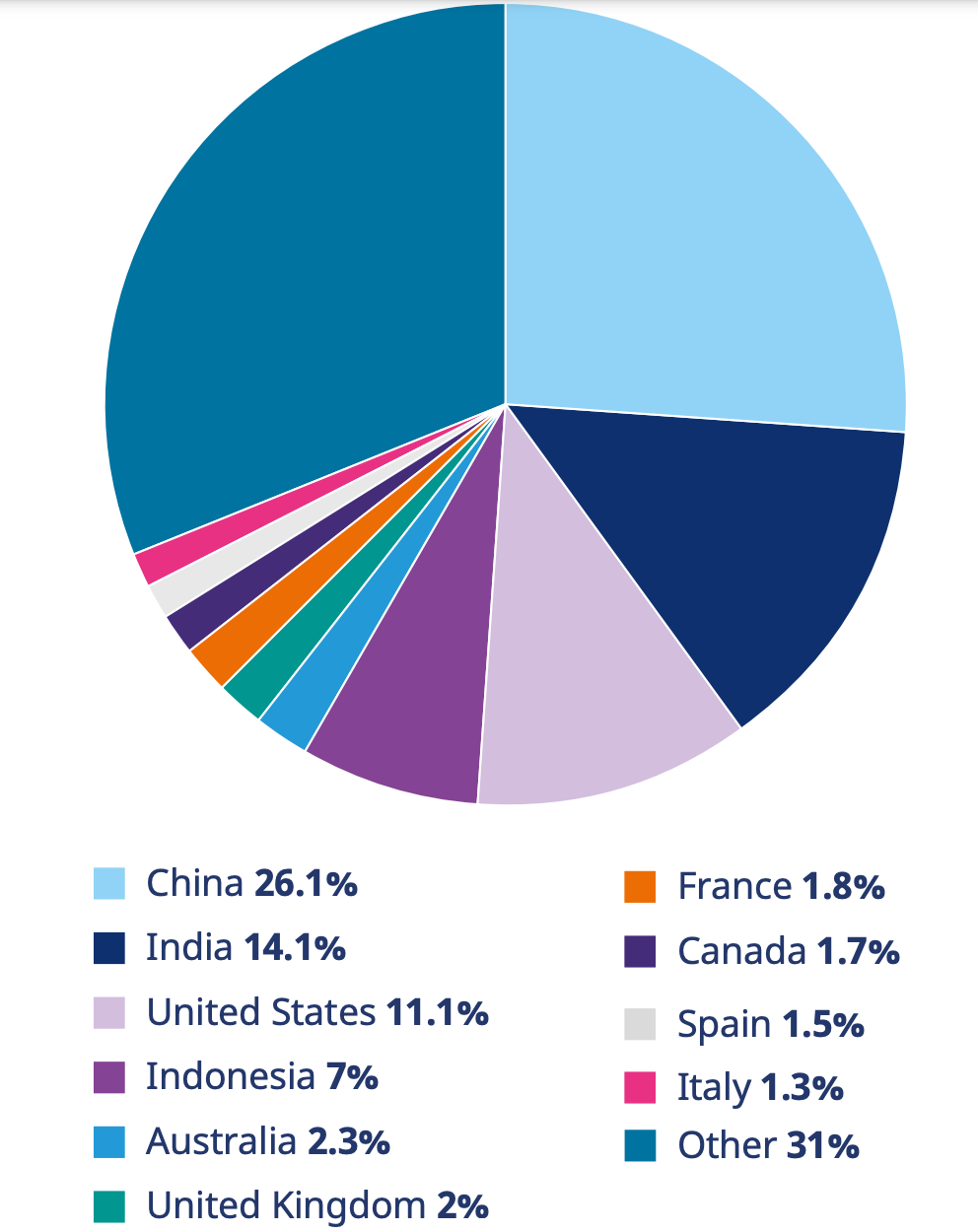

Countries

China makes up the largest portion of global construction spending at 26% followed by India at 14%, the US at 11% and Indonesia at 7%. Together these make up about 58% of total construction spending.

By 2030 the US is expected to become a larger portion at 14% of while china will shrink to 24%, India will shrink to 7% and Indonesia will shrink to 4%.

U.S. Growth

Growth in US construction spending will likely come from building and maintain infrastructure, new homes, renewable energy, green construction, increased industrial capacity and the re-shoring of U.S. manufacturing.

A few of these are political issues that have bi-partisan support. Almost everyone agrees that there is a housing shortage and there needs to be more homes built and infrastructure needs to be updated and maintained. Renewable energy and green construction is going to become an important part of the construction industry as building codes are updated and renewable energy is required in residential zones and individual homes. Tensions with between the US and china have highlighted the need for increased manufacturing capacity here in the US which may drive the growth of industrial construction.

The biggest growth drivers in the immediate future will probably be infrastructure and residential homes.

Sectors

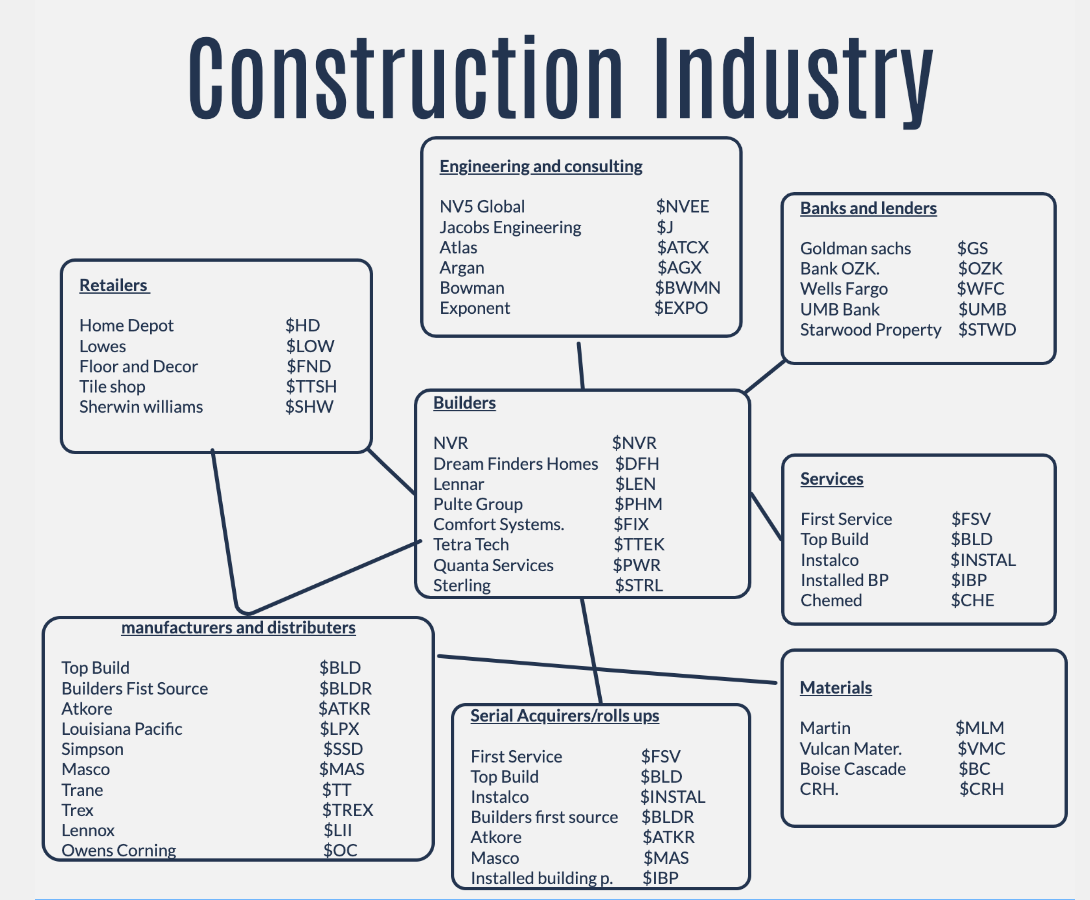

The US construction industry can be divided up into a few different categories. To sum it up you have materials suppliers who produce the raw materials, building product manufacturers, builders, engineering and consulting firms, and then service based business. Oh and of course the banks and lenders who finance everything. There is some overlap between some of these categories but they are fairly straight forward businesses that have somewhat simple and understandable products and services.

Below is a rough sketch of the different parts of the industry and some of the different public companies in each.

I’ve also added a section for serial acquirers in case anyone is interested in the companies that have a more acquisitive strategy. Instalco is not a U.S. company but its definitely an interesting Swedish serial acquirer.

There are a few more sectors that are smaller and don’t quite fit into the list such as specialty industrial machinery and equipment manufactures and software companies.

Specialty industrial machinery and equipment companies may have some construction exposure because they design different tools and applications used in construction, this would include companies like

Illinois tool works ITW 0.00%↑

Graco GGG 0.00%↑

CSWI industrials CSWI 0.00%↑

In software you would find a few companies that help organize the construction process for builders and engineers.

Autodesk ADSK 0.00%↑

Bentley systems BSY 0.00%↑

Procore PCOR 0.00%↑

Margins and metrics in each sector

I guess the next question question is which industries have higher ROIC and margin profiles? This is a difficult question to answer because some of these sectors have businesses that are not easily comparable.

Home builders have a tighter range of margin and roic profiles because they don’t differ so much in their strategies or products, however some manufactures and infrastructure builders are going to have very different capital requirements and margin profiles.

Regardless, I’m going to do my best to show what kind of margins you’ll find in each. It important to note that these figures were taken from 2022 so they are probably a little higher than normal because the industry as a whole had higher margins and returns over the last few years. I analyzed about 10-20 companies in each category.

Product manufacturers and distributors

This category generally refers to companies that manufacture building products and or distribute them. It includes companies like Atkore ATKR 0.00%↑ , Louisiana pacific LPX 0.00%↑, Trex TREX 0.00%↑ Top Build BLD 0.00%↑ and Simpson manufacturing SSD 0.00%↑ . The different products manufactured in this category include composite materials, artificial wood products, concrete, insulation, electrical supplies, wood paneling, lumber and other structural wood products, HVAC products and structural connectors. Many of these products are sold through online or retail channels.

Avergage gross margins: 30.92%

Average profit margin: 12%

Average ROIC: 19%

Home improvement retailers

This group consists of companies that we’re all more familiar with such a Home Depot HD 0.00%↑, Lowes LOW 0.00%↑ and Floor and Decor FND 0.00%↑. Many of these companies have lower profit margins, as many retailers do, but higher inventory turnover and higher returns on capital. These companies sell virtually all building products associated with the construction of homes and commercial buildings as well as infrastructure.

Average gross margin: 44%

Average profit margin: 8%

Average ROIC: 28%

Home builders

Home builders are pretty self explanatory. The generally erect new homes to be sold to prospective home buyers. This includes companies like Dr. Horton DHI 0.00%↑ , Dream Finders Homes $DFH, NVR 0.00%↑ and Lennar LEN 0.00%↑ .

Average gross margin: 28%

Average net profit margin: 13%

Average ROIC: 24%

Other builders

I separated this group from home builders because they are typically firms that engage in more commercial and public work such as infrastructure projects and commercial construction. This includes large electrical contractors like Quanta PWR 0.00%↑ , Sterling construction STRL 0.00%↑ , and Comfort systems FIX 0.00%↑.

Average gross margin: 16%

Average net profit margin: 6%

Average ROIC: 9%

Materials producers

This category consists of companies that produce raw building materials such as lumber, concrete, sand, stone, and so forth. This includes companies like Vulcan Materials VMC 0.00%↑ and Boise Cascade BC 0.00%↑

Average gross margin: 29%

Average net profit margin: 11%

Average ROIC: 16%

Engineering and consulting

This category is a small group of companies that focus more on consulting and engineering, they might not be totally committed to providing engineering solely for the construction industry but they at least have significant exposure to it. This includes companies like Jacobs Engineering J 0.00%↑ , and Exponent EXPO 0.00%↑

Average gross margin: 32%

Average net profit margin: 12%

Average ROIC: 14%

Cyclicality of the construction industry

I guess I should start by saying not all construction is equal because while most areas of construction are more cyclical, there are some companies that are a lot less sensitive to interest rates and the over all macro economic environment.

It obvious that home builders like DHI 0.00%↑ are typically going to sell more homes and earn more profit when mortgage rates are low and buyers are incentivized to buy.

On the other hand certain service companies like Chemed CHE 0.00%↑ which owns Roto Rooter, a plumbing and water mitigation company, may not be as affected by interest rates because most of the work they do is emergency type work (drains, toilet clogs, floods). Another example of another service based company like is FirstService FSV 0.00%↑ which operates a large restoration business that mitigates damage from emergency type incidents like floods and fires and so forth. I used to do this exact job. Its all insurance paid and emergency work.

Trane Technologies T 0.00%↑ is also probably not as cyclical because HVAC parts and supplies are typically less discretionary because they are essential products for modern commercial and residential dwellings.

There is also a few home builders like NVR NVR 0.00%↑ and Dream Finders Homes DFH 0.00%↑ who have internal strategies that help mitigate the risks of the business cycle. They have an asset light strategy that allows them to outsource more risky activities like owning and developing raw land which leaves them with less assets and more cash on the their balance sheet, which can come in handy during an economic down turn.

I’ve done a few write ups on Dream Finders Homes DFH 0.00%↑ which I personally own. I would love to own NVR 0.00%↑ as well at the right price.

Which sectors are my favorite?

I prefer the home builders, retailers and service based businesses simply because they are a bit more predicable and and understandable. Regardless of the fact that I own a construction business, I don’t understand some of the civil engineering and infrastructure companies on the list and I’m ok with that, I know a few areas very well and that’s all I need to know.

Out of all the stocks I’ve mentioned above I own Floor and Decor FND 0.00%↑, Dream Finders Homes DFH 0.00%↑ FirstService FSV 0.00%↑ and Lowe’s LOW 0.00%↑

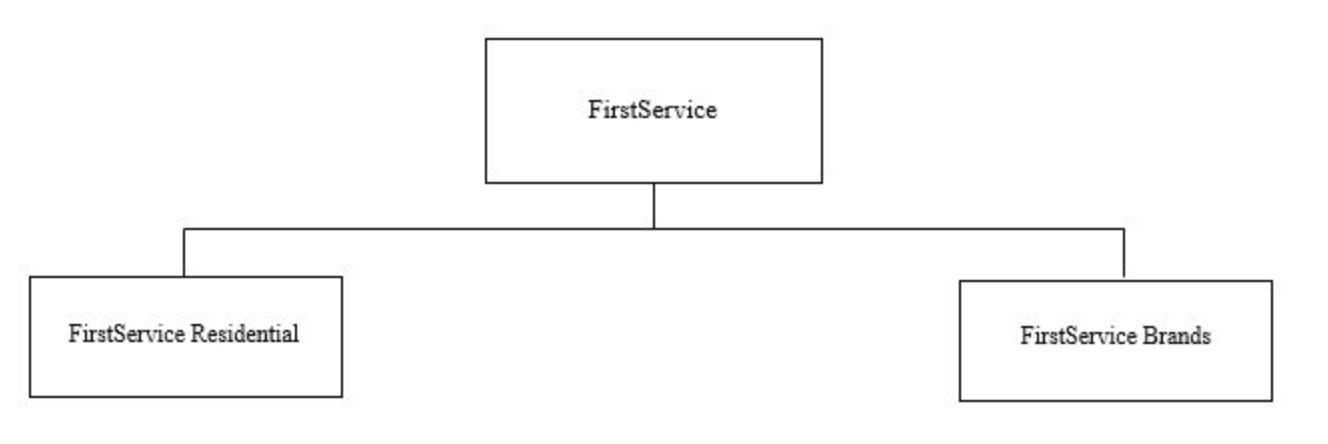

FirstService is a platform serial acquirer that slowly acquires its way into adjacent markets in the real estate services industry. So far they have built a massive restoration business within their FirstService Brands segment. They’ve also built a large property management business in their FirstService Residential segment. They basically acquire a business with a strong brand and then roll up smaller companies into those established brands. Some of the industries they are in are very stable.

Floor and Decor FND 0.00%↑ is the number one low cost provider of hard surface flooring and accessories. They’re taking market share from smaller mom and pop shops and the major home improvement retailers on selection. They offer way more selection at better prices which has created a one stop shop for this niche area of construction.

DFH 0.00%↑ is a home builder that is aiming to be the next NVR 0.00%↑ and so far they haven’t disappointed me. They have made a few acquisitions that have allowed them to increase their presence in their core markets like Florida and Texas, and they’ve also navigated the asset light building strategy well since going public. The founder has almost his entire net worth in the company plus his family and friends are invested.

Lowe’s LOW 0.00%↑ is just a position I own because I admire their commitment to share repurchases, they’ve essentially reduced their shares outstanding by 45% since 2014. They pay a nice growing dividend as well.

Hope this was helpful and gave you some ideas.

Thanks for reading!