Overview

Property and casualty insurers have been on a roll over the last few years. Competition is down, rates are up, and the market has been hard due to inflation, rising claims costs, and natural disasters. This has been beneficial to many specialty P&C insurers.

I recently wrote about IGIC, an international insurer with some qualities I thought were intriguing; however, the valuation was just south of my sweet spot.

Continuing in my hunt through obscure insurers, today I’m looking at another insurance company that is quite a bit cheaper, trading at 70% of book value and potentially 4-5x 2025 earnings and growing book value per share quickly. If it can grow book at 5-10% over the next few years and re-rate to 1x book, it could potentially provide decent upside over the next few years. This, of course, assumes the thesis isn’t derailed by a few particular risks, which I will get into a bit later.

Fidelis Insurance Holdings is a specialty insurance company with a reinsurance operation. Although this company doesn’t quite have the interesting back story and insider alignment that IGIC has, it could make up for it in valuation and potential returns.

History

Fidelis was founded in 2015 by an experienced management team. Since then, they’ve built a diversified global book of business.

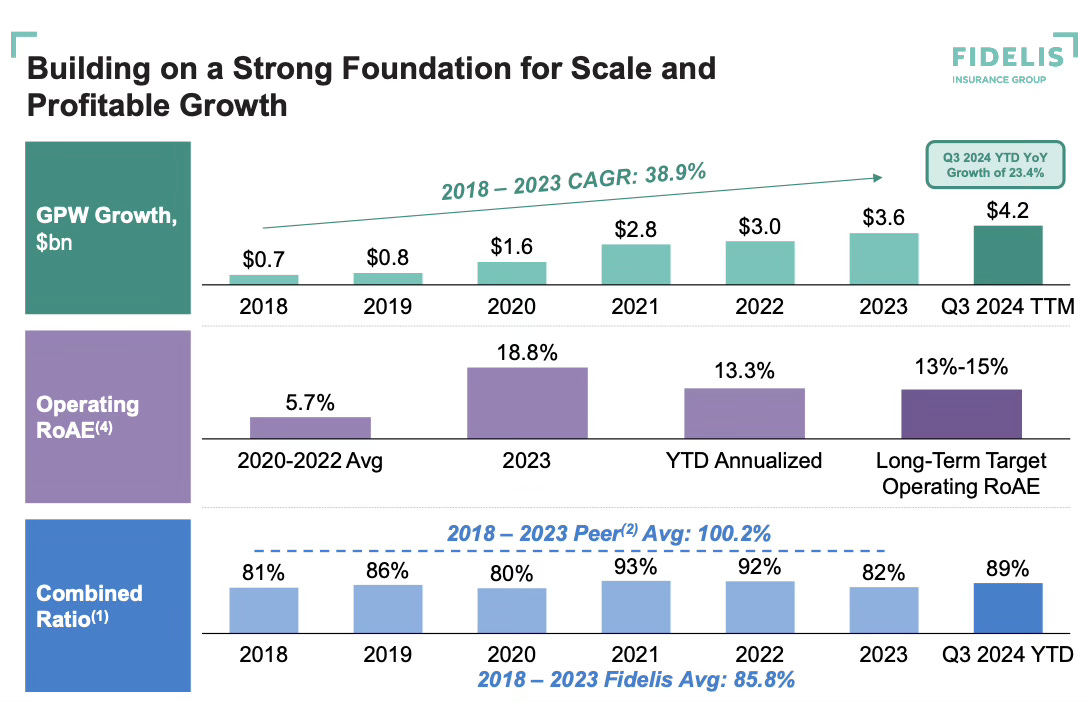

FIHl did $3.6 billion in GWP and $1.8 billion of net premiums for the year ended December 31, 2023. Between 2017 and 2023, they had an average loss ratio of 45% and an average combined ratio of 86%. Their GPW’s and NPE also grew at a 36.8% and 43% CAGR.

Before going public they arranged a separation and reorganization occurred where they separated into two organizations, FIHL (Fidelis Insurance Group) and MGU HoldCo (Fidelis partnership). MGU does their underwriting and origination activities, while FIHL focuses on portfolio optimization and capital management with exclusive access to MGU’s underwriting and origination business.

The partnership enables management to allocate more time to their core competencies at Fidelis, specifically capital management.

Business mix

Segments

Specialty:

Focused mostly short-tail risk such as energy, marine, property, property development and finance, aviation and aerospace, and other specialty risks.

61% of GWP

Grew 22% in Q3 and 20% YTD as of Q3.

80% underwriting ratio

51% loss ratio

Reinsurance:

This segment is primarily focused on residential property catastrophe book, encompassing, Retrocession, property reinsurance and whole account reinsurance.

20% of GWP

Growing at 56% in Q3 and 36% YTD as of Q3 2024.

31% underwriting ratio

8% loss ratio

Bespoke:

Primarily focused on political and credit risks and other bespoke opportunities.

19% of GWP

Grew at 17% in Q3 and 17% YTD as of Q3 2024.

61% underwriting ratio

26% loss ratio

Reinsurance and Specialty are the crown jewels here, with reinsurance growing quite a bit faster and more efficiently but specialty quite a bit larger.

Performance

Fidelis targets a long-term ROAE of 13% - 15% for the business. Between 2018 and 2023, Fidelis put up some impressive growth numbers. Gross written premiums grew at a CAGR of 39%, while net premiums written grew by a CAGR of 44.5%. Book value per share has been growing nicely as well over the last few years as well at a 44% CAGR.

Their loss and expense ratios have also outperformed peers, indicating discipline and efficiency in acquiring and underwriting, which results in a combined ratio of 87.4%.

This is impressive; however, keep in mind, Fidelis isn’t the only insurer doing well over the last few years. Their success correlates to the broader market conditions they’ve been operating in, where rates have been rising, particularly in reinsurance and specialty lines P&C. I will touch on this a bit more in the risk section as it feeds into one of the key risks and reasons it may be undervalued.

Assessing liquidity and debt levels

Fidelis has 3.1 billion in total capital consisting of

2.2 billion (83.8%) in common equity

58.4 million (1.8%) in preferred equity

448.8 million (14%) in debt

Debt-to-equity ratio is 0.17 compared to 0.3 - 0.4 for the broader specialty and reinsurance1, indicating conservative leverage and discipline. Fidelis also has 2.8 billion in loss reserves against 4.7 billion in liquid assets indicating sufficient reserves.

Investment portfolio

Fidelis has a conservative investment portfolio of $4.7 billion consisting of 40% cash and US treasuries. Their fixed income portfolio is around $ 3.7 billion and has an average rating of AA- with an average duration of 2.7 years. Interest income was $52 million in Q3 2024 (about $200 million annualized)

Capital return program

They announced a $50 million share repurchase program in late 2023, followed by a quarterly dividend of $0.10. In late 2024, they announced another $200 million repurchase program, of which they have already returned roughly $100 million. As of Q3 2024, they had returned a total of $141 million in dividends and buybacks and repurchased 6.57 million common shares.

Moving forward, they will maintain their $0.10 quarterly dividend (2.42% yield) and return the estimated $100 million (5% of market cap) that remains from their repurchase program.

Management

Dan Burrows

Dan Burrows is the CEO of Fidelis, and he joined in 2015. He has over 35 years of insurance experience, previously holding senior broking roles like Head of Global Retrocession at Benfield and CEO of Aon’s Global Specialty division. The details of his ownership and compensation are as follows.

Burrows owns 247,489 shares worth about $ 4 million.

Base salary of $3.6 million.

Total compensation of $20.9 million, including an annual performance-based cash bonus of $8.6 million, and long-term share incentive of $7.6 million.

In my view, this reveals very little shareholder alignment, if any at all. Although eventually he is required to hold 6x his salary in common equity, it remains to be seen when this will materialize.

There is another insider, Hinal Patel, a non-executive director, who owns 225k shares worth around $3.7 million. However, this is also insignificant and the total inside ownership from all directors and senior managment is less than 1%.

Risks

Declining CAT rates: Fidelis is heavily exposed to reinsurance property catastrophic rates, which have been declining as capital and competition has flooded into this profitable niche 2. 20% of their portfolio is property reinsurance, and just as they benefited from increased pricing, they will be negatively affected by declining rates and a softer market. However, it should be noted that some have argued that they will go back up 3. Regardless, property reinsurance is a large and fast growing segment in Fidelis’ business and declining rates would affect them negatively. Goldman Sachs recently downgraded Fidelis to sell because of this.

Zero shareholder alignment: This is a big one, particularly for long-term shareholders. It’s hard to see how management can be incentivized to care about shareholder value over the long term if they don’t own any stock.

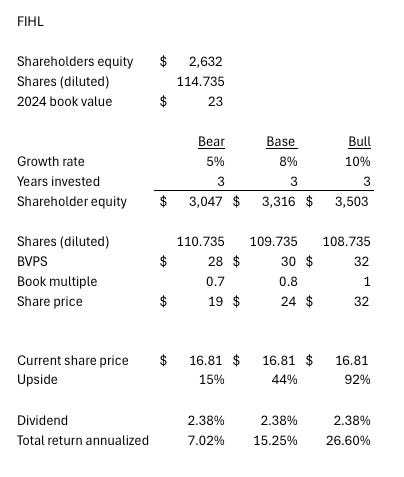

Valuation

If Fidelis can maintain decent growth in book value per share of between 5-10%, and re-rate, there may be a decent return to be had if you include buybacks and dividends.

Assumptions:

Growth between 5-10% (modest)

The remaining buyback programs reduces share by 4 - 6 million shares ( average of $15 - $25 per share)

Multiple between 0.7x - 1x (reinsurance and specialty peers are typically in this range) although Fidelis is growing faster than many competitors.

Conclusion

This is an interesting set up, but it doesn’t come without risks. On one hand, this may be good for someone who’s looking for something to buy at a discount and sell at fair value after a re-rate. I wouldn’t be surprised to see this revert back to $19 per share in the short term, and even higher in the long term.

On the other hand, the exposure to reinsurance rates and the lack of alignment may be a turn off for some investors. I’m personally going to pass and look for something more compelling. I already own SKYW 0.00%↑ which is a bit more balanced in its business mix and has very low exposure to CAT losses and reinsurance rates.

Thanks for reading!

Disclaimer: Nothing I say should be taken as financial advice. None of my financial models should be taken as buy or sell signals. Please consult a financial advisor before buying or selling any securities.

Full disclosure: I am not an FIHL 0.00%↑ shareholder at the time this was written.

https://fullratio.com/debt-to-equity-by-industry

https://www.insurancejournal.com/news/international/2024/05/30/777252.htm

https://www.carriermanagement.com/news/2025/01/31/271282.htm

Nice write up.

Did also pass on them a year ago and will do so again. Too many negatives.

Also their 'outperformance' with lower CRs does come with quite low underwriting leverage (NPE/EQ) and thus is not that high of a ROE contribution...

Look here for some other notes: https://docs.google.com/document/d/1r0z2b2hpaUTB-miR2_EFlAC7RZ4iDnLiBaWE5xGCilM/edit?usp=sharing