Double Down Interactive

A deep value I-Gaming company

Key information

Investment type: Deep value

Ticker: DDI 0.00%↑

Market cap: $490mm

Net cash: $380mm

Net cash per share: $7.70

Net Current asset value per share: $6.30

Current share price: $9.89

P/NCAV: 1.58x

P/E: 4

P/FCF: 3

High level overview

Double Down Interactive ( DDI) was founded in South Korea as a web based casual game developer that was originally named The8Games Co. They have evolved to focus primarily on social casino and gaming for mobile applications and have become a leading online gaming company.

Social casinos don’t use real money, nor do they offer real cash prizes, but instead they use virtual currency are intended for entertainment purposes. DDI was an early pioneer in social gaming, launching one of the first social casinos in 2010 named ‘DoubleDown Casino.’

They have also acquired a handful of other highly successful games and rebranded them as Double Down Classic Slots (2017), Double Down Fortnox (2018)

The most recently acquisition, SuprNation AB (2023), is an I-Gaming company (gambling) that uses real money and has real cash prizes. As a result they now operate 3 real-money I-Gaming sites in Western Europe where they are licensed to operate. I will elaborate a bit more on this later.

DDI distributes its games through various platforms, including the Apple App Store, Facebook, Google Play Store, and Amazon Appstore. Notably, a significant portion of their customer acquisition happens through Google and Facebook.

Why it’s so cheap?

Lawsuits

Although Double Down Casino is not a true casino and doesn’t offer real-money gambling or cash prizes, they were still involved in a few lawsuits, one of which alleged that players “wager to acquire more chips than they otherwise would need to buy.” So, although players receive free chips to play, additional chips can be purchased in-app, which, according to Washington State, constitutes gambling. DDI settled out for $415 million, and the final payment was made in 2023. There are also 3 lawsuits have not amounted to anything yet.

Q3 2024 results

In Q3 2024, DDI reported earnings, and the market dumped the stock, which is now down 39%. FX headwinds and higher-than-expected G&A expenses for SuprNation were not the results the market was looking for. The stock now trades at just 3.95X earnings and 3X free cash flow, leaving me wondering if there is an opportunity here.

General post-covid decline in users/revenue

DDI operates a freemium model where users are able to play for free but can pay for certain premium features and in-app purchases. They have 117 million total downloads and 1.4 million monthly active users, which is down from 1.7 million the prior year. Unfortunately, they have lost monthly active users every year since going public in late 2021. This is partially because DDI benefitted greatly in the 18 months leading up to DDI’s IPO due to stay at home policies during Covid-19.

I think this decline can also partially be explained by the awful customer retention inherent in the mobile app market. An old article by Andrew Chen, Andreessen Horowitz partner, explains this pretty well. “Most mobile apps lose 77% of users within the first 3 days.”1

It seems that users tend to take a sort of ‘fitting room’ approach, They download many apps, try them on, keep what fits and then discard the rest.

Revenue picks back up

Despite this decline in users, they have been able to effectively monetize their user base at higher rates and in turn increase their most important performance indicators, such as average revenue per user and payer conversion rate. Their payer conversion rate, which is the percentage of monthly players that make at least one in-app purchase, has increased from 5.2% in 2019 to 6.7% in 2024.

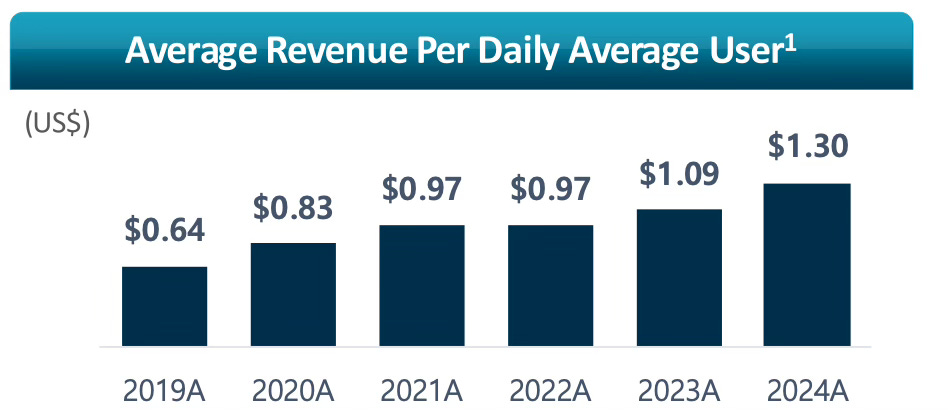

Below you can also see that their revenue per daily active user has more than doubled since 2019. So while users have declined in the post-COVID era, revenue per user has increased, which translated into revenue growth in 2024, after two years of decline.

They are able to monetize their players at a higher rate than peers due to collecting data from customers and finding creative ways to engage and retain customers. They have a process for testing player behavior and predicting whether a feature will prove to add to monetization.

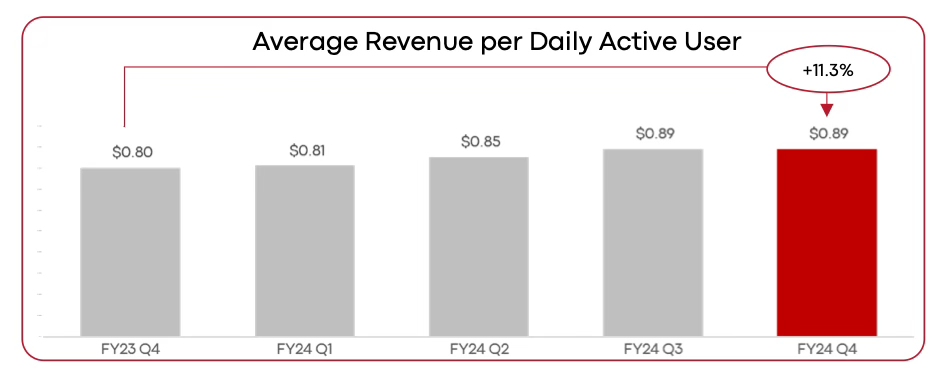

A quick comparison of a larger competitor like Playtika reveals that DDI is able to monetize their users more effectively. Below you can see that Playtika is only able to generate $0.89 per user.

Market opportunity

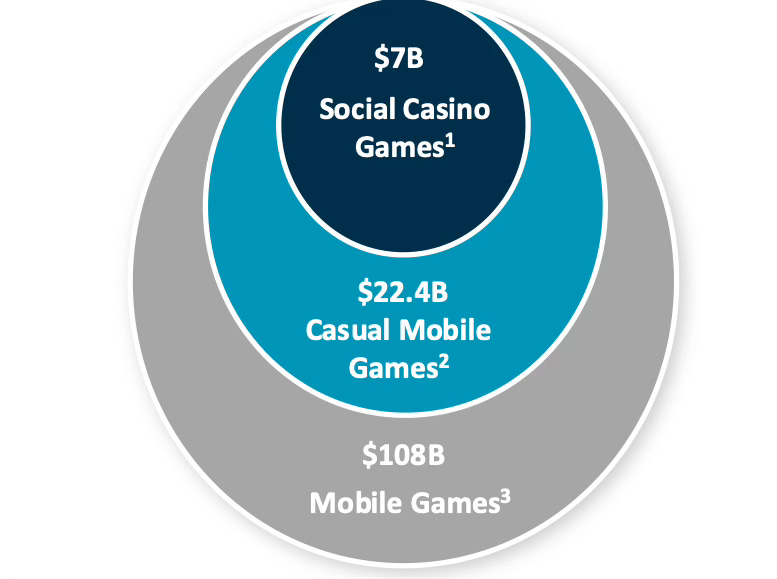

Although the social casino is a smaller niche market with a $ 7.5 billion addressable market, they have been able to increase their addressable market via acquisition, and they plan to continue doing so going forward.

I-Gaming

Their acquisition of SuprNation gave them entry into the I-Gaming industry. They paid $ 36.5 million for SuprNation, which was 1.3x sales at the time, or roughly 1x forward sales. This acquisition gave exposure to the UK and Sweden, which are highly regulated but stable markets for I-Gaming. SuprNation’s revenue grew 39% in 2024, implying strong I-Gaming demand in these markets.

Their serviceable I-Gaming market opportunity is about $ 25 billion, of which $ 405 million is derived from the markets they already operate in Sweden and the UK. They intend to continue pursuing market share growth in the UK and Sweden, but they also believe they are able to expand into Italy, France, Germany, the Netherlands, and Spain.

A pile of cash, what is it worth?

DDI currently has a net cash position of 380 million (334mm cash + 80mm short term investments - 34mm debt).

DDI’s net cash is roughly 78% of the current market cap (487 mm). DDI is trading at 3X free cash flow (32% FCF yield!)

This is a large amount of cash and one must ask why a company growing its revenue per user, expanding it margins is trading this low? I believe the concerns noted in the beginning of this article best explain the low valuation.

The lawsuit startled investors who are concerned it could happen again.

Decline in monthly active users since pandemic

Currency headwinds and higher expenses for SuprNation.

What will they do with the cash?

It’s hard to say exactly what they will do with all this cash. Management has said that they intend to focus on growth through acquisition, and this makes the most sense if acquisitions are priced well and accretive to shareholders.

They could also theoretically use the cash for dividends or buybacks. Buybacks in particular would be somewhat limited and less flexible since the majority of shares are already held by institutions, and shares available for trading are low.

Unfortunately, they have historically avoided buybacks and dividends. Instead, they prefer to just hold cash and look for opportunities for inorganic growth.

Catalysts/ Growth avenues

There a few different catalyst in my mind

I-Gaming: could provide a large runway for acquisitions and faster growth for DDI going forward. Accretive acquisition, particular in the I-Gaming sector, could prove to be beneficial for shareholders.

Recession: This may sound counterintuitive, but research has shown that during times of economic hardship, people tend to spend more on luck based gambling.2 3 This obviously needs to be studied in more depth, and it’s certainly irrational behavior, but it is indeed human behavior. People feel financially squeezed so they buy a lottery ticket thinking it will fix their financial problems. NOTE: Although only 10% of DDI’s portfolio is real-money I-Gaming, it’s growing much faster than the rest of the company.

Risks

Competition: Mobile gaming is very competitive, and there is no shortage of gaming companies. Playtika, EA, Take-Two, Tencent, Gravity, Light and Wonder, and many others compete with DDI on some level. Then there is competition from countless small-time game developers. DDI operates in a very competitive market (mobile apps) with very low barriers to entry, and anyone with $50k - $100k can create an app and begin advertising it on Facebook.

Double Down Casino accounts for 96% of revenue. If they fail to keep players engaged or payer conversion decreases, it would spell trouble.

Their social casinos are free to play and therefore all revenue I derived from the 5% -6% of players who choose to pay for new chips and in-app purchases. This number has increased but it still represents a concentration risk.

Low inside ownership. Insiders own less than 1%. 96% of the company is held by a few entities, which implies low float and potential stock price volatility.

Stic Special situations fund, a private equity special sits/restructuring fund, holds 20% of DDI shares, acquired in 2017.

Bryant Wiley, chairman and CEO of B. Riley ($RILY) holds 8.9%

DoubleU Games Co. is DDI’s parent company (public on Korean stock exchange). They hold a controlling stake of 67%

Legal proceedings: Although one of the lawsuits has been settled, there are three additional lawsuits filed in Alabama, Kentucky, and Tennessee, none of which can be predicted in terms of the outcome and none of which have amounted to anything yet.

Valuation

DDI is cheap, but it’s not quite cheap enough to be a “cigar butt” investment. The net current asset value per share is $6.30 (Current assets - liabilities - Non-controlling interests), and the net cash value per share is around $7.70. These are below the current $10 share price.

However, the company doesn’t appear to be in any real danger of bankruptcy, margins are expanding, and the assets are generating incrementally more revenue per user. Therefore, it makes more sense to value this company based on future earning potential rather than the net asset value.

Assumptions:

Growth is very modest in 3% - 7% range, bull case assumes another accretive acquisition, bear case does not.

Margins remain . This is a function of getting more revenue out of fewer customers.

End multiple between 5x - 10x. Within their normal range. Competitors such as Playtika, Light and Wonder, have much higher multiples that average between 10x - 20x.

Conclusion

This is definitely buy low and sell at fair value kind of value stock. It offers downside protection and some upside potential. However, there is nothing about this company that screams “quality buy and hold”. I personally don’t like the industry and the extremely competitive environment and low barriers to entry.

I’m going to pass on this one for now, however, this isn’t a final decision and I’ll likely revisit it later, especially if the company trades down closer to its liquidation or net cash value.

Disclaimer: Nothing I say should be taken as financial advice. I am not a financial advisor. None of my financial models should be taken as buy or sell signals. Some stocks I discuss are very risky. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am not a DDI 0.00%↑ shareholder at the time this was written.

https://andrewchen.com/new-data-shows-why-losing-80-of-your-mobile-users-is-normal-and-that-the-best-apps-do-much-better/

https://www.greo.ca/Modules/EvidenceCentre/files/Capacci%20et%20al%20(2017)_Are%20consumers%20more%20willing%20to%20invest%20in%20luck_final.pdf

https://www.frontiersin.org/journals/psychology/articles/10.3389/fpsyg.2017.01247/full

Interesting writeup, thanks! - just wanted to note this:

"Their serviceable I-Gaming market opportunity is about $ 25 billion, of which $ 405 million is derived from the markets they already operate in Sweden and the UK."

Doesn't tell us much, online casinos are a dime a dozen and there is no reason to see why this specific one will suddenly gain market share

That's not to say it can't be a good investment at the right price though!

Good article, but doesn't mention the ongoing lawsuits in three other states similar to the Washington one?