Key summary

StoneCo. is a cloud based Brazilian payments company that ran into some trouble over the last few years.

They re-launched their credit offering, did some damage control and have began to turn the company around.

Brazil’s finance ministry is lowering rates and anticipates a soft landing.

StoneCo. has returned some cash to shareholders in a series of buybacks.

Company Information

Ticker: STNE 0.00%↑

Market cap: 5.8 billion

2023 revenue: 2.3 billion

P/E: 28

Foreward P/E: 18

Intro

StoneCo. is financial technology company that primarily facilitates in person, online and mobile payments in Brazil. They also offer business management software, digital banking, and different credit products to their customers. They’ve been compared to a profitable Brazilian version of Square.

The fall

I’ve written about StoneCo before here and its currently one of my larger positions. I’ve owned a small position in StoneCo. since 2018 and I held the stock through the massive drawdown as the company went through a period mishaps and increased financial expenses.

The previous CEO rushed their credit product to market and didn’t manage it well at all. It ended up being a disaster that was exacerbated by Brazil’s faulty collateral registry system and StoneCo.’s less than optimal credit scoring system. The result was higher average non performing loans and they discontinued their credit solutions product temporarily.

They also sold off their Banco Inter investment at a loss and the market rightfully threw a fit and sent the stock tumbling 93% at one point.

Redemption

They’ve emerged from the mess with a new CEO and a resolve to make things right. They have rebuilt their credit product, credit scoring system and sorted out their migration to Brazils new collateral registry system.

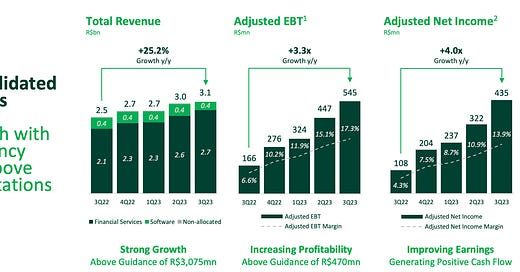

Despite their many problems Stone’s core business continued to grow at a brisk pace and while increasing their total payments, customer deposits and take rate. They’ve made a commitment to manage their risk with a better credit scoring system and automatic paybacks on their loans. They’ve partially resurrected their EBT margins to around 17%, although they were around 35% before which tells me they could potentially expand even further.

They’ve also announced two share repurchase programs this year, the second was a replacement of the first. In the first buyback program they bought back 5,733,740 shares at $10.29 per share. The second buyback program authorized to replace the first one and was announced for 1 billion Real’s which is about $200 million USD.

Growing customers and take rate

StoneCo. targets micro, small and medium sized businesses (MSMB’S) in Brazil. They estimate there are 13 million MSMB in brazil but I’ve seen estimates of up to 30 million. These MSMB’s make up 70% of jobs and about 30% of total GDP.

They continue to grow their customer base year over year in payments (41%) banking (340%) and now that they’ve re-launched their credit solution and added 3,741 new clients to their re-vamped credit platform.

Brazilian payments Market

According to IBGE, GDP and Private Consumption spending in in 2022 in Brazil were R$9.9 trillion and R$6.3 trillion, up from R$8.9 trillion and R$5.4 trillion in 2021. With 90% the population having access to financial services and cards, electronic payments are becoming more popular. Brazilian card TPV as a percentage of household consumption has increased from 29.9% in the end of 2016 to 53.0% at the end of 2022.

E-commerce is expected to drive the majority of payments growth in Brazil as 84% of Brazilians are connected to the internet and the population is tech savvy, especially the younger generations are who are eager to buy online.

The Brazilian e-commerce market is one of the most advanced in latin America and the 13th largest in the world because of high internet and smart phone adoption amongst the population. Consumers spend an average of US$1000 on e-commerce purchases annually as online purchases continue to make up a larger portion of retail sales in Brazil. E-commerce sales as a percentage of total retail sales in Brazil is currently somewhere between 8-10%, which leaves room to grow.

The e-commerce market is expected to grow from roughly $44 billion in 2023 to $105 billion in 2028, a CAGR of 18%. I think explains why companies like Shopee have made their way into the Brazilian market.

Management

The previous CEO Thiago Piau made a very poor investment in Banco Inter and really fumbled the ball during the launch of their credit product. A little damage control was needed so he was replaced by Pedro Zinner who Is much older (50) and experienced in turnarounds.

Pedro Zinner previously spent 5 years leading Eneva, a Brazilian energy company as it remerged from bankruptcy. Under his leadership Eneva grew significantly in the renewable and power markets and regained a financial footing.

Side note: It seems a bit odd to me to have a CEO who was previously in the power industry come into the fin-tech industry but I guess they thought the Eneva turnaround was so impressive that they decided to give him a shot. So far he has been doing a great job and shareholders have been rewarded.

Competition

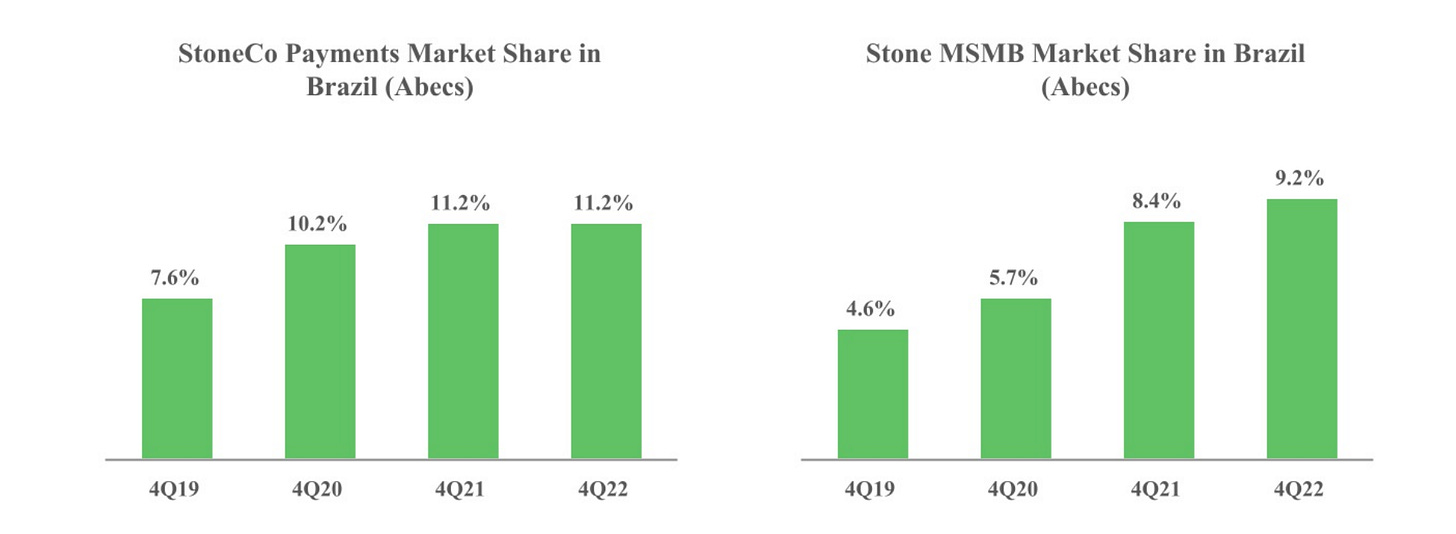

Brazil’s payments space is very competitive Their main payment competitors are PagSeguro PAGS 0.00%↑ , Cielo and and Rede. These are all formidable competitors and should be monitored but ultimately it seems that Stone is winning market share in the micro, small and medium sized business space because they offer best in class service with their Stone Hubs and a one stop suite of solutions for payments, banking and capital needs.

On the and banking side they compete with major Banks in brazil such as NuBank NU 0.00%↑ Banco do Brazil and Itau ITUB 0.00%↑. Of all the banks mentioned NuBank concerns me the most because they’re taking market share from virtually all other banks in Brazil, which is partially why I own some NU 0.00%↑ as well.

It’s important to note, even though most of these banks offer similar banking and credit products as Stone, Stone is far more convenient because as I mentioned earlier, they already have a one stop shop suite of solutions for merchants and they’ve already established trust with them. This trust and convenience factor is why Stone has been successful in cross selling their customers.

Macro

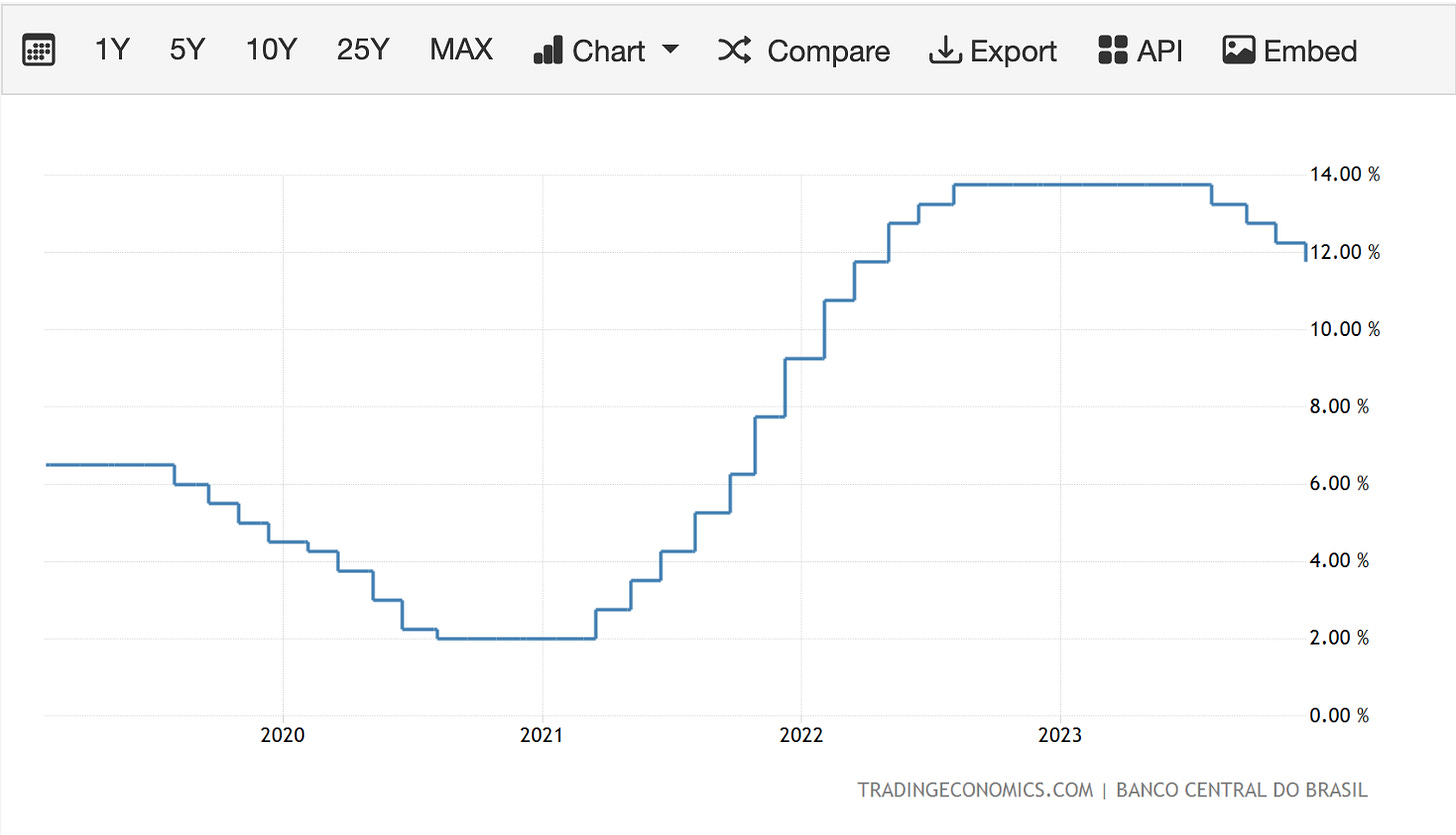

I’m not a huge macro guy but I still feel obligated to know what time it is. Just like the rest of the world, Brazil saw a big jump in inflation over the past few years but has since put out the fire with higher interest rates (14%) which has slowed down their economy. It appears higher rates have successfully cooled down the economy without causing recession, or as the elite fed economists like to say a “collapse in aggregate demand.”

Inflation and GDP are both back down to normalized levels and they’ve continued to lower interest rates. Let’s hope demand stays fairly stable.

One of stone biggest expenses has become their financial expenses due to higher rates which have affected their net margin. Among other things, lower rates should enable them to finance their operations at a lower cost and therefore expand their profit margins going forward.

Valuation

Although I initially began covering Stone while it was much cheaper I still think there could still potentially be a little value here. The could grow at 10-15% CAGR over the next few years so long as there isn’t a recession. I also think they could potentially expand their margins a tiny bit going forward and end with a multiple somewhere between 15-20x.

The return isn’t quite as exciting as it was a few months ago at $9-$11 but it still offers potential for double digits. This model doesn’t account for buybacks which could boost returns a tiny bit. I didn’t factor them because I’m not entirely sure whether they are going to continue buying back shares.

Final thoughts

For now, I wont be buying more STNE 0.00%↑ because it’s already a larger position and I expect it to grow over the next few years. Even though I was buying at $9-$12, my cost basis is around $14.5 because I owned the company since before the massive sell off which raised my cost basis considerably. It would have been nice to start fresh with a cost basis of $10 but oh well, we cant have everything we want in life. Anyways thats it for this week.

Thanks for reading!

Love the posts and in a similiar position (started buying at 9 and kept increasing the avg to 11.5 as I got more comfortable with the company and made it a 7% position).

I think you are spot on with the research and potentially extremely conservative in your bull case. If interest rates inevitably subside, the credit product works ok and they keep executing, 30%+ profit margins with 20% growth seems reasonable.

Your conclusion makes sense. There was a lot of margin of safety at 9 and still a lot of optionally still worth holding for.

Happy new year!

Just came across these posts on Stone, so helpful to see your valuation framework for someone learning like myself.

I'm interested to hear more of your thinking on handling currencies. I noticed you convert to USD at each step (revenue, income). Are there any pros/cons to this approach vs. keeping everything in BRL to match the company's reporting and then convert to USD at the end? Since the BRL and USD have been fluctuating quite a bit over the past few years, how do you choose the ratio to convert at?

Any guidance you can provide would be greatly appreciated. I'm teaching myself how to value companies with the power of Substack + ChatGPT while using Stone as an example but the currency is throwing me off a bit. Thanks!