UL Solutions

ULS has a very strong market position, high returns on capital, and potential for pricing power and various secular tailwinds such as autonomous driving, electric vehicles, and the energy transition.

UL Solutions is the for-profit testing and certification company associated with the larger UL brand name. They are a safety certification and consulting company that tests and certifies various products to verify performance, safety, and sustainability.

For example, if a consumer product company wants to launch a new product, they will work closely with UL during the research and development process to assess safety risks with that product or component. This in turn helps the company comply with regulations and get their product to market faster. This also often satisfies the demands of insurers and retailers who typically won’t insure or carry products that have not been tested against safety standards.

Company History

The company was founded in 1894 by an electrical engineer from MIT named William Henry Merrill. Merrill worked as an electrical inspector for the Boston Board of Fire Underwriters. The Chicago Board of Fire Underwriters was the Chicago division of the National Board of Fire Underwriters (NBFU), which was an organization comprised of many insurance companies who shared information with each other and worked together to asses fire risk in different municipalities. They did this in order to determine the appropriate rates to charge in difference areas. They also recommended certain guidelines to prevent fires.

As the frequency and severity of fires increased in the 18th century, a need for standardized testing and risk assessment developed. With the help of an underwriters association and an insurance union, William Merrill founded Underwriter's Electrical Bureau, a testing laboratory associated with the NBFU. The purpose of the organization was to test products and assess risks for insurance underwriters for the purpose of reducing insurance payouts and promoting safe living and working environments.

By 1903, the company had established its first safety standards for fire doors and changed its name to Underwriters Laboratory. In 1906, the company established its “UL” label service, where products could be tested and given the UL stamp of approval, indicating the quality and safety of a product.

Over the next few decades, UL went through various leaders and expanded its testing and certification capabilities into categories such as cars, appliances, plastics, radio, TV, and construction. During this time, UL thoroughly established itself as a writing body for various standards while branding itself on a national scale as an advocate for the consumer. In the eyes of consumers, UL became synonymous with quality products, but more importantly, safe products. By the 1980s, UL had become an international certification company and was expanding itself dramatically in the Asia-Pacific region (Hong Kong, Singapore, Taiwan).

2010 marks a shift in UL’s growth and direction. UL outlines a growth plan and shifts into a more acquisitive strategy, acquiring 54 companies between 2010 and 2024. In 2021, as a result of a “reorganization” process, three distinct organizations emerged with one shared mission.

UL Research Institutes (ULRI): A non-profit safety research institute dedicated to researching issues related to public safety. This company informs the policies and standards produces by UL Standards and Engagement.

UL Standards and Engagement (ULSE): A non-profit organization dedicated to producing public safety standards and policies.

UL Solutions (ULS) : A for profit testing inspection and certification organization. This is the company that went public in April 2024. It is the company that we are primarily concerned with in this write up. I will be referring to this entity as “ULS” or “UL Solutions” for the remainder of this write up.

The purpose of the reorganization was to separate the primary activities of the different organizations and dedicate resources to each. During the reorganization process, all the stock of UL Solutions (ULS) was transferred to UL Standards and Engagement (ULSE), along with the assets from the standards writing operation. The parent company, ULSE, received $1.03 billion in proceeds from the sale of shares at the IPO.

Proceeds from the IPO are being used to further research and standard development, which in turn could benefit UL Solutions. There were also special dividends paid to the parent company totaling $2.4 billion since the reorganization began in 2021. I assume the cash accrued from the special dividends has gone to the same end as the IPO proceeds.

It’s easy to see the complementary relationship between the parent and the subsidiary here. UL Standards creates the standards, and UL Solutions certifies products according to those standards for a profit, and the cycle repeats.

UL Solutions today

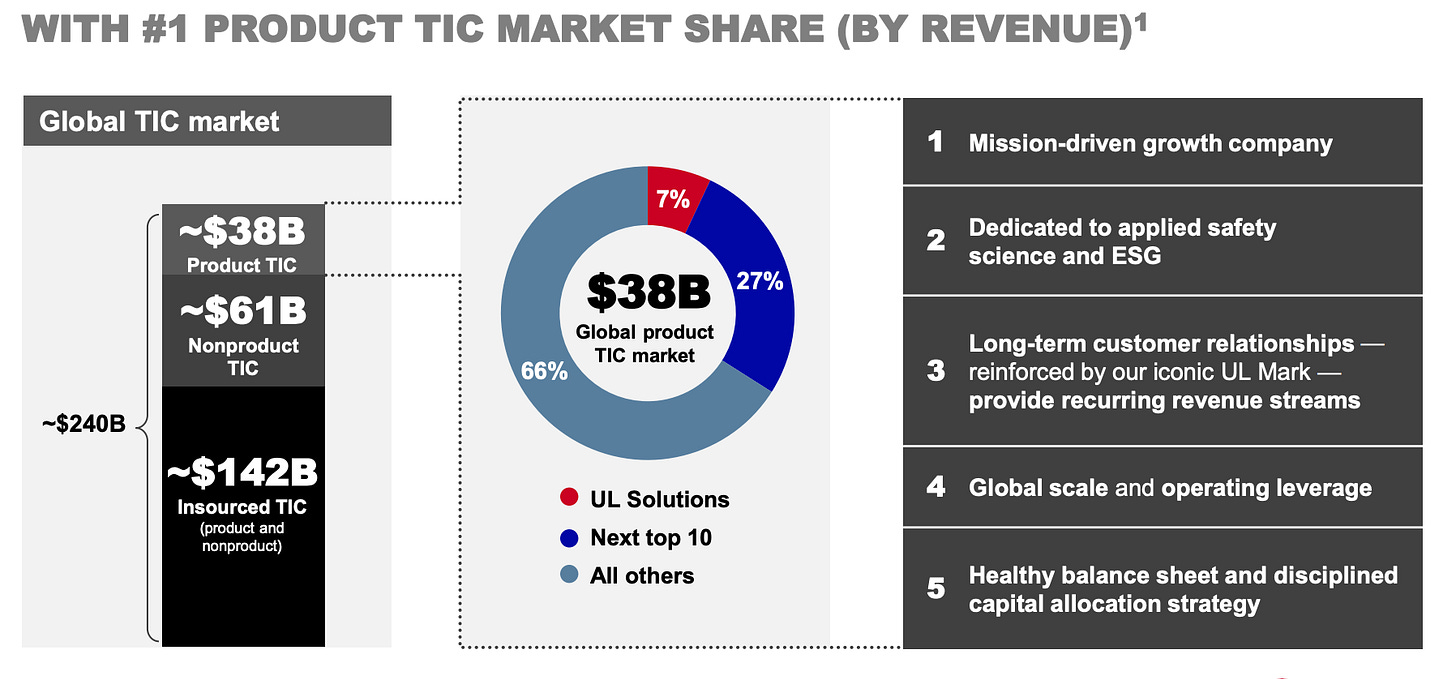

UL Solutions is now the largest testing and certification company in North America with testing labs all around the world. They have 80,000 customers, serving 35 industries in 110 countries. ULS has 7% of the TIC market (testing, inspection, and certification) which is estimated to be $38 billion.

The classic “UL” mark appears on billions of products around the world each year. They serve end markets such as automotive, autonomous vehicles, appliances, batteries, building, HVAC, life sciences, governments, electronics, chemicals, materials, plumbing, wire and cable, lighting, financial and investment services and more.

Services and segments

ULS has 3 service lines.

Certification testing (27% of revenue): This service line is primarily concerned with evaluating, testing, and certifying products, systems and components according to regulatory requirements or other specifications or standards. ULS is typically working with their customers through product cycles, conducting reviews, tests and engineering evaluations so that customers are in compliance with regulations and selling safe products. UL Solutions customers are then allowed to display the “UL” mark on their products and, delivering confidence to their own customers. These services typically lead to ongoing testing and certification.

Ongoing testing and certification (33% of revenue): These are the testing and certification services mentioned above except they are done on an ongoing basis (typically 4 times per yer), for the life of a product. These are annual contracts that are renewed in the 4th quarter if each year. These are done via periodic inspections, follow-up audits, and sample testing. This is for companies that need ongoing compliance. They also do factory inspections to make sure they are keeping with manufacturing standards.

Non-certification testing and other services (30% of revenue) : UL Solutions also offers performance testing services that aren’t necessarily required by regulation but still ensure that their customers products are safe and and reliable. Services include on-site or remote inspections, audits, and field engineering specialty services such as testing for

Energy efficiency

Wireless and electromagnetic compatibility, quality, chemical and reliability for customers in medical devices.

Information technologies

Appliances, HVAC and lighting.

Software advisory (10% of revenue): This category provides software as a service and license based software solutions. This software helps their customers navigate complex regulatory requirements, deliver supply chain transparency and operationalize sustainability.

The Software and Ongoing Testing services lines collectively make up about 43-45% of revenue, and these are recurring in nature and therefore provide stable recurring revenues for UL Solutions. They indicated in their Q1 call that they have pricing power, although they were somewhat vague.

“So we work with our customers in the fourth quarter of each year and reset those contracts, and that's the timing of when any price increases go through. With regard to the 10% of our recurring revenue that's software services, as we're extending the length of those software contracts, that gives us the opportunity to add in appropriate pricing moves. And so while that doesn't happen all in the same quarter, typically, it happens at the timing of those renewals and then as part of the new software-as-a-service sales.”

Jennifer Scanlon CEO

“45% of our revenue, and they're largely recurring revenue streams that are updated annually. So they're less suited to price/volume metrics. The other 55% of our revenue, from certification testing and non-certification testing, are mostly testing services with specific deliverables that we're paid for. Those services grew about 8% in the first quarter, and we had similar contributions from both price and volume.”

Ryan Robinson VP and CFO

Segments

ULS also breaks revenue down into segments: Consumer, Industrial, and Software. Consumer and Industrial segments make up roughly 87% of the business and roughly correspond to the three main certification and testing service lines. This is because most of their TIC services are either provided to consumers or to industrial applications.

The other segment—software and advisory (S&A)— compliments their consumer and industrial TIC services by helping their customers to navigate an increasingly complex regulatory environment. 70% of their customers use both TIC and Software and advisory services as of 2023.

Industrial stands out as the most important segment with adj. EBITDA margins north of 30% and revenue growing at 9.8% in 2023. Compare this to the consumer segment with margins of around 13.6% and growth of 4%, and software at 16% margins and growing at 3.4%.

CEO Jennifer Scanlon indicated that they were unsatisfied with the margin profile of their software business and are pursuing margin expansion there along with the rest of the business.

Industry and opportunity

The global TIC market is estimated to be $233 billion and expected to grow 5% annually to over $300 billion in 20301. However, the market is divided into insourced TIC and outsourced TIC. Insourced TIC is done in-house by companies, while outsourced is done by third parties like UL.

The outsourced market is also divided into outsourced product TIC and other outsourced TIC, with the former being where UL operates. This is a $38 billion dollar market focused on products, assets, components, and supply chains for commercial and industrial applications. ULS believes this market will grow at 5% - 6% over the next few years.

UL currently has the largest share of the the outsourced product TIC market in the world and they prefer this specific market because it’s less cyclical and more prone to technological innovation, leading to more growth opportunities.

Growth drivers

Testing, inspection, and certification is a stable, growing market opportunity. As new technologies and products are rolled out, they create a continuous need for safety certification. There are really two parts to the growth drivers here: the products side and the regulatory side. The products side deals with the products and the consumers that use them, while the regulatory side deals with regulatory pressure fueling demand for certifications.

Products:

New technologies and products being introduced to the market. New innovations associated with EV batteries, electric vehicle components, renewable energy, smart systems will continue to create demand for complex testing and certification.

Increasing variations of existing products being rolled out.

Consumer preferences have increased due to widely available information concerning the safety of products and manufacturing processes.

Increasing supply chain complexity

Regulatory:

Increasing and evolving regulations concerning the safety of products and components.

Increasing focus on ESG principals and associated regulatory requirements.

Growth strategy

Their growth strategy can be summed as as organic, inorganic and margin expansion. They are first and foremost concerned with growing organically via cross selling, expanding their offerings in existing industry verticals and expanding into new industry verticals.

Secondly, they intend to continue deploying capital to acquisitions. They operate in a fragmented market with many sub-scale competitors that would benefit from UL Solutions scale. Lastly, the believe they can improve margins by continuous improvement in operational efficiency.

“Our margin expansion progression is over the long term, and there are some key areas that we intend to really log progress.”

“Over the long term we are targeting 24% EBITDA margins”

Jennifer Scanlon Q1 quarterly call

Moat

UL has a few competitive advantages, brand, barriers to entry, regulatory, and insurance backing.

Brand

The “UL” mark is one of the most recognized marks in the world as it has been stamped on billions of products annually worldwide. Collectively, all three UL organizations have played a massive role in pioneering the field of standards and certification over the last 130 years. This gives them a unique position in the world of testing, inspection, and certification, as the UL stamp has become iconic and representative of trust and safety.

UL Solutions conducted an internal study across 13 markets with 2,000 respondents, which concluded that UL Solutions brand strength and trustworthiness scored number one out of 11 global certification brands. Respondents also associated technical expertise with UL more than any of the other brands as well.

In a sense, UL Solutions is ultimately in the business of upholding brand integrity for other businesses by reducing risks and bringing products to market under the UL brand. They are a brand for all brands.

The deep trust in the UL brand is reflected in the fact that they have long-standing customer relationships, and their top 500 customers have a retention rate of 99%.

Barriers to entry/Scale

Barriers

It would be very difficult to start a testing inspection and certification company that could compete directly with UL Solutions. Not only has the UL brand built deep relationships with regulators, insurance companies, and the general public, but they’ve built up a massive pile of 650 accreditations.

These accreditations range from the World Health Organization to a number of national/regional standards councils. Some of them are mandatory to operate, and others were sought by UL to broaden their capabilities.

Accreditations allow them to enter new markets and certify new components and products. They also enable them to operate more effectively. In order for an organization to begin competing directly with UL Solution, they would need to spend years accumulating different certifications.

Scale

UL Solutions also has 140 locations operating in 35 countries, which allows them to serve larger international customers on-site and serve smaller regional customers at the local level. This is particularly important considering regulations are adopted and modified differently from one region to another.

Regulatory

UL Solutions is very well recognized by governments and international standards bodies. A significant portion of UL Solutions’ revenue is driven by regulatory pressure in the private sector where third-party testing and certification are required. Certification is required on many products such as electrical components, HVAC, and lighting products. These certifications are enforced by local governments.

Before we talk about regulatory backing, first let me define a few things.

A Code: A set of rules and suggestions developed by a private scientific consensus that tell you what you need to do, in this case as it pertains to electrical wiring and equipment in the US. Codes are not law but are usually adopted and enforced by regional municipalities.

A standard: A set of guidelines developed by a private scientific consensus that tells you how you ought to satisfy a codes. When a code is enforced by law, and it suggests a particular standard, the standard is enforced as well. Standards include detailed procedural suggestions in manufacturing, testing, construction, installation and so forth.

Enforcement: The local authority having jurisdiction (AHJ) which is another name for the local government.

One thing you’ll notice when studying anything related to testing, inspection, building, or engineering is that the industry is bloated with standards organizations, technical committees, and non-profit trade associations that write and influence the codes and standards for building, manufacturing, testing, and so forth. Even for someone like myself who is knowledgeable in the field, it can be difficult to grasp all the intricacies. However, the main thing to understand is that these organizations exist to create industry standards that encourage conformity and uniformity in the way things are built, manufactured, and tested.

UL Solutions is active on over 1,300 standards committees and their sister organization, UL Standards and Engagement, has developed 1,700 safety standards. Collectively, the three UL brands are so deeply ingrained in standardization process of testing and certification that they’ve been embedded into some laws and codes. For example, in 2023 New York City enacted Local Law 39 requiring E-bikes to meet the safety standards published by UL standards and Engagement.2

Now, this doesn’t guarantee that UL Solutions will be doing the testing and certification process, but it does help that UL Solution is the biggest name in the industry and bears the same name as the standards writer. It easy to see how the three UL brands compliment each other. One does the research to find new safety risks, the other writes the standards and the other certifies against those standards.

I found the following statement from their prospectus indicative of their complimentary relationship with UL safety and standards

“Our technical leadership is built upon our legacy of being a global safety science leader for products and technologies. This expertise is complemented by our ongoing technical research and participation in standards development around the world, including the technical committees of UL Standards & Engagement.”

“We deepen our technical knowledge through the ongoing compliance certification of thousands of our customers’ products, components and systems. As our customers continue to develop new products and new safety risks are introduced, we leverage our knowledge base to generate new testing and certification programs, which drives recurring and incremental service opportunities from customers who seek out our technical knowledge.”

UL solutions collects data from their testing and certification processes and this data is often used to develop new standards, testing and certification programs that in turn drive incremental and recurring revenue for UL Solutions.

Building codes/NRTL

Some of UL Solutions services are indirectly implied in building codes, which are adopted and largely enforced in most states, particularly in commercial and workplace settings.

The National Electrical Code article 90.7 requires that electrical equipment be examined and “listed” by a qualified electrical testing organization. Article 110.3 (C) also elaborates on this

“Product testing, evaluation, and listing (product certification) shall be performed by recognized qualified electrical testing laboratories”. NEC 110.3 (C)

“Qualified testing laboratory” is another word for a Nationally Recognized Testing Laboratory (NRTL), a group of companies that are approved by OSHA (government agency) to do testing inspection and certification for certain products that are required to be certified. UL Solutions isn’t the only NRTL, but they are most certainly the most known and trusted.

The question of whether UL Solution will be used to certify a particular product really depends on the product being certified. Each NRTL has its own scope of standards and products it covers.

Insurance/retailer pressure

Another thing worth mentioning is the pressure that comes from insurance companies and retailers. In order to avoid insurance claim payouts, insurance carriers typically won’t insure products that are not manufactured according to safety standards.

Likewise, most retailers will refuse to carry certain products that aren’t certified in order to avoid liability. Again, there are competitors who can do these certifications as well, but UL Solutions bears the brand name that is most recognizable and well known for writing the standards and therefore benefits from insurance and retailer pressure.

Management

Being a 130 year old organization, UL Solution has seen a large number of leaders throughout the years, with the most recent CEO being Jennifer Scanlon.

Scanlon previously served 16 years at USG, a building materials manufacturer, where she held various roles including CEO from 2016-2019. This highlights her experience in manufacturing, which is relevant to the majority of UL Solutions activities, where they work side by side with manufacturers. She also holds various other board seats, including at Norfolk Southern and the Federal Reserve Bank of Chicago..

Scanlon’s salary is $1 million as of 2023 and she had an additional $5.5 million in options and performance based cash awards.

Scanlon’s stock ownership is tiny at just under $5 million in class A stock. She is required to retain 100% of equity awards until she owns 6x her base salary, which she hasn’t done quite yet. This is common practice for many companies. The management’s teams aggregate ownership is also very small as well at around 1% collectively.

Capital allocation

Their capital allocation plan is simple and consists of reinvesting in the business and returning excess capital via buybacks and dividends. They primarily invest in CapEx and acquisitions to further expand into new markets and expand their certification capacity in existing markets. On average, they’ve acquired 4 companies per year since 2010 for a total of 56 companies and $1.3 billion deployed.

Risks

When I think about risks for UL Solutions it’s hard to see a scenario where something could serve a devastating blow to this business. This company has survived two world wars, dozens of presidential administrations and business cycles. There are however a few risks I see with UL Solutions.

Competition: UL Solutions has a dominant position in the outsourced product and component TIC market globally. ULS mainly competes with a few larger public companies such as Intertek, Bureau Veritas, SGS and Eurofins as well as a handful of private organizations such as Element, TÜV, DNV, SÜD, and DEKRA. Competition may act against their pricing power.

AI threat: I imagine UL solutions would adopt as many ai solutions available to them as possible, however, it’s feasible that another company could come along and provide similar testing and certification services with ai and robotics, except with fewer skilled technicians.

Regulatory risk: UL Solutions benefits greatly from regulations around the world and this dependance on regulations could potentially destroy demand if regulations were to loosen up in any of the countries they operate in.

ULSE concentrated ownership: UL Standards and Engagement owns the vast majority of ULS 0.00%↑ shares and has voting control for the foreseeable future, which limits investor influence on corporate matters. This can obviously become a problem. For example, if Scanlon is performing poorly and ULSE doesn’t want to remove her and elect someone else. In order to invest in ULS, one must essentially trust that the ULSE will put the interests of ULS shareholders first.

Financials

ULS has a 12% profit margin and decent returns on capital around 20%. Gross margins are 47.6% and EBITDA margins are around 20% and growing. Over the long term, they are targeting 24% EBITDA margins, although they didn’t provide guidance as to when this target would materialize. Sales growth has been around 7% over the last decade. This is a very stable, slow-growing, yet profitable business.

UL Solutions balance sheet is solid. As of July 2024 UL Solutions total debt before unamortized debt issuance costs was $802 million, against $600 million in EBITDA (my non-adjusted 2024 estimate) indicating very manageable levels of debt.

Valuation

The company trades at around 17x EV/EBITDA which is higher than competitors which are between 10x-15x. One could argue the premium its warranted considering they are the dominant TIC player globally.

The model below assumes revenue growth within historical norms (6% - 7%) and an EBITDA margin of 21% which is just slightly higher than it is today as they continue to expand it. It also assumes a multiple of 16-18x and a similar leverage ratio of less than 1.

Assuming the assumptions are correct, the result is probably not very compelling for most investors. This would be much more interesting below $40. Those who got in right after the IPO below $35 got a good deal on a quality business. There are two scenarios that could produce a mid teens return.

First, if the stock was acquired below $40, or if they were to achieve their target of a 24% EBITDA margin and the multiple were to expand slightly, the base and bull case could provide a low to mid-teens return from here. There is also a 1% dividend which should be accounted for.

Final thoughts

This isn’t really my cup of tea at the moment. I love the industry and I love the fact that ULS has a very defensible competitive advantage, but the slow growth and lack of inside ownership are problematic for me personally. I also don’t like that ULSE effectively controls ULS. If this was much cheaper, or margins or growth dramatically improve, I would consider it.

Thanks for reading!

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am not a ULS 0.00%↑ shareholder at the time this was written

Custom market Insights TIC market

Just a FYI, current consensus for revenue and EBITDA in 2027 is: $4,438M and $883M implying an EBITDA margin of 25.7%