Lindbergh $LDB.MI

A unique logistics business with an HVAC roll up on the side.

Overview & key details

Ticker: $LDB.MI (Milan)

Share price: EUR 3.96

Market cap: EUR 38 million

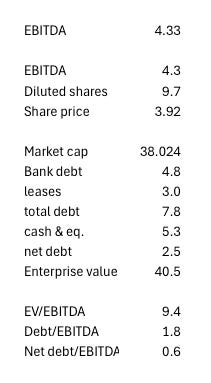

EBITDA: EUR 4.3 million

EV/EBITDA: 9.4

Forward EV/EBITDA: 7.3

Potential 3 year upside: 53% - 190%

High-level summary

Lindbergh S.p.A. is an Italian company specializing in innovative logistics and waste management, all of which are accessed and managed through its cloud-based T-Linq application. The company also entered the HVAC maintenance and service market and has been consolidating the fragmented market in Italy.

Why this opportunity exists

Despite being on the radar of a few microcap investors, Lindbergh is not well known. It remains an obscure Italian microcap with a small hodgepodge of niche businesses. The company has also undergone a slight transformation from being primarily a logistics business to a roll-up, whereby HVAC acquisitions will drive most of the growth going forward. The legacy logistics businesses are also in a slow season which has put pressure on the stocks price. The stock has gone nowhere for a year and could outperform over the next few years.

Evolution to Italian HVAC leader

The best way to think about the company, in my view, is to divide the history up into three chapters.

Founding and early diversification (2006-2020): This chapter spans the period between the founding by Marco Pomè and Michele Corradi and the IPO. Although it was Initially established as a logistics consultancy, the company quickly moved into operations and launched a waste management company (2010), an overnight logistics services business (2013), and a Network Management unit (2015). The company also entered into a joint partnership in connection with its initial entrance not the French market.

Public Listing and strategic pivot (2021-2024): The went public and began trading on the Euronext Growth Milan (EGM). The IPO marked a new chapter for Lindbergh as it increased the companies liquidity and opportunity for Growth. The company acquired a French business (Lindbergh) and launched full logistics, delivery and MRO company in the French market. A more significant development came in 2023 when Lindberg entered into the HVAC market. This marked a “turning point” for Lindbergh as they aggressively began acquiring HVAC installation and maintenance companies with a new goal to become Italy’s #1 Installation and maintenance HVAC company. Lindbergh also divested the night-delivery portion the French business which, despite best efforts, remained largely unprofitable.

Italian HVAC aggregator (2025 onwards): Looking ahead, Lindbergh made another strategic pivot to focus firmly on becoming the leading HVAC player in the Italian equipment service and installation sector by acting as an aggregator in a highly fragmented market.

Segment and market overview

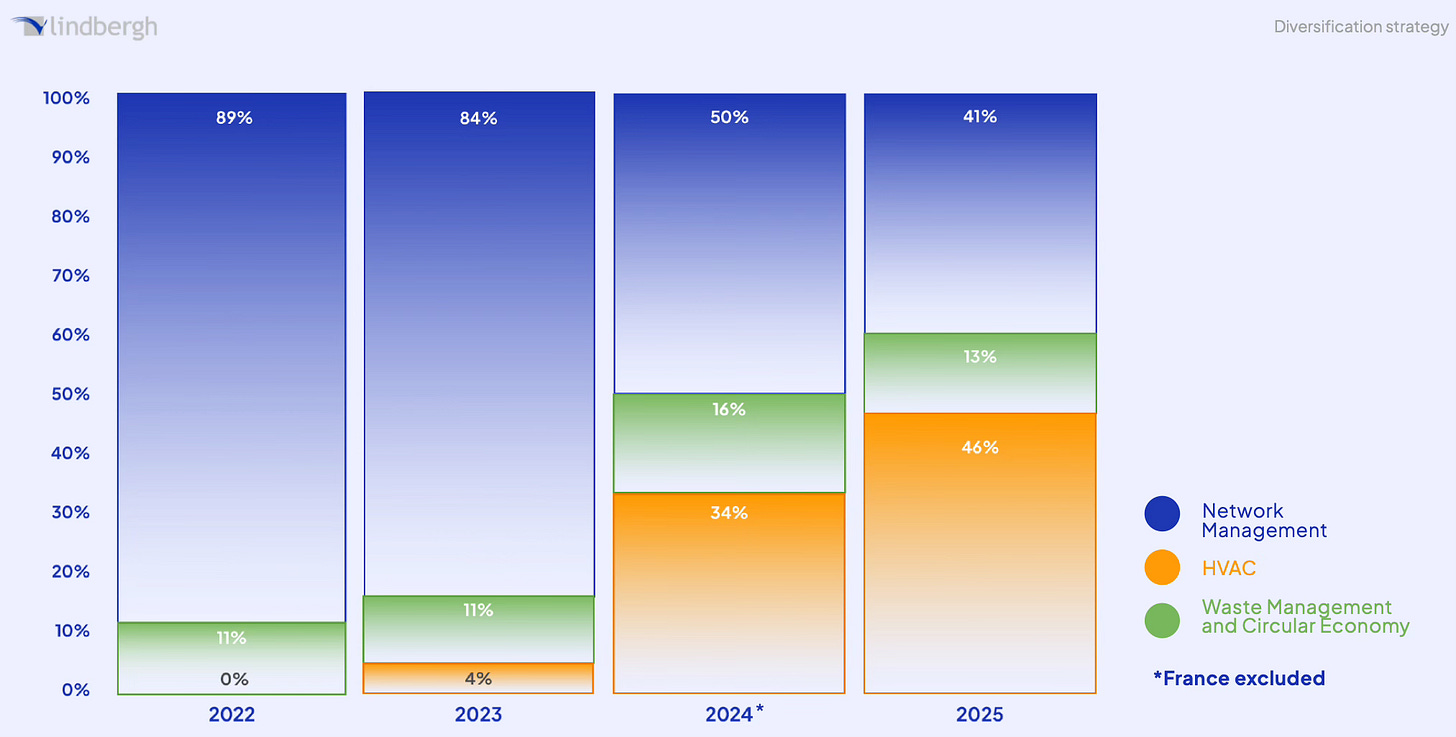

92% of revenue is derived from Italy, and the other 8% from the EU. Lindbergh has three segments: Network Management, HVAC, and Waste Management, and Circular Economy. The company’s revenue mix has changed dramatically over the last few years due to divestitures and investments in HVAC.

I’ll briefly summarize the segments

1. Management network (logistics)

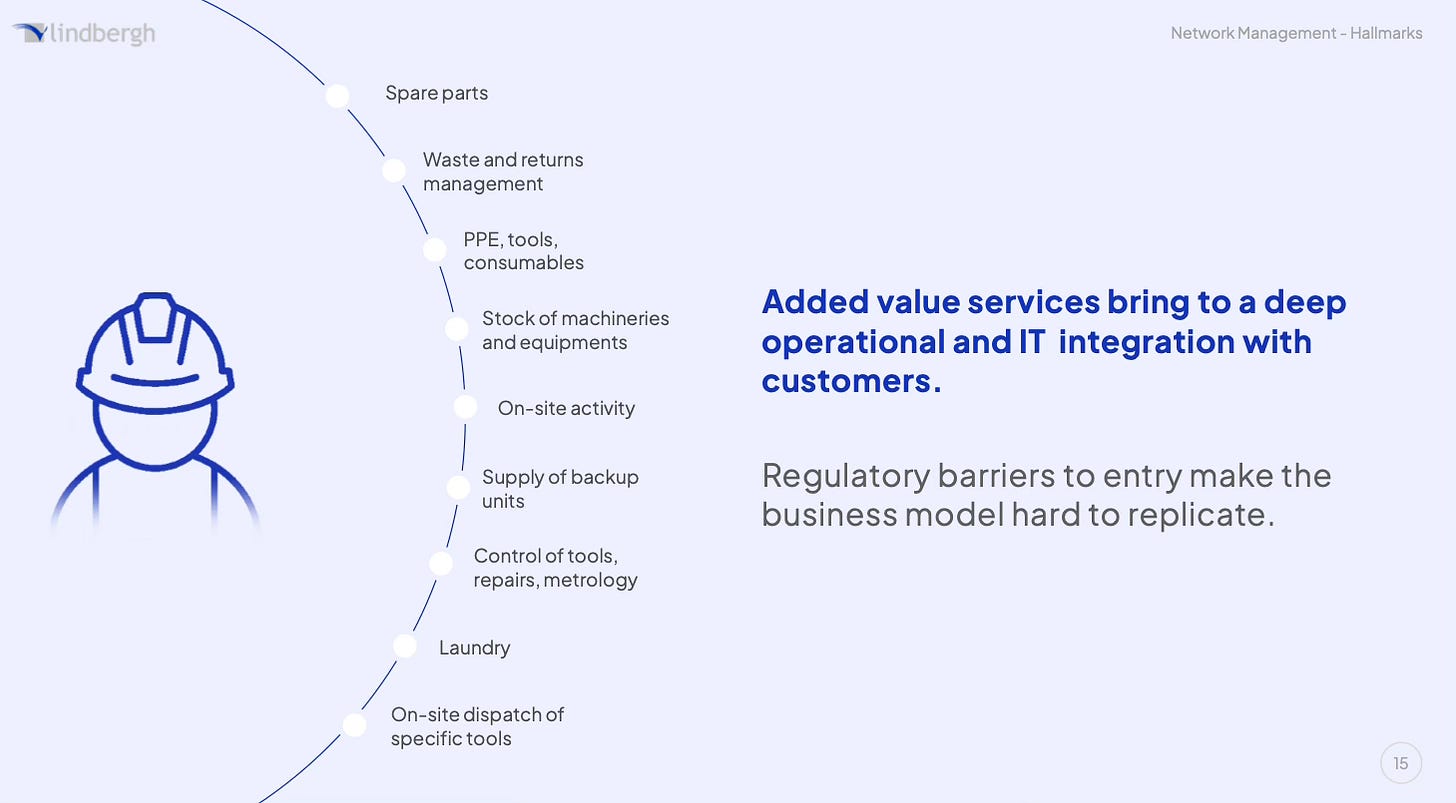

The segment offers unique, value-added logistics services to customers across various industrial sectors, in which they enter into multi-year contracts with their customers.

These services are primarily provided to service engineers and technicians who provide work for large companies and do repairs and routine maintenance in the field. These technicians often need to make supply runs and carry out small tasks that put a drag on the productivity of their overall work.

The simplest example of this would be an industrial service technician working out of a service van who needs to frequently collect or return certain parts. Even just one hour per day away from the project at hand easily amounts to over 260 hours, or 32 work days lost per year. Instead of carving out time to do these things during the work day, technicians can instead order what they need on the T-Linq app and have Lindbergh deliver the items to their van overnight by 7 a.m. Lindbergh has keys to their customers’ vehicles and delivers the items directly into the interior of their work vans. They are able to deliver items in a timely manner by operating at night where there is no traffic.

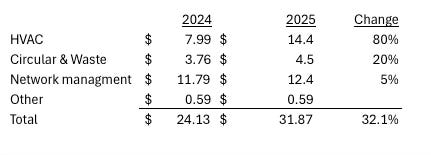

Network Management has been in a sort of slow season—growing a mere 1.2%. The segment comprised 81% of revenue in 2023, and subsequently decreased to 50% in 2024, and is expected to reach 41% in 2025. This is partially due to a slowdown in industrial production in Europe and also a strategic change in revenue mix that involved a divestiture of the night-time delivery business in France, which accounted for 48% of the segment.

The divested portion of the segment faced headwinds from competition and lack of scalability and profitability, which put a drag on margins. It was ultimately divested in order to pursue better opportunities in HVAC in Italy. Margins subsequently jumped after the divestiture. The divestiture was described as a “coherent choice” to avoid “disproportionate risks” and avoid a “price war with an aggressive competitor.”

In my view this was a rational decision that was promptly made so as to benefit the company. I’ll explain a bit more in the management section why I think this was an intelligent series of decisions.

Network management services offered

Network management services include things such as:

Night distribution logistics: Over-night spare part deliveries which can be delivered to the technicians van by 7am next day.

Waste management at night: Special waste produced by technicians’ maintenance activities can be managed and transported and stored.

Tools management and testing: Stock management, preparation, and distribution, Technicians can also book and reserve tools, and monitor tool and equipment stock in real-time.

Supply of Personal Protective Equipment (PPE): Field technicians can order Gloves, work overalls, safety shoes, accessories, consumables and other items directly through T-LINK mobile app or web portal.

Kitting and workwear washing: Uniforms and clothes can be ordered, cleaned, fixed and delivered.

On-site support: Installation and maintenance of queue-jumping, network equipment, traction batteries and UPS systems, TLC interventions for FWA systems, and various other services.

2. Waste management and circular economy

This segment contributed approximately 16.0% of the total revenues in 2024. It demonstrated strong organic growth of +24% compared to 2023.

Field technicians often use or produce excess oil, chemicals, electronics, and other items that are considered waste and that need to be disposed of in a particular manner. Lindbergh has a network by which is can collect and dispose of waste materials and chemical such that disposal requirements can be met by their customers. They’re able to request and track waste collection directly through the T-LINQ app.

3. HVAC

Lindbergh has also positioned itself to become an HVAC roll up. The goal here is to become the number one HVAC installation and maintenance company in Italy. Since launching the HVAC segment in 2023, they’ve acquire 11 companies under their acquisition vehicle, SMIT Srl.

This segment comprises 34% of total revenue in 2024, but is expected to grow to 46% in 2025 and likely more beyond that as they continue acquiring and consolidating the highly fragmented HVAC industry. This segment posted 575% revenue growth in 2024 due to rapid acquisitions, and its EBITDA margin also improved from 13.6% to 15.4%.

SMIT acquires these companies at 3x - 4x EBITDA and they target at least a 10% EBIDTA margin, with margin gains within a few years. They look for regional and operation synergies, and aim to improve the acquired HVAC companies by optimizing overhead costs, standardize processes. They also rationalize costs by centralizing strategic functions and low-added-value activities.

HVAC growth opportunity

The growth opportunity for this business is actually quite interesting. There are few key things to understand.

HVAC ripe for consolidation

HVAC presents a great opportunity for consolidation. There’s a reason that private equity firms have been consolidating the HVAC trades, among others. I could probably write a lot about this because I work in the industry and I’ve looked into acquiring some of these trade companies myself. The main thing to understand is that construction trades and home services have historically seen low capital investments, but more recently there has been an uptick in investment, particularly in service-oriented businesses with essential maintenance such as HVAC, fire safety, and plumbing. This isn’t just in the US either, it’s happening in Europe and globally.

The main reason for this is that HVAC is a growing, fragmented industry run by baby boomers who are entering retirement, and their children have no interest in carrying on the family business. Thus, there’s a large supply of stable, cash-flowing businesses coming onto the market at low valuations. HVAC services in particular have certain compelling characteristics that make it a good business for shareholders. It’s a cash-flowing business with very low CapEx, it’s also essential with somewhat predictable revenue, and decent margins. Once companies are consolidated, cost synergies come from accounting, human resources, marketing, and IT systems that can be spread out, reducing redundancies and excess back-office expenses.

Now, admittedly I’m not the most knowledgeable of the Italian HVAC market and there is limited data available. However, in the US, small to midsize operations that are less than $5 million in EBITDA typically get valued at 4x - 8x EBITDA, depending on business characteristics. Larger companies, doing $5 - $10 million in EBITDA, can be valued a bit higher between 8x - 12x. Commercial typically gets valued slightly lower than residential, and companies with future maintenance contracts are desirable and command higher valuation.

Lindbergh seems to be acquiring small to medium sized operations that are more geared towards industrial and civil applications. Some of these companies also have a water treatment aspect to them as well and likely have service/ maintenance contracts in place.

Growing HVAC need in Italy

There is a clear and growing need for HVAC technicians in Italy, driven by much higher European sustainability mandates, increasing disposable incomes, rising temperatures, building retrofits, and government incentives12 The Italian market is set to grow at more than 6% + through to 2033.

There are also tax incentives that have increase HVAC activity in recent years. Introduced initially as a 110% tax credit, the “Superbonus” covered energy-saving interventions, including installing heat pumps, with the goal to encourage a rapid shift to more sustainable and energy-efficient heating and cooling systems. As of 2025, the Superbonus has been reduced to a 65% tax credit.3

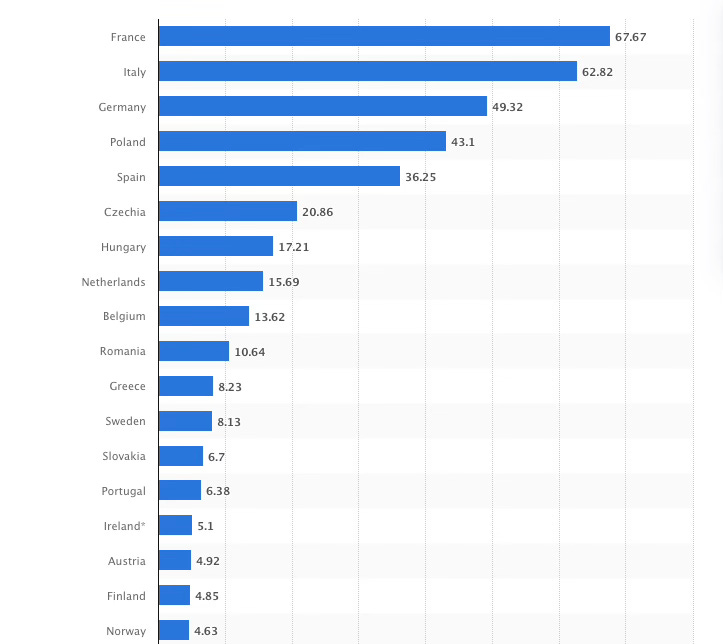

Second, there are a lot of small and mediums sized HVAC businesses in Italy. Lindbergh has estimated the market to be EUR 12 billion ($14 billion USD) consisting of around 12,000 HVAC companies that could potentially be acquired. Of these, there are 5,500 enterprises with revenue between €500k - €10 million Euros.

According to Statista, Italy is among the countries with the largest numbers of plumbing and HVAC businesses in Europe, amounting to 62,000 companies.

Lindbergh is yet to expand into other European countries, but if they did it could offer a great opportunity as well as the European HVAC market is set to grow at a similar rate. 4 In Europe, only 20% of homes have air conditioning, compared to 90% in the US.5 Given the obvious temperature difference between the two countries, it’s understandable that the US has more air conditioning. However, there is evidence to suggest that heat waves may become an increasing problem in Europe 6. As baby boomers enter the last stages of life, it presents heat stroke risks, which inevitably increased demand for air conditioning.

Europe also similar stringent regulations as Italy which put pressure on building owners to install, update and replace and HVAC systems to keep energy consumption down.

Management and share structure

Lindberg was founded by Marco Pome and Michele Corradi in 2006. Both Marco and Michele founded the company with only 5 thousand Euros, and have since grown the company into a EUR 37 million company. Both Michele and Marco have extensive experience in European industrial logistics, the rest of the team has been with the company 15-17 years. Marco previously worked at DHL and HP, while Corradi worked at Steer Davies Gleave.

Management appears to be somewhat nimble and decisive. There is something to be said about their launch and subsequent exit from their French night delivery business. It can be viewed two ways. On one hand, it can be viewed as a mistake, which it was. On the other hand, they were able to acquire a deeply unprofitable French company with a history of losses and make it somewhat profitable. EBITDA margin went from -14.4% at the 2021 acquisition to + 0.8% in 2022. However, the minute it became clear that they weren’t able to replicate the scale and margins of their Italian business, they divested and used proceeds a more promising opportunity, HVAC.

Michele has also been very clear that Pome and himself are very committed to the company and see it as their own creation and long-term project. They have expressed a sense of duty to shareholders and commitment to communication, even with retail, which is compelling. Michele has also spoken of capital allocation being very important and judging the company by its ability to produce cash and reinvest that cash.7

Below are a few excerpts from the annual letters.

“The company is first and foremost ours, we created it and want to hold on to it.”

“We are still deeply engaged in the company.”

“the market is every one of you (shareholders), and we will be accountable to every one of you.”

“So I would like to confirm my and Marco’s desire and determination to work passionately and enthusiastically to build a solid, lasting future for Lindbergh.”

“I have a lot of respect and gratitude for those who have decided to invest even a small part of their savings in our company. And I feel a huge responsibility towards every one of them. This is why I am always willing to respond to anyone who would like news or information about our business and how we run the company.”

“We are looking into the possibility to organize one or more meetings with anyone who would like to ask questions or is curious to find out more about our business model. A sort of Q&A where the Lindbergh management is at the disposal of its retail investors.”

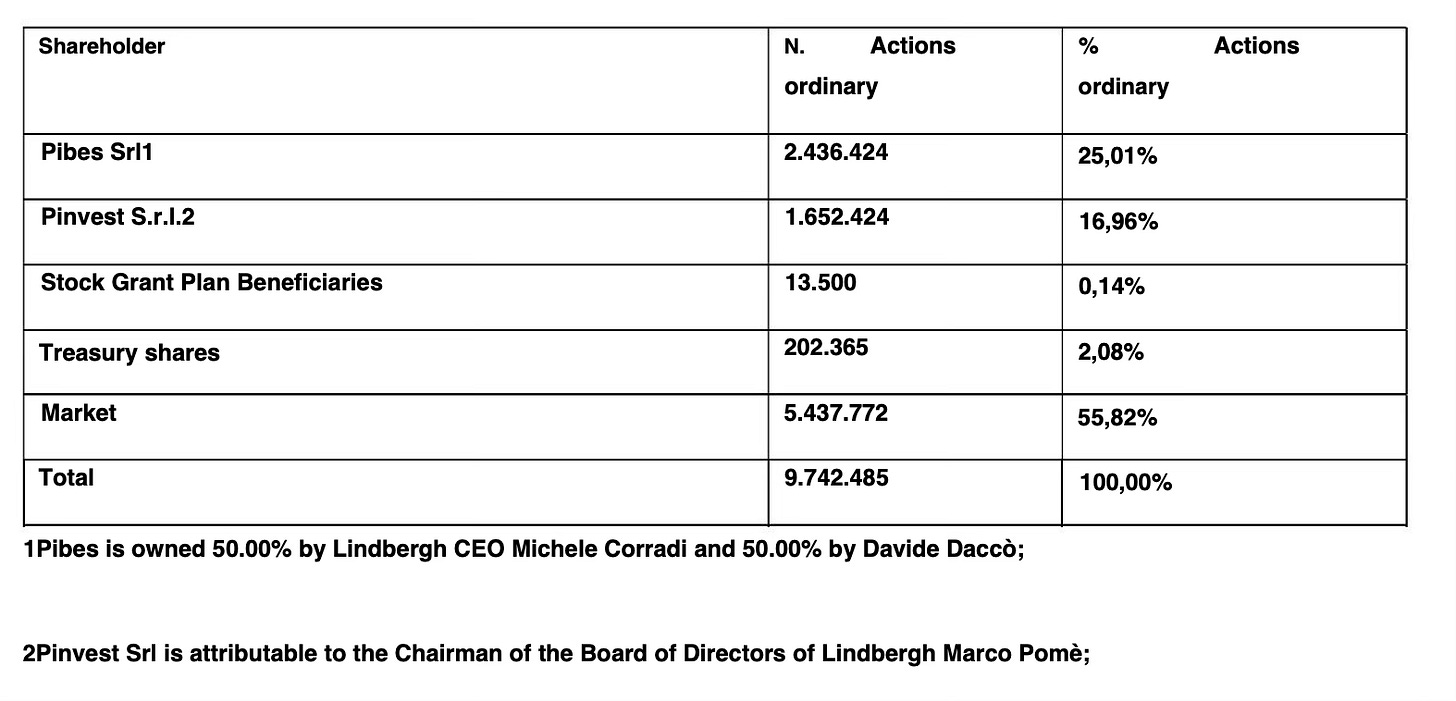

Inside ownership is largely held through a few LLC’s. Marco owns 16.96% of the company through Pinvest Srl., and Michele Corradi owns roughly 12.5% through Pibes, amounting to 29.5% for both founders.

The other insiders, Marco Rodini (IT Director), Andrea Allegrini (Sales), and Matteo Vaccari (Operations), own 3.91% each of outstanding Lindbergh shares. Altogether, insiders own around 41% of the company. There is also a large shareholder, Davide Dacco, who owns 12.5% through his ownership in Pibes. Davide doesn’t appear to be connected to the company in any other way except through equity ownership.

The Thorndike thing

Despite being a tiny company, Lindbergh has attracted an investment from Sun Mountain Partners, founded by Will Thorndike. Most readers will undoubtedly know this name, but if you don’t, he is basically an investor who wrote a book, which is considered by some to be the Bible for capital allocation, and it details some of the greatest business leaders of all time.

Now, I would give a word of caution here. Just because Thorndike wrote a book about great business leaders, it doesn’t necessarily follow that he is great at picking stocks. However, it does indicate that he has a history of studying and understanding great business leaders.

Risks

There’s a few very obvious risks

Dilution: Micro-caps are often dependent on equity financing because they lack access to low-cost debt like larger firms. Lindbergh is no exception. Although they’ve already exercised warrants from the IPO, which I’ll discuss in a minute, future dilution would dilute shareholders. As of now, another equity raise doesn’t appear to be in the cards, but this can change fairly quickly.

Macroeconomic risk: Lindbergh is in some sense more sensitive to the macro environment because they are exposed to industrials, logistics and HVAC, which can be more correlated to economics activity. A good recession in Italy would most certainly put pressure on the company.

Customer concentration: Lindbergh has some customer concentration, however, I was hesitant to include this as a risk because their HVAC operations should significantly diversify their revenue streams.

Financials

Lindbergh has experienced significant revenue growth over the last few years—compounding at 28% annually since 2020, after adjusting for the France divestiture.

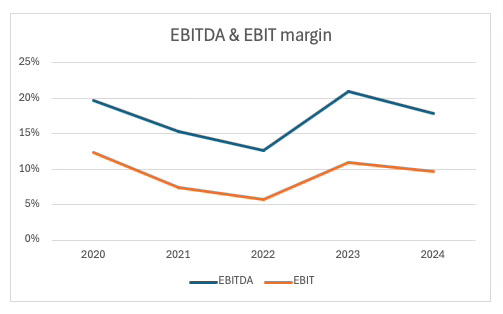

The company generates about EUR 1.7 million in free cash flow, which implies a 4.5% free cash low yield. EBITDA margin for 2023 was originally 12.4%, but after divesting the French business and revising financials EBITDA margin jumped to 21%. Margins slightly declined in 2024 due to stagnation in Network Management segment.

Lindbergh has financed its operations over the last few years through a combination of equity infusions (from IPO and warrant exercises) and debt, including bank loans.

At the IPO, Lindbergh raised EUR 4.5 million and also issued 2,528,000 warrants, of which 98% were exercised in December 2024, raising an additional EUR 2.7 million. The additional EUR 2.7 million stabilized the net financial position and brought the companies cash position to EUR 5.25 million and net cash position to EUR 500,000.

The company’s debt is 1.8x EBIDTA, and net debt is 0.6x EBITDA, reflecting very conservative debt financing, which is appropriate for the industries Lindbergh operates in. Management is intentional about keeping leverage low.

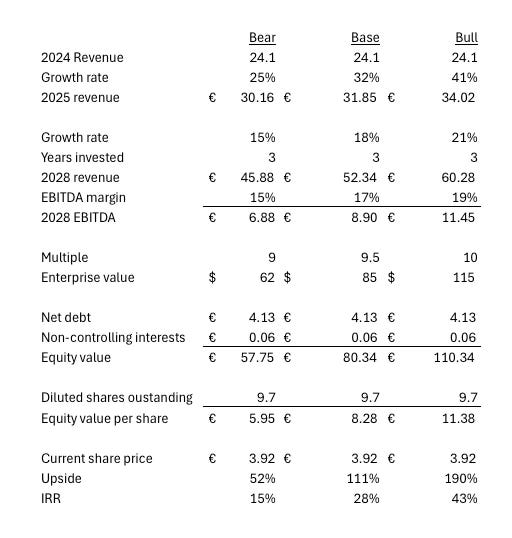

Valuation

At 22x free cash flow, Lindbergh isn’t dirt cheap, however it’s growing fairly rapidly. Going forward, Lindberghs growth rate will depend largely on the continued growth and consolidation of the HVAC business. They rapidly scaled HVAC operation in 2024—growing revenue by 575%. It’s expected to be the largest segment in 2025 and continue to grow rapidly going forward.

Waste and Circular grew at 24% and is expected to continue growing but it’s not a significant contributor of revenue at only 12%. Network management is in a slow season and is not expected to grow as fast as it has in the past, management is currently focused on optimizing costs and recovering lost margins there.

Assumptions

Revenue growth between 25% - 45% in 2025, with a base case of 32%. Below is the breakdown for my 2025 estimate.

Beyond 2025, I’m assuming growth between 15% - 21% until 2030, with a base case of 18%. I believe this are reasonable growth rates considering the company size, and as they roll-up smaller HVAC players and Network Management comes back online.

EV/EBITDA multiple of 9x - 10x with a base case of 9.5x, which is where it currently sits. I don’t see any reason to assume a large increase or decrease in multiple at this point.

EBITDA margin between 15% - 19% with a base case of 17%, which implies a slight decease in profitability as HVAC, which is slightly lower margin, contributes more.

Net debt of 4.3 EUR million (0.5x debt/ebitda) reflecting slight growth in lease liabilities but conservative financial management as financing comes largely through cash flow.

This assumes no additional equity raise over the next few years. Diluted share count remains 9.7 million.

This is compelling. Even with a decelerating growth rate and slight multiple contraction, this could end up being a decent investment.

Final thoughts

I like this set-up. It’s small, with a reasonable valuation and potentially great management. My only hesitation in buying Lindbergh is that I own a lot of companies tied to construction activity already. However, I’m considering whether I should let go of one my existing positions in order to fund this one. However, as of right now I have not made a decision.

That’s it for this week, thank you for reading.

Disclaimer: I am not a financial advisor and nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Some investments I discuss are very risky, so please do your own research and consult a financial advisor before buying or selling any securities.

Full disclosure: I am not a Lindbergh $LDB.MI shareholder at the time this was written.

https://www.techsciresearch.com/report/europe-hvac-market/17377.html?utm_source=chatgpt.com

https://www.datainsightsmarket.com/reports/italy-hvac-market-20453#

https://arlettipartners.com/italian-superbonus-2025-the-110-superbonus-is-reduced-to-65/

https://www.marketreportanalytics.com/reports/europe-hvac-market-88650

https://www.cnn.com/2025/07/02/climate/europe-air-conditioning-heat-wave-intl-latam

https://www.reuters.com/sustainability/cop/european-heatwave-caused-2300-deaths-scientists-estimate-2025-07-09/

Thanks for the write-up. Mind elaborating on the competitive advantages of a collection of many HVAC businesses? I liked their network segment because I understood the advantages of route density, but I’m less clear on the edge provided by this new roll-up strategy. Is this merely financial engineering - buy at 3x-4x and selling for 9x EBITDA?

Thank you for the write-up, really interesting. Given you identify equity financing as a potential risk (bc of the dilution) what do you think of their intention to grow through acquisition coupled with their relative low free cash flow ?